Internet Business Banking Service Agreement - Union Bank

Internet Business Banking Service Agreement - Union Bank

Internet Business Banking Service Agreement - Union Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

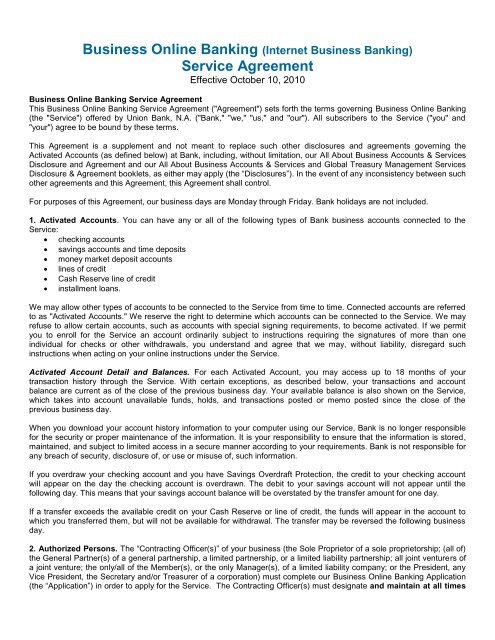

<strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong> (<strong>Internet</strong> <strong>Business</strong> <strong><strong>Bank</strong>ing</strong>)<br />

<strong>Service</strong> <strong>Agreement</strong><br />

Effective October 10, 2010<br />

<strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong> <strong>Service</strong> <strong>Agreement</strong><br />

This <strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong> <strong>Service</strong> <strong>Agreement</strong> ("<strong>Agreement</strong>") sets forth the terms governing <strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong><br />

(the "<strong>Service</strong>") offered by <strong>Union</strong> <strong>Bank</strong>, N.A. ("<strong>Bank</strong>," "we," "us," and "our"). All subscribers to the <strong>Service</strong> ("you" and<br />

"your") agree to be bound by these terms.<br />

This <strong>Agreement</strong> is a supplement and not meant to replace such other disclosures and agreements governing the<br />

Activated Accounts (as defined below) at <strong>Bank</strong>, including, without limitation, our All About <strong>Business</strong> Accounts & <strong>Service</strong>s<br />

Disclosure and <strong>Agreement</strong> and our All About <strong>Business</strong> Accounts & <strong>Service</strong>s and Global Treasury Management <strong>Service</strong>s<br />

Disclosure & <strong>Agreement</strong> booklets, as either may apply (the “Disclosures”). In the event of any inconsistency between such<br />

other agreements and this <strong>Agreement</strong>, this <strong>Agreement</strong> shall control.<br />

For purposes of this <strong>Agreement</strong>, our business days are Monday through Friday. <strong>Bank</strong> holidays are not included.<br />

1. Activated Accounts. You can have any or all of the following types of <strong>Bank</strong> business accounts connected to the<br />

<strong>Service</strong>:<br />

� checking accounts<br />

� savings accounts and time deposits<br />

� money market deposit accounts<br />

� lines of credit<br />

� Cash Reserve line of credit<br />

� installment loans.<br />

We may allow other types of accounts to be connected to the <strong>Service</strong> from time to time. Connected accounts are referred<br />

to as "Activated Accounts." We reserve the right to determine which accounts can be connected to the <strong>Service</strong>. We may<br />

refuse to allow certain accounts, such as accounts with special signing requirements, to become activated. If we permit<br />

you to enroll for the <strong>Service</strong> an account ordinarily subject to instructions requiring the signatures of more than one<br />

individual for checks or other withdrawals, you understand and agree that we may, without liability, disregard such<br />

instructions when acting on your online instructions under the <strong>Service</strong>.<br />

Activated Account Detail and Balances. For each Activated Account, you may access up to 18 months of your<br />

transaction history through the <strong>Service</strong>. With certain exceptions, as described below, your transactions and account<br />

balance are current as of the close of the previous business day. Your available balance is also shown on the <strong>Service</strong>,<br />

which takes into account unavailable funds, holds, and transactions posted or memo posted since the close of the<br />

previous business day.<br />

When you download your account history information to your computer using our <strong>Service</strong>, <strong>Bank</strong> is no longer responsible<br />

for the security or proper maintenance of the information. It is your responsibility to ensure that the information is stored,<br />

maintained, and subject to limited access in a secure manner according to your requirements. <strong>Bank</strong> is not responsible for<br />

any breach of security, disclosure of, or use or misuse of, such information.<br />

If you overdraw your checking account and you have Savings Overdraft Protection, the credit to your checking account<br />

will appear on the day the checking account is overdrawn. The debit to your savings account will not appear until the<br />

following day. This means that your savings account balance will be overstated by the transfer amount for one day.<br />

If a transfer exceeds the available credit on your Cash Reserve or line of credit, the funds will appear in the account to<br />

which you transferred them, but will not be available for withdrawal. The transfer may be reversed the following business<br />

day.<br />

2. Authorized Persons. The “Contracting Officer(s)” of your business (the Sole Proprietor of a sole proprietorship; (all of)<br />

the General Partner(s) of a general partnership, a limited partnership, or a limited liability partnership; all joint venturers of<br />

a joint venture; the only/all of the Member(s), or the only Manager(s), of a limited liability company; or the President, any<br />

