TATA STEEL LIMITED - Moneycontrol.com

TATA STEEL LIMITED - Moneycontrol.com

TATA STEEL LIMITED - Moneycontrol.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

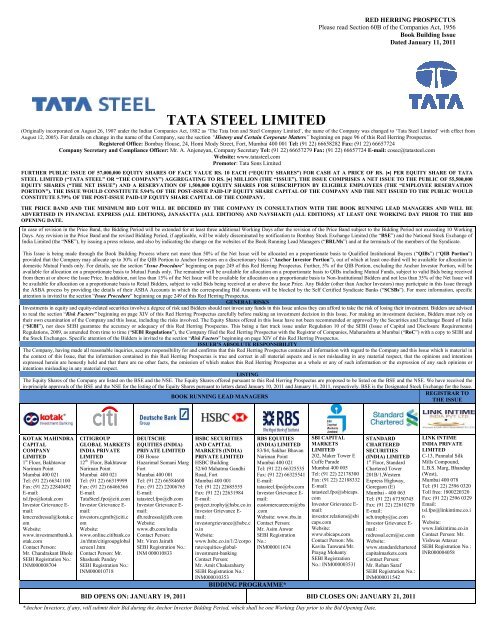

<strong>TATA</strong> <strong>STEEL</strong> <strong>LIMITED</strong><br />

(Originally incorporated on August 26, 1907 under the Indian Companies Act, 1882 as ‘The Tata Iron and Steel Company Limited’, the name of the Company was changed to ‘Tata Steel Limited’ with effect from<br />

August 12, 2005). For details on change in the name of the Company, see the section “History and Certain Corporate Matters” beginning on page 96 of this Red Herring Prospectus.<br />

Registered Office: Bombay House, 24, Homi Mody Street, Fort, Mumbai 400 001 Tel: (91 22) 66658282 Fax: (91 22) 66657724<br />

Company Secretary and Compliance Officer: Mr. A. Anjeneyan, Company Secretary Tel: (91 22) 66657279 Fax: (91 22) 66657724 E-mail: cosec@tatasteel.<strong>com</strong><br />

Website: www.tatasteel.<strong>com</strong><br />

Promoter: Tata Sons Limited<br />

FURTHER PUBLIC ISSUE OF 57,000,000 EQUITY SHARES OF FACE VALUE RS. 10 EACH (“EQUITY SHARES”) FOR CASH AT A PRICE OF RS. [•] PER EQUITY SHARE OF <strong>TATA</strong><br />

<strong>STEEL</strong> <strong>LIMITED</strong> (“<strong>TATA</strong> <strong>STEEL</strong>” OR “THE COMPANY”) AGGREGATING TO RS. [•] MILLION (THE “ISSUE”). THE ISSUE COMPRISES A NET ISSUE TO THE PUBLIC OF 55,500,000<br />

EQUITY SHARES (“THE NET ISSUE”) AND A RESERVATION OF 1,500,000 EQUITY SHARES FOR SUBSCRIPTION BY ELIGIBLE EMPLOYEES (THE “EMPLOYEE RESERVATION<br />

PORTION”). THE ISSUE WOULD CONSTITUTE 5.94% OF THE POST-ISSUE PAID-UP EQUITY SHARE CAPITAL OF THE COMPANY AND THE NET ISSUED TO THE PUBLIC WOULD<br />

CONSTITUTE 5.79% OF THE POST-ISSUE PAID-UP EQUITY SHARE CAPITAL OF THE COMPANY.<br />

THE PRICE BAND AND THE MINIMUM BID LOT WILL BE DECIDED BY THE COMPANY IN CONSULTATION WITH THE BOOK RUNNING LEAD MANAGERS AND WILL BE<br />

ADVERTISED IN FINANCIAL EXPRESS (ALL EDITIONS), JANASATTA (ALL EDITIONS) AND NAVSHAKTI (ALL EDITIONS) AT LEAST ONE WORKING DAY PRIOR TO THE BID<br />

OPENING DATE.<br />

In case of revision in the Price Band, the Bidding Period will be extended for at least three additional Working Days after the revision of the Price Band subject to the Bidding Period not exceeding 10 Working<br />

Days. Any revision in the Price Band and the revised Bidding Period, if applicable, will be widely disseminated by notification to Bombay Stock Exchange Limited (the “BSE”) and the National Stock Exchange of<br />

India Limited (the “NSE”), by issuing a press release, and also by indicating the change on the websites of the Book Running Lead Managers (“BRLMs”) and at the terminals of the members of the Syndicate.<br />

This Issue is being made through the Book Building Process where not more than 50% of the Net Issue will be allocated on a proportionate basis to Qualified Institutional Buyers (“QIBs”) (“QIB Portion”)<br />

provided that the Company may allocate up to 30% of the QIB Portion to Anchor Investors on a discretionary basis (“Anchor Investor Portion”), out of which at least one-third will be available for allocation to<br />

domestic Mutual Funds only. For details, see the section “Issue Procedure” beginning on page 249 of this Red Herring Prospectus. Further, 5% of the QIB Portion, excluding the Anchor Investor Portion, will be<br />

available for allocation on a proportionate basis to Mutual Funds only. The remainder will be available for allocation on a proportionate basis to QIBs including Mutual Funds, subject to valid Bids being received<br />

from them at or above the Issue Price. In addition, not less than 15% of the Net Issue will be available for allocation on a proportionate basis to Non-Institutional Bidders and not less than 35% of the Net Issue will<br />

be available for allocation on a proportionate basis to Retail Bidders, subject to valid Bids being received at or above the Issue Price. Any Bidder (other than Anchor Investors) may participate in this Issue through<br />

the ASBA process by providing the details of their ASBA Accounts in which the corresponding Bid Amounts will be blocked by the Self Certified Syndicate Banks (“SCSBs”). For more information, specific<br />

attention is invited to the section “Issue Procedure” beginning on page 249 of this Red Herring Prospectus.<br />

GENERAL RISKS<br />

Investments in equity and equity-related securities involve a degree of risk and Bidders should not invest any funds in this Issue unless they can afford to take the risk of losing their investment. Bidders are advised<br />

to read the section “Risk Factors” beginning on page XIV of this Red Herring Prospectus carefully before making an investment decision in this Issue. For making an investment decision, Bidders must rely on<br />

their own examination of the Company and this Issue, including the risks involved. The Equity Shares offered in this Issue have not been re<strong>com</strong>mended or approved by the Securities and Exchange Board of India<br />

(“SEBI”), nor does SEBI guarantee the accuracy or adequacy of this Red Herring Prospectus. This being a fast track issue under Regulation 10 of the SEBI (Issue of Capital and Disclosure Requirements)<br />

Regulations, 2009, as amended from time to time (“SEBI Regulations”), the Company filed the Red Herring Prospectus with the Registrar of Companies, Maharashtra at Mumbai (“RoC”) with a copy to SEBI and<br />

the Stock Exchanges. Specific attention of the Bidders is invited to the section “Risk Factors” beginning on page XIV of this Red Herring Prospectus.<br />

ISSUER’S ABSOLUTE RESPONSIBILITY<br />

The Company, having made all reasonable inquiries, accepts responsibility for and confirms that this Red Herring Prospectus contains all information with regard to the Company and this Issue which is material in<br />

the context of this Issue, that the information contained in this Red Herring Prospectus is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions<br />

expressed herein are honestly held and that there are no other facts, the omission of which makes this Red Herring Prospectus as a whole or any of such information or the expression of any such opinions or<br />

intentions misleading in any material respect.<br />

LISTING<br />

The Equity Shares of the Company are listed on the BSE and the NSE. The Equity Shares offered pursuant to this Red Herring Prospectus are proposed to be listed on the BSE and the NSE. We have received the<br />

in-principle approvals of the BSE and the NSE for the listing of the Equity Shares pursuant to letters dated January 10, 2011 and January 11, 2011, respectively. BSE is the Designated Stock Exchange for the Issue.<br />

