- Page 1 and 2:

Firms, Prices, And Markets Timothy

- Page 3 and 4:

Table of Contents Math Review 1 M.1

- Page 5 and 6:

Table of Contents iii 7 Pricing wit

- Page 7:

Table of Contents v 16.5 Comparison

- Page 11 and 12:

M.1 What math? Math Review Microeco

- Page 13 and 14:

Section 3 Graphs 3 M.3 Graphs To gr

- Page 15 and 16:

Section 4 Inverse of a function 5 f

- Page 17 and 18:

Section 6 Some nonlinear functions

- Page 19 and 20:

Section 8 Slope of a nonlinear func

- Page 21 and 22:

Preliminaries Analytic Methods for

- Page 23 and 24:

Section 2 The economist’s notion

- Page 25 and 26:

Section 4 Decomposition of decision

- Page 27 and 28:

Section 5 Marginal analysis 17 Marg

- Page 29 and 30:

Section 5 Marginal analysis 19 •

- Page 31 and 32:

Section 6 The mathematics of margin

- Page 33 and 34:

Section 7 Wrap-up 23 Observe that a

- Page 35 and 36:

1.1 Motives and objectives Broadly

- Page 37 and 38:

Section 3 Valuation, cost, and surp

- Page 39 and 40:

Section 5 Many buyers and many sell

- Page 41 and 42:

Section 5 Many buyers and many sell

- Page 43 and 44:

Section 6 Very many buyers and very

- Page 45 and 46:

Section 8 Wrap-up 35 1.8 Wrap-up Th

- Page 47 and 48:

Chapter 2 Supply, Demand, and Marke

- Page 49 and 50:

Section 3 Many buyers and many sell

- Page 51 and 52:

Section 4 Demand and supply: Graphi

- Page 53 and 54:

Section 5 Consumer and producer sur

- Page 55 and 56:

Section 6 Gains from trade in equil

- Page 57 and 58:

Section7 Changesincostsorvaluations

- Page 59 and 60:

Section7 Changesincostsorvaluations

- Page 61 and 62:

Section 8 Taxes on transaction 51 s

- Page 63 and 64:

Section 9 Wrap-up 53 ation curve (m

- Page 65 and 66:

Additional exercises 55 Exercise 2.

- Page 67 and 68:

Chapter 3 Consumer Choice and Deman

- Page 69 and 70:

Section 3 A model of consumer choic

- Page 71 and 72:

Section 4 Interpretation of demand

- Page 73 and 74:

Section 4 Interpretation of demand

- Page 75 and 76:

Section 5 Wrap-up 65 Linear and log

- Page 77 and 78:

Chapter 4 Production and Costs 4.1

- Page 79 and 80:

Section 3 What to include in the co

- Page 81 and 82:

Section 3 What to include in the co

- Page 83 and 84:

Section 4 Economies of scale 73 Sou

- Page 85 and 86:

Section 5 A typical cost curve 75 M

- Page 87 and 88:

Section 6 When are fixed costs impo

- Page 89 and 90:

Section 6 When are fixed costs impo

- Page 91 and 92:

Section 7 Pitfalls to avoid regardi

- Page 93 and 94:

Section 8 The leading examples of c

- Page 95 and 96:

Section 8 The leading examples of c

- Page 97 and 98:

Section 8 The leading examples of c

- Page 99 and 100:

Section 8 The leading examples of c

- Page 101:

Additional exercises 91 Additional

- Page 104 and 105:

94 Competitive Supply and Market Pr

- Page 106 and 107:

96 Competitive Supply and Market Pr

- Page 108 and 109:

98 Competitive Supply and Market Pr

- Page 110 and 111:

100 Competitive Supply and Market P

- Page 112 and 113:

102 Competitive Supply and Market P

- Page 114 and 115:

104 Competitive Supply and Market P

- Page 116 and 117:

106 Competitive Supply and Market P

- Page 118 and 119:

108 Competitive Supply and Market P

- Page 120 and 121:

110 Competitive Supply and Market P

- Page 122 and 123:

112 Competitive Supply and Market P

- Page 124 and 125:

114 Short-Run Costs and Prices Chap

- Page 126 and 127:

116 Short-Run Costs and Prices Chap

- Page 128 and 129:

118 Short-Run Costs and Prices Chap

- Page 130 and 131: 120 Short-Run Costs and Prices Chap

- Page 132 and 133: 122 Short-Run Costs and Prices Chap

- Page 134 and 135: 124 Short-Run Costs and Prices Chap

- Page 136 and 137: 126 Short-Run Costs and Prices Chap

- Page 138 and 139: 128 Short-Run Costs and Prices Chap

- Page 141 and 142: Chapter 7 Pricing with Market Power

- Page 143 and 144: Section 3 Profit-maximizing output

- Page 145 and 146: Section 3 Profit-maximizing output

- Page 147 and 148: Section 4 Profit maximization versu

- Page 149 and 150: Section 4 Profit maximization versu

- Page 151 and 152: Section 4 Profit maximization versu

- Page 153 and 154: Section 5 The effect of a long-run

- Page 155 and 156: Additional exercises 145 produces l

- Page 157 and 158: Chapter 8 Elasticity of Demand 8.1

- Page 159 and 160: Section 2 Measuring elasticity 149

- Page 161 and 162: Section 4 Elasticity of special dem

- Page 163 and 164: Section 4 Elasticity of special dem

- Page 165 and 166: Section 6 Wrap-up 155 For example,

- Page 167 and 168: Chapter 9 How Pricing Depends on th

- Page 169 and 170: Section 3 Marginal revenue and elas

- Page 171 and 172: Section 4 The effect of an increase

- Page 173 and 174: Section 5 The price-sensitivity eff

- Page 175 and 176: Section 6 The volume effect 165 Alt

- Page 177 and 178: Section 8 Wrap-up 167 The shift in

- Page 179: Additional exercises 169 Figure E9.

