BBA Group Annual Report 2004 - BBA Aviation

BBA Group Annual Report 2004 - BBA Aviation

BBA Group Annual Report 2004 - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22 <strong>BBA</strong> GROUP FINANCIAL<br />

ANNUAL REPORT<br />

<strong>2004</strong> REVIEW<br />

Acquisitions and Disposals broken down between UK schemes £33 million and<br />

The <strong>Group</strong> acquired 9 businesses during the year for a total overseas schemes £23 million. Following an actuarial<br />

consideration of £98 million. In Fiberweb we continued to valuation of the UK schemes in <strong>2004</strong>, the Board has agreed<br />

invest in the European wipes market with the acquisition to make a special contribution of £10 million spread over two<br />

of Tenotex, which is based in Spain and Italy and further years to reduce the deficit, after which the situation will be<br />

consolidates our position in this growing sector. In <strong>Aviation</strong> reviewed again. The overseas deficit includes unfunded<br />

we made a number of acquisitions to expand the Signature schemes valued at £11.3 million.<br />

network, particularly in Europe, and we also acquired<br />

businesses for ASIG, our commercial aviation handling Cash Flow and Debt<br />

operation. These businesses, which are detailed in the The <strong>Group</strong> produced another year of good free cash flows:<br />

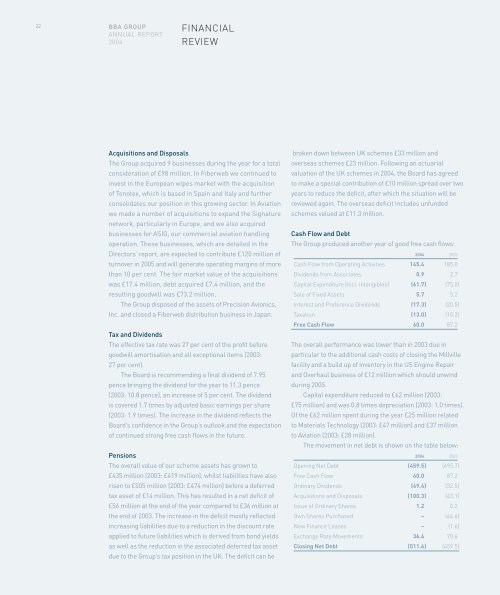

Directors’ report, are expected to contribute £120 million of <strong>2004</strong> 2003<br />

turnover in 2005 and will generate operating margins of more Cash Flow from Operating Activities 145.4 185.0<br />

than 10 per cent. The fair market value of the acquisitions Dividends from Associates 0.9 2.7<br />

was £17.4 million, debt acquired £7.4 million, and the Capital Expenditure (incl. intangibles) (61.7) (75.0)<br />

resulting goodwill was £73.2 million. Sale of Fixed Assets 5.7 5.2<br />

The <strong>Group</strong> disposed of the assets of Precision Avionics, Interest and Preference Dividends (17.3) (20.5)<br />

Inc. and closed a Fiberweb distribution business in Japan. Taxation (13.0) (10.2)<br />

Tax and Dividends<br />

Free Cash Flow 60.0 87.2<br />

The effective tax rate was 27 per cent of the profit before The overall performance was lower than in 2003 due in<br />

goodwill amortisation and all exceptional items (2003: particular to the additional cash costs of closing the Millville<br />

27 per cent). facility and a build up of inventory in the US Engine Repair<br />

The Board is recommending a final dividend of 7.95 and Overhaul business of £12 million which should unwind<br />

pence bringing the dividend for the year to 11.3 pence during 2005.<br />

(2003: 10.8 pence), an increase of 5 per cent. The dividend Capital expenditure reduced to £62 million (2003:<br />

is covered 1.7 times by adjusted basic earnings per share £75 million) and was 0.8 times depreciation (2003: 1.0 times).<br />

(2003: 1.9 times). The increase in the dividend reflects the Of the £62 million spent during the year £25 million related<br />

Board’s confidence in the <strong>Group</strong>’s outlook and the expectation to Materials Technology (2003: £47 million) and £37 million<br />

of continued strong free cash flows in the future. to <strong>Aviation</strong> (2003: £28 million).<br />

The movement in net debt is shown on the table below:<br />

Pensions <strong>2004</strong> 2003<br />

The overall value of our scheme assets has grown to Opening Net Debt (459.5) (495.7)<br />

£435 million (2003: £419 million), whilst liabilities have also Free Cash Flow 60.0 87.2<br />

risen to £505 million (2003: £474 million) before a deferred Ordinary Dividends (49.4) (32.5)<br />

tax asset of £14 million. This has resulted in a net deficit of Acquisitions and Disposals (100.3) (43.1)<br />

£56 million at the end of the year compared to £36 million at Issue of Ordinary Shares 1.2 0.2<br />

the end of 2003. The increase in the deficit mostly reflected Own Shares Purchased – (44.6)<br />

increasing liabilities due to a reduction in the discount rate New Finance Leases – (1.6)<br />

applied to future liabilities which is derived from bond yields Exchange Rate Movements 36.4 70.6<br />

as well as the reduction in the associated deferred tax asset Closing Net Debt (511.6) (459.5)<br />

due to the <strong>Group</strong>’s tax position in the UK. The deficit can be