Jer Rutton Kavasmneck alias Jer Jawahar Thandi - Bombay High ...

Jer Rutton Kavasmneck alias Jer Jawahar Thandi - Bombay High ...

Jer Rutton Kavasmneck alias Jer Jawahar Thandi - Bombay High ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

hvn<br />

1/195<br />

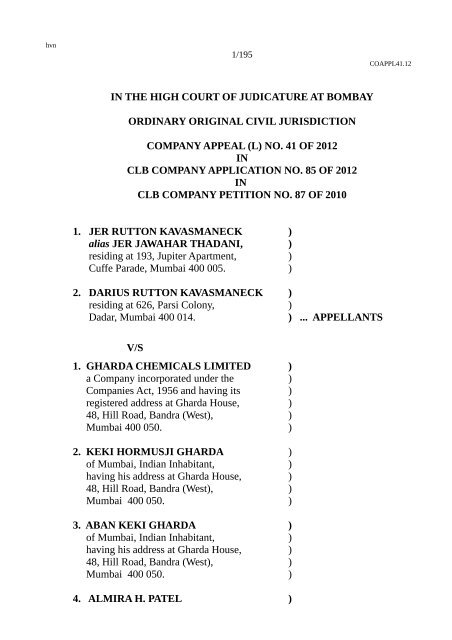

IN THE HIGH COURT OF JUDICATURE AT BOMBAY<br />

ORDINARY ORIGINAL CIVIL JURISDICTION<br />

COMPANY APPEAL (L) NO. 41 OF 2012<br />

IN<br />

CLB COMPANY APPLICATION NO. 85 OF 2012<br />

IN<br />

CLB COMPANY PETITION NO. 87 OF 2010<br />

1. JER RUTTON KAVASMANECK )<br />

<strong>alias</strong> JER JAWAHAR THADANI, )<br />

residing at 193, Jupiter Apartment, )<br />

Cuffe Parade, Mumbai 400 005. )<br />

2. DARIUS RUTTON KAVASMANECK )<br />

residing at 626, Parsi Colony, )<br />

Dadar, Mumbai 400 014. ) ... APPELLANTS<br />

V/S<br />

1. GHARDA CHEMICALS LIMITED )<br />

a Company incorporated under the )<br />

Companies Act, 1956 and having its )<br />

registered address at Gharda House, )<br />

48, Hill Road, Bandra (West), )<br />

Mumbai 400 050. )<br />

2. KEKI HORMUSJI GHARDA )<br />

of Mumbai, Indian Inhabitant, )<br />

having his address at Gharda House, )<br />

48, Hill Road, Bandra (West), )<br />

Mumbai 400 050. )<br />

3. ABAN KEKI GHARDA )<br />

of Mumbai, Indian Inhabitant, )<br />

having his address at Gharda House, )<br />

48, Hill Road, Bandra (West), )<br />

Mumbai 400 050. )<br />

4. ALMIRA H. PATEL )<br />

COAPPL41.12

hvn<br />

2/195<br />

of Mumbai, Indian Inhabitant, )<br />

having his address at Gharda House, )<br />

48, Hill Road, Bandra (West), )<br />

Mumbai 400 050. )<br />

5. D.T.DESAI )<br />

of Mumbai, Indian Inhabitant, )<br />

having his address at Gharda House, )<br />

48, Hill Road, Bandra (West), )<br />

Mumbai 400 050. )<br />

6. MAHARUKH MURAD OOMRIGAR, )<br />

having her address at T/176, )<br />

AA Palm Beach, Juhu Tara Road, )<br />

Juhu, Mumbai 400 049. )<br />

7. PERCY RUTTON KAVASMANECK, )<br />

residing at 134, Olivera Way, )<br />

Palm Beach Garden 33418, Florida, )<br />

USA. )<br />

COAPPL41.12<br />

8. ABAN PERCY KAVASMANECK, )<br />

residing at 134, Olivera Way, )<br />

Palm Beach Garden 33418, Florida, )<br />

USA. ) ... RESPONDENTS<br />

...................<br />

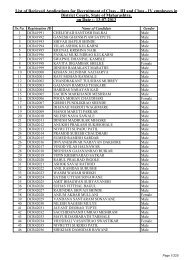

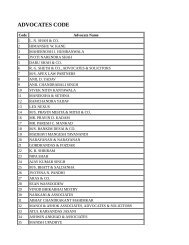

Mr Pravin Samdhani, Senior Advocate along with Mr.Shriraj Dhruv, Mr.Snehal<br />

Shah, Ms Khyati Ghevaria and Mr.Manish Acharya, i/b. M/s Dhruv & Co. for<br />

the Appellants.<br />

Mr Ravi Kadam, Senior Advocate along with Mr.Suhas Tulzapurkar,<br />

Mr.Nishad Nadkarni, Mr.Vineet Srivastava, Mr.Abhishek Adke, Mr.Ashutosh<br />

Sampat, i/b. Legasis Partners for Respondent No.1.<br />

Mr Vinod Bobde, Senior Advocate along with Mr.Suhas Tulzapurkar,<br />

Mr.Nishad Nadkarni, Mr. Vineet Srivastava, Mr. Abhishek Adke, Mr. Ashutosh<br />

Sampat, i/b. Legasis Partners for Respondent No.2.<br />

Mr T.N. Subramaniyam, Senior Advocate along with Mr. Suhas Tulzapurkar,<br />

Mr.Nishad Nadkarni, Mr.Vineet Srivastava, Mr.Abhishek Adke, Mr.Ashutosh<br />

Sampat, i/b. Legasis Partners for Respondent No.3.

hvn<br />

3/195<br />

COAPPL41.12<br />

Mr Sunip Sen along with Mr.Suhas Tulzapurkar, Mr.Nishad Nadkarni,<br />

Mr.Vineet Srivastava, Mr.Abhishek Adke, i/b. Legasis Partners for Respondent<br />

Nos.4 and 5.<br />

Dr Birendra Saraf along with Ms. Ankita Singhania, i/b. M/s D.H.Law<br />

Associates for Respondent Nos.7 and 8.<br />

Mr.V.R.Dhond, Senior Advocate alongwith Mr.Amit Jamsandekar and<br />

Ms.Pratibha Mehta, i/b. M/s.Little & Co. for Applicant Godrej Industries<br />

Intervenor.<br />

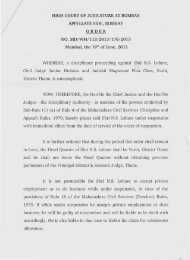

ORAL JUDGMENT :<br />

CORAM : R.D.DHANUKA J.<br />

RESERVED ON : OCTOBER 16, 2012<br />

PRONOUNCED ON : DECEMBER 20, 2012<br />

Admit. By consent of the parties, the present appeal was heard finally<br />

at the admission stage and is disposed of by this Judgment.<br />

2. The appellants have formulated following questions of law for<br />

determination of this Court :<br />

A. Whether the CLB does not have the power to review its<br />

earlier Order when the earlier order was not obtained on fraud or<br />

fabricated documents ?<br />

B. Whether the CLB could not have entertained an application<br />

filed by the 1 st Respondent, which was in effect and even stated to<br />

be for review of an earlier order passed by the CLB ?<br />

C. Whether the CLB could not have vacated its Order dated May

hvn<br />

4/195<br />

COAPPL41.12<br />

21, 2012 on the same grounds on the basis of which the Order<br />

dated May 2012 was passed ?<br />

D. Whether the CLB is required to “pronounce” its orders and<br />

whether an order merely posted by speed post without its being<br />

“pronounced” is not a judicial order in the eyes of law?<br />

E. Whether the CLB could not have permitted the 1 st<br />

Respondent from implementing a resolution purportedly passed at<br />

its Extraordinary General Meeting when :<br />

(i) the CLB itself permitted amendment of the Company Petition<br />

impugning the convening of the said EOGM, and<br />

(ii) the CLB had adjourned another Company Application for<br />

further amendment of the Company Petition questioning the<br />

conduct at the impugned EOGM?<br />

F. Whether the CLB could not have permitted the 1 st Respondent<br />

to implement the resolution purportedly passed at the impugned<br />

EOGM when the conduct of the impugned EOGM was under<br />

serious dispute and challenge and without even considering the<br />

prima facie case made out by the Appellants ?<br />

G. Whether the abrogation of the vested right of preemption<br />

from the Articles of Association itself amounts to oppression?<br />

H. Whether the majority rights cannot be abused for amending<br />

the Articles of Association of a Company in a manner that is<br />

oppressive to the minority shareholders ?