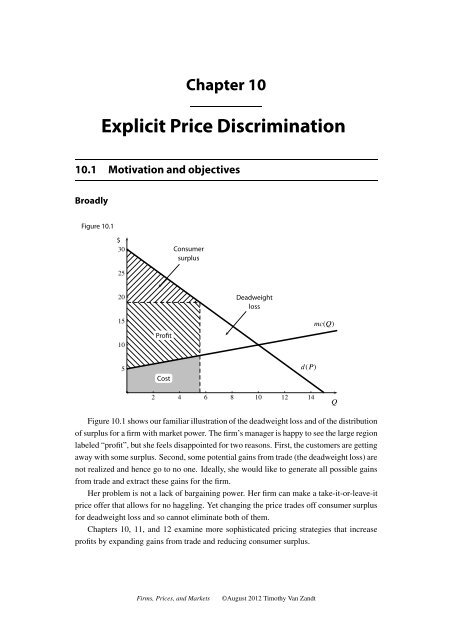

- Page 183 and 184: Section 2 Requirements for explicit

- Page 185 and 186: Section 3 Different prices for diff

- Page 187 and 188: Section 3 Different prices for diff

- Page 189 and 190: Chapter 11 Implicit Price Discrimin

- Page 191 and 192: Section 3 Screening: basic framewor

- Page 193 and 194: Section 4 Differentiated products a

- Page 195 and 196: Section 5 Example: Software version

- Page 197 and 198: Section 5 Example: Software version

- Page 199 and 200: Section 6 Example: Airlines 189 11.

- Page 201 and 202: Section 7 Intertemporal product dif

- Page 203 and 204: Section 8 Bundling 193 offer the sa

- Page 205 and 206: Section 8 Bundling 195 Table 11.7 C

- Page 207 and 208: Additional exercises 197 purchases

- Page 209 and 210: Chapter 12 Nonlinear Pricing 12.1 M

- Page 211 and 212: Section 3 More on nonlinear pricing

- Page 213 and 214: Section 4 An example of nonlinear p

- Page 215 and 216: Section 4 An example of nonlinear p

- Page 217 and 218: Section 5 Two-part tariffs 207 for

- Page 219 and 220: Section 6 “Degrees” of price di

- Page 221 and 222: Chapter 13 Static Games and Nash Eq

- Page 223 and 224: Section 3 Payoffs 213 For a discret

- Page 225 and 226: Section 5 Best responses 215 Discre

- Page 227 and 228: Section 5 Best responses 217 Figure

- Page 229 and 230: Section 6 Equilibrium 219 This is c

- Page 231 and 232:

Section 6 Equilibrium 221 You can s

- Page 233 and 234:

Section 6 Equilibrium 223 Let’s u

- Page 235 and 236:

Section 6 Equilibrium 225 Nash equi

- Page 237 and 238:

Section 7 Wrap-up 227 such coordina

- Page 239 and 240:

Chapter 14 Imperfect Competition 14

- Page 241 and 242:

Section 2 Price competition 231 is

- Page 243 and 244:

Section 2 Price competition 233 a p

- Page 245 and 246:

Section 3 Price competition with pe

- Page 247 and 248:

Section 4 Cournot model: Quantity c

- Page 249 and 250:

Section 4 Cournot model: Quantity c

- Page 251 and 252:

Section 5 Quantity vs. price compet

- Page 253:

Section 7 Wrap-up 243 no further en

- Page 256 and 257:

246 Explicit and Implicit Cooperati

- Page 258 and 259:

248 Explicit and Implicit Cooperati

- Page 260 and 261:

250 Explicit and Implicit Cooperati

- Page 262 and 263:

252 Explicit and Implicit Cooperati

- Page 265 and 266:

Chapter 16 Strategic Commitment 16.

- Page 267 and 268:

Section 2 Sequential games 257 Tabl

- Page 269 and 270:

Section 2 Sequential games 259 What

- Page 271 and 272:

Section 3 Stackelberg games 261 16.

- Page 273 and 274:

Section 3 Stackelberg games 263 can

- Page 275 and 276:

Section 5 Comparisons between Nash

- Page 277 and 278:

Section 5 Comparisons between Nash

- Page 279 and 280:

Section 6 Examples using the basic

- Page 281 and 282:

Section 8 Wrap-up 271 many small pl

- Page 283 and 284:

Section 8 Wrap-up 273 Suppose inste