FY2012A eServGlobal Investor Presentation (PDF)

FY2012A eServGlobal Investor Presentation (PDF)

FY2012A eServGlobal Investor Presentation (PDF)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12<br />

Shops<br />

Distributors<br />

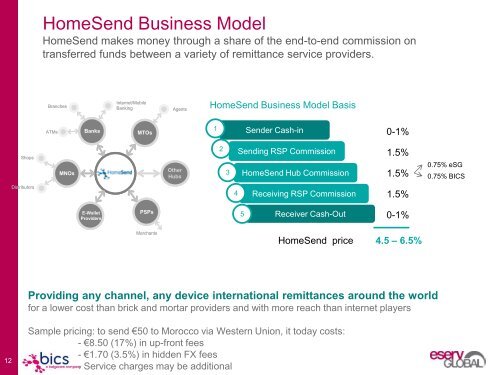

HomeSend Business Model<br />

HomeSend makes money through a share of the end-to-end commission on<br />

transferred funds between a variety of remittance service providers.<br />

Branches<br />

ATMs<br />

MNOs<br />

Banks<br />

E-Wallet<br />

Providers<br />

Internet/Mobile<br />

Banking<br />

MTOs<br />

PSPs<br />

Merchants<br />

Agents<br />

Other<br />

Hubs<br />

HomeSend Business Model Basis<br />

1<br />

2<br />

3<br />

4<br />

Sender Cash-in<br />

Sending RSP Commission<br />

HomeSend Hub Commission<br />

5<br />

Receiving RSP Commission<br />

Receiver Cash-Out<br />

0-1%<br />

1.5%<br />

1.5%<br />

1.5%<br />

0-1%<br />

HomeSend price 4.5 – 6.5%<br />

Providing any channel, any device international remittances around the world<br />

for a lower cost than brick and mortar providers and with more reach than internet players<br />

Sample pricing: to send €50 to Morocco via Western Union, it today costs:<br />

- €8.50 (17%) in up-front fees<br />

- €1.70 (3.5%) in hidden FX fees<br />

- Service charges may be additional<br />

0.75% eSG<br />

0.75% BICS