Vice President, the Secretary and/or Treasurer of a corporation) must complete our <strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong> Application<br />

(the “Application”) in order to apply for the <strong>Service</strong>. The Contracting Officer(s) must designate and maintain at all times

at least one “Web Administrator” for the <strong>Service</strong>. Each Web Administrator has complete authority over Activated<br />

Accounts. Any Contracting Officer and any Web Administrator, acting alone, may also designate one or more Web User<br />

and/or View Only Web User for the <strong>Service</strong> and list the Activated Account(s) to which such Web User and/or View Only<br />

Web User is authorized to have access.<br />

Web Users. Each Web User, acting alone, may, for each Activated Account the Contracting Officer(s) or Web<br />

Administrator has listed on the Application for such Web User’s access:<br />

� obtain account balance and transaction information<br />

� access images of paid checks and deposit slips<br />

� transfer money between such Activated Accounts<br />

� set up weekly, biweekly, monthly or bimonthly recurring transfers from one Activated Account to another Activated<br />

Account (recurring transfers must be for the same amount)<br />

� transfer money to pay certain <strong>Bank</strong> lines of credit and loans<br />

� receive and change the manner of delivery of electronic account alerts and notifications to the Web User<br />

� request a stop payment on a check or other transfer<br />

� order copies of paid checks and prior statements<br />

� reorder checks from Deluxe® Check Printers<br />

� activate the Web User’s ATM Card and Debit <strong>Business</strong>Card<br />

� receive online (electronic) delivery of Statements and Customer Notices<br />

Web Administrators. Each Web Administrator, acting alone, may perform all of the functions of a Web User, and, in<br />

addition, may:<br />

� pay bills to any merchant, institution or individual with a U.S. address, or to a <strong>Bank</strong> credit card<br />

� enroll one or more accounts for the <strong>Service</strong><br />

� delete one or more Activated Accounts from the <strong>Service</strong><br />

� designate and/or remove Web Users and/or View Only Web Users and set or change their levels of access to the<br />

<strong>Service</strong><br />

� enter into or withdraw from this or any additional <strong>Bank</strong> service or modify or amend the <strong>Service</strong>(s) from time to time<br />

� elect online (electronic) delivery of Statements and Customer Notices and/or terminate any prior election of the<br />

same<br />

� enroll, or terminate the enrollment of, any eligible Activated Account for online (electronic) delivery of Statements<br />

and Customer Notices pursuant to Section 16 of this <strong>Agreement</strong><br />

� enroll in and designate Web User access to receive electronic account alerts and notifications<br />

� receive and accept changes in terms relating to any Activated Account or related service, including changes in<br />

fees, pursuant to Section 16 of this <strong>Agreement</strong><br />

� receive and accept changes in terms to this <strong>Agreement</strong> pursuant to Section 24 of this <strong>Agreement</strong><br />

View Only Web User. Each View Only Web User, acting alone, may for each Activated Account the Contracting<br />

Officer(s) or Web Administrator has listed on the Application for such View Only Web User access:<br />

� view account information, including without limitation Statements and Customer Notices delivered electronically,<br />

only.<br />

3. Access to the <strong>Service</strong>. Each Web Administrator, Web User, and View Only Web User needs an Access Code and<br />

Personal Identification Number ("PIN") to access the <strong>Service</strong>. When the Contracting Officer(s) sign(s) up for the <strong>Service</strong>,<br />

<strong>Bank</strong> will mail an Access Code and temporary PIN to each Web Administrator, Web User, and View Only Web User<br />

designated in the Application. To access the <strong>Service</strong>, each Web Administrator, Web User, and View Only Web User will<br />

be required to enroll in our “Online <strong>Business</strong> Center”, our single entry point to our web services, by entering the <strong>Business</strong><br />

Online <strong><strong>Bank</strong>ing</strong> Access Code and PIN provided and selecting a new, individual Online <strong>Business</strong> Center User ID and<br />

Password. Each Web Administrator, Web User, and View Only Web User will use this User ID and Password to access<br />

the <strong>Service</strong>, and other web services to which he or she is entitled, through the Online <strong>Business</strong> Center.<br />

4. Online Security. We operate the <strong>Service</strong> on our secure servers and protect your information using advanced<br />

encryption techniques and online security measures. Such security measures are contingent upon your responsible<br />

behavior in protecting your login information, PIN and password. You agree to keep all passwords or PINs protected and<br />

confidential in order to prevent unauthorized access to your Activated Accounts and the <strong>Service</strong>. To help safeguard your<br />

security, passwords should be changed frequently and can be changed within the Online <strong>Business</strong> Center. If someone<br />

forgets a password, he or she must contact us to have the password reset or a new temporary password issued. No

<strong>Union</strong> <strong>Bank</strong> employee will ever ask for your password or PIN. You should never include a password in any oral, written,<br />

faxed, or e-mail communication with us. To report a lost or stolen password, see Section 20 of this <strong>Agreement</strong>.<br />

5. Transfers. <strong>Service</strong> transactions are generally unlimited, none of which can exceed the account available balance.<br />