hvn<br />

5/195<br />

COAPPL41.12<br />

I. Whether the Appellants are entitled to challenge the conduct<br />

of the impugned EOGM as well as the rulings given by the<br />

Chairman on the ground that the same were patently illegal, mala<br />

fide and a part of the preconceived deliberate oppressive design ?<br />

J. Whether the CLB could not have permitted the 1 st<br />

Respondent to implement the resolution deleting Article 57 on the<br />

ground that it was invalid when the challenge to the validity of the<br />

said Article was itself pending in the Hon'ble Supreme Court ?<br />

3. Some of the relevant facts which have bearing on various issues raised<br />

by the parties and which emerge from the pleadings and documents filed by the<br />

parties are as under.<br />

This appeal filed under Section 10F of the Companies Act, 1956 is<br />

directed against an order dated 13 th August 2012 passed by the Company Law<br />

Board, Mumbai (for short CLB) allowing Company Application No.85 of 2012<br />

which was filed by the first respondent in Company Petition No.87 of 2010.<br />

By the said order, the CLB has allowed Company Application No.85 of 2012<br />

by which the first respondent had applied for vacating and/or modifying ad<br />

interim order dated 21 st May 2012 passed by the CLB. By order dated 21 st<br />

May 2012 in C.A.No.73 of 2012 filed by the appellants, the CLB allowed the<br />

first respondent company to proceed with the Extra Ordinary General Body<br />

Meeting (EOGM) on 22 nd May 2012 and ordered that the resolutions passed if<br />

any, in the EOGM on 22 nd May 2012 shall be kept in abeyance till further

hvn<br />

6/195<br />

COAPPL41.12<br />

orders. The said C.A. (73/12) was filed by the appellants in Company Petition<br />

No.87 of 2010 under Sections 397, 398 read with 402 of the Companies Act,<br />

1956 alleging oppression and mismanagement in respondent No.1 company by<br />

respondent No.2. In the said Company Petition (87/10) filed by the appellants,<br />

the appellants sought injunction against holding of EOGM then proposed to be<br />

held on 12 th November 2010 to consider resolutions to delete certain Articles<br />

including Art.57 which provides for a right for preemption to the shareholders<br />

of the first respondent company.<br />

4. <strong>Jer</strong> <strong>Rutton</strong> Kavasmaneck @ <strong>Jer</strong> <strong>Jawahar</strong> Thadani (herein after<br />

referred as JRK) is original first claimant in Company Petition No.<br />

87/397-398/CLB/MB/2010. Darius <strong>Rutton</strong> Kavasmaneck (herein after<br />

referred as DRK) is original second claimant in the said Company Petition.<br />

DRK is a son of JRK.<br />

The first respondent is a company (hereinafter referred as the said<br />

company) in which the appellants and the respondents are shareholders. The<br />

second respondent Mr Keki Hormusji Gharda (herein after referred as Dr<br />

Gharda) is the brother of JRK and is Chairman and Managing Director of the<br />

said company. The third respondent is wife of Dr Gharda and also a Director of<br />

the said company. The fourth respondent is wife of ex Chairman and Director<br />

of the said company. The fifth respondent is Chartered Accountant and is on<br />

the Board of Directors of the said company. The sixth to eighth respondents

hvn<br />

7/195<br />

COAPPL41.12<br />

were joined as additional respondents to C.A.No.73 of 2012 before the CLB.<br />

The sixth respondent is daughter of JRK and sister of DRK. She owns and/or<br />

controls 3814 equity shares of the said company constituting approximately<br />

6%. The seventh respondent is the son of JRK and brother of DRK. The eighth<br />

respondent is wife of the seventh respondent and they between themselves hold<br />

and/or otherwise control 4301 equity shares of the first respondent constituting<br />

approximately 7%.<br />

5. On 28 th April, 1962 under a Deed of Partnership of M/s Gharda<br />

Chemicals, Kavasmanecks and Gharda became the partners. On 7 th March,<br />

1967 M/s Gharda Chemicals Pvt. Ltd. was incorporated to take away the<br />

affairs of said M/s Gharda Chemicals. On 7 th August, 1988, the said M/s<br />

Gharda Chemicals Pvt. Ltd., became a deemed public company as a result of<br />

turnover criteria under Section 43A of the Companies Act.<br />

6. In 1990 JRK, DRK along with other Kavasmanecks and Rebello filed<br />

Company Petition (77 of 1990) in this Court under Section 397 and 398 of the<br />

Companies Act against the said company. After the first respondent<br />

Company became a deemed public Company pursuant to Section 42 of the<br />

Companies Act with effect from 17 th August 1988, necessary changes were<br />

carried out in the Certificate of incorporation by the Registrar of Companies.<br />

Section 43(A) permitted deemed Public Limited Company to retain the

hvn<br />

8/195<br />

COAPPL41.12<br />

provisions referred to in Section 3(i)(iii) of the Companies Act. Pursuant to the<br />

Companies Amendment Act 2000, Section 3 of the said Act was amended to<br />

add further requirement viz (d) prohibits any invitation or acceptance of<br />

deposits from the persons other than its members and directors or their<br />

relatives and Section 43(A) deleted by way of amendment in the year 2000.<br />

Consequently the third category of the Company i.e. Deemed Public Limited<br />

Companies which continued to be permitted to include provisions applicable<br />

to Private Limited Company ceased to exist. Thereafter there are only two<br />

categories of Companies in the Companies Act viz. 'Private' and 'Public'.<br />

7. On 2 nd April 2001, the first respondent Company issued a notice calling<br />

upon EOGM to pass special resolution to amend Art. 3 of the Articles of<br />

Association to insert clause (d) prohibiting acceptance of deposits from<br />

persons other than members, directors or their relatives and also to change the<br />

name of the Company from Gharda Chemicals Limited to Gharda Chemicals<br />

Private Limited. However, the said resolution was defeated in the EOGM<br />

dated 5 th January 2001 by the appellants and their group who approx. hold<br />

more than 32% of the paid-up capital.<br />

8. By letter dated 17 th May 2001, the first respondent Company informed<br />

the appellant No.2 that a transfer notice dated<br />

15 th May 2001 from Ms P.E. Daruwalla had been received by the Company

hvn<br />

9/195<br />

COAPPL41.12<br />

expressing her desire to transfer her shares of the first respondent company and<br />

requesting the company to offer the same to all members as per Article 57 of<br />

the Articles of Association of the Company. The Company requested<br />

appellant No.2 to intimate his desire to purchase any or all such shares offered<br />

by Mrs. B.E.Daruwalla within 15 days as stipulated in Article 57 of the<br />

Articles of Association.<br />

9. By another letter dated 28 th May 2001, the first respondent company<br />

intimated the second appellant about a transfer notice dated 23 rd May 2001<br />

received from Shakuntala C. Gandhi expressing her desire of transferring 35<br />

equity shares of the first respondent company and requesting appellant No.2 to<br />

intimate his desire to purchase any or all her shares within 15 days.<br />

10. By letter dated 6 th June 2001, appellant No.2 informed the first<br />

respondent Company which read as under :<br />

“ I have received Transfer Notices dated 17 th May and 28 th May<br />

from Mrs. B.E.Daruwalla and Mrs. S.C.Gandhi, circulated by the<br />

Company purportedly under Article 57 of the Articles of<br />

Association of the Company.<br />

I am surprised to receive the above Transfer Notices. I am unable<br />

to understand as to how the Company continues to circulate<br />

Transfer Notices under Article 57, especially in view of the recent<br />

turn of events.<br />

I wish to put on record my objection to the Company, circulating<br />

Transfer Notices purportedly under Article 57 of the Articles of<br />

Association. I am ignoring these Transfer Notices and shall ignore

hvn<br />

10/195<br />

COAPPL41.12<br />

further Transfer Notices, if any, circulated by the Company<br />

purportedly under Article 57.<br />

11. On 30 th September, 2002, Government of India, Ministry of Finance,<br />

Department of Company Affairs issued a Circular and made it clear that these<br />

companies which did not approach the Registrar of Companies, seeking<br />

reversion back to private company's status, are deemed to have chosen to<br />

remain as public company.<br />

12. On 8 th September, 2005, the JRK and DRK and Rebello withdrew from<br />

the said Company Petition (77 of 1990) and other Kavasmanecks continued to<br />

pursue the said petition. By an order dated 8 th September 2005 passed by Shri<br />

Justice A.M.Khanvilkar, in the said petition, this Court recorded statement of<br />

the appellants and two other parties who were also petitioners in the said<br />

petitions that those parties were not interested in prosecuting the Company<br />

