KYC-Know Your Customer - Bosch Software Innovations

KYC-Know Your Customer - Bosch Software Innovations

KYC-Know Your Customer - Bosch Software Innovations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

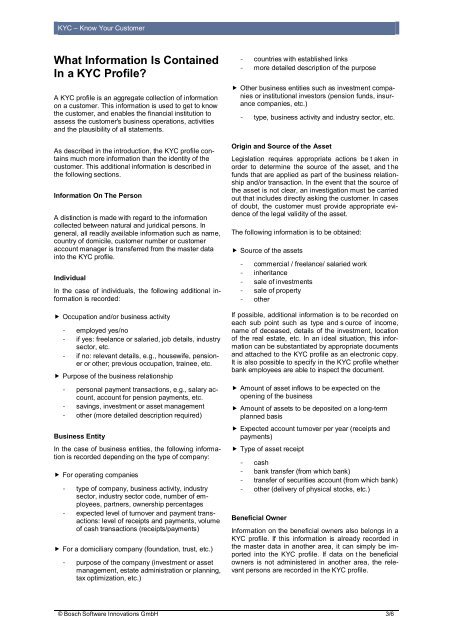

<strong>KYC</strong> – <strong>Know</strong> <strong>Your</strong> <strong>Customer</strong><br />

What Information Is Contained<br />

In a <strong>KYC</strong> Profile?<br />

A <strong>KYC</strong> profile is an aggregate collection of information<br />

on a customer. This information is used to get to know<br />

the customer, and enables the financial institution to<br />

assess the customer's business operations, activities<br />

and the plausibility of all statements.<br />

As described in the introduction, the <strong>KYC</strong> profile contains<br />

much more information than the identity of the<br />

customer. This additional information is described in<br />

the following sections.<br />

Information On The Person<br />

A distinction is made with regard to the information<br />

collected between natural and juridical persons. In<br />

general, all readily available information such as name,<br />

country of domicile, customer number or customer<br />

account manager is transferred from the master data<br />

into the <strong>KYC</strong> profile.<br />

Individual<br />

In the case of individuals, the following additional information<br />

is recorded:<br />

� Occupation and/or business activity<br />

employed yes/no<br />

if yes: freelance or salaried, job details, industry<br />

sector, etc.<br />

if no: relevant details, e.g., housewife, pensioner<br />

or other; previous occupation, trainee, etc.<br />

� Purpose of the business relationship<br />

personal payment transactions, e.g., salary account,<br />

account for pension payments, etc.<br />

savings, investment or asset management<br />

other (more detailed description required)<br />

Business Entity<br />

In the case of business entities, the following information<br />

is recorded depending on the type of company:<br />

� For operating companies<br />

type of company, business activity, industry<br />

sector, industry sector code, number of employees,<br />

partners, ownership percentages<br />

expected level of turnover and payment transactions:<br />

level of receipts and payments, volume<br />

of cash transactions (receipts/payments)<br />

� For a domiciliary company (foundation, trust, etc.)<br />

purpose of the company (investment or asset<br />

management, estate administration or planning,<br />

tax optimization, etc.)<br />

countries with established links<br />

more detailed description of the purpose<br />

� Other business entities such as investment companies<br />

or institutional investors (pension funds, insurance<br />

companies, etc.)<br />

type, business activity and industry sector, etc.<br />

Origin and Source of the Asset<br />

Legislation requires appropriate actions be t aken in<br />

order to determine the source of the asset, and t he<br />

funds that are applied as part of the business relationship<br />

and/or transaction. In the event that the source of<br />

the asset is not clear, an investigation must be carried<br />

out that includes directly asking the customer. In cases<br />

of doubt, the customer must provide appropriate evidence<br />

of the legal validity of the asset.<br />

The following information is to be obtained:<br />

� Source of the assets<br />

commercial / freelance/ salaried work<br />

inheritance<br />

sale of investments<br />

sale of property<br />

other<br />

If possible, additional information is to be recorded on<br />

each sub point such as type and s ource of income,<br />

name of deceased, details of the investment, location<br />

of the real estate, etc. In an i deal situation, this information<br />

can be substantiated by appropriate documents<br />

and attached to the <strong>KYC</strong> profile as an electronic copy.<br />

It is also possible to specify in the <strong>KYC</strong> profile whether<br />

bank employees are able to inspect the document.<br />

� Amount of asset inflows to be expected on the<br />

opening of the business<br />

� Amount of assets to be deposited on a long-term<br />

planned basis<br />

� Expected account turnover per year (receipts and<br />

payments)<br />

� Type of asset receipt<br />

cash<br />

bank transfer (from which bank)<br />

transfer of securities account (from which bank)<br />

other (delivery of physical stocks, etc.)<br />

Beneficial Owner<br />

Information on the beneficial owners also belongs in a<br />

<strong>KYC</strong> profile. If this information is already recorded in<br />

the master data in another area, it can simply be imported<br />

into the <strong>KYC</strong> profile. If data on t he beneficial<br />

owners is not administered in another area, the relevant<br />

persons are recorded in the <strong>KYC</strong> profile.<br />

© <strong>Bosch</strong> <strong>Software</strong> <strong>Innovations</strong> GmbH 3/6