REGISTRAR TO<br />

BOOK RUNNING LEAD MANAGERS<br />

THE ISSUE<br />

KOTAK MAHINDRA<br />

CAPITAL<br />

COMPANY<br />

<strong>LIMITED</strong><br />

1 st Floor, Bakhtawar<br />

Nariman Point<br />

Mumbai 400 021<br />

Tel: (91 22) 66341100<br />

Fax: (91 22) 22840492<br />

E-mail:<br />

tsl.fpo@kotak.<strong>com</strong><br />

Investor Grievance Email:<br />

kmccredressal@kotak.c<br />

om<br />

Website:<br />

www.investmentbank.k<br />

otak.<strong>com</strong><br />

Contact Person:<br />

Mr. Chandrakant Bhole<br />

SEBI Registration No.:<br />

INM000008704<br />

CITIGROUP<br />

GLOBAL MARKETS<br />

INDIA PRIVATE<br />

<strong>LIMITED</strong><br />

12 th Floor, Bakhtawar<br />

Nariman Point<br />

Mumbai 400 021<br />

Tel: (91 22) 66319999<br />

Fax: (91 22) 66466366<br />

E-mail:<br />

TataSteel.fpo@citi.<strong>com</strong><br />

Investor Grievance Email:<br />

investors.cgmib@citi.c<br />

om<br />

Website:<br />

www.online.citibank.co<br />

.in/rhtm/citigroupglobal<br />

screen1.htm<br />

Contact Person: Mr.<br />

Shashank Pandey<br />

SEBI Registration No.:<br />

INM000010718<br />

DEUTSCHE<br />

EQUITIES (INDIA)<br />

PRIVATE <strong>LIMITED</strong><br />

DB House<br />

Hazarimal Somani Marg<br />

Fort<br />

Mumbai 400 001<br />

Tel: (91 22) 66584600<br />

Fax: (91 22) 22006765<br />

E-mail:<br />

tatasteel.fpo@db.<strong>com</strong><br />

Investor Grievance Email:<br />

db.redressal@db.<strong>com</strong><br />

Website:<br />

www.db.<strong>com</strong>/india<br />

Contact Person:<br />

Mr. Viren Jairath<br />

SEBI Registration No.:<br />

INM 000010833<br />

HSBC SECURITIES<br />

AND CAPITAL<br />

MARKETS (INDIA)<br />

PRIVATE <strong>LIMITED</strong><br />

HSBC Building<br />

52/60 Mahatma Gandhi<br />

Road, Fort<br />

Mumbai 400 001<br />

Tel: (91 22) 22685555<br />

Fax: (91 22) 22631984<br />

E-mail:<br />

project.trophy@hsbc.co.in<br />

Investor Grievance Email:<br />

investorgrievance@hsbc.c<br />

o.in<br />

Website:<br />

www.hsbc.co.in/1/2/corpo<br />

rate/equities-globalinvestment-banking<br />

Contact Person:<br />

Mr. Amit Chakarabarty<br />

SEBI Registration No.:<br />

INM000010353<br />

RBS EQUITIES<br />

(INDIA) <strong>LIMITED</strong><br />

83/84, Sakhar Bhavan<br />

Nariman Point<br />

Mumbai 400 021<br />

Tel: (91 22) 66325535<br />

Fax: (91 22) 66325541<br />

E-mail:<br />

tatasteel.fpo@rbs.<strong>com</strong><br />

Investor Grievance Email:<br />

customercareecm@rbs<br />

.<strong>com</strong><br />

Website: www.rbs.in<br />

Contact Person:<br />

Mr. Asim Anwar<br />

SEBI Registration<br />

No.:<br />

INM000011674<br />

BIDDING PROGRAMME*<br />

SBI CAPITAL<br />

MARKETS<br />

<strong>LIMITED</strong><br />

202, Maker Tower E<br />

Cuffe Parade<br />

Mumbai 400 005<br />

Tel: (91 22) 22178300<br />

Fax: (91 22) 22188332<br />

E-mail:<br />

tatasteel.fpo@sbicaps.<br />

<strong>com</strong><br />

Investor Grievance Email:<br />

investor.relations@sbi<br />

caps.<strong>com</strong><br />

Website:<br />

www.sbicaps.<strong>com</strong><br />

Contact Person: Ms.<br />

Kavita Tanwani/Mr.<br />

Prayag Mohanty<br />

SEBI Registration<br />

No.: INM000003531<br />

STANDARD<br />

CHARTERED<br />

SECURITIES<br />

(INDIA) <strong>LIMITED</strong><br />

1 st Floor, Standard<br />

Chartered Tower<br />

201B/1,Western<br />

Express Highway,<br />

Goregaon (E)<br />

Mumbai - 400 063<br />

Tel: (91 22) 67350745<br />

Fax: (91 22) 22610270<br />

E-mail:<br />

scb.trophy@sc.<strong>com</strong><br />

Investor Grievance Email:<br />

redressal.ecm@sc.<strong>com</strong><br />

Website:<br />

www.standardchartered<br />

capitalmarkets.<strong>com</strong><br />

Contact Person:<br />

Mr. Rohan Saraf<br />

SEBI Registration No.:<br />

INM000011542<br />

BID OPENS ON: JANUARY 19, 2011 BID CLOSES ON: JANUARY 21, 2011<br />

*Anchor Investors, if any, will submit their Bid during the Anchor Investor Bidding Period, which shall be one Working Day prior to the Bid Opening Date.<br />

RED HERRING PROSPECTUS<br />

Please read Section 60B of the Companies Act, 1956<br />

Book Building Issue<br />

Dated January 11, 2011<br />

LINK INTIME<br />

INDIA PRIVATE<br />

<strong>LIMITED</strong><br />

C-13, Pannalal Silk<br />

Mills Compound,<br />

L.B.S. Marg, Bhandup<br />

(West),<br />

Mumbai 400 078<br />

Tel: (91 22) 2596 0320<br />

Toll free: 1800220320<br />

Fax: (91 22) 2596 0329<br />

Email:<br />

tsl.fpo@linkintime.co.i<br />

n<br />

Website:<br />

www.linkintime.co.in<br />

Contact Person: Mr.<br />

Vishwas Attavar<br />

SEBI Registration No.:<br />

INR000004058

TABLE OF CONTENTS<br />

SECTION I – GENERAL ........................................................................................................................................... I<br />

DEFINITIONS AND ABBREVIATIONS ................................................................................................................ i<br />

CERTAIN CONVENTIONS, USE OF FINANCIAL INFORMATION AND MARKET DATA AND<br />

CURRENCY OF PRESENTATION ....................................................................................................................... ix<br />

NOTICE TO INVESTORS ..................................................................................................................................... xi<br />

FORWARD LOOKING STATEMENTS .............................................................................................................. xii<br />

SECTION II - RISK FACTORS ........................................................................................................................... XIV<br />

SECTION III – INTRODUCTION ............................................................................................................................ 1<br />

SUMMARY OF INDUSTRY .................................................................................................................................. 1<br />

SUMMARY OF BUSINESS .................................................................................................................................... 3<br />

SUMMARY FINANCIAL INFORMATION .......................................................................................................... 9<br />

THE ISSUE ............................................................................................................................................................ 17<br />

GENERAL INFORMATION ................................................................................................................................. 19<br />

CAPITAL STRUCTURE ....................................................................................................................................... 30<br />

OBJECTS OF THE ISSUE ..................................................................................................................................... 39<br />

BASIS FOR ISSUE PRICE .................................................................................................................................... 48<br />

STATEMENT OF TAX BENEFITS ...................................................................................................................... 51<br />

SECTION IV- ABOUT US ....................................................................................................................................... 58<br />

INDUSTRY OVERVIEW ...................................................................................................................................... 58<br />

