- Page 2:

This page intentionally left blank

- Page 6:

This page intentionally left blank

- Page 10:

EDITOR Lacey Vitetta PROJECT EDITOR

- Page 14:

vi BRIEF CONTENTS PART III PARTIAL

- Page 18:

viii PREFACE TO 2 ND EDITION—A RE

- Page 22:

x PREFACE TO 2 ND EDITION—A READE

- Page 26:

This page intentionally left blank

- Page 30:

This page intentionally left blank

- Page 34:

This page intentionally left blank

- Page 38:

xviii CONTENTS CHAPTER 3 VC RETURNS

- Page 42:

xx CONTENTS Reference 177 Exercises

- Page 46:

xxii CONTENTS Summary 288 Key Terms

- Page 50:

xxiv CONTENTS 23.3 Sequential Games

- Page 54:

This page intentionally left blank

- Page 58:

4 CHAPTER 1 THE VC INDUSTRY EXHIBIT

- Page 62:

6 CHAPTER 1 THE VC INDUSTRY capital

- Page 66:

8 CHAPTER 1 THE VC INDUSTRY Because

- Page 70:

10 CHAPTER 1 THE VC INDUSTRY a succ

- Page 74:

12 CHAPTER 1 THE VC INDUSTRY EXHIBI

- Page 78:

14 CHAPTER 1 THE VC INDUSTRY compan

- Page 82:

16 CHAPTER 1 THE VC INDUSTRY The ma

- Page 86:

18 CHAPTER 1 THE VC INDUSTRY EXHIBI

- Page 90:

20 CHAPTER 1 THE VC INDUSTRY rapid

- Page 94:

22 CHAPTER 2 VC PLAYERS focusing on

- Page 98:

24 CHAPTER 2 VC PLAYERS EXHIBIT 2-2

- Page 102:

26 CHAPTER 2 VC PLAYERS just a few

- Page 106:

28 CHAPTER 2 VC PLAYERS EXHIBIT 2-4

- Page 110:

30 CHAPTER 2 VC PLAYERS true that d

- Page 114:

32 CHAPTER 2 VC PLAYERS methods, we

- Page 118:

34 CHAPTER 2 VC PLAYERS EXAMPLE 2.2

- Page 122:

36 CHAPTER 2 VC PLAYERS As an illus

- Page 126:

38 CHAPTER 2 VC PLAYERS EXHIBIT 2-5

- Page 130:

40 CHAPTER 2 VC PLAYERS restriction

- Page 134:

42 CHAPTER 2 VC PLAYERS GPs are com

- Page 138:

44 CHAPTER 2 VC PLAYERS Distributio

- Page 142:

CHAPTER3 VC RETURNS VCS SPEND their

- Page 146:

48 CHAPTER 3 VC RETURNS EXHIBIT 3-2

- Page 150:

50 CHAPTER 3 VC RETURNS unfolded in

- Page 154:

52 CHAPTER 3 VC RETURNS CA clients

- Page 158:

54 CHAPTER 3 VC RETURNS and the ann

- Page 162:

56 CHAPTER 3 VC RETURNS EXHIBIT 3-5

- Page 166:

58 CHAPTER 3 VC RETURNS Gross value

- Page 170:

60 CHAPTER 3 VC RETURNS EXHIBIT 3-7

- Page 174:

62 CHAPTER 3 VC RETURNS EXHIBIT 3-8

- Page 178:

64 CHAPTER 3 VC RETURNS EXHIBIT 3-9

- Page 182:

66 CHAPTER 4 THE COST OF CAPITAL FO

- Page 186:

68 CHAPTER 4 THE COST OF CAPITAL FO

- Page 190:

70 CHAPTER 4 THE COST OF CAPITAL FO

- Page 194:

72 CHAPTER 4 THE COST OF CAPITAL FO

- Page 198:

74 CHAPTER 4 THE COST OF CAPITAL FO

- Page 202:

76 CHAPTER 4 THE COST OF CAPITAL FO

- Page 206:

78 CHAPTER 4 THE COST OF CAPITAL FO

- Page 210:

80 CHAPTER 4 THE COST OF CAPITAL FO

- Page 214:

82 CHAPTER 4 THE COST OF CAPITAL FO

- Page 218:

84 CHAPTER 5 THE BEST VCs First, we

- Page 222:

86 CHAPTER 5 THE BEST VCs reason to

- Page 226:

88 CHAPTER 5 THE BEST VCs EXHIBIT 5

- Page 230:

90 CHAPTER 5 THE BEST VCs multiple

- Page 234:

92 CHAPTER 5 THE BEST VCs time with

- Page 238:

94 CHAPTER 5 THE BEST VCs among the

- Page 242:

96 CHAPTER 5 THE BEST VCs and other

- Page 246:

98 CHAPTER 5 THE BEST VCs SUMMARY A

- Page 250:

100 CHAPTER 6 VC AROUND THE WORLD E

- Page 254:

102 CHAPTER 6 VC AROUND THE WORLD c

- Page 258:

104 CHAPTER 6 VC AROUND THE WORLD p

- Page 262:

106 CHAPTER 6 VC AROUND THE WORLD T

- Page 266:

108 CHAPTER 6 VC AROUND THE WORLD c

- Page 270:

110 CHAPTER 6 VC AROUND THE WORLD E

- Page 274:

112 CHAPTER 6 VC AROUND THE WORLD 6

- Page 278:

114 CHAPTER 6 VC AROUND THE WORLD P

- Page 282:

116 CHAPTER 6 VC AROUND THE WORLD s

- Page 286:

118 CHAPTER 6 VC AROUND THE WORLD 6

- Page 290:

120 CHAPTER 6 VC AROUND THE WORLD B

- Page 294:

This page intentionally left blank

- Page 298:

124 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 302:

126 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 306:

128 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 310:

130 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 314:

132 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 318:

134 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 322:

136 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 326:

138 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 330:

140 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 334:

142 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 338:

144 CHAPTER 7 THE ANALYSIS OF VC IN

- Page 342:

CHAPTER8 TERM SHEETS IN THIS CHAPTE

- Page 346:

148 CHAPTER 8 TERM SHEETS Pre-Money

- Page 350:

150 CHAPTER 8 TERM SHEETS The pretr

- Page 354:

152 CHAPTER 8 TERM SHEETS Optional

- Page 358:

154 CHAPTER 8 TERM SHEETS Jones Rep

- Page 362:

156 CHAPTER 8 TERM SHEETS Managemen

- Page 366:

158 CHAPTER 8 TERM SHEETS 8.3.1 Reg

- Page 370:

160 CHAPTER 8 TERM SHEETS Board of

- Page 374:

162 CHAPTER 8 TERM SHEETS REFERENCE

- Page 378:

164 CHAPTER 9 PREFERRED STOCK For p

- Page 382:

166 CHAPTER 9 PREFERRED STOCK Alter

- Page 386:

168 CHAPTER 9 PREFERRED STOCK EXHIB

- Page 390:

170 CHAPTER 9 PREFERRED STOCK EXHIB

- Page 394:

172 CHAPTER 9 PREFERRED STOCK EXHIB

- Page 398:

174 CHAPTER 9 PREFERRED STOCK broad

- Page 402:

176 CHAPTER 9 PREFERRED STOCK REALI

- Page 406:

CHAPTER10 THE VC METHOD THIS CHAPTE

- Page 410:

180 CHAPTER 10 THE VC METHOD about

- Page 414:

182 CHAPTER 10 THE VC METHOD exampl

- Page 418:

184 CHAPTER 10 THE VC METHOD 10.2 T

- Page 422:

186 CHAPTER 10 THE VC METHOD for tw

- Page 426:

188 CHAPTER 10 THE VC METHOD Step 5

- Page 430:

190 CHAPTER 10 THE VC METHOD EXHIBI

- Page 434:

192 CHAPTER 10 THE VC METHOD SUMMAR

- Page 438:

194 CHAPTER 10 THE VC METHOD expect

- Page 442:

196 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 446:

198 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 450:

200 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 454:

202 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 458:

204 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 462:

206 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 466:

208 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 470:

210 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 474:

212 CHAPTER 11 DCF ANALYSIS OF GROW

- Page 478:

CHAPTER12 COMPARABLES ANALYSIS IN T

- Page 482:

216 CHAPTER 12 COMPARABLES ANALYSIS

- Page 486:

218 CHAPTER 12 COMPARABLES ANALYSIS

- Page 490:

220 CHAPTER 12 COMPARABLES ANALYSIS

- Page 494:

222 CHAPTER 12 COMPARABLES ANALYSIS

- Page 498:

224 CHAPTER 12 COMPARABLES ANALYSIS

- Page 502:

226 CHAPTER 12 COMPARABLES ANALYSIS

- Page 506:

228 CHAPTER 12 COMPARABLES ANALYSIS

- Page 510:

This page intentionally left blank

- Page 514:

232 CHAPTER 13 OPTION PRICING Secti

- Page 518:

234 CHAPTER 13 OPTION PRICING EXHIB

- Page 522:

236 CHAPTER 13 OPTION PRICING EXHIB

- Page 526:

238 CHAPTER 13 OPTION PRICING 13.3

- Page 530:

240 CHAPTER 13 OPTION PRICING EXHIB

- Page 534:

242 CHAPTER 13 OPTION PRICING distr

- Page 538:

244 CHAPTER 13 OPTION PRICING we ne

- Page 542:

246 CHAPTER 13 OPTION PRICING In al

- Page 546:

248 CHAPTER 13 OPTION PRICING We ca

- Page 550:

250 CHAPTER 13 OPTION PRICING EXHIB

- Page 554:

CHAPTER14 THE VALUATION OF PREFERRE

- Page 558:

254 CHAPTER 14 THE VALUATION OF PRE

- Page 562:

256 CHAPTER 14 THE VALUATION OF PRE

- Page 566:

258 CHAPTER 14 THE VALUATION OF PRE

- Page 570:

260 CHAPTER 14 THE VALUATION OF PRE

- Page 574:

262 CHAPTER 14 THE VALUATION OF PRE

- Page 578:

264 CHAPTER 14 THE VALUATION OF PRE

- Page 582:

266 CHAPTER 14 THE VALUATION OF PRE

- Page 586:

268 CHAPTER 14 THE VALUATION OF PRE

- Page 590:

270 CHAPTER 14 THE VALUATION OF PRE

- Page 594:

CHAPTER15 LATER-ROUND INVESTMENTS T

- Page 598:

274 CHAPTER 15 LATER-ROUND INVESTME

- Page 602:

276 CHAPTER 15 LATER-ROUND INVESTME

- Page 606:

278 CHAPTER 15 LATER-ROUND INVESTME

- Page 610:

280 CHAPTER 15 LATER-ROUND INVESTME

- Page 614:

282 CHAPTER 15 LATER-ROUND INVESTME

- Page 618:

284 CHAPTER 15 LATER-ROUND INVESTME

- Page 622:

286 CHAPTER 15 LATER-ROUND INVESTME

- Page 626:

288 CHAPTER 15 LATER-ROUND INVESTME

- Page 630:

CHAPTER16 PARTICIPATING CONVERTIBLE

- Page 634:

292 CHAPTER 16 PARTICIPATING CONVER

- Page 638:

294 CHAPTER 16 PARTICIPATING CONVER

- Page 642:

296 CHAPTER 16 PARTICIPATING CONVER

- Page 646:

298 CHAPTER 16 PARTICIPATING CONVER

- Page 650:

300 CHAPTER 16 PARTICIPATING CONVER

- Page 654:

302 CHAPTER 16 PARTICIPATING CONVER

- Page 658: 304 CHAPTER 16 PARTICIPATING CONVER

- Page 662: 306 CHAPTER 17 IMPLIED VALUATION th

- Page 666: 308 CHAPTER 17 IMPLIED VALUATION So

- Page 670: 310 CHAPTER 17 IMPLIED VALUATION EX

- Page 674: 312 CHAPTER 17 IMPLIED VALUATION 5

- Page 678: 314 CHAPTER 17 IMPLIED VALUATION EX

- Page 682: 316 CHAPTER 17 IMPLIED VALUATION We

- Page 686: 318 CHAPTER 17 IMPLIED VALUATION ma

- Page 690: CHAPTER18 COMPLEX STRUCTURES IN PAR

- Page 694: 322 CHAPTER 18 COMPLEX STRUCTURES E

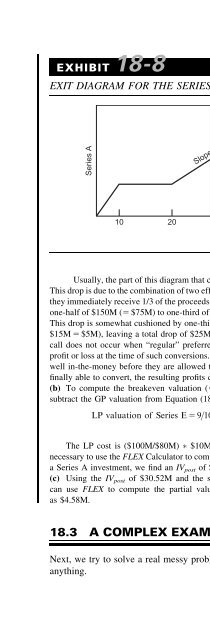

- Page 698: 324 CHAPTER 18 COMPLEX STRUCTURES (

- Page 702: 326 CHAPTER 18 COMPLEX STRUCTURES E

- Page 706: 328 CHAPTER 18 COMPLEX STRUCTURES t

- Page 712: So far, these are exactly the same

- Page 716: EXHIBIT 18-10 EXIT DIAGRAM FOR THE

- Page 720: EXERCISES 335 18.2 We use the same

- Page 724: PARTIV THE FINANCE OF INNOVATION 33

- Page 728: CHAPTER19 R&D FINANCE RESEARCH AND

- Page 732: EXHIBIT 19-2 R&D SHARE OF GDP, MOST

- Page 736: EXHIBIT 19-4 R&D EXPENDITURE BY SOU

- Page 740: more than $5B in R&D are “transpo

- Page 744: the FDA relies heavily on advisory

- Page 748: EXHIBIT 19-8 FUEL CELL PROJECT Proj

- Page 752: EXHIBIT 19-9 R&D EXPENDITURE AND CO

- Page 756: 19.3 HOW IS R&D FINANCED? 353 far a

- Page 760:

Exhibits 19-7 and 19-8, summarize t

- Page 764:

CHAPTER20 MONTE CARLO SIMULATION IN

- Page 768:

analyst generates random numbers an

- Page 772:

EXHIBIT 20-3 EVENT TREE WITH THREE

- Page 776:

point x, which can be written as th

- Page 780:

anch represents the maximum of the

- Page 784:

is 5 E 2 $1B f(E). Then, the expect

- Page 788:

EXHIBIT 20-12 LOG-NORMAL PDF 0.5 0.

- Page 792:

EXHIBIT 20-15 MONTE CARLO SIMULATIO

- Page 796:

20.3 SIMULATION WITH MULTIPLE SOURC

- Page 800:

375 EXHIBIT 20-19 DCF MODEL FOR NEW

- Page 804:

of development. (Note that this pro

- Page 808:

21.1 DECISION TREES When a decision

- Page 812:

compute the expected value at Node

- Page 816:

EXAMPLE 21.1 (Fuelco) Fuelco is con

- Page 820:

EXHIBIT 21-5 FUELCO’S DECISION TR

- Page 824:

Denoting shares of the binary optio

- Page 828:

EXHIBIT 21-7 FUELCO’S DECISION TR

- Page 832:

EXHIBIT 21-8 FUELCO’S DECISION TR

- Page 836:

where V(β) is given by Equation (2

- Page 840:

21.5 DRUGCO, REVISITED In this sect

- Page 844:

397 EXHIBIT 21-12 DCF MODEL FOR NEW

- Page 848:

(a) Draw the decision tree for Semi

- Page 852:

EXHIBIT 22-1 CALL OPTION IN A DECIS

- Page 856:

subperiod, we allow only two possib

- Page 860:

22.1 THE BLACK-SCHOLES EQUATION, RE

- Page 864:

EXHIBIT 22-5 JOE’S PROBLEM, BASE

- Page 868:

22.2 MULTIPLE STRIKE PRICES AND EAR

- Page 872:

EXHIBIT 22-9 EXCERPTS FROM TREES FO

- Page 876:

In Exhibit 22-11, we show the optio

- Page 880:

value. Thus, if Fuelco delays the p

- Page 884:

EXHIBIT 22-14 EXCERPTS FROM TREES F

- Page 888:

CHAPTER23 GAME THEORY R&D DECISIONS

- Page 892:

EXHIBIT 23-2 PRISONER’S DILEMMA,

- Page 896:

As in the prisoner’s dilemma game

- Page 900:

EXAMPLE 23.2 Drugco and Pharmco pro

- Page 904:

EXHIBIT 23-8 ODDS-AND-EVENS GAME, N

- Page 908:

Problems (a) Draw the extensive for

- Page 912:

Thus far in the book, we have perfo

- Page 916:

EXHIBIT 23-12 STANDARDS GAME, NORMA

- Page 920:

EXHIBIT 23-14 ENTRY GAME, NORMAL FO

- Page 924:

EXHIBIT 23-16 ENTRY GAME, WITH COMM

- Page 928:

competitor can just come along and

- Page 932:

EXHIBIT 23-19 PROJECT C, STEP 2, WE

- Page 936:

ugly head: both Fuelco and Cellco w

- Page 940:

CHAPTER24 R&D VALUATION IN THIS CHA

- Page 944:

EXHIBIT 24-1 SCHEMATIC FOR THE FULL

- Page 948:

449 EXHIBIT 24-4 DCF MODEL, DEAL 1

- Page 952:

EXHIBIT 24-5 BIGCO NPV AS OF PHASE

- Page 956:

24.1 DRUG DEVELOPMENT 453 (c) To ev

- Page 960:

EXHIBIT 24-9 DRUGCO ZERO-PROFIT CUR

- Page 964:

Problems (a) Draw the decision tree

- Page 968:

EXHIBIT 24-12 FUELCO’S DECISION T

- Page 972:

EXHIBIT 24-14 FUELCO’S DECISION T

- Page 976:

EXHIBIT 24-17 NODE 12, EXPANDED 12

- Page 980:

can reap great rewards, it is dange

- Page 984:

TERM SHEET FOR SERIES A PREFERRED S

- Page 988:

APPENDIX A SAMPLE TERM SHEET 469 Li

- Page 992:

APPENDIX A SAMPLE TERM SHEET 471 of

- Page 996:

APPENDIX A SAMPLE TERM SHEET 473 su

- Page 1000:

[regarding technology ownership, co

- Page 1004:

Lock-up: Investors shall agree in c

- Page 1008:

Non-Competition and Non-Solicitatio

- Page 1012:

holding greater than [1]% of Compan

- Page 1016:

Company breaches this no-shop oblig

- Page 1020:

in Chapters 13. We describe below h

- Page 1024:

APPENDIXC GUIDE TO CRYSTAL BALL s C

- Page 1028:

EXHIBIT C-2 SPREADSHEET SETUP FOR C

- Page 1032:

APPENDIX C GUIDE TO CRYSTAL BALL EX

- Page 1036:

EXHIBIT C-6 RUN PREFERENCES WINDOW

- Page 1040:

EXHIBIT C-8 SPREADSHEET SETUP FOR C

- Page 1044:

APPENDIX C GUIDE TO CRYSTAL BALL EX

- Page 1048:

APPENDIX C GUIDE TO CRYSTAL BALL EX

- Page 1052:

501 EXHIBIT C-13 SPREADSHEET SETUP

- Page 1056:

EXHIBIT C-14 STATISTICAL OUTCOME FO

- Page 1060:

“exercises” are given without s

- Page 1064:

507 EXHIBIT C-19 SPREADSHEET SETUP

- Page 1068:

APPENDIX C GUIDE TO CRYSTAL BALL s

- Page 1072:

REFERENCES 511 EXHIBIT C-24 OUTCOME

- Page 1076:

GLOSSARY 513 Adjusted conversion pr

- Page 1080:

GLOSSARY 515 then general partners

- Page 1084:

GLOSSARY 517 Discount rate: The rat

- Page 1088:

GLOSSARY 519 Expiration diagram: On

- Page 1092:

GLOSSARY 521 Hedge funds: Hedge fun

- Page 1096:

GLOSSARY 523 exclusive (only the li

- Page 1100:

GLOSSARY 525 Mixed-strategy NE: A N

- Page 1104:

GLOSSARY 527 Periodic return: The r

- Page 1108:

GLOSSARY 529 Rapid-growth period: I

- Page 1112:

GLOSSARY 531 Rule 144A: A Securitie

- Page 1116:

GLOSSARY 533 Tagalong: (5 Take-me-a

- Page 1120:

INDEX Abnormal returns, 68, 512 neg

- Page 1124:

EV/Revenue, 216 Price/Book, 217 Pri

- Page 1128:

Exercise price, 518 Exit diagram, 1

- Page 1132:

Implied valuation, 305 319, 521. Se

- Page 1136:

LP cost, 186 LP valuation, 186 Moni

- Page 1140:

Private Equity Performance Monitor,

- Page 1144:

Series C investment, 278 282 exit d

- Page 1148:

spreadsheet, 189 standard VC method