Petition (77 of 1990). This Court accepted the said request of the appellants<br />

and two others to permit them to withdraw from proceedings by deleting their<br />

names from the array of parties. Petitioner Nos.4 and 5 in the said petition,<br />

however, continued to pursue the said company petition (77 of 1990). This<br />

Court permitted petitioner Nos.4 and 5 to the said petition to carry out<br />

necessary amendment to the said Company Petition (77 of 1990).<br />

13. By an order dated 14 th November 2008 passed by Shri Justice A.M.

hvn<br />

11/195<br />

COAPPL41.12<br />

Khanvilkar, the said company petition No.77 of 1990 came to be dismissed. It<br />

is a common ground that none of the parties have challenged the said Judgment<br />

and Order dated 14 th November 2008 passed by this Court.<br />

14. On 11 th December, 2009, JRK and DRK filed another company petition<br />

before the CLB (CP 132 of 2009) under Section 397 and 398 of the Companies<br />

Act. On 25 th January, 2010, the CLB granted interim injunction in favour of<br />

JRK and DRK in the said C.P.(132 of 2009). On 26 th March, 2010, this Court<br />

in Company appeal, did not interfere with the interim order passed by the CLB<br />

on 25 th January, 2010 however directing that the hearing of the C.P. (132 of<br />

2009) be held and permitted inter member transfers. On 14 th May 2010, the<br />

CLB dismissed C.P.(132 of 2009) filed by JRK and DRK on the ground that<br />

the Company was a public limited company and article 57 of the Articles of<br />

Association was consequently invalid.<br />

15. On 28 th June, 2010 this Court admitted the appeal filed by JRK and DRK<br />

under Section 10F of the Companies Act, 1956 and granted interim relief.<br />

During the pendency of the said appeal, the said company convened an EOGM<br />

for deleting Article 57 on the ground that it was declared as invalid by the<br />

CLB by an Order dated 14 th May, 2010. In the month of October, 2010, JRK<br />

and DRK filed C.P.(87 of 2010) before the CLB interalia challenging the<br />

action of the said company to convene an EOGM for deleting Article 57 of the

hvn<br />

12/195<br />

COAPPL41.12<br />

Articles of Association. On 9 th November, 2010, the CLB rejected the interim<br />

injunction prayer for by JRK and DRK to restrain holding of the proposed<br />

EOGM. CLB however, directed hearing of the petition on a later date and the<br />

parties were directed to complete the pleadings.<br />

16. On 10 th November, 2010 JRK and DRK filed Company Appeal under<br />

Section 10F of the Companies Act, 1956 in this Court which was numbered as<br />

Company Appeal (2 of 2011). This Court passed an Order dated 10 th<br />

November, 2010, directing holding of the meeting, however not to implement<br />

the resolution passed therein till 18 th November, 2010.<br />

17. On 9 th December, 2010, the said company withdrew notice of EOGM.<br />

On 14 th June, 2011, this Court dismissed Company Appeal filed by JRK and<br />

DRK on the ground that the said company was a public company and thus<br />

Article 57 was invalid.<br />

18. The appellants challenged the Judgment and Order dated 14 th June 2011<br />

delivered by this Court by filing Special Leave Petition in the Supreme Court<br />

(Special Leave to Appeal (Civil) No.16994/11). On 22 nd July, the Supreme<br />

Court passed the following order :<br />

“ Let this matter be listed on 27 th July, 2011, before other<br />

matters, to consider issuance of notice.<br />

Till then, the interim orders which had been passed by the

hvn<br />

13/195<br />

<strong>Bombay</strong> <strong>High</strong> Court, will continue.<br />

COAPPL41.12<br />

19. On 27 th July 2011, the Supreme Court passed the following Order in the<br />

same Special Leave to Appeal No.16994/2011) filed by the appellant :<br />

“ Issue notice, returnable six weeks hence.<br />

All the respondents, except for the respondent No.4, are duly<br />

represented on caveat. Accordingly, service on the said<br />

respondents is dispensed with. As far as the respondent No.4, is<br />

concerned, since he was a nominee Director and is no longer on<br />

the Board, service of notice on the said respondent is dispensed<br />

with.<br />

The respondents will be entitled to file their respective counter<br />

affidavits to the special leave petition within 4 weeks. Rejoinder,<br />

if any, may be filed within two weeks thereafter.<br />

The interim order, which was passed on 22 nd July, 2011, will<br />

continue in the meantime.<br />

Let the matter be listed on the returnable date.”<br />

The said Special Leave to Appeal (16994/11) is pending and is not yet<br />

admitted by the Supreme Court.<br />

20. On 8 th August 2011, the appellants withdrew Company Appeal (2 of<br />

2011). This Court passed the following order.<br />

“ 1. Mentioned. Not on board.<br />

2. It is stated that two Company Appeals were on this Court's<br />

board. One company Appeal has been disposed of, whereas no<br />

orders are made on the other Company Appeal.<br />

3. It is stated that by a letter dated 9-12-2010, the Extra<br />

Ordinary General Meeting which was scheduled to be held on<br />

10-12-2010 has been adjourned/postponed. A fresh notice will be<br />

issued intimating the date of the Extra Ordinary General Meeting.

hvn<br />

14/195<br />

COAPPL41.12<br />

4. In these circumstances, the Learned Counsel Mr Samdhani<br />

appearing for the Appellants seeks leave to withdraw this Appeal<br />

with liberty to adopt appropriate proceedings, in case an occasion<br />

arises and if fresh meeting is convened.<br />

5. The application for withdrawal is granted. The Company<br />

appeal is allowed to be withdrawn and is dismissed as such with<br />

liberty to the Appellants to adopt appropriate proceedings in case<br />

a fresh Extra Ordinary General Meeting is convened. All<br />

contentions of both the sides in that behalf including the<br />

maintainability are kept open.<br />

6. Needless to, therefore, state that if the Appellants adopt<br />

appropriate proceedings, the Company Law Board or such other<br />

Forum may decide the same on its own merits and in accordance<br />

with law.<br />

7. Needless to state that a fresh Extra Ordinary General<br />

Meeting is convened, that would necessarily mean a fresh cause<br />

of action and once this Appeal is withdrawn, there is no doubt that<br />

the Company Law Board or such other forum which is<br />

approached by the Appellant, will decide the proceedings<br />

independent of the observations made in the earlier order.”<br />

21. On 31 st March 2012, the respondent Nos.6 to 8 collectively holding<br />

12.58% of the paid-up share capital issued by the first respondent Company,<br />

issued a notice under Section 169 of the Companies Act 1956 and Article 76 of<br />

the Articles of Association to convene an Extra Ordinary General Meeting<br />

(EOGM) of the members of the Company to transact the following business by<br />

special resolution.<br />

“ Amendment of Articles of Association of the company for<br />

deletion of Article 57 of the Articles of Association of<br />

company.”<br />

“RESOLVED THAT pursuant to section 31 of the<br />

Companies Act, 1956 and other applicable provisions

hvn<br />

April 2012.<br />

15/195<br />

COAPPL41.12<br />

thereof, if any, the Articles of Association of the Company<br />

be amended by deleting the existing Article 57 of the<br />

Articles of Association of the Company.”<br />

The said notice was received by the first respondent company on 20 th<br />

22. On 25 th April 2012, the first respondent company issued a notice to the<br />

shareholders in compliance with requisition dated 31 st March 2012 under<br />

Section 169 of the Companies Act 1956 and Article 76 received from<br />

respondent Nos.6 to 8 and proposed to hold EOGM on 22 nd May 2012 at 11.30<br />

am to pass a following resolution as special resolution.<br />

“ RESOLVED THAT pursuant to section 31 of the<br />

Companies Act, 1956 and other applicable provisions<br />

thereof, if any, the Articles of Association of the Company be<br />

amended by deleting the existing Article 57 of the Articles of<br />

Association of the Company.”<br />

23. Along with the said notice, the Company annexed the copy of requisition<br />

dated 31 st March 2012 and informed that the original could be inspected at the<br />

registered office of the company. It was made clear that a member entitled to<br />

attend and vote in the meeting was entitled to appoint a proxy to attend and<br />

vote instead of himself and the proxy need not be a member. It was also<br />

conveyed that no explanatory statement had been received by the company<br />

from the requisitionists and hence did not form part of the said notice.

hvn<br />

16/195<br />

COAPPL41.12<br />

24. The appellants filed C.A.(73/12) before the CLB in C.P.(87 of 2010) and<br />

sought amendment to C.P.(87/10) and stay in respect of the notice dated 25 th<br />