Transfers can be canceled at any time before 11:45 p.m. (Pacific Time) on the business day the transaction is scheduled<br />

to take place.<br />

Some funds transfers made through the <strong>Service</strong> are also subject to wire transfer and ACH transfer rules. Other terms and<br />

conditions governing transfers are contained in the Disclosures.<br />

Transfers or payments from savings or money market accounts may be limited. See Limitations below for a summary of<br />

the applicable limitations. Additional details can be found in the Disclosures under the description of your account. If there<br />

are insufficient available funds in an account designated to make a transfer, or if making a transfer would cause your line<br />

of credit account to exceed your credit limit, we may prevent or reverse the transfer. If <strong>Bank</strong> chooses, we may complete<br />

the transfer by overdrawing your account or by making an advance on your line of credit in excess of your credit limit. We<br />

may charge a fee for each transfer request that would overdraw your account (or exceed your credit limit) whether or not<br />

we complete the transfer.<br />

Line of Credit. Each transfer made from a line of credit account will be treated as a loan advance. The interest rate and<br />

fee(s) for the loan advance shall be that which is set forth in the loan documentation evidencing the line of credit.<br />

Limitations. Federal regulations limit certain types of transfers from your <strong>Business</strong> Savings Account and <strong>Business</strong><br />

MoneyMarket Account to a combined maximum of six per calendar month. Limited transactions include: 1) automatic<br />

transfers to another deposit account at <strong>Union</strong> <strong>Bank</strong> (including <strong>Business</strong> Savings Overdraft Protection Plan transfers), 2)<br />

automatic transfers to another institution, 3) preauthorized payments such as bill payments or direct (ACH) payments, 4)<br />

telephone transfers, and 5) computer online transfers. Refer to the Disclosures for further details. <strong>Bank</strong> also reserves the<br />

right to limit the frequency and dollar amount of transactions from your Activated Accounts for security reasons.<br />

6. Stop Payments for Checks Not Issued Through the <strong>Service</strong>. You can use the <strong>Service</strong> to place a stop payment<br />

order for a traditional paper check you have written on any Activated Account. To do so, you must provide us with timely,<br />

complete and accurate information regarding the account number the item is drawn upon, the item number, and the exact<br />

amount of the item (dollars and cents). If any information is incomplete or incorrect, we will not be responsible for failing to<br />

stop payment on the item. Also, depending on the date you request a stop payment, we may not be able to verify whether<br />

the item has been paid, in which case we may ask you to contact us. Be sure to wait for an online confirmation that a stop<br />

payment was placed before you log out of the <strong>Service</strong>. Requests become effective only when we confirm their receipt and<br />

have verified that the item has not been paid.<br />

To place a stop payment covering a range of checks that are missing or stolen, you must call us for personal assistance<br />

(see Section 20) or contact your banking office. Other terms and conditions governing stop payments are contained in the<br />

Disclosures.<br />

You may not place a stop payment order on a payment you have instructed us to make through the <strong>Service</strong>. If you do not<br />

want us to make a payment you requested through the <strong>Service</strong>, you must give us a timely cancellation request either:<br />

i) on the <strong>Bank</strong>’s “Pending Payments/Transfers” web site page; or ii) by calling us at 1-800-238-4486.<br />

Other terms and conditions governing stop payments are contained in the Disclosures.<br />

7. Bill Payment. Web Administrator(s) may use the Bill Payment function of the <strong>Service</strong> to make payments to individuals,<br />

businesses, merchants, and <strong>Bank</strong> credit card accounts; and set up payments to be made on a regular basis. Each time<br />

you make a Bill Payment, you must indicate the <strong>Bank</strong> Activated Account from which you wish the payment to be made<br />

(the "Payment Account"). Payments, except <strong>Bank</strong> loan payments, may not be made from savings accounts. When a<br />

payment is requested using Bill Payment, you agree that we may charge your account to make the payment with the<br />

same effect as if you had signed a check.<br />

Payment Method. Your Bill Payment(s) will be made by transferring funds electronically from the Payment Account to the<br />

payee, or by mailing, or otherwise delivering a check payable to the payee. A "payee" is a person or business you are<br />

paying. You can only designate a payee with a United States address. You or the <strong>Bank</strong> may delete payees from your<br />

<strong>Service</strong> if you do not use them. You will receive a notification via the <strong>Service</strong> when a payee is deleted.

Timing and Scheduling Your Payments. To allow time for the payee to receive your payment, you must schedule the<br />

payment to be made at least five business days prior to the day you want a payee to receive payment. The day, which the<br />

payee indicates payment is due, is the "Due Date."<br />

We recommend that you do not schedule the payment to be made during a grace period your payee grants between the<br />

Due Date and the date at which the payment is considered late. We will not be liable for late charges, penalties, interest,<br />

finance charges, and other damages if you schedule your payment to be paid during a grace period.<br />

We will initiate your payment request either on the business day we receive your request, or the business day you specify<br />

the payment be made (the “Date to Send”), up to one year later. Payments requested to occur on a Saturday, Sunday, or<br />

<strong>Bank</strong> holiday will be processed the next business day.<br />

When requesting a Bill Payment, your Payment Account will be charged on the Date to Send. You must have sufficient<br />

available funds on deposit in the account you specify on the Date to Send for the payment to be made.<br />

