Annual Report 2011 Holcim Ltd

Annual Report 2011 Holcim Ltd

Annual Report 2011 Holcim Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Value-Driven<br />

Corporate Management<br />

36<br />

Because low demand means that the European cement<br />

industry currently emits less CO2 than producers are<br />

entitled to, non-required CO2 emission certificates<br />

can be sold. The lower emissions not only reflect the<br />

current economic situation, but also the industry’s<br />

efforts to increase plant efficiency and reduce the<br />

clinker factor.<br />

The CHF 100 million in payments received by <strong>Holcim</strong><br />

each year were channeled in <strong>2011</strong> into an internal<br />

energy fund created in 2010. The fund should help<br />

ensure the realization of innovative projects in the field<br />

of heat recovery, the recycling of alternative fuels and<br />

raw materials, as well as wind power and hydroelectricity.<br />

The objective is to further reduce consumption<br />

of fossil fuels and increase energy efficiency. Several<br />

projects are being implemented (see also pages 55).<br />

Together they will yield savings of around 200,000<br />

tonnes of CO2.<br />

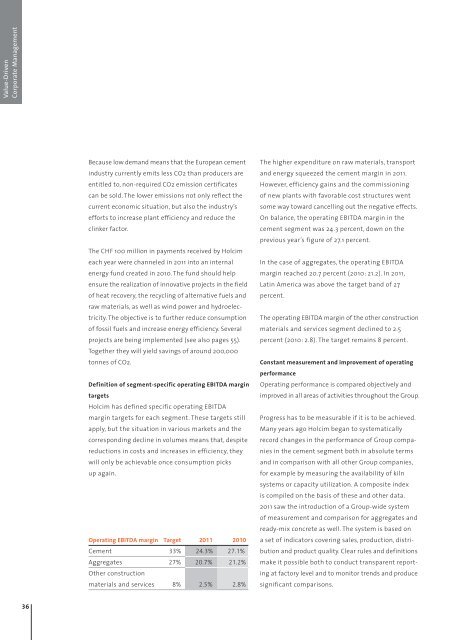

Definition of segment-specific operating EBITDA margin<br />

targets<br />

<strong>Holcim</strong> has defined specific operating EBITDA<br />

margin targets for each segment. These targets still<br />

apply, but the situation in various markets and the<br />

corresponding decline in volumes means that, despite<br />

reductions in costs and increases in efficiency, they<br />

will only be achievable once consumption picks<br />

up again.<br />

Operating EBITDA margin Target <strong>2011</strong> 2010<br />

Cement 33% 24.3% 27.1%<br />

Aggregates 27% 20.7% 21.2%<br />

Other construction<br />

materials and services 8% 2.5% 2.8%<br />

The higher expenditure on raw materials, transport<br />

and energy squeezed the cement margin in <strong>2011</strong>.<br />

However, efficiency gains and the commissioning<br />

of new plants with favorable cost structures went<br />

some way toward cancelling out the negative effects.<br />

On balance, the operating EBITDA margin in the<br />

cement segment was 24.3 percent, down on the<br />

previous year’s figure of 27.1 percent.<br />

In the case of aggregates, the operating EBITDA<br />

margin reached 20.7 percent (2010: 21.2). In <strong>2011</strong>,<br />

Latin America was above the target band of 27<br />

percent.<br />

The operating EBITDA margin of the other construction<br />

materials and services segment declined to 2.5<br />

percent (2010: 2.8). The target remains 8 percent.<br />

Constant measurement and improvement of operating<br />

performance<br />

Operating performance is compared objectively and<br />

improved in all areas of activities throughout the Group.<br />

Progress has to be measurable if it is to be achieved.<br />

Many years ago <strong>Holcim</strong> began to systematically<br />

record changes in the performance of Group companies<br />

in the cement segment both in absolute terms<br />

and in comparison with all other Group companies,<br />

for example by measuring the availability of kiln<br />

systems or capacity utilization. A composite index<br />

is compiled on the basis of these and other data.<br />

<strong>2011</strong> saw the introduction of a Group-wide system<br />

of measurement and comparison for aggregates and<br />

ready-mix concrete as well. The system is based on<br />

a set of indicators covering sales, production, distribution<br />

and product quality. Clear rules and definitions<br />

make it possible both to conduct transparent reporting<br />

at factory level and to monitor trends and produce<br />

significant comparisons.