April 2012 issued by the first respondent company from convening EOGM on<br />

22 nd May 2012 or on any subsequent dates for the purpose of considering<br />

and/or passing resolution referred to in the said notice dated 25 th April 2012 or<br />

any part thereof or any other resolution similar thereto.<br />

25. On 19 th May 2012, one of the requisitionist Ms Mahrukh Oomrigar<br />

respondent No.6 holding 6% shares addressed a letter to her Advocates and<br />

Solicitors M/s Juris Corp instructing to support the C.A.(73 of 2012) filed by<br />

the appellants and to concede to the injunction prayed for in the said<br />

application. The sixth respondent conveyed that she did not propose to move<br />

or support the proposed resolution for deletion of Art.57. She informed that a<br />

copy of the said letter was also sent to the Registrar of CLB and to the<br />

Advocates for the petitioner/applicants.<br />

26. On 19 th May 2012, M/s Godrej Industries Ltd., addressed a letter to the<br />

first respondent company informing that the Godrej Industries Ltd., was<br />

pledgee of 6355 shares of Gharda Chemicals standing in the names of Darius<br />

and <strong>Jer</strong> Kavasmaneck and hold the said shares as security for loan aggregating<br />

to Rs. 10.34 crores granted by Godrej Industries Ltd. to them and to certain

hvn<br />

17/195<br />

COAPPL41.12<br />

other shareholders of the company. The said shareholders had executed<br />

loan/pledge agreement and irrevocable power of attorneys. Copies of powers<br />

of attorney were annexed. It is stated that the power of attorney expressly<br />

authorised Godrej Industries Ltd., to attend, vote and/or otherwise take part in<br />

all meetings held in connection with the company in relation to shares and to<br />

sign proxies for the purposes of voting and for any other purposes connected<br />

therewith as freely as the shareholders could themselves do. By the said letter,<br />

the Godrej Industries Ltd., authorized Mr Rajiv Bakshi, Executive Vice<br />

President (Legal) to attend, participate and vote at the EOGM of the company<br />

to be held on 22 nd May 2012 or on any adjourned date thereof pursuant to the<br />

powers contained in irrevocable powers of attorney. Godrej Industries Ltd.,<br />

certified signature of Mr Bakshi appended thereon. The said letter was signed<br />

by Mr Clemant Pinto, Vice President (Finance) on behalf of Godrej Industries<br />

Ltd. The said letter was received by the first respondent company on 19 th May<br />

2012.<br />

27. Mr Rajiv Bakshi signed a proxy form on behalf of the second appellant<br />

on the strength of the powers of attorney granted in favour of Godrej Industries<br />

Ltd. The said proxy form was in respect of 4645 shares held by appellant No.2<br />

in the first respondent company. The said proxy form was received by first<br />

respondent company on 19 th May 2012. A similar proxy form was signed<br />

by Mr Rajiv Bakshi on behalf of Godrej Industries Ltd. being constituted

hvn<br />

18/195<br />

COAPPL41.12<br />

attorney (CA) of the first appellant in respect of 1710 shares. The said proxy<br />

form was received by the first respondent company on 19 th May 2012. It is the<br />

case of respondent No.1 company as well as Godrej Industries Ltd., that the<br />

appellants had authorized the Godrej Industries Ltd., to appoint Mr Rajiv<br />

Bakshi as proxy to vote for the appellants at the EOGM to be held on 22 nd May<br />

2012 and at any adjournment thereof.<br />

28. On 21 st May 2012, the CLB passed an Order in C.A.No.73/12 thereby<br />

allowing the first respondent company to proceed with the convening of the<br />

meeting, however directed that resolution if passed, cannot be allowed to<br />

preempt adjudication of questions of law before the Apex Court and hence<br />

resolution passed, if any, in the EOGM on 22 nd May 2012 shall be kept in<br />

abeyance till further orders. The relevant paragraphs of the said order dated<br />

21 st May 2012 are as under :<br />

5. … CLB has the jurisdiction on the issue of convening of<br />

EOGM by the R-1 Company which is in the affairs of the R1<br />

Company in which a petition No.87/10 is pending adjudication on<br />

completion of pleadings which are not complete as yet. It is noted<br />

that CP.No.87/10 has not become infructuous as alleged by the<br />

Respondents. Besides the issue of deletion of Articles (including<br />

Article 57) of this Public Ltd. Company which is not a listed<br />

company, the petitioners have made other allegations as well as the<br />

CLB in its order dated 9-11-2010 had required the parties to<br />

complete pleadings in the matter. In the facts and circumstances of<br />

this case, it is noted that filing of SLP before the Apex Court which<br />

has also allowed the interim injunctions granted by the Hon'ble<br />

<strong>High</strong> Court at Mumbai to continue, does not fetter the rights of the<br />

requisitionists to move for convening of EOGM, nor does it restrict<br />

the R-1 company from convening of EOGM. The R-1 Company

hvn<br />

19/195<br />

COAPPL41.12<br />

has not choice under Section 169 of the Act but to convene the<br />

meeting. Even if the R-I Company does not convene the meeting,<br />

the requisitionists have the right, after the prescribed period, to go<br />

ahead with convening of the meeting. This right of the<br />

shareholders is, except in exceptional circumstances, not curtailed<br />

by the CLB.<br />

6. In view of the foregoing, I hereby allow the R-1 Company to<br />

go ahead with the convened Meeting, but keeping in view the<br />

questions of law raised in the SLP in which the Apex Court has<br />

decided to permit continuation of the interim injunction granted by<br />

the Hon'ble <strong>High</strong> Court, the Resolutions, if passed, cannot be<br />

allowed to pre-exempt adjudication of the questions of law before<br />

the Apex Court, hence, the Resolutions passed, if any, in the<br />

EOGM on 22 nd May 2012 shall be kept in abeyance till further<br />

orders.<br />

29. The Chairman of the first respondent company appointed the second<br />

appellant and one Mr Michael Raj as Scrutinizers for the EOGM dated 22 nd<br />

May 2012. On 22 nd May 2012, appellant No.2 and Mr Michael Raj submitted<br />

a report to the Chairman in the said EOGM recording of various observations<br />

made by them. In the said report, the appellant No.2 rejected the power of<br />

attorney under which Mr Rajiv Bakshi had voted in respect of 1710 shares held<br />

by the first appellant. It is submitted that Mr Rajiv Bakshi was not relative of<br />

Godrej Industries Ltd., and hence power of attorney itself was to be considered<br />

defective, invalid and ought to be rejected. In the said report, it was observed<br />

that no board resolution authorizing Mr Rajiv Bakshi on behalf of Godrej<br />

Industries Ltd. to attend and vote at the meeting was lodged with the company.<br />