BUSINESS ............................................................................................................................................................. 65<br />

REGULATIONS AND POLICIES IN INDIA ....................................................................................................... 91<br />

HISTORY AND CERTAIN CORPORATE MATTERS ....................................................................................... 96<br />

SUBSIDIARIES ................................................................................................................................................... 100<br />

MANAGEMENT ................................................................................................................................................. 112<br />

THE PROMOTER AND GROUP COMPANIES ................................................................................................ 125<br />

DIVIDEND POLICY ........................................................................................................................................... 151<br />

SECTION V – FINANCIAL INFORMATION .................................................................................................... 152<br />

FINANCIAL STATEMENTS .............................................................................................................................. 152<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF<br />

OPERATIONS ..................................................................................................................................................... 157<br />

FINANCIAL INDEBTEDNESS .......................................................................................................................... 185<br />

STOCK MARKET DATA FOR EQUITY SHARES OF THE COMPANY ....................................................... 197<br />

SECTION VI – LEGAL AND OTHER INFORMATION .................................................................................. 200<br />

OUTSTANDING LITIGATION AND DEFAULTS ........................................................................................... 200<br />

GOVERNMENT AND OTHER APPROVALS .................................................................................................. 224<br />

OTHER REGULATORY AND STATUTORY DISCLOSURES ....................................................................... 230<br />

SECTION VII – ISSUE RELATED INFORMATION ........................................................................................ 241<br />

ISSUE STRUCTURE ........................................................................................................................................... 241<br />

TERMS OF THE ISSUE ...................................................................................................................................... 246<br />

ISSUE PROCEDURE .......................................................................................................................................... 249<br />

RESTRICTIONS ON FOREIGN OWNERSHIP OF INDIAN SECURITIES .................................................... 277<br />

SECTION VIII – MAIN PROVISIONS OF THE ARTICLES OF ASSOCIATION ....................................... 278<br />

SECTION IX – OTHER INFORMATION ........................................................................................................... 295<br />

MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ............................................................. 295<br />

DECLARATION .................................................................................................................................................. 297

SECTION I – GENERAL<br />

DEFINITIONS AND ABBREVIATIONS<br />

Unless the context otherwise indicates or implies, the following terms have the following meanings in this Red<br />

Herring Prospectus and references to any statute or regulations or policies will include any amendments or reenactments<br />

thereto, from time to time.<br />

Company-Related Terms<br />

Term Description<br />

“Tata Steel” or the “Company” Tata Steel Limited and its consolidated subsidiaries, unless otherwise<br />

specified<br />

“Tata Steel India” Tata Steel Limited as a stand-alone entity<br />

“TSE” Tata Steel Europe and its subsidiaries<br />

“TSL” Tata Steel Limited and its subsidiaries, except TSE and TSE’s subsidiaries<br />

Articles of Association or Articles The articles of association of the Company, as amended from time<br />

to time<br />

Audit Committee The audit <strong>com</strong>mittee of the Board of Directors described in the section<br />

“Management” beginning on page 112 of this Red Herring Prospectus<br />

Auditors The statutory auditors of the Company, being Messrs. Deloitte Haskins &<br />

Sells, Chartered Accountants<br />

Board or Board of Directors The board of directors of the Company, unless otherwise specified<br />

Directors The directors of the Company<br />

Group Companies Includes those <strong>com</strong>panies, firms, ventures, etc., promoted by the<br />

Promoter, irrespective of whether such entities are covered under Section<br />

370(1B) of the Companies Act or not. For details, see the section “The<br />

Promoter and Group Companies” beginning on page 125 of this Red<br />

Herring Prospectus<br />

Memorandum of Association The memorandum of association of the Company, as amended from time<br />

to time<br />

Promoter or Tata Sons Tata Sons Limited<br />

Registered Office The registered office of the Company, at Bombay House, 24, Homi<br />

Mody Street, Fort, Mumbai 400 001<br />

Issue Related Terms<br />

Term Description<br />

Allotted/Allotment/Allot Unless the context otherwise requires, means the allotment of Equity<br />

Shares pursuant to this Issue to successful Bidders<br />

Allottee A successful Bidder to whom the Equity Shares are Allotted<br />

Application Supported by Blocked<br />

Amount/ASBA<br />

Application (whether physical or electronic) used by an ASBA Bidder to<br />

make a Bid authorising the SCSB to block the Bid Amount in the<br />

specified bank account maintained with the SCSB<br />

ASBA Account Account maintained with an SCSB which will be blocked by such SCSB<br />

to the extent of the Bid Amount of an ASBA Bidder<br />

ASBA Bid cum Application Form The Bid cum Application Form, whether physical or electronic, used by<br />

an ASBA Bidder to make a Bid, which will be considered as the<br />

application for Allotment for the purposes of this Red Herring Prospectus<br />

and the Prospectus<br />

ASBA Bidder Any Bidder other than an Anchor Investor who intends to apply through<br />

ASBA<br />

ASBA Revision Form The revision forms used by ASBA Bidders to modify the quantity of<br />

Equity Shares in any of their ASBA Bid cum Application Forms or any<br />

previous ASBA Revision Forms<br />

i

Term Description<br />

Anchor Investor A Qualified Institutional Buyer, who applies under the Anchor Investor<br />

Portion with a minimum Bid of Rs. 100 million<br />

Anchor Investor Allocation Notice Notice or intimation of allocation of Equity Shares sent to Anchor<br />

Investors who have been allocated Equity Shares<br />

Anchor Investor Bid Bid made by the Anchor Investor<br />

Anchor Investor Bidding Period The day which is one Working Day prior to the Bid Opening Date, prior<br />

to or after which the Syndicate will not accept any Bids from the Anchor<br />

Investors<br />

Anchor Investor Issue Price The final price at which Equity Shares will be issued and Allotted in<br />

terms of the Red Herring Prospectus and the Prospectus to the Anchor<br />

Investors, which will be a price equal to or higher than the Issue Price but<br />

not higher than the Cap Price.<br />

Anchor Investor Portion Up to 30% of the QIB Portion which may be allocated to Anchor<br />

Investors by the Company in consultation with the BRLMs on a<br />

discretionary basis. One-third of the Anchor Investor Portion will be<br />

reserved for allocation to domestic Mutual Funds, subject to valid Anchor<br />

Investor Bids being received from domestic Mutual Funds at or above the<br />

price at which allocation is being made to Anchor Investors<br />

Bankers to the Issue/Escrow Collection Axis Bank Limited, HDFC Bank Limited, and ICICI Bank Limited<br />

Banks<br />

Basis of Allotment The basis on which the Equity Shares will be Allotted, described in the<br />

section “Issue Procedure” beginning on page 249 of this Red Herring<br />

Prospectus.<br />

Bid An indication to make an offer during the Bidding Period by a Bidder, or<br />

during the Anchor Investor Bidding Period by an Anchor Investor,<br />

pursuant to submission of a Bid cum Application Form to subscribe to<br />

the Equity Shares at a price within the Price Band, including all revisions<br />

and modifications thereto<br />

Bid Amount The highest value of the optional Bids indicated in the Bid cum<br />

Application Form and payable by a Bidder on submission of a Bid in the<br />

Issue and in the case of ASBA Bidders, the amount mentioned in the<br />

ASBA Bid cum Application Form<br />

Bid Closing Date Except in relation to Anchor Investors, January 21, 2011<br />

Bid cum Application Form The form in terms of which the Bidder will make an offer to purchase<br />

Equity Shares and which will be considered as the application for the<br />

issue of Equity Shares pursuant to the terms of this Red Herring<br />

Prospectus and the Prospectus, including the ASBA Bid cum<br />

Application, as may be applicable<br />

Bidder Any prospective investor who makes a Bid pursuant to the terms of the<br />