We assume no responsibility for late payments if you do not properly schedule and submit your request. To ensure that<br />

critical or time-sensitive payments are made in a timely manner, we recommend that you schedule these payments well in<br />

advance of their Due Dates. Payees may require extra time to post a payment to your account because they do not<br />

receive a payment coupon or invoice number with the payment.<br />

Recurring payments may be set up for weekly, biweekly, monthly or bimonthly payment. They must be for the same<br />

amount each time. Any scheduled or recurring payment request you designate that falls on a Saturday, Sunday, or a <strong>Bank</strong><br />

holiday will be made on the following <strong>Business</strong> Day.<br />

Caution Against Using the <strong>Service</strong> to Make Tax Payments: We discourage you from using Bill Payment to pay federal,<br />

state, or local tax agencies. These agencies frequently require that coupons accompany payments, which cannot be done<br />

through Bill Payment. For this reason, unless we made an error in scheduling a payment, we will not be liable for penalties,<br />

interest, or other damages of any kind to tax agencies.<br />

Disconnected <strong>Service</strong>. If for some reason you are disconnected from the <strong>Service</strong> before you log out, we recommend that<br />

you log back onto the <strong>Service</strong> to verify that the payments or transfers you scheduled appear on your pending<br />

payments/transfers screen. If a scheduled payment or transfer is missing, contact us.<br />

Do NOT reissue any payment requests made during the interrupted session unless we have advised you to do so.<br />

Otherwise, a duplicate payment could result. You authorize us to pay any duplicate payments you issue. We will not be<br />

responsible for any payee’s refusal to return any duplicate payments issued by you.<br />

Rejecting Payment Requests. Payment requests may be rejected if they appear to be fraudulent or erroneous, or if they<br />

contain profane, abusive or threatening language. A payment request may also be refused if there is any uncertainty<br />

regarding the transacting party’s authority to conduct the transaction, or if there is any dispute or uncertainty regarding the<br />

ownership or control of the Payment Account.<br />

Canceling Bill Payments. After a payment request is transmitted, you may use Bill Payment to cancel the payment by<br />

using the DELETE function on <strong>Bank</strong>’s "Pending Payments" website page or by calling us. The request for canceling a<br />

payment must be transmitted before 11:45 p.m. (Pacific Time) on the business day the transaction is scheduled to take<br />

place, or you may be responsible for the payment. Recurring payment instructions must be canceled no later than 11:45<br />

p.m. (Pacific Time) the day prior to the recurring payment date.<br />

8. Mobile <strong>Business</strong> Center. Your enrollment in the <strong>Service</strong> enables you to access certain features and functionality of<br />

the <strong>Service</strong> by use of an electronic wireless device, such as a cellular or mobile telephone (“Mobile <strong>Business</strong> Center”).<br />

The Mobile <strong>Business</strong> Center requires you to have a mobile device with <strong>Internet</strong> capability. In order to use the Mobile<br />

<strong>Business</strong> Center, you must first enroll in by logging into the “Admin Console” for <strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong>.<br />

(a) The following types of account transactions may be completed by using the Mobile <strong>Business</strong> Center: 1) View account<br />

balance; 2) View transaction history; 3) Initiate a single (not recurring) bill payment to an established bill payee; 4) Perform<br />

a funds transfer between <strong>Union</strong> <strong>Bank</strong> accounts owned by you; 5) View pending bill payments; and 6) View pending<br />

transfers.<br />

(b)No fees are assessed to enroll in the Mobile <strong>Business</strong> Center, to access the Mobile <strong>Business</strong> Center, or to complete<br />

the types of transactions described immediately above. You may, however, incur charges from your telecommunications

carrier when sending or receiving messages to your wireless device. You may also incur charges to receive <strong>Internet</strong><br />

service on your mobile device. <strong>Union</strong> <strong>Bank</strong> will not be responsible for any such charges that you may incur.<br />

(c) You acknowledge and agree that the Mobile <strong>Business</strong> Center service is dependent upon the functionality of the<br />

telecommunications or <strong>Internet</strong> service provider that supports your mobile device. <strong>Union</strong> <strong>Bank</strong> is not responsible for the<br />

unavailability or temporary interruption of the Mobile <strong>Business</strong> Center due to service interruptions or failure of the device<br />

or telecommunications service provider.<br />

(d) Information you provide in connection with the Mobile <strong>Business</strong> Center service will be stored on <strong>Union</strong> <strong>Bank</strong>’s secure<br />

server(s) and protected by advanced encryption techniques. As with all electronic banking, security is contingent upon<br />

your responsible behavior in protecting your username and password and your mobile device. You should avoid<br />

conducting any Mobile <strong>Business</strong> Center transaction in view of others and should never abandon your device before your<br />

transaction is completed.<br />

9. Transaction Alerts and Notifications. Your enrollment in the <strong>Service</strong> allows you to elect to receive transaction alerts<br />

and notifications (“Alerts”). Alerts are electronic and/or telephonic notices from us that contain transactional information<br />

about your Activated Account(s). For example, Alerts may include information about the receipt of wire transfers or other<br />

credits to an account, about withdrawals that exceed a certain dollar amount that you specify when you enroll for the<br />

<strong>Service</strong>, or the status of online bill payments.<br />

(a) By subscribing to the Alerts feature, you acknowledge and agree that: 1) Alerts are provided solely as a convenience;<br />

2) Alerts are not a substitute for the periodic statements for your Activated Account(s) or any other notices we may send<br />

you about such Activated Account(s), without regard to the manner in which you have chosen to receive such periodic<br />

statements or other notices; and 3) such periodic statements and other notices remain the official records of your<br />