30. On 22 nd May 2012 in the said EOGM of the first respondent, 8 members<br />

were personally present. One power of attorney holder was present, two

hvn<br />

20/195<br />

COAPPL41.12<br />

authorised representatives were present. Number of shares represented by<br />

proxies were at 10408. The Chairman declared that special resolution was<br />

passed to delete Art.57 of Articles of Association of the first respondent<br />

company with requisite majority. The amended Article 57 before deletion<br />

reads as under :-<br />

ARTICLES OF ASSOCIATION<br />

ARTICLE 57<br />

(As amended)<br />

The amended Article 57 of the Articles of Association<br />

which has been deleted reads thus :-<br />

57. Save as aforesaid, the following provisions shall apply<br />

to the transfer of shares :-<br />

(a) A member of the Company may transfer a share to his<br />

lineal descendent, but save as aforesaid no share shall be<br />

transfered to a person who is not a member of the Company so<br />

long as any member is willing to purchase the same at the fair<br />

value as hereinafter provided ;<br />

(b) The member proposing to transfer any shares<br />

(hereinafter called the proposing transferor) shall give notice<br />

in writing (hereinafter called a transfer notice) to the<br />

Company that he desires to transfer the same ;<br />

(c) Within the period of seven days from the receipt of a<br />

transfer notice as aforesaid the Company shall offer to each of

hvn<br />

21/195<br />

the existing members of the Company respectively such<br />

number of the shares included in the transfer notice as a pro<br />

rata or as nearly as may be to the holding of each member<br />

respectively on the footing that if he desires to purchase any<br />

or all of such numbers of the said shares at the fair value he<br />

shall within fifteen days of the offer be entitled to apply for<br />

the purchase and transfer of the same and the Company shall<br />

be bound, upon payment to the transferor of the fair value of<br />

such shares to transfer the shares of member applying;<br />

(d) In case of any member or members shall not have<br />

applied for the purchase and transfer of any or all of the shares<br />

to which he is entitled, the Company shall within seven days<br />

of the date at which the offer closed, offer the untaken shares<br />

to such of the members as have applied for the purchase and<br />

transfer of all of the shares to which they were entitled by the<br />

terms of the original offer in proportion as the holding of each<br />

of such members bears to the total number of shares held by<br />

them and they shall be entitled within fifteen days of the offer<br />

to apply for the purchase and transfer of a pro rata number of<br />

the said untaken shares and the Company shall be bound,<br />

upon payment to the transfer of the fair value of such shares to<br />

transfer the shares to the member applying;<br />

(e) The proposing transferor shall be bound to execute a<br />

transfer in respect of any shares so sold and in default thereof<br />

be deemed to have executed such a transfer. The Company<br />

shall thereupon cause the names of the members who have<br />

purchased the shares to be entered in the Registrar as the<br />

COAPPL41.12

hvn<br />

22/195<br />

holders of such shares and thereafter the validity of the<br />

proceedings shall not be questioned by any person;<br />

(f) In case no member shall apply for any of the shares<br />

included in the transfer notice or in case any are untaken after<br />

compliance with the foregoing provisions of this Article the<br />

intending transferor shall have the right (which right shall<br />

endure for the period of one year from the date of transfer<br />

notice) to sell and dispose of his shares to any person and at<br />

any price and to apply for registration of the transfer of the<br />

same and the company shall be bound to give effect to the<br />

transfer of such shares accordingly;<br />

(g) For the purpose of this clause the fair value of the share<br />

shall be such sum, if any, as the auditors for the time being of<br />

the Company shall certify as the fair value thereof provided<br />

that it expressly declared that the fair value shall be (1) the<br />

amount of capital paid up thereon plus, (2) a sum bearing the<br />

same proportion to the value as appearing in the Company’s<br />

last balance sheet of any reserve fund or other fund of the<br />

Company as the capital paid up on all the shares of the<br />

Company for the time being issued plus or minus as the case,<br />

may be, (3) a sum bearing the same proportion to the value as<br />

appearing in the Company’s last chance sheet of any balance<br />

in the profit and loss account consisting of or representing<br />

undivided profits or losses account consisting of or<br />

representing undivided profits or losses as the capital paid up<br />

on such shares, bears to the total capital paid up on all the<br />

shares of the Company for the time being issued.<br />

COAPPL41.12

hvn<br />

23/195<br />

Amendment to Articles : Article Nos. 57(h), 57(i), 57(j) and<br />

57(k) were inserted as additional clauses to Article 57<br />

pursuant to Special Resolution dated 15th<br />

February, 1990.<br />

Nothing contained in clauses 57(a) to 57(g) hereof shall<br />

apply to any transfer of shares which falls under any one or<br />

more of the following circumstances :-<br />

57(h) transfer by a person to another person who is a<br />

“relative” within the meaning ascribed thereto in the<br />

Companies Act, 1956.<br />

57(i) transfer to a body corporate in which a majority of<br />

directors (or other persons who in law are to be regarded as<br />

Directors) or shareholders holding not less than 51% of the<br />

voting rights are persons who are the members of the<br />

company.<br />

57(j) transfer by way of gift whether on account of love and<br />

affection between persons who are relatives of each other or<br />

by way of philanthropy.<br />

57(k) transfer by a person to another person who is an<br />

existing member of the company.<br />

PROVIDED THAT in each case the question as to<br />

whether the case falls under any of the foregoing circumstance<br />

shall be subject to a decision by the Board of Directors who<br />

shall be entitled to call for such information and particulars as<br />

COAPPL41.12

hvn<br />

24/195<br />

may be reasonably required to examine as to whether the case<br />

does infact bona fide fall under any of the foregoing<br />

circumstances.”<br />

COAPPL41.12<br />

31. The Chairman of the meeting signed minutes of EOGM dated 22 nd May<br />

2012. According to the said Minutes, the Chairman gave ruling after giving<br />

due consideration to the objection and observations made by both the<br />

scrutinizers as referred in the minutes of meeting and announced the result of<br />

the poll. According to the said minutes of meeting of EOGM dated 22 nd May<br />

2012, the total votes polled were 62883. Votes in favour of the resolution were<br />

47623 (75.73%) and the votes against the resolution were 15260 (24.26%).<br />

32. On 9 th June 2012, the appellants filed CA (91/12) for further amendment<br />

to CP(87/10) before the CLB challenging the meeting dated 22 nd May 2012 and<br />

seeking injunction on implementation of the resolution dated 22 nd May 2012.<br />

On 12 th June, 2012, the first respondent company filed CA (85/12) before CLB<br />

for vacating and/or modifying interim injunction order dated 21 st May 2012<br />

passed by CLB in CA (73/12).<br />

33. On 10 th August, 2012 arguments on C.A. (73/12) and C.A.(85/12) were<br />

closed and orders were reserved. C.A.(91/12) was adjourned to 6 th September<br />

2012. On 13 th August 2012, the CLB passed a detailed order and judgment<br />

allowing C.A.(73/12) seeking amendment to C.P.(87/10) filed by the

hvn<br />

25/195<br />

COAPPL41.12<br />

appellants. The CLB also by the same order allowed C.A. (85/12) filed by the<br />

first respondent company and vacated order dated 21 st May, 2012.<br />

34. Being aggrieved by order dated 13 th August 2012 passed by the CLB<br />

allowing CA No.73/12 filed by the appellants herein, the first respondent<br />

company has filed Company Appeal (L) No.45/12 under Section 10F of the<br />

Companies Act 1956 in this Court which was heard along with present<br />

company appeal and being disposed of by a separate order. Being aggrieved<br />

by order dated 13 th August 2012 allowing C.A. No.85/12 filed by the first<br />

respondent company, the appellants have filed this appeal.<br />

35. Some of the relevant provisions of Companies Act and Company<br />

Law Board Regulations, 1991 relied upon the parties are extracted as<br />

under :<br />

Section 3. Definitions of “company”, “existing company”,<br />

“private company” and “public company”.<br />

(1), (2) Not relevant.<br />

(3) Every private company, existing on the commencement of the<br />

Companies (Amendment) Act, 2000, with a paid-up capital of less<br />

than one lakh rupees, shall, within a period of two years from such<br />

commencement, enhance its paid-up capital to one lakh rupees.<br />

(4) Every public company, existing on the commencement of the<br />

Companies (Amendment) Act, 2000, with a paid-up capital of less

hvn<br />

26/195<br />

COAPPL41.12<br />

than five lack rupees, shall within a period of two years from such<br />

commencement, enhance its paid-up capital to five lakh rupees.<br />

Section 9. Act to override memorandum, articles, etc. :-<br />

(a) the provisions of this Act shall have effect<br />

notwithstanding anything to the contrary contained in the<br />

memorandum or articles of a company, or in any<br />

agreement executed by it, or in any resolution passed by<br />

the company in general meeting or by its Board of<br />

directors, whether the same be registered, executed or<br />

passed, as the case may be, before or after the<br />

commencement of this Act; and<br />

(b) any provision contained in the memorandum, articles,<br />

agreement or resolution aforesaid shall, to the extent to<br />

which it is repugnant to the provisions of this Act, become<br />

or be void, as the case may be.<br />

Sec.10F. : Appeals against the order of the Company Law Board :-<br />

Any person aggrieved by any decision or order of the Company<br />

Law Board may file an appeal to the <strong>High</strong> Court within sixty days<br />

from the date of communication of the decision or order of the<br />

Company Law Board to him on any question of law arising out of<br />

such order:<br />

Provided that the <strong>High</strong> Court may, if its is satisfied that the appellant<br />