Red Herring Prospectus and the Bid cum Application Form, including an<br />

ASBA Bidder and an Anchor Investor<br />

Bidding Period The applicable period between the Bid Opening Date and the Bid<br />

Closing Date, inclusive of both days, during which prospective Bidders<br />

(other than Anchor Investors) can submit their Bids, including any<br />

revisions thereof<br />

Bid Opening Date Except in relation to Anchor Investors, January 19, 2011<br />

Book Building Process The method of book building as described in Schedule XI of the SEBI<br />

Regulations, in terms of which the Issue is being made<br />

Book Running Lead Managers/BRLMs The book running lead managers to the Issue, in this case being:<br />

• Kotak Mahindra Capital Company Limited;<br />

• Citigroup Global Markets India Private Limited;<br />

• Deutsche Equities (India) Private Limited;<br />

• HSBC Securities and Capital Markets (India) Private Limited;<br />

ii

Term Description<br />

• RBS Equities (India) Limited;<br />

• SBI Capital Markets Limited; and<br />

• Standard Chartered Securities (India) Limited<br />

Cap Price Higher end of the Price Band, including revisions thereof, above which<br />

the Issue Price and Anchor Investor Issue Price will not be determined<br />

and above which no Bids will be accepted<br />

Citi Citigroup Global Markets India Private Limited<br />

Controlling Branches of the SCSBs Such branches of the SCSBs which coordinate Bids in the Issue by<br />

ASBA Bidders with the BRLMs, the Registrar to the Issue and the Stock<br />

Exchanges, a list of which is available on www.sebi.gov.in/pmd/scsb.pdf<br />

Cut-off Price The Issue Price finalized by the Company in consultation with the<br />

BRLMs which will be any price within the Price Band. Only Retail<br />

Bidders and Eligible Employees are entitled to Bid at the Cut-off Price.<br />

QIBs (including Anchor Investors) and Non-Institutional Bidders are not<br />

entitled to Bid at the Cut-off Price<br />

Designated Branches Such branches of the SCSBs which will collect the ASBA Bid cum<br />

Application Form used by ASBA Bidders, a list of which is available on<br />

www.sebi.gov.in/pmd/scsb.pdf<br />

Designated Date The date on which funds are transferred from the Escrow Accounts to the<br />

Public Issue Account and the amount blocked by the SCSBs are<br />

transferred from the ASBA Accounts to the Public Issue Account, as the<br />

case may be, after the Prospectus is filed with the RoC, following which<br />

the Equity Shares will be Allotted<br />

Designated Stock Exchange Bombay Stock Exchange Limited<br />

Deutsche Bank Deutsche Equities (India) Private Limited<br />

DP ID Depository Participant’s Identity<br />

Eligible Employee A permanent and full-time employee of the Company or a Director of the<br />

Company (excluding such other persons not eligible under applicable<br />

laws, rules, regulations and guidelines), as on the date of filing of the Red<br />

Herring Prospectus with the RoC, who are Indian nationals and are<br />

based, working and present in India as on the date of submission of the<br />

Bid cum Application Form and who continue to be in the employment of<br />

the Company or Directors of the Company, as the case may be, until<br />

submission of the Bid cum Application Form.<br />

Employee Reservation Portion The portion of the Issue, being 1,500,000 Equity Shares, available for<br />

allocation to Eligible Employees.<br />

Eligible NRI A NRI resident in a jurisdiction outside India where it is not unlawful to<br />

make an offer or invitation under the Issue and in relation to whom the<br />

Red Herring Prospectus constitutes an invitation to subscribe for the<br />

Equity Shares<br />

Equity Listing Agreement The Company’s equity listing agreements entered into with the Stock<br />

Exchanges<br />

Equity Shares or Ordinary Shares The ordinary shares of the Company having a face value of Rs. 10,<br />

unless otherwise specified in the context thereof<br />

Escrow Account(s) Accounts opened with the Escrow Collection Banks for the Issue and in<br />

whose favour the Bidders (excluding ASBA Bidders) will issue cheques<br />

or demand drafts in respect of the Bid Amount<br />

Escrow Agreement Agreement to be entered into among the Company, the Registrar, the<br />

members of the Syndicate, the Escrow Collection Banks and the Refund<br />

Banks for collection of the Bid Amounts and remitting refunds, if any, of<br />

the amounts to the Bidders (excluding ASBA Bidders) on the terms and<br />

conditions thereof<br />

First Bidder The Bidder whose name appears first in the Bid cum Application Form<br />

or the Revision Form<br />

iii

Term Description<br />

Floor Price Lower end of the Price Band and any revisions thereof, below which the<br />

Issue Price will not be finalized and no Bids will be accepted and which<br />

shall not be lower than the face value of the Equity Shares<br />

HSBC HSBC Securities and Capital Markets (India) Private Limited<br />

Issue Further public issue of up to 57,000,000 Equity Shares of Rs. 10 each<br />

for cash at a price of Rs. [●] per Equity Share of the Company<br />

aggregating to Rs. [●] million<br />

Issue Agreement The agreement dated January 11, 2011 entered into amongst the<br />

Company and the BRLMs pursuant to which certain arrangements are<br />

agreed to in relation to the Issue<br />

Issue Price The final price at which the Equity Shares will be issued and Allotted to<br />

the successful Bidders in terms of the Red Herring Prospectus and the<br />

Prospectus. The Issue Price will be decided by the Company in<br />

consultation with the BRLMs<br />

Kotak Kotak Mahindra Capital Company Limited<br />

Monitoring Agency HDFC Bank Limited<br />

Mutual Funds Mutual funds registered with SEBI under the SEBI (Mutual Funds)<br />

Regulations, 1996, as amended<br />

Mutual Funds Portion 5% of the QIB Portion (excluding the Anchor Investor Portion) equal to a<br />

minimum of 971,250 Equity Shares available for allocation to Mutual<br />

Funds only, out of the QIB Portion on a proportionate basis<br />

Net Issue Issue less the Employees Reservation Portion, consisting of 55,500,000<br />

Equity Shares<br />

Net Proceeds Proceeds of the Issue that are available to the Company excluding Issue<br />

expenses<br />

Non-Institutional Bidders All Bidders, including sub-accounts of FIIs registered with SEBI, which<br />

are foreign corporate or foreign individuals, that are not QIBs or Retail<br />

Bidders and who have Bid for the Equity Shares for an amount more than<br />

Rs. 200,000<br />

Non-Institutional Portion The portion of the Issue, being not less than 15% of the Net Issue or<br />

8,325,000 Equity Shares, available for allocation to Non-Institutional<br />

Bidders<br />

Non-Resident Indian or NRI A person resident outside India, who is a citizen of India or a person of<br />

Indian origin and will have the same meaning as ascribed to such term in<br />

the Foreign Exchange Management (Deposit) Regulations, 2000, as<br />

amended<br />

Pay-in Date Bid Closing Date, except with respect to Anchor Investors, the Anchor<br />

Investor Bidding Period or a date mentioned in the Anchor Investor<br />

Allocation Notice<br />

Pay-in Period Except with respect to ASBA Bidders, the period <strong>com</strong>mencing on the<br />

Bid Opening Date and extending until the Bid Closing Date<br />

Price Band Price band of a minimum price (Floor Price) of Rs. [●] and a maximum<br />

price (Cap Price) of Rs. [●], including revisions thereof. The Price Band<br />

and the minimum Bid lot for the Issue will be decided by the Company in<br />

consultation with the BRLMs and advertised in Financial Express (all<br />

editions), Janasatta (all editions) and Navshakti (all editions) at least one<br />

Working Day prior to the Bid Opening Date, with the relevant financial<br />

ratios calculated at the Floor Price and at the Cap Price<br />

Pricing Date The date on which the Company in consultation with the BRLMs will<br />

decide the Issue Price<br />

Prospectus The Prospectus to be filed with the RoC in terms of Section 60 of the<br />