Activated Account(s); and d) your ongoing obligation promptly to review periodic statements, other notices, and all other<br />

correspondence from us regarding your Activated Account(s) and other services you obtain from us remains in full force<br />

and effect.<br />

(b) You agree to provide us a valid phone number, cellular (mobile) phone number, e-mail address or other electronic<br />

delivery location so that we may send you Alerts about your Account(s). Additionally, you agree to indemnify, defend and<br />

hold us harmless from and against any and all claims, losses, liability, cost and expenses (including reasonable attorneys’<br />

fees) arising in any manner from your providing us a phone number, e-mail address, or other electronic delivery location<br />

that is not your own or that you provide in violation of applicable federal, state or local law, regulation or ordinance. Your<br />

obligations under this paragraph shall survive termination of this <strong>Agreement</strong>.<br />

(c) We may provide Alerts through one or more of: 1) a cellular telephone, by text message, 2) a text- or Web-enabled<br />

mobile device; or 3) an e-mail account that is accessed via a personal computer. It is your responsibility to determine that<br />

each of the service providers for the communication media described in 1) through 3), above (each a “<strong>Service</strong> Provider”)<br />

supports the text message Alerts you selected above. You agree that the Alerts are subject to the terms and conditions of<br />

your agreement(s) with your <strong>Service</strong> Provider(s) and that you are solely responsible for any fees imposed for an Alert by<br />

your <strong>Service</strong> Provider(s).<br />

(d) You acknowledge and agree that: 1) Alerts may not be encrypted and may include personal or confidential information<br />

about you and your transactions, such as your name and account activity or status; 2) your Alerts may be delayed,<br />

misdirected, not delivered, or corrupted due to circumstances or conditions affecting your <strong>Service</strong> Provider(s) or other<br />

parties; and 3) we will not be liable for losses or damages arising from (i) any non-delivery, delayed delivery, misdirected<br />

delivery, or corruption of an Alert, (ii) inaccurate, untimely or incomplete content in an Alert; (iii) your reliance on or use of<br />

the information provided in an Alert for any purpose, or (iv) any other circumstances beyond our control.<br />

10. E-mail Limitations. We may not immediately receive the e-mail that you send. Therefore, you should not rely on email<br />

if you need to communicate with us immediately, for example, if you need to report a lost or stolen card or PIN, or<br />

report an unauthorized transaction from one of your accounts. (If you need to contact us immediately, refer to Section 20<br />

of this <strong>Agreement</strong>). We cannot take action based on your e-mail requests until we actually receive your message and<br />

have a reasonable opportunity to act. E-mail may not be used to request account information or to conduct transactions<br />

with us (e.g., wire transfer requests, loan payments, or funds transfers). Also, because the e-mail you send to us may not<br />

be secure, do not include confidential information. If in doubt, contact us.<br />

10.1. Maintenance of Your E-mail Address. If for any reason your external e-mail address changes or becomes<br />

disabled, you agree to contact us immediately so that we can continue to provide you with notice, via e-mail, of: a) online<br />

delivery of Statements and Customer Notices, if you choose this option under Section 16 of this <strong>Agreement</strong>, and b)

changes in the terms of this <strong>Agreement</strong> pursuant to Section 24 of this <strong>Agreement</strong>. Please call us at 1-800-238-4486, or<br />

write to us at: <strong>Union</strong> <strong>Bank</strong>, P.O. Box 2306, Brea, California, 92822-2306. You can also e-mail us by logging into your<br />

Online <strong>Business</strong> Center and selecting the Change My Profile option to change your e-mail address.<br />

11. Computer Requirements. The <strong>Service</strong> requires you to have certain computer capabilities, which we may change<br />

from time to time without prior notice to you. Refer to www.unionbank.com/computerrequirements for our current<br />

computer requirements.<br />

12. Hours of Operation and Transaction Cutoff Time. The <strong>Service</strong> is available to you 24 hours a day, 365/366 days a<br />

year, except at times of "<strong>Service</strong> Unavailability" (see Section 13 of this <strong>Agreement</strong>). Your Activated Account information is<br />

updated at each "Update Time", defined as 6:00 a.m. (Pacific Time) Tuesday through Friday and 8:00 a.m. (Pacific Time)<br />

on Saturday, except on <strong>Bank</strong> holidays.<br />

We will process your transaction request at the end of the business day if you complete and transmit the request on<br />

<strong>Business</strong> Days by 11:45 p.m. (Pacific Time) (the "Cutoff Time"). Transfer requests submitted after the Cutoff Time or on<br />

non-<strong>Business</strong> Days will be considered requested as of the next business day.<br />

If you attempt to send transaction requests near the Cutoff Time, and your request is not completed before the Cutoff<br />

Time, your transaction requests may be deemed received as of the next business day.<br />

The exact timing of the Update Time or the Cutoff Time may vary without notice. We will not be responsible for any loss or<br />

delay related to any variation.<br />

13. <strong>Service</strong> Unavailability. Access to the <strong>Service</strong> may be unavailable without notice at certain times for the following<br />

reasons:<br />

� Scheduled Maintenance. There will be periods when systems require maintenance or upgrades. These typically<br />

occur as follows: (a) unavailable Monday to Friday 11:30 p.m. to 12:00 a.m. (Pacific Time) (b) available for<br />

inquiries only Tuesday to Saturday 12:00 a.m. to as late as 1:00 a.m. (Pacific Time) (c) unavailable Sunday from<br />