was prevented by sufficient cause from filing the appeal within the<br />

said period, allow it to be filed within a further period not exceeding<br />

sixty days.<br />

Sec.43 : Consequences of default in complying with conditions<br />

constituting a company a private company, - Where the articles<br />

of a company include the provisions which, under clause (iii) of<br />

sub-section (1) of section 3, are required to be included in the<br />

articles of a company in order to constitute it a private company, but<br />

default is made in complying with any of those provisions, the

hvn<br />

27/195<br />

COAPPL41.12<br />

company shall cease to be entitled to the privileges and exemptions<br />

conferred on private companies by or under this Act, and this Act<br />

shall apply to the company as if it were not a private company:<br />

Provided that the (Central Government) on being satisfied that the<br />

failure to comply with the conditions was accidental or due to<br />

inadvertence or to some other sufficient cause, or that on other<br />

grounds it is just and equitable to grant relief, may, on the<br />

application of the company or any other person interested and on<br />

such terms and conditions as seem to the (Central Government) just<br />

and expedient, order that the company be relieved from such<br />

consequences as aforesaid.<br />

Sec.43(A) : A private company to become public company in<br />

certain cases :- (1) Save as otherwise provided in this section,<br />

where not less than twenty-five per cent of the paid-up share capital<br />

of a private company having a share capital, is held by one or more<br />

bodies corporate, the private company shall :<br />

(a) on an from the date on which the aforesaid percentage is<br />

first held by such body or bodies corporate, or<br />

(b) where the aforesaid percentage has been first so held<br />

before the commencement of the Companies (Amendment)<br />

Act, 1960 (65 of 1960), on and from the expiry of the period<br />

of three months from the date of such commencement unless<br />

within that period the aforesaid percentage is reduced below<br />

twenty-five per cent of the paid-up share capital of the private<br />

company, become by virtue of this section a public company:<br />

Provided that even after the private company has so become a<br />

public company, its articles of association may include<br />

provisions relating to the matters specified in clause (iii) of

hvn<br />

28/195<br />

COAPPL41.12<br />

sub-section (1) of section 3 and the number of its members<br />

may be, or may at any time be reduced, below seven:<br />

Provided further that in computing the aforesaid percentage,<br />

account shall not be taken of any share in the private company<br />

held by a banking company, if, but only if, the following<br />

conditions are satisfied in respect of such share, namely;<br />

(a) that the share -----<br />

(i) forms part of the subject-matter of a trust,<br />

(ii) has not been set apart for the benefit of any body<br />

corporate, and<br />

(iii) is held by the banking company either as a trustee of<br />

that trust or in its own name on behalf of a trustee of that<br />

trust, or<br />

(b) that the share ---<br />

(i) forms part of the estate of a deceased person,<br />

(ii) has not been bequeathed by the deceased person by his<br />

will to any body corporate, and<br />

(iii) is held by the banking company either as an executor<br />

or administrator of the deceased person or in its own name<br />

on behalf of an executor or administrator of the deceased<br />

person, and the registrar may, for the purpose of<br />

satisfying himself that any share is held in the private<br />

company by a banking company as aforesaid, call for at any<br />

time from the banking company such books and papers as<br />

he considers necessary.<br />

Sec.43(2)(A) : Where a public company referred to in sub-section<br />

(2) becomes a private company on or after the commencement of<br />

the Companies (Amendment) Act, 2000, such company shall

hvn<br />

29/195<br />

COAPPL41.12<br />

inform the Registrar that it has become a private company and<br />

thereupon the Registrar shall substitute the word “private company”<br />

for the word “public company” in the name of the company upon<br />

the register and shall also make the necessary alterations in the<br />

certificate of incorporation issued to the company and in its<br />

memorandum of association within four weeks from the date of<br />

application made by the company.<br />

Sec.397. Application to Company Law Board for relief in cases<br />

of oppression :- (1) Any member of a company who complain<br />

that the affairs of the company are being conducted in a manner<br />

prejudicial to public interest or in a manner oppressive to any<br />

member or members (including any one or more of themselves)<br />

may apply to the Company Law Board for an order under this<br />

section, provided such members have a right so to apply in virtue of<br />

section 399.<br />

(2) If, on any application under sub-section (1), the Court is os<br />

opinion :<br />

(a) that the company's affairs (are being conducted in a<br />

manner prejudicial to public interest or) in a manner<br />

oppressive to any member of members; and<br />

(b) that to wind up the company would unfairly prejudice<br />

such member or members, but that otherwise the facts<br />

would justify the making of a winding-up order on the<br />

ground that it was just and equitable that the company<br />

should be wound up,<br />

the Company Law Board may, with a view to bringing to an<br />

end the matters complained of, make such order as it thinks<br />

fit.

hvn<br />

30/195<br />

COAPPL41.12<br />

Sec.398 : Application to Company Law Board for relief in cases of<br />

mismanagement :<br />

(1) Any members of a company who complain :-<br />

(a) that the affairs of the company are being conducted in a<br />

manner prejudicial to public interest or in a manner<br />

prejudicial to the interests of the company; or<br />

(b) that a material change not being a change brought about<br />

by, or in the interests of, any creditors including debenture<br />

holders, or any class of shareholders, of the company) has<br />

taken place in the management or control of the company,<br />

whether by an alteration in its Board of directors, or<br />

manager), or in the ownership of the company's shares, or if<br />

it has no share capital, in its membership, or in nay other<br />

manner whatsoever, and that by reason of such change, it is<br />

likely that the affairs of the company will be conducted in a<br />

manner prejudicial to public interest or in a manner<br />

prejudicial to the interests of the company,<br />

may apply to the Company Law Board for an order under<br />

this section, provided such members have a right so to apply<br />

in virtue of section 399.<br />

(2) If, on any application under sub-section (1), the Company Law<br />

Board is of opinion that the affairs of the company are being<br />

conducted as aforesaid or that by reason of any material change as<br />

aforesaid in the management or control of the company, it is likely<br />

that the affairs of the company will be conducted as aforesaid, the<br />

Company Law Board may, with a view to bringing to an end or<br />

preventing the matters complained of or apprehended, make such<br />

order as it thinks fit.

hvn<br />

31/195<br />

COAPPL41.12<br />

Sec.402. Powers of “Company Law Board” to apply under<br />

section 397 and 398 : - Without prejudice to the generality of the<br />

powers of the Company Law Board under section 397 or 398, any<br />

order under either section may provide for<br />

(a) the regulation of the conduct of the company's affairs in future ;<br />

(b) the purchase of the shares or interests of any members of the<br />

company by other members thereof or by the company ;<br />

(c) in the case of a purchase of its shares by the company as<br />

aforesaid, the consequent reduction of its share capital.<br />

(d) the termination, setting aside or modification of any agreement,<br />

howsoever arrived at, between the company on the one hand, and<br />

any of the following persons, on the other, namely<br />

(i) the managing director.<br />

(ii) any other director,<br />

(iii)<br />

(iv)<br />

(v) the manager, upon such terms and conditions as may,<br />

in the opinion of the Company Law Board, be just and<br />

equitable in all the circumstances of the case ;<br />

(e) the termination, setting aside or modification of any agreement<br />

between the company and any person not referred to in clause (d),<br />

provided that no such agreement shall be terminated, set aside or<br />

modified except after due notice to the party concerned and<br />

provided further that no such agreement shall be modified except<br />

after obtaining the consent of the party concerned ;<br />

(f) the setting aside of any transfer, delivery of goods, payment,<br />

execution or other act relating to property made or done by or<br />

against the company within three months before the date of the<br />

application under section 397 or 398, which would, if made or done<br />

by or against an individual, be deemed in his insolvency to be a<br />

fraudulent preference ;<br />

(g) any other matter for which in the opinion of the Company Law<br />

Board it is just and equitable that provision should be made.

hvn<br />

32/195<br />

Company Law Board Regulations, 1991.<br />

COAPPL41.12<br />

29. Order of the Bench.- (1) Every order of the Bench shall be in<br />

writing and shall be signed by the member or members constituting<br />

the Bench which pronounces the order.<br />

(2) In case of difference of opinion among the members of the<br />

Bench, the opinion of the majority shall prevail and the opinion or<br />

orders of the Bench shall be expressed in terms of the views of the<br />

majority: Provided that where a matter is heard by a Bench<br />

consisting of an even number of members and such members are<br />

divided equally in their opinion, it shall be placed before the<br />

Chairman who may himself deal with the matter or nominate any<br />

other member to deal with the same.<br />

(3) Any order of the bench deemed fit for publication in any<br />

journal, authoritative report or the Press may be released for such<br />

publication on such terms and conditions as the Board may specify<br />

by general or special order.<br />

(4) A copy of every interim order granting or refusing or modifying<br />

interim relief and final order passed on any petition or reference<br />

shall be communicated to the petitioner or the applicant and to the<br />

respondents and other parties concerned free of cost:<br />

Provided that in the case of an order under section 17 confirming<br />

change of registered office, two copies of the order shall be<br />

supplied to the petitioner company free of cost.<br />

(5) If the petitioner or the applicant or the respondent to any<br />

proceeding requires a copy of any document or proceeding, the<br />

same shall be supplied to him on such terms and conditions and on<br />

payment of such fee as may be fixed by the Bench by general or<br />

special order.<br />

(6) The Bench may make such order or give such direction as may<br />

be necessary or expedient to give effect to its orders or to prevent<br />

abuse of its process or to secure the ends of justice.<br />

(7) It shall be lawful for a Bench to fix, and award, costs to any of<br />

the parties before it where it is of opinion that the award of such<br />

costs is necessary.<br />

33. Registers of petitions and applications :-<br />

(2) In every register, referred to in sub regulation (1), there shall

hvn<br />

33/195<br />

be entered the following particulars, namely,<br />

(a) to (i) not relevant.<br />

COAPPL41.12<br />

(j) the date when the formal order is drawn up and communicated<br />

to the parties.<br />

44. Saving of inherent power of the Bench.- Nothing in these Rules shall be<br />

deemed to limit or otherwise affect the inherent power of the Bench<br />

to make such orders as may be necessary for the ends of justice or<br />

to prevent abuse of the process of the Bench.<br />

36. On question of maintainability of present appeal, Mr.Bobde, the learned<br />

senior counsel appearing for respondent no. 2 submits as under :<br />

(a) Under section 10F of the Companies Act, the appeal to the <strong>High</strong><br />