Companies Act, containing, among other things, the Issue Price that is<br />

determined at the end of the Book Building Process, the size of the Issue<br />

and certain other information and including any addenda or corrigenda<br />

iv

Term Description<br />

thereof<br />

Public Issue Account The account to be opened with the Bankers to the Issue to receive monies<br />

from the Escrow Account(s) and the ASBA Accounts<br />

Qualified Institutional Buyers or QIBs Public financial institutions as specified in Section 4A of the Companies<br />

Act, FIIs and sub-accounts registered with SEBI, other than a subaccount<br />

which is a foreign corporate or foreign individual, scheduled<br />

<strong>com</strong>mercial banks, Mutual Funds, VCFs and FVCIs registered with<br />

SEBI, multilateral and bilateral development financial institutions, state<br />

industrial development corporations, insurance <strong>com</strong>panies registered<br />

with the Insurance Regulatory and Development Authority, provident<br />

funds (subject to applicable law) with minimum corpus of Rs. 250<br />

million and pension funds with minimum corpus of Rs. 250 million, the<br />

National Investment Fund set up by resolution F. No. 2/3/2005-DD-II<br />

dated November 23, 2005 of Government of India published in the<br />

Gazette of India, insurance funds set up and managed by army, navy or<br />

air force of the Union of India and insurance funds set up and managed<br />

by the Department of Posts, India<br />

QIB Portion The portion of the Issue being not more than 50% of the Net Issue or<br />

27,750,000 Equity Shares available for allocation to QIBs, including the<br />

Anchor Investor Portion<br />

RBS RBS Equities (India) Limited<br />

Red Herring Prospectus or RHP This Red Herring Prospectus dated January 11, 2011 issued in<br />

accordance with Section 60B of the Companies Act, which does not have<br />

<strong>com</strong>plete particulars of the Issue Price and the Price Band and which<br />

be<strong>com</strong>es the Prospectus after filing with the RoC after the Pricing Date<br />

Refund Account(s) Account(s) opened with Escrow Collection Bank(s) from which refunds<br />

of the whole or part of the Bid Amount (excluding the ASBA Bidders), if<br />

any, will be made<br />

Refund Bank(s) Escrow Collection Bank(s) with which an account is opened and from<br />

which a refund of the whole or part of the Bid Amount, if any, will be<br />

made<br />

Registrar to the Issue/Registrar Link Intime India Private Limited<br />

Registrar’s Agreement The agreement entered into among the Company and the Registrar to the<br />

Issue pursuant to which certain arrangements are agreed to in relation to<br />

the Issue<br />

Retail Bidders Bidders (including HUFs and NRIs), other than Eligible Employees<br />

submitting Bids under the Employee Reservation Portion, who have Bid<br />

for the Equity Shares for an amount less than or equal to Rs. 200,000 in<br />

any of the bidding options in the Net Issue<br />

Retail Portion The portion of the Issue, being not less than 35% of the Net Issue, or<br />

19,425,000 Equity Shares at the Issue Price, available for allocation to<br />

Retail Bidders<br />

Revision Form The form used by the Bidders to modify the quantity of Equity Shares or<br />

the Bid Amount, as applicable, in any of their Bid cum Application<br />

Forms, ASBA Bid cum Application Forms or any previous Revision<br />

Form(s)<br />

SBI Caps SBI Capital Markets Limited<br />

Self Certified Syndicate Bank or SCSB Banks which are registered with SEBI under the SEBI (Bankers to an<br />

Issue) Regulations, 1994, as amended, and offer services of ASBA,<br />

including blocking of ASBA Accounts, a list of which is available on<br />

www.sebi.gov.in/pmd/scsb.pdf<br />

SCS Standard Chartered Securities (India) Limited<br />

Stock Exchanges The BSE and the NSE<br />

Syndicate Collectively, the BRLMs and the Syndicate Members<br />

v

Term Description<br />

Syndicate Agreement Agreement to be entered between the Syndicate and the Company in<br />

relation to the collection of Bids (excluding Bids from the ASBA<br />

Bidders) in this Issue<br />

Syndicate Members Kotak Securities Limited and SBICAP Securities Limited<br />

Transaction Registration Slip or TRS The slip or document issued by a member of the Syndicate to a Bidder as<br />

proof of registration of the Bid<br />

Underwriters Kotak, Citi, Deutsche Bank, HSBC, RBS, SCS, the Syndicate Members<br />

and State Bank of India<br />

Underwriting Agreement The Agreement between the Underwriters and the Company to<br />

underwrite and/or procure subscription for the Equity Shares to be issued<br />

and offered under this Issue<br />

U.S. person A U.S. person as defined in Regulation S under the U.S. Securities Act of<br />

1933<br />

U.S. QIB U.S. persons that are “qualified institutional buyers” as defined in Rule<br />

144A under the U.S. Securities Act of 1933<br />

Working Day All days other than a Sunday or a public holiday (except in reference to<br />

the Anchor Investor Bidding Period, announcement of Price Band and<br />

Bidding Period, where a working day means all days other than a<br />

Saturday, Sunday or a public holiday), on which <strong>com</strong>mercial banks in<br />

Mumbai are open for business<br />

Conventional and General Terms<br />

Term Description<br />

Act or Companies Act Companies Act, 1956, as amended<br />

BSE Bombay Stock Exchange Limited<br />

CAGR Compounded Annual Growth Rate<br />

CDSL Central Depository Services (India) Limited<br />

Crore 10 million<br />

Depositories NSDL and CDSL<br />

Depositories Act Depositories Act, 1996, as amended<br />

Depository Participant or DP A depository participant as defined under the Depositories Act<br />

ECS Electronic clearing service<br />

EGM Extraordinary general meeting of the shareholders of a <strong>com</strong>pany<br />

EPA Environment (Protection) Act, 1986, as amended<br />

EPF Act Employees (Provident Fund and Miscellaneous Provisions) Act, 1952, as<br />

amended<br />

EPS Earnings per share, i.e., profit after tax for a financial year divided by the<br />

weighted average number of equity shares during the financial year<br />

EURIBOR Euro Interbank Offered Rate<br />

FEMA Foreign Exchange Management Act, 1999, as amended, together with<br />

rules and regulations thereunder<br />

FIIs Foreign Institutional Investors (as defined under the Securities and<br />

Exchange Board of India (Foreign Institutional Investors) Regulations,<br />

1995) registered with SEBI<br />

Financial Year Period of 12 months ended March 31 of that particular year<br />

FIPB Foreign Investment Promotion Board<br />

FPO Further Public Offering<br />

FVCI Foreign Venture Capital Investors (as defined under the SEBI (Foreign<br />

GoI or Government or Central<br />

Government<br />

Venture Capital Investors) Regulations, 2000) registered with SEBI<br />

Government of India<br />

vi

Term Description<br />

Hazardous Wastes Rules The Hazardous Waste (Management and Handling) Rules, 1989 as<br />

amended, and as superceded by the Hazardous Wastes (Management,<br />

Handling and Transboundary Movement) Rules, 2008 and the<br />

Manufacture, Storage and Import of Hazardous Chemicals Rules, 1989<br />

HUF Hindu Undivided Family<br />

IFRS International Financial Reporting Standards<br />

ID Act Industrial Disputes Act, 1947, as amended<br />

I.T. Act In<strong>com</strong>e Tax Act, 1961, as amended<br />

Indian GAAP Generally Accepted Accounting Principles in India<br />

Industrial Policy The policy and guidelines relating to industrial activity in India, issued<br />

by the Government of India from time to time<br />

Km Kilometers<br />

LIBOR London Interbank Offered Rate<br />

Minimum Wages Act Minimum Wages Act, 1948, as amended<br />

MoEF Ministry of Environment and Forests, Government of India<br />

MoF Ministry of Finance, GoI<br />

MoU Memorandum of Understanding<br />

NEFT National Electronic Fund Transfer<br />

Non-Resident or NR A person resident outside India, as defined under the FEMA and includes<br />

a Non-Resident Indian<br />

NRE Account Non-Resident External Account established in accordance with the<br />