12:00 a.m. to between 3:00 a.m. and 6:00 a.m. (Pacific Time) (d) unavailable 12:00 a.m. to 4:00 a.m. (Pacific<br />

Time) Monday.<br />

� Unscheduled Maintenance. The <strong>Service</strong> may be unavailable when unforeseen maintenance is necessary.<br />

� System Outages. Major unforeseen events, such as earthquakes, fires, floods, computer failures, interruptions in<br />

telephone service, or electrical outages may interrupt <strong>Service</strong> availability. During Inquiry Only Mode you will not<br />

be able to schedule payments, transfers, or change your password.<br />

Although we undertake reasonable efforts to ensure the availability of the <strong>Service</strong>, we will not be liable in any way for its<br />

unavailability or for any damages that may result from such unavailability.<br />

14. <strong>Service</strong> Fees. Refer to your <strong>Business</strong> Fee Schedule for fee information about <strong>Business</strong> Online <strong><strong>Bank</strong>ing</strong> and other<br />

banking services.<br />

15. Account Statements. You will continue to receive Statements for your Activated Accounts in the normal manner,<br />

except to the extent that you elect online delivery of Statements and Customer Notices pursuant to Section 16 of this<br />

<strong>Agreement</strong>. <strong>Service</strong> transactions will appear on your Statements. Copies of checks and Statements can be ordered<br />

through the <strong>Service</strong>, or obtained by contacting Direct Client <strong>Service</strong>s, Commercial Customer <strong>Service</strong>, or your banking<br />

office. We may impose a fee for such copies.<br />

16. Option to Receive Electronic (Online) Statements and Customer Notices. With few exceptions (for example,<br />

certain savings and time deposit accounts), we provide Statements for all accounts. An electronic Statement is an online<br />

version of the periodic statement of account that lists your account transactions for a specified period of time, for example,<br />

a month or a calendar quarter. An electronic Statement contains all of the transaction information found in a traditional<br />

paper Statement, including the ability to view images of the front and back of checks paid during the Statement period.<br />

An electronic Customer Notice is an online (electronic) version of a written communication we would normally send to you<br />

via postal mail. Such online Customer Notices may include, but are not limited to:<br />

� Delivering information about your Activated Accounts and related services, such as notices of dishonored checks<br />

and deposited checks returned unpaid;<br />

� Notifying you of a change in the terms of this <strong>Agreement</strong> or to the agreement for any Activated Account or related<br />

service, including changes in fees; and

� Notifying you of any other required disclosures.<br />

16.1. Accounts Eligible for Electronic Statements. Checking accounts which are ”Activated Accounts” are eligible to<br />

receive Statements and Customer Notices electronically.<br />

16.2. Enrolling an Activated Account for Online Statements and Customer Notices. A Web Administrator can enroll,<br />

or terminate the enrollment of, an eligible Activated Account, through the <strong>Service</strong>, for electronic (online) delivery of<br />

periodic Statements and Customer Notices. Online delivery allows you to replace your mailed (paper) Statement with an<br />

electronic version that you can view, save to your computer and/or print at your convenience. Online delivery of your<br />

Statements also permits you to view the fronts and backs of checks paid during the Statement period. Similarly, online<br />

delivery of Customer Notices allows you to replace mailed (paper) notices about your Activated Accounts with electronic<br />

notices of, for example: dishonored checks and deposited checks returned unpaid; notices of changes to the terms of this<br />

<strong>Agreement</strong> or to the agreement for any Activated Account (or related service), including changes in fees; and any other<br />

required disclosures.<br />

16.3. E-Mail Notice of Electronic Statements and Customer Notices. If a Web Administrator has enrolled an Activated<br />

Account for online Statement delivery, then until such time as you instruct us otherwise in accordance with the terms of<br />

this <strong>Agreement</strong>, we may notify you via e-mail when we have posted your electronic Statement or a Customer Notice on<br />

our Web Site (www.unionbank.com/ibb), and each such e-mail notice shall be deemed to have been received by you on<br />

the day we send it. Any such Customer Notice, the Statement, and images of paid checks remain accessible there for 90<br />

days after the later of: (a) the date of our e-mail notice, or (b) the date the Statement was first posted on our Web<br />

Site. We may also send you Customer Notices via e-mail only, that is, without also posting the Customer Notice on our<br />

Web Site. If you agree to receive electronic Statements and Customer Notices, we may elect not to additionally provide<br />

them in paper form.<br />

16.4. Downloading, Printing and Saving Electronic Statements and Customer Notices. You may download and/or<br />

print both our e-mail notice and your Statements and Customer Notices. You will be able to view statements back to<br />

January 2004, or up to seven years of statements, whichever is less.<br />

16.5. Requirements for Electronic Statements and Customer Notices. Your business must be enrolled in the <strong>Service</strong><br />

to be eligible to receive Statements and Customer Notices electronically. Any Web Administrator may enroll an eligible<br />

Activated Account for electronic delivery of Statements and Customer Notices, and such enrollment binds all account<br />

owners. In addition, a Web Administrator must complete an enrollment process within the <strong>Service</strong> to receive Statements<br />

and Customer Notices electronically. Once a Web Administrator has enrolled an eligible Activated Account, all users will<br />

have online access to Statements and Customer Notices for those accounts that they currently have access to in their<br />