Court is maintainable from the order of the CLB only on the question of law.<br />

CLB is the final authority on facts unless the said findings are perverse based<br />

on no evidence and or are otherwise arbitrary. The jurisdiction of the appellate<br />

court under section 10F is restricted to the question as to whether on the facts<br />

as noticed by the CLB, the inference could reasonably be arrived at that such<br />

conduct was against the probity and good conduct and or was mala fide or<br />

for a collateral purpose or was burdensome, harsh or wrongful. The present<br />

appeal makes out no case warranting any interference by this court.<br />

Section 10F of the Companies Act, 1956 reads as under :<br />

“10F. 3[ Appeals against the orders of the Company Law Board. Any<br />

person aggrieved by any decision or order of the Company Law<br />

Board may file an appeal to the <strong>High</strong> Court within sixty days from<br />

the date of communication of the decision or order of the Company

hvn<br />

34/195<br />

COAPPL41.12<br />

Law Board to him on any question of law arising out of such order:<br />

Provided that the <strong>High</strong> Court may, if it is satisfied that the appellant<br />

was prevented by sufficient cause from filing the appeal within the<br />

said period, allow it to be filed within a further period not exceeding<br />

sixty days.] ”<br />

(b) This court can only consider if the question of law has been<br />

wrongly decided and can not substitute its own discretion with that of the<br />

CLB and or inquire into the merits of the case on facts unless the order is<br />

arbitrary, capricious or has ignored settled principles regulating grant or<br />

refusal of injunctions or other interim orders. In the present case, no such<br />

case is made out by the appellants warranting interference. The respondents<br />

placed reliance upon the judgment of the Supreme Court in the case of V.S.<br />

Krishnan Vs. Westfort Hi-tech Hospital Limited and Ors. (2008) 3<br />

S.C.C. 363 and more particularly para 16 which reads :<br />

“16. It is clear that Section 10F permits an appeal to the <strong>High</strong><br />

Court from an order of the Company Law Board only on a question of<br />

law i.e., the Company Law Board is the final authority on facts unless<br />

such findings are perverse based on no evidence or are otherwise<br />

arbitrary. Therefore, the jurisdiction of the appellate Court under Section<br />

10F is restricted to the question as to whether on the facts as noticed by<br />

the Company Law Board and has placed before it, an inference could<br />

reasonably be arrived at that such conduct was against probity and good<br />

conduct or was mala fide or for a collateral purpose or was burdensome,<br />

harsh or wrongful. The only other basis on which the appellate Court<br />

would interfere under Section 10F was if such conclusion was (a) against<br />

law or (b) arose from consideration of irrelevant material or (c) omission<br />

to construe relevant materials.”<br />

37. Mr. Samdani, learned senior counsel appearing for the appellant submits<br />

that the question of law have been framed in appeal and are to be found at

hvn<br />

35/195<br />

COAPPL41.12<br />

Paragraphs (A) to (J). It is submitted that it is settled law that mixed question<br />

of law and fact is also a question of law. The appellant placed reliance upon<br />

the judgment of the Supreme Court in the case of Sree Meenakshi Mills Ltd.<br />

Vs. Commissioner of Income Tax, AIR 1957 SC 47 more particularly para 10<br />

which reads thus :<br />

“10. It was next contended for the appellant that inference from facts<br />

was a question of law, and that as the conclusion of the Tribunal that<br />

the intermediaries were dummies and that the sales standing in their<br />

names were sham and fictitious was itself an inference from several<br />

basic facts found by it, it was a question of law and that the appellant<br />

had the right under section 66(1) to have the decision of the court on<br />

its correctness, and support for this position was sought from certain<br />

observations in Edwards (Inspector of Taxes) v. Bairstow , Bomford<br />

v. Osborne ; , Thomas Fattorini (Lancashire), Ltd. v. Commissioners<br />

of Inland Revenue : 24 T. C. 328.], Cameron v. Prendergast ; 8 I. T.<br />

R. Supplt. 75.] and The Gramophone and Typewriter Company, Ltd.<br />

v. Stanley ; 5 T. C. 358.]. At the first blush, it does sound somewhat<br />

of a contradiction to speak of a finding of fact as one of law even<br />

when that finding is an inference from other facts, the accepted<br />

notion being that questions of law and of fact form antithesis to each<br />

other with spheres distinct and separate. When the Legislature in<br />

terms restricts the power of the court to review decisions of<br />

Tribunals to questions of law, it obviously intends to shut out<br />

questions of fact from its jurisdiction. If the contention of the<br />

appellant is correct, then a finding of fact must, when it is an<br />

inference from other facts, be open to consideration not only on the<br />

ground that it is not supported by evidence or perverse but also on<br />

the ground that it is not a proper conclusion to come to on the facts.<br />

In other words, the jurisdiction in such cases is in the nature of a<br />

regular appeal on the correctness of the finding. And as a contested<br />

assessment - and it is only such that will come up before the Tribunal<br />

under section 33 of the Act, must involve disputed questions of fast,<br />

the determination of which must ultimately depend on findings on<br />

various preliminary or evidentiary facts, it must result that<br />

practically all orders of assessment of the Tribunal could be brought<br />

up for review before courts. That will, in effect, be to wipe out the<br />

distinction between questions of law and questions of fact and to<br />

defeat the policy underlying sections 66(1) and 66(2). One should

hvn<br />

36/195<br />

COAPPL41.12<br />

hesitate to accept a contention which leads to consequences so<br />

startling, unless there are compelling reasons therefore. Far from that<br />

being the case, both principle and authority are clearly adverse to it.”<br />

38. In rejoinder on this issue the learned counsel appearing for the<br />

respondent no.2 distinguished the judgment of the Supreme Court in the case<br />

of Sree Meenakshi Mills (supra) on the ground that the said judgment did not<br />

pertain to appeal under section 10F of the Companies Act, 1956 and in any<br />

event does not hold that the question of law means mixed question of facts<br />

and law or that this court is empowered to reconsider the facts and come to a<br />

different conclusion on such reconsideration. It is reiterated that plain reading<br />

of section 10F of the Companies Act makes it clear that the appeal may be<br />

filed only on the question of law. The CLB has rendered findings of facts and<br />

thus interference of this court under section 10F is not permissible.<br />

39. In my view, the appeal lies to the <strong>High</strong> Court under Section 10F on any<br />

question of law arising from any decision or order of the Company Law<br />

Board. The finding of fact recorded by CLB Is final and is not appealable<br />

unless it is perverse, based on no evidence or otherwise arbitrary. Even if the<br />

court would have come to a different conclusion on the facts, appeal cannot be<br />

entertained on a mere finding of fact. The Supreme Court in case of<br />

V.S.Krishnan (supra) has held that section 10F can be invoked only on a<br />

question of law and CLB is final authority on facts unless such findings are

hvn<br />

37/195<br />

COAPPL41.12<br />

perverse based on no evidence or otherwise arbitrary. The jurisdiction of<br />

appellate court under section 10F is restricted to the question as to whether on<br />

the facts as noticed by the CLB and has placed before it, an interference could<br />

reasonably be arrived at that such conduct was against probity and good<br />

conduct or was malafide or for a collateral purpose or was burdensome, harsh<br />

or wrongful. The appellate court can also interfere if the conclusion was<br />

against law or arose from consideration of irrelevant material or omission to<br />

construe relevant materials.<br />

40. The appellants have formulated various questions which are setout in<br />

para (2) of this order which shall be dealt with by this court in the subsequent<br />

paragraphs of this order as to whether any question of law as formulated by the<br />

appellants arise for the determination of this court or not.<br />

41. Mr. Samdhani, learned senior counsel appearing for the appellant<br />

submitted that the impugned order passed by the CLB in Company Application<br />

(85 of 2012) on 13 th August, 2012 is in the nature of review. It is submitted<br />

that the CLB has no power to review and thus Company Application (85 of<br />

2012) ought to have been rejected. In the alternate, it is submitted that even if<br />

