PEOPLE FOCUS - CIPD

PEOPLE FOCUS - CIPD

PEOPLE FOCUS - CIPD

- TAGS

- people

- focus

- cipd

- www.cipd.co.uk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PENSIONS <strong>PEOPLE</strong> <strong>FOCUS</strong><br />

‘Forecasting for the Future’ on<br />

Women and Pensions Day 2008<br />

Almost 49% of the female<br />

workforce have no personal<br />

pension coverage and are being<br />

urged by the National Pensions<br />

Action Campaign to seriously<br />

consider planning for their<br />

financial future.<br />

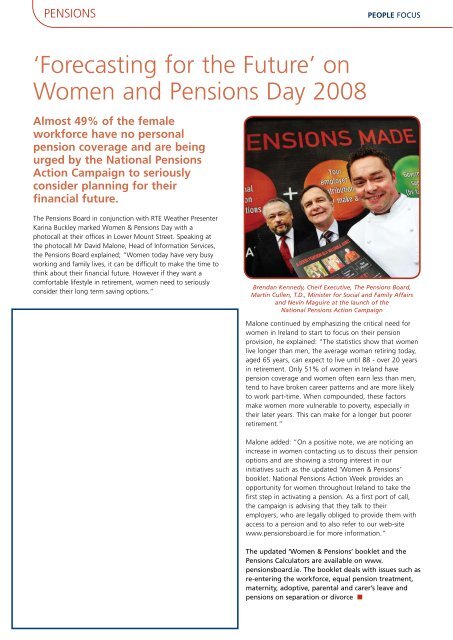

The Pensions Board in conjunction with RTE Weather Presenter<br />

Karina Buckley marked Women & Pensions Day with a<br />

photocall at their offices in Lower Mount Street. Speaking at<br />

the photocall Mr David Malone, Head of Information Services,<br />

the Pensions Board explained; “Women today have very busy<br />

working and family lives, it can be difficult to make the time to<br />

think about their financial future. However if they want a<br />

comfortable lifestyle in retirement, women need to seriously<br />

consider their long term saving options.”<br />

Brendan Kennedy, Cheif Executive, The Pensions Board,<br />

Martin Cullen, T.D., Minister for Social and Family Affairs<br />

and Nevin Maguire at the launch of the<br />

National Pensions Action Campaign<br />

Malone continued by emphasizing the critical need for<br />

women in Ireland to start to focus on their pension<br />

provision, he explained: “The statistics show that women<br />

live longer than men, the average woman retiring today,<br />

aged 65 years, can expect to live until 88 - over 20 years<br />

in retirement. Only 51% of women in Ireland have<br />

pension coverage and women often earn less than men,<br />

tend to have broken career patterns and are more likely<br />

to work part-time. When compounded, these factors<br />

make women more vulnerable to poverty, especially in<br />

their later years. This can make for a longer but poorer<br />

retirement.”<br />

Malone added: “On a positive note, we are noticing an<br />

increase in women contacting us to discuss their pension<br />

options and are showing a strong interest in our<br />

initiatives such as the updated ‘Women & Pensions’<br />

booklet. National Pensions Action Week provides an<br />

opportunity for women throughout Ireland to take the<br />

first step in activating a pension. As a first port of call,<br />

the campaign is advising that they talk to their<br />

employers, who are legally obliged to provide them with<br />

access to a pension and to also refer to our web-site<br />

www.pensionsboard.ie for more information.”<br />

The updated ‘Women & Pensions’ booklet and the<br />

Pensions Calculators are available on www.<br />

pensionsboard.ie. The booklet deals with issues such as<br />

re-entering the workforce, equal pension treatment,<br />

maternity, adoptive, parental and carer’s leave and<br />

pensions on separation or divorce ■