Financial Summary. For so long as the enrollment to receive electronic Statements and Customer Notices remains in<br />

effect, we may elect not to mail paper Statements or Customer Notices to you for the account(s) so enrolled.<br />

16.6. Stopping Electronic Statement Delivery; Terminating Enrollment. Any Web User can terminate electronic<br />

delivery of Statements and Customer Notices for any Activated Account to which the Web User has authorized access at<br />

any time by accessing the <strong>Business</strong> Statement option in the Online <strong>Business</strong> Center. In the <strong>Business</strong> Statements function,<br />

any Web Administrator can terminate the enrollment of any Activated Account for electronic delivery of Statements and<br />

Customer Notices by clicking the “Paper/No Paper” radio button. There is no fee for terminating the enrollment of an<br />

Activated Account for electronic Statement delivery. However, when you stop receiving electronic Statements and<br />

Customer Notices, you will automatically begin receiving mailed (paper) Statements with your next Statement cycle. This<br />

also means that any special pricing applicable to accounts receiving Statements electronically will end, and the regular<br />

monthly service charge for your account(s) will be determined in accordance with our fee schedule(s) for accounts not<br />

receiving Statements online.<br />

16.7. Fees. There is no service charge to receive Statements and Customer Notices online. Normal account fees and<br />

service charges continue to apply. You are responsible for any <strong>Internet</strong> service provider fees.<br />

16.8. Limitation of Our Liability. Neither we nor our service providers can make any representations or warranties that<br />

you will have continuous or uninterrupted access to your Statements or Customer Notices online or that any of the<br />

functions of the <strong>Service</strong> will be error-free. To the maximum extent permitted by law, we disclaim responsibility and liability<br />

for any delays, disruptions or failures caused by such other companies.

17. Our Liability For Failing To Make or Complete a Transaction. You agree that <strong>Bank</strong> shall not be liable for failing to<br />

complete a Bill Payment or transfer on time or in the correct amount if:<br />

� you fail to provide us with timely, complete, and accurate information for a stop payment;<br />

� through no fault of <strong>Bank</strong>'s, you do not have enough available funds or credit availability in your account to make<br />

the payment or transfer;<br />

� the payment or transfer would exceed the credit limit under any credit arrangement established to cover negative<br />

balances;<br />

� circumstances beyond our control (such as fire, flood, water damage, power failure, strike, labor dispute,<br />

computer breakdown, telephone line disruption, or a natural disaster) prevent or delay the transfer despite<br />

reasonable precautions taken by us;<br />

� the system or terminal was not working properly and you knew, or should have known, about the problem when<br />

you started the transaction;<br />

� the funds in your account are subject to legal process, a hold, or are otherwise not available for withdrawal;<br />

� your <strong>Union</strong> <strong>Bank</strong> account or the payee’s account is closed or frozen;<br />

� the electronic funds transfer system of <strong>Bank</strong> is not working properly;<br />

� the information supplied by you or a third party is incorrect, incomplete, ambiguous, or untimely;<br />

� you did not properly follow <strong>Service</strong> instructions on how to make the transfer or payment (this includes incorrect<br />

date, amount, and/or address information);<br />

� you did not authorize a payment early enough for the payment to be scheduled, transmitted, received, and<br />

credited by the payee’s Due Date;<br />

� we made a timely payment, but the payee refused to accept the payment or did not promptly credit your payment<br />

after receipt;<br />

� any third party through whom any Bill Payment is made fails to properly transmit the payment to the intended<br />

payee;<br />

� your Computer malfunctioned for any reason, or the transaction could not be completed due to <strong>Service</strong><br />

Unavailability; and/or<br />

� we suspect that you may not have authorized the transaction.<br />

There may be other exceptions stated in our other agreements with you.<br />

WE WILL HAVE NO LIABILITY FOR CONSEQUENTIAL, SPECIAL, INCIDENTAL, PUNITIVE, REMOTE, OR INDIRECT<br />

DAMAGES resulting from any failure to complete a transaction, even if we have been advised of the possibility of such<br />

damages.<br />

18. Your Liability for Unauthorized Electronic Fund Transfers. Tell us IMMEDIATELY if you believe your Password<br />

has been lost, stolen, or otherwise compromised, or someone has transferred or may transfer money from your account<br />

without your permission. Telephoning is the best way of limiting your possible losses. You could lose all the money in your<br />

account(s) (plus the aggregate maximum amount of your line(s) of credit for your Activated Accounts). You agree to<br />

review promptly all Statements, Customer Notices, other notices and transaction information made available to you, and<br />

to report all unauthorized transactions and errors to us immediately. You agree that we may process payment or transfer<br />

instructions, which are submitted with a correct Password, and agree that such instructions will be deemed effective as<br />

your instructions, even if you did not transmit or authorize them. Our responsibilities are described in the Disclosures and<br />

other disclosures and agreements, which apply to your Activated Accounts.<br />

19. In Case of Errors or Questions About Your Electronic Transfers or Payments. Telephone us immediately if you<br />

think your Statement is wrong or if you need more information about a transfer listed on the Statement.<br />

(1) Tell us your name and account number.<br />

(2) Tell us the dollar amount of the suspected error.<br />

(3) Describe the error or the transfer you are unsure about and explain, as clearly as you can, why you believe it is an<br />

error or why you need more information.<br />

We may require that you send us your complaint or question in writing. We will investigate and report back to you.<br />