CLB did have power to review its earlier order, it could not come to the<br />

diametrically opposite conclusion on the same arguments that were advanced<br />

before passing the order of 21 st May, 2012. It is submitted that Company

hvn<br />

38/195<br />

COAPPL41.12<br />

Application (85 of 2012) was thus not maintainable and thus injunction order<br />

dated 21 st May, 2012 could not have been vacated by the CLB. It is submitted<br />

that under the guise of clarification or modification one can not seek review.<br />

The learned counsel submits that notwithstanding that the appellant had<br />

contended that the order was an ad interim order, the fact remains that the<br />

respondents did not agree with that interpretation of the appellants. It is<br />

submitted that the nature of the order dated 21 st May, 2012 has to be<br />

ascertained on the perusal of the order itself. From the reading of the order, it<br />

clearly states that the order of 21 st May, 2012 was not ad interim order but<br />

was interim order disposing of the application regarding injunction. The only<br />

new event was that the impugned meeting had now been held. It is submitted<br />

that merely because meeting was held would not entitle the respondents to<br />

seek vacation/modification/review of the order dated 21 st May, 2012. The CLB<br />

had already considered possibility of the resolution being passed.<br />

42. Mr. Bobde, the learned senior counsel appearing on behalf of the<br />

respondents, on the other hand submits as under :<br />

(a) The power of review is vested in civil courts by section 114<br />

and order XLVII Rule 1 of Code of Civil Procedure, 1908 in relation to final<br />

decrees/orders passed under the Code. The order sought to be reviewed must<br />

have finally disposed of the case. No review is permissible under the Criminal<br />

Procedure Code. Variation, modification or vacation of interim order does

hvn<br />

39/195<br />

COAPPL41.12<br />

not amount to review of that order. By its very nature, interim order or ad<br />

interim orders are capable of being modified or vacated on the latter date.<br />

(b) Order XXXIX rule 1 and 2 of C.P.C. 1908 provide for grant of<br />

temporary injunction. Rule 4 expressly provide for discharge, variation or<br />

setting aside of a temporary injunction. The CLB exercises inherent powers<br />

when granting, refusing, modifying or vacating an interim order. It is<br />

submitted that the sole question is whether the interim order is just and<br />

equitable and secures the ends of justice. Earlier order dated 21 st May, 2012<br />

was ad interim order “till further orders” and was passed without having<br />

benefit of resolution which was passed next day. It is submitted that the order<br />

was passed on the very preliminary view of the order since the EOGM was<br />

scheduled for the next date and that is why it was expressly stated to be “till<br />

further orders”. It is submitted that when EOGM was held, the respondent no.<br />

1 company filed Company Application (85 of 2012) for vacating/modifying<br />

the order dated 21 st May, 2012 after bringing on record the resolution passed<br />

In EOGM by Respondent No. 1. The respondents placed reliance on the<br />

judgment of the Supreme Court in the case of Manohar Lal Vs. Seth Hiralal,<br />

AIR 1962 SC 527 and more particularly para 23 thereof which reads thus :<br />

“The section itself says that nothing in the Code shall be deemed to<br />

limit or otherwise affect the inherent power of the Court to make<br />

orders necessary for the ends of justice. In the face of such a clear<br />

statement, it is not possible to hold that the provisions of the Code<br />

control the inherent power by limiting it or otherwise affecting it.<br />

The inherent power has not been conferred upon the Court; it is a<br />

power inherent in the Court by virtue of its duty to do justice

hvn<br />

between the parties before it. ”<br />

40/195<br />

COAPPL41.12<br />

43. The learned counsel for the respondents placed reliance on Regulation<br />

29(4) of the Company Law Board Regulation, 1991 which reads as under:<br />

“A copy of every interim order granting or refusing or modifying<br />

interim relief and final order passed on any petition or reference<br />

shall be communicated to the petitioner or the applicant and to the<br />

respondents and other parties concerned free of cost.”<br />

44. Relying upon Regulation 29(4) it is submitted that the said Regulation<br />

postulates that CLB has power to grant interim order or refuse or modify that.<br />

It is submitted that the source of that power is to be found in section 403 of<br />

the companies Act, 1956 read with regulation 44 which saves inherent power<br />

of the Bench. It is submitted that on a conjoint reading of Regulation 44 and<br />

29(4), the CLB has inherent powers to grant interim relief and to modify or<br />

vacate or refuse interim relief as may be necessary for the ends of justice or to<br />

prevent the abuse of the process of the Bench.<br />

45. Mr. Kadam, the learned senior counsel appearing for respondent no. 1<br />

submitted that no provisions in law can control inherent powers of the court.<br />

The inherent powers are exercised to do complete justice. It is submitted that<br />

the order dated 21 st May, 2012 passed by CLB clearly provide that the same<br />

was “till further orders”. The first respondent company had applied for

hvn<br />

41/195<br />

COAPPL41.12<br />

vacating the said ad interim order and the said application was not for seeking<br />

any review. It is submitted that the as per Order XXXIX rule 4, the order of<br />

injunction also may be varied if there is change in circumstances or if<br />

hardship is caused to the party. The learned counsel for the first respondent<br />

placed reliance upon the judgment of the Supreme Court in the case of<br />

Gujarat Bottling Co. Ltd. Vs. Coco Cola Co. (1995) 5 S.C.C. 545 and<br />

more particularly para 47 which reads thus :<br />

“46. The grant of an interlocutory injunction during the pendency of<br />

legal proceedings is a matter requiring the exercise of discretion of<br />

the court. While exercising the discretion the court applies the<br />

following tests - (i) whether the plaintiff has a prima facie case; (ii)<br />

whether the balance of convenience is in favour of the plaintiff; and<br />

(iii) whether the plaintiff would suffer an irreparable injury if his<br />

prayer for interlocutory injunction is disallowed. The decision<br />

whether or not to grant an interlocutory injunction has to be taken at<br />

a time when the existence of the legal right assailed by the plaintiff<br />

and its alleged violation are both contested and uncertain and remain<br />

uncertain till they are established at the trial on evidence. Relief by<br />

way of interlocutory injunction is granted to mitigate the risk of<br />

injustice to the plaintiff during the period before that uncertainty<br />

could be resolved. The object of the interlocutory injunction is to<br />

protect the plaintiff against injury by violation of his right for which<br />

he could not be adequately compensated in damages recoverable in<br />

the action if the uncertainty were resolved in his favour at the trial.<br />

The need for such protection has, however, to be weighed against the<br />

corresponding need of the defendant to be protected against injury<br />

resulting from his having been prevented from exercising his own<br />

legal rights for which he could not be adequately compensated. The<br />

court must weigh one need against another and determine where the<br />

'balance of convenience' lies. See : Wander Ltd. and Anr. v. Antox<br />

India P. Ltd. MANU/SC/0595/1990 . In order to protect the<br />

defendant while granting an interlocutory injunction in his favour the<br />

Court can require the plaintiff to furnish an under taking so that the<br />

defendant can be adequately compensated if the uncertainty were<br />

resolved in his favour at the trial.”

hvn<br />

42/195<br />

COAPPL41.12<br />

46. Mr. Sen, the learned counsel appearing for Respondent nos. 4 and 5<br />

invited my attention to Para 6 of the order dated 21 st May, 2012 passed by CLB<br />

allowing the first respondent company to go ahead with convening the<br />

meeting, however, making it clear that the resolution passed, if any in the<br />

EOGM on 21 st May, 2012 shall be kept in abeyance till further orders. The<br />

learned counsel invited my attention to the order sheet dated 21 st May, 2012<br />

in the Company Application (73 of 2012) which reads thus :<br />

“Part heard. Company Application No. 74 of 2012 with<br />

respect to interim injunction as prayed for in Company Application<br />

No. 73 of 2012. R-I company is hereby allowed to hold EOGM<br />

scheduled on 22-5-2012 at 11.30 a.m. That the resolution if any<br />

passed, shall not be given effect to till further orders. Detailed order<br />

follows.”<br />

47. Mr. Sen, the learned counsel submits that it is clear that the order passed<br />