FEMA<br />

NRO Account Non-Resident Ordinary Account established in accordance with the<br />

FEMA<br />

NSDL National Securities Depository Limited<br />

NSE National Stock Exchange of India Limited<br />

OCB A <strong>com</strong>pany, partnership, society or other corporate body owned directly<br />

or indirectly to the extent of at least 60% by NRIs including overseas<br />

trusts in which not less than 60% of the beneficial interest is irrevocably<br />

held by NRIs directly or indirectly and which was in existence on<br />

October 3, 2003 and immediately before such date was eligible to<br />

undertake transactions pursuant to the general permission granted to<br />

OCBs under the FEMA. OCBs are not allowed to invest in this Issue<br />

PAN Permanent Account Number allotted under the I.T. Act<br />

RBI Reserve Bank of India<br />

Re. One Indian Rupee<br />

RoC Registrar of Companies, Maharashtra at Mumbai<br />

Rs. or Rupees or ` Indian Rupees<br />

RTGS Real Time Gross Settlement<br />

SCRA Securities Contract (Regulations) Act, 1956, as amended<br />

SCRR Securities Contracts (Regulation) Rules, 1957, as amended<br />

SEBI Securities and Exchange Board of India constituted under the SEBI Act<br />

SEBI Act Securities and Exchange Board of India Act, 1992, as amended<br />

SEBI Insider Trading Regulations SEBI (Prohibition of Insider Trading) Regulations, 1992, as amended<br />

SEBI Regulations SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009,<br />

as amended<br />

STT Securities Transaction Tax<br />

Supreme Court Supreme Court of India<br />

US GAAP Generally accepted accounting principles in the United States of America<br />

VCF(s) Venture Capital Funds as defined and registered with SEBI under the<br />

SEBI (Venture Capital Fund) Regulations, 1996, as amended<br />

Workmen’s Compensation Act Workmen’s Compensation Act, 1923, as amended<br />

vii

Industry Related Terms<br />

Term Description<br />

Brownfield Land occupied by defunct or under-utilised <strong>com</strong>mercial or industrial<br />

facilities.<br />

Crude steel Cast, solidified steel before further treatment.<br />

Downstream Further processing of crude steel to produce finished steel products.<br />

Finished product Steel ready for construction or manufacturing use.<br />

Greenfield Land that is currently undeveloped or in agricultural use.<br />

Mothballing A process (distinct from permanent closure) whereby a facility ceases<br />

production but is maintained in readiness, so that it can be restarted<br />

relatively quickly when the need arises.<br />

mt million tonnes<br />

mtpa million tonnes per annum<br />

tpa tonnes per annum<br />

Upstream Processing of raw materials and production of crude steel<br />

The words and expressions used but not defined in this Red Herring Prospectus will have the same meaning as<br />

assigned to such terms under the Companies Act, SEBI Act, SCRA, Depositories Act and the rules and regulations<br />

made thereunder.<br />

Notwithstanding the foregoing, terms in the sections “Main Provisions of the Articles of Association”, “Statement<br />

of Tax Benefits”, “Regulations and Policies in India”, “Financial Statements” and “Outstanding Litigation and<br />

Defaults” beginning on pages 278, 51, 91, 152 and 200 respectively of this Red Herring Prospectus, will have the<br />

same meaning given to such terms in these respective sections.<br />

viii

CERTAIN CONVENTIONS, USE OF FINANCIAL INFORMATION AND MARKET DATA AND<br />

CURRENCY OF PRESENTATION<br />

Financial Data<br />

Unless stated otherwise, the financial data in this Red Herring Prospectus is derived from the financial statements of<br />

the Company prepared in accordance with Indian GAAP and the Companies Act and in accordance with the SEBI<br />

Regulations for the six month period ended September 30, 2010 and Financial Years 2010, 2009, 2008, 2007 and<br />

2006.<br />

The Company’s financial year <strong>com</strong>mences on April 1 and ends on March 31, so all references to a particular<br />

financial year are to the twelve-month period ended March 31 of that year. In this Red Herring Prospectus, any<br />

discrepancies in any table between the total and the sums of the amounts listed are due to rounding off.<br />

There are significant differences between Indian GAAP, US GAAP and IFRS. The Company has not attempted to<br />

explain those differences or quantify their impact on the financial data included herein, and the Company urges you<br />

to consult your own advisors regarding such differences and their impact on the Company’s financial data.<br />

Accordingly, the degree to which the Indian GAAP financial statements included in this Red Herring Prospectus<br />

will provide meaningful information is entirely dependent on the reader’s level of familiarity with Indian GAAP.<br />

Any reliance by persons not familiar with Indian accounting practices on the financial disclosures presented in this<br />

Red Herring Prospectus should accordingly be limited. Please see “Risk Factors–Risks Related to Investing in an<br />

Indian Company–Significant differences exist between Indian GAAP and other accounting principles, such as<br />

US GAAP and IFRS, which may be material to investors’ assessments of the Company’s financial condition.<br />

Also, failure of the Company to successfully adopt IFRS which is effective from April 2011 could have a material<br />

adverse effect on the trading price of the Equity Shares.” on page xxxii of this Red Herring Prospectus.<br />

All financial information, description and other information in this Red Herring Prospectus regarding the<br />

Company’s activities, financial condition and results of operations are, unless otherwise indicated or required by<br />

context, presented on a consolidated basis.<br />

All references to “India” contained in this Red Herring Prospectus are to the Republic of India, all references to the<br />

“U.S.”, “USA”, or the “United States” are to the United States of America.<br />

Industry and Market Data<br />

Unless stated otherwise, the industry and market data used throughout this Red Herring Prospectus has been<br />

obtained from industry publications and government data. These publications generally state that the information<br />

contained therein has been obtained from sources believed to be reliable but that their accuracy and <strong>com</strong>pleteness<br />

are not guaranteed and their reliability cannot be assured. Accordingly, no investment decision should be made on<br />

the basis of such information. Although we believe industry data used in this Red Herring Prospectus is reliable, it<br />

has not been independently verified. Data from these sources may also not be <strong>com</strong>parable. The extent to which<br />

industry and market data used in this Red Herring Prospectus is meaningful depends on the readers’ familiarity with<br />

and understanding of the methodologies used in <strong>com</strong>piling such data.<br />

Information regarding market position, growth rates and other industry data pertaining to the businesses of the<br />

Company contained in this Red Herring Prospectus consists of estimates based on data reports <strong>com</strong>piled by<br />

government bodies, professional organisations and analysts, data from other external sources and knowledge of the<br />

markets in which the Company <strong>com</strong>petes. Unless stated otherwise, the statistical information included in this Red<br />

Herring Prospectus relating to the industry in which the Company operates has been reproduced from various trade,<br />

industry and government publications and websites. Unless otherwise stated, <strong>com</strong>parative and empirical industry<br />

data in this Red Herring Prospectus have been derived from the publicly available information and industry<br />

publications published by the World Steel Association, the Indian Ministry of Steel, the Ministry of Heavy<br />

Industries and Public Enterprises of India, the Society of Indian Automobile Manufacturers, the Automotive<br />

Component Manufacturers Association of India and the Investment Committee of India.<br />

This data has not been prepared or independently verified by the Company or the BRLMs or any of their respective<br />

ix

affiliates or advisors. Such data involves risks, uncertainties and numerous assumptions and is subject to change<br />

based on various factors, including those discussed in the section “Risk Factors” beginning on page XIV of this Red<br />

Herring Prospectus. Accordingly, investment decisions should not be based on such information.<br />