20. Contacting <strong>Bank</strong>. Telephone us at 1-800-238-4486 or write to:<br />

<strong>Union</strong> <strong>Bank</strong>, N.A.<br />

P.O. Box 2306<br />

Brea, California, 92822-2306

21. Release of Account Information. Our policy on disclosing information about your accounts is set forth in the<br />

“Release of Account Information” section of the Disclosures.<br />

22. Non-usage and Cancellation of the <strong>Service</strong>. You may cancel the <strong>Service</strong> by written notice to us at the address in<br />

Section 20 of this <strong>Agreement</strong>. Non-usage of the <strong>Service</strong> for 60 consecutive days may result in either termination of the<br />

<strong>Service</strong> or discontinuance of any service fee waiver at our sole discretion. You agree that at any time after such notice or<br />

period of non-use we may, without notice to you, discontinue both the <strong>Service</strong> and any service fee discount or waiver<br />

associated with use of the <strong>Service</strong>. Non-usage of the <strong>Service</strong> by a designated sole Web Administrator for 60 consecutive<br />

days may cause the <strong>Service</strong> to become inaccessible to designated Web Users.<br />

We strongly suggest that you cancel all recurring and future bill payments before you cancel your <strong>Service</strong>, either by<br />

deleting those payments yourself using the <strong>Service</strong>, or by calling us at the number listed in Section 20 of this <strong>Agreement</strong>,<br />

to avoid making duplicate payments. We will automatically delete, without notice to you, all outstanding payment orders,<br />

whether for one-time or recurring payments, once we have been notified that your <strong>Service</strong> has been terminated. We will<br />

continue to maintain your accounts in accordance with the terms of the Disclosures.<br />

23. Termination of <strong>Service</strong>. We may suspend or terminate your <strong>Service</strong> at any time, with or without cause and without<br />

affecting your outstanding obligations under this <strong>Agreement</strong>. We may immediately take this action if:<br />

� you breach this or any other agreement with us;<br />

� we have reason to believe that there has been or may be an unauthorized use of your account or Password;<br />

� there are conflicting claims to the funds in your account;<br />

� you close all of your Activated Accounts; or<br />

� you request that we do so.<br />

24. Amendments to this <strong>Agreement</strong>. Except as otherwise required by law, rule, or regulation, we may add to, delete,<br />

amend or change the terms of this <strong>Agreement</strong> from time to time and at any time.<br />

24.1. Electronic (Online) Notice of Amendments - Clients Who Have Elected Online Delivery of Statements and<br />

Customer Notices. If you have enrolled to receive Statements and Customer Notices electronically (see Section 16,<br />

above), then for so long as any Activated Account remains so enrolled, we may notify you of a change in the terms of this<br />

<strong>Agreement</strong> by sending you via e-mail: a) a Customer Notice that we have posted a change-in-terms notice on our Web<br />

Site (www.unionbank.com/ibb); or b) a Customer Notice that sets forth the change-in-terms notice (i.e., without also<br />

posting the change-in-terms notice on our Web Site).<br />

24.2. Electronic (Online) Notice of Amendments - Clients Who Have Not Elected Online Delivery of Statements<br />

and Customer Notices. Even if you have not enrolled to receive Statements and Customer Notices electronically, you<br />

agree that we may notify you of a change in the terms of this <strong>Agreement</strong> by sending you via e-mail, to any external e-mail<br />

address for you in our file: a) a Customer Notice that we have posted a change-in-terms notice on our Web Site<br />

(www.unionbank.com/ibb); or b) a Customer Notice that sets forth the change-in-terms notice (i.e., without also posting<br />

the change-in-terms notice on our Web Site).<br />

24.3. Amendments - All Clients. Each e-mail notice which includes: a) a Customer Notice that we have posted a<br />

change-in-terms notice on our Web Site (www.unionbank.com/ibb); or b) a Customer Notice that sets forth the change-interms<br />

notice (i.e. with or without also posting the change-in-terms notice on our Web Site) shall be deemed to have been<br />

received by you on the day we send it. Any such Customer Notice posted on our Web Site shall be deemed to have been<br />

received by you on the day we post it, and will remain accessible there for 90 days after the later of our e-mail notice, if<br />

any, or the date the Customer Notice was first posted on our Web Site. If a change to this <strong>Agreement</strong> cannot be<br />

disclosed without jeopardizing the security of the system or if a law, rule or regulation requires that it be updated at an<br />

earlier time, we will notify you within thirty (30) days after the effective date of the change. You may choose to accept or<br />

decline a change to this <strong>Agreement</strong> by continuing or discontinuing to use the <strong>Service</strong> after the effective date of the change.<br />

25. Notices. We may mail notices to you at the address shown in our account or <strong>Service</strong> records. If you have elected<br />

online delivery of Statements and Customer Notices, we may send notices to you in the manner described in 16 of this<br />

<strong>Agreement</strong>.<br />

26. Severability. If any provision of this <strong>Agreement</strong> is determined to be void or invalid, the rest of the <strong>Agreement</strong> will<br />

remain in full force and effect.

27. Disputes and Governing Law. All claims, causes of action or other disputes concerning this <strong>Agreement</strong> will be<br />

determined in accordance with problem resolution procedures and governing law as set forth in the Disclosures.