In accordance with the SEBI Regulations, the Company has included in the section “Basis for the Issue Price”<br />

beginning on page 48 of this Red Herring Prospectus, information relating to the Company’s peer group <strong>com</strong>panies.<br />

Such information has been derived from publicly available sources and the Company has not independently verified<br />

such information.<br />

Currency and Units of Presentation<br />

All references to “Rupees” or “Rs.” or “`” are to Indian Rupees, the official currency of the Republic of India. All<br />

references to “U.S. Dollar” or “USD” or “US$” are to United States Dollar, the official currency of the United<br />

States of America. All references to “Euro” or “EUR” or “€” are to the single currency of the member states of the<br />

European Community that adopt or have adopted the Euro as their lawful currency under the legislation of the<br />

European Union or European Treaty Union. All references to “GBP” or “£” are to the Pound Sterling, the official<br />

currency of the United Kingdom of Great Britain and Northern Ireland. All references to “JPY” are to Japanese<br />

Yen, the official currency of Japan.<br />

Exchange Rates<br />

This Red Herring Prospectus contains translations of certain U.S. Dollar and other currency amounts into Indian<br />

Rupees that have been presented solely to <strong>com</strong>ply with the requirements of item (VIII) sub-item (G) of Part A of<br />

Schedule VIII of the SEBI Regulations. These convenience translations should not be construed as a representation<br />

that those U.S. Dollar or other currency amounts could have been, or can be converted into Indian Rupees, at any<br />

particular rate or at all.<br />

The exchange rates for conversion of US$ to Rs. as on March 31, 2010, March 31, 2009, September 30, 2010 and<br />

September 30, 2009 are provided below:<br />

Currency Exchange Rate as<br />

on March 31, 2010<br />

Exchange Rate as<br />

on March 31, 2009<br />

x<br />

Exchange Rate as<br />

on September 30,<br />

2010<br />

(Rs.)<br />

Exchange Rate as<br />

on September 30,<br />

2009<br />

1 US$ 45.14 50.95 44.92 48.04<br />

Source: RBI Reference Rate

United States<br />

NOTICE TO INVESTORS<br />

The Equity Shares have not been re<strong>com</strong>mended by any U.S. federal or state securities <strong>com</strong>mission or regulatory<br />

authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of<br />

this Red Herring Prospectus. Any representation to the contrary is a criminal offence in the United States and may<br />

be a criminal offence in other jurisdictions.<br />

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the<br />

“U.S. Securities Act”) and may not be offered or sold within the United States except pursuant to an exemption<br />

from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable state<br />

securities laws.<br />

Accordingly, the Equity Shares are being offered and sold (i) in the United States only to “qualified institutional<br />

buyers” (as defined in Rule 144A under the U.S. Securities Act (“Rule 144A”) and referred to in this Red Herring<br />

Prospectus as “U.S. QIBs”; which, for the avoidance of doubt, does not refer to a category of institutional investors<br />

defined under applicable Indian regulations and referred to in the Red Herring Prospectus as “QIBs”) acting for its<br />

own account or for the account of another U.S. QIB (and meets the other requirements set forth herein), in reliance<br />

on the exemption from registration under the U.S. Securities Act provided by Rule 144A or other available<br />

exemption and (ii) outside the United States in reliance on Regulation S under the U.S. Securities Act.<br />

Each purchaser of Equity Shares within the United States will be required to represent and agree, among other<br />

things, that such purchaser is purchasing the Equity Shares for its own account or an account with respect to which it<br />

exercises sole investment discretion and that it and any such account (i) is a U.S. QIB and is aware that the sale to it<br />

is being made in reliance on Rule 144A under the U.S. Securities Act; and (ii) will only reoffer, resell, pledge or<br />

otherwise transfer the Equity Shares within the United States in reliance on the exemption from registration under<br />

the U.S. Securities Act provided by Rule 144A or other available exemption or outside the United States in an<br />

“offshore transaction” in accordance with Rule 903 or Rule 904 of Regulation S under the U.S. Securities Act.<br />

Each purchaser of Equity Shares outside the United States will be required to represent and agree, among other<br />

things, that such purchaser is acquiring the Equity Shares in an “offshore transaction” in accordance with Regulation<br />

S under the U.S. Securities Act.<br />

European Economic Area<br />

This Red Herring Prospectus has been prepared on the basis that any offer of Equity Shares in any Member State of<br />

the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”)<br />

will be made pursuant to an exemption under the Prospectus Directive from the requirement to publish a prospectus<br />

for offers of Equity Shares. Accordingly any person making or intending to make an offer in that Relevant Member<br />

State of Equity Shares which are the subject of the offering contemplated in this Red Herring Prospectus may only<br />

do so in circumstances in which no obligation arises for the Company or any of the Underwriters to publish a<br />

prospectus pursuant to Article 3 of the Prospectus Directive, in each case, in relation to such offer. Neither the<br />

Company nor the Underwriters have authorised, nor do they authorise, the making of any offer of Equity Shares in<br />

circumstances in which an obligation arises for the Company or the Underwriters to publish a prospectus for such<br />

offer. The expression Prospectus Directive means Directive 2003/71/EC (and amendments thereto, including the<br />

2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant<br />

implementing measure in the Relevant Member State and the expression 2010 PD Amending Directive means<br />

Directive 2010/73/EU.<br />

xi

FORWARD LOOKING STATEMENTS<br />

This Red Herring Prospectus contains certain “forward looking statements”. These forward looking statements<br />

generally can be identified by words or phrases such as “aim”, “anticipate”, “believe”, “can”, “could”, “expect”,<br />

“estimate”, “intend”, “objective”, “plan”, “project”, “shall”, “will”, “will continue”, “will pursue” or other words or<br />

phrases of similar import. Similarly, statements that describe the Company’s objectives, strategies, plans or goals are<br />

also forward looking statements. All forward looking statements are subject to risks, uncertainties and assumptions<br />

about the Company that could cause actual results to differ materially from those contemplated by the relevant<br />

forward looking statement. These forward looking statements include statements as to the Company’s business<br />

strategy, its revenue and profitability (including, without limitation, any financial or operating projections or<br />

forecasts), planned projects and other matters discussed in this Red Herring Prospectus regarding matters that are not<br />

historical fact. These forward looking statements and any other projections contained in this Red Herring Prospectus<br />

involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual financial<br />

results, performance or achievements to be materially different from any future financial results, performance or<br />

achievements expressed or implied by such forward looking statements or other projections.<br />

Important factors that could cause actual results to differ materially from the Company’s expectations include, but<br />

are not limited to, the following:<br />

• the downturn in the global economy and the risk of a protracted recession;<br />

• the risk of a potential fall in steel prices or of price volatility;<br />

• the integration of <strong>com</strong>panies or business acquired by the Company;<br />

• the implementation of new projects, including future acquisitions and financings;<br />

• the Company’s ability to recover the mineral reserves to which it has access or develop new mineral<br />

reserves;<br />

• changes in expenses, including the cost of transporting the Company’s products and the cost of energy,<br />

such as coal and electricity;<br />

• the Company’s substantial indebtedness and ability to meet its debt service obligations;<br />

• changes in government regulation;<br />

• terrorist attacks, civil disturbances, regional conflicts, accidents and natural disasters;<br />

• general economic and business conditions in the markets in which the Company operates and in the local,<br />

regional and national economies;<br />

• increasing <strong>com</strong>petition in or other factors affecting the industry segments in which the Company operates;<br />

• changes in laws and regulations relating to the industries in which the Company operates;<br />

• the Company’s ability to meet its capital expenditure requirements or increases in capital expenditure<br />

requirements;<br />

• fluctuations in operating costs and related impact on the financial results of the Company;<br />

• the Company’s ability to attract and retain qualified personnel;<br />

• changes in technology in the future;<br />

xii

• changes in political and social conditions in India or in other countries in which the Company has<br />

operations, the monetary policies of India or of such other countries, inflation, deflation, unanticipated<br />

turbulence in interest rates, equity prices, exchange rates or other rates or prices;<br />

• the performance of the financial markets in India and other countries where the Company has operations, as<br />

well as the performance of financial markets globally; and<br />

• any adverse out<strong>com</strong>e in legal proceedings in which the Company is or may be<strong>com</strong>e involved including,<br />

with respect to product liability claims.<br />

For further discussion of factors that could cause the actual results of the Company to differ, see the sections “Risk<br />

Factors”, “Business” and “Management Discussion and Analysis of Financial Condition and Results of<br />

Operations” beginning on pages XIV, 65 and 157 of this Red Herring Prospectus, respectively. By their nature,<br />

certain market risk disclosures are only estimates and could be materially different from what actually occurs in the<br />

future. As a result, actual future gains or losses could materially differ from those that have been estimated. Neither<br />

the Company nor the BRLMs nor the Syndicate Members nor any of their respective affiliates have any obligation<br />

to update or otherwise revise any statements reflecting circumstances arising after the date hereof or to reflect the<br />

occurrence of underlying events, even if the underlying assumptions do not <strong>com</strong>e to fruition. In accordance with<br />

SEBI requirements, the Company and the BRLMs will ensure that investors in India are informed of material<br />

developments until such time as the grant of listing and trading permission by the Stock Exchanges for the Equity<br />

Shares.<br />

xiii

SECTION II - RISK FACTORS<br />

An investment in the Equity Shares involves a high degree of risk. You should carefully consider all information in<br />

this Red Herring Prospectus, including the risks and uncertainties described below, before making an investment in<br />

the Equity Shares. The risks described below are not the only ones relevant to the countries and the industries in<br />

which the Company operates, the Company or the Equity Shares. Additional risks not presently known to the<br />

Company or that the Company currently deems immaterial may also impair the Company’s business operations. To<br />

obtain a <strong>com</strong>plete understanding of the Company’s business, you should read this section in conjunction with the<br />

sections “Business” and “Management’s Discussion and Analysis of Financial Conditions and Results of<br />

Operations” beginning on pages 65 and 157 of this Red Herring Prospectus, respectively, as well as other financial<br />

information contained in this Red Herring Prospectus. If any or some <strong>com</strong>bination of the following risks, any of the<br />

other risks and uncertainties discussed in this Red Herring Prospectus or other risks that are not currently known or<br />

are now deemed immaterial actually occur, the Company’s business, financial condition and results of operations<br />

could be materially effected, the trading price of the Equity Shares and the value of your investment in the Equity<br />

Shares could decline, and you may lose all or part of your investment.<br />

Unless specified or quantified in the relevant risk factors below, the Company is not in a position to quantify the<br />

financial or other implication of any of the risks described in this section.<br />

Unless otherwise stated, the financial information of the Company used in this section is derived from the<br />

Company’s restated consolidated financial statements.<br />

Risks Related to the Company<br />

1. The steel industry is affected by global economic conditions. A slower than expected recovery of the<br />

global economy or a renewed global recession could have a material adverse effect on the steel industry<br />

and the Company.<br />

The Company’s business and results of operations are affected by international, national and regional economic<br />

conditions. Starting in September 2008, a steep downturn in the global economy, sparked by uncertainty in credit<br />

markets and deteriorating consumer confidence, sharply reduced global demand for steel products. This has had a<br />

pronounced negative effect on, and to some extent continues to negatively affect, the Company’s business and<br />

results of operations. Although the global economy has shown signs of recovery since the end of 2009 and in 2010,<br />

with a certain degree of recovery and stabilisation of steel prices, should the recovery falter, the outlook of steel<br />

producers could again worsen. In particular, a renewed recession or period of lower growth or lower public spending<br />

on infrastructure in Europe or in the United States, or significantly slower growth or the spread of recessionary<br />

conditions to emerging economies that are substantial consumers of steel (such as China, Brazil, Russia and India, as<br />

well as emerging Asian markets, the Middle East and the Commonwealth of Independent States (“CIS”) regions)<br />

would have a material adverse effect on the steel industry. The European economy and, as a result, the European<br />

steel market, have been slower in their recovery from the global economic downturn than the economies and steel<br />

markets of other regions. The European construction industry, a key consumer of steel products, including the<br />

Company’s, has been particularly severely affected and has not fully <strong>com</strong>e out of the recession, which has adversely<br />

impacted, and continues to negatively affect, the Company’s business and results of operations in Europe.<br />

An uneven recovery, with positive growth limited to certain regions, or excluding key markets such as Europe,<br />

which accounted for 46.4% of the Company’s net sales in Financial Year 2010, would also have an adverse effect on<br />

the Company’s business, results of operations, financial conditions and prospects. Continued financial weakness<br />

among substantial consumers of steel products, such as the automotive industry and the construction industry, or the<br />

bankruptcy of any large <strong>com</strong>panies in such industries, would exacerbate the negative trend in market conditions.<br />

Protracted declines in steel consumption caused by poor economic conditions in one or more of the Company’s<br />

major markets or by the deterioration of the financial condition of its key customers would have a material adverse<br />

effect on demand for its products and hence on its business and results of operations. An unsustainable recovery and<br />

persistent weak economic conditions in any of the Company’s key markets could have a material adverse effect on<br />

the Company’s business, results of operations, financial condition and prospects.<br />

xiv

2. The steel industry is highly cyclical and a decrease in steel prices may have an adverse effect on the<br />

Company’s results of operations and financial condition.<br />

Steel prices are volatile, reflecting the highly cyclical nature of the global steel industry. Steel prices fluctuate based<br />

on macroeconomic factors, including, amongst others, consumer confidence, employment rates, interest rates and<br />

inflation rates, in the economies in which the steel producers sell their products and are sensitive to the trends of<br />

particular industries, such as the automotive, construction, packaging, appliance, machinery, equipment and<br />

transportation industries, which are among the biggest consumers of steel products. When downturns occur in these<br />

economies or sectors, the Company may experience decreased demand for its products, which may lead to a<br />

decrease in steel prices.<br />

After rising steadily during 2007 and into the third quarter of 2008, global steel prices fell sharply as the global<br />

credit crisis led to a collapse in global demand. Prices remained depressed, despite widespread production cuts, until<br />

the second half of 2009. The depressed state of steel prices during this period adversely affected the businesses and<br />

results of operations of steel producers generally, including the Company, resulting in lower revenues and margins<br />

and write downs of finished steel products and raw material inventories. In addition, the volatility, length and nature<br />

of business cycles affecting the steel industry have be<strong>com</strong>e increasingly unpredictable, and the recurrence of another<br />

major downturn in the industry may have a material adverse impact on the Company’s business, results of<br />

operations, financial condition and prospects.<br />

In addition, substantial decreases in steel prices during periods of economic weakness have not always been<br />

balanced by <strong>com</strong>mensurate price increases during periods of economic strength. Although steel prices have, to a<br />

certain degree, recovered and stabilised since their sharp fall in 2008, the timing and extent of price recovery or<br />

return to prior levels remains uncertain. A sustained price recovery will most likely require a broad economic<br />

recovery, in order to underpin an increase in real demand for steel products by end users.<br />

3. Europe is the Company’s largest market, and its current business and future growth could be materially<br />

and adversely affected if economic conditions in Europe deteriorate.<br />

Europe is the Company’s largest market, accounting for 62.7%, 55.0% and 46.4% of the Company’s net sales in<br />

Financial Years 2008, 2009 and 2010, respectively. Sales of the Company's products in Europe are affected by the<br />

condition of major steel consuming industries, such as automobile, infrastructure and construction, and the European<br />

economy in general. In addition, a significant majority of the Company’s operations and assets are located in<br />

Europe. As a result, the Company is subject to economic, political, legal and regulatory risks that are related to<br />

Europe.<br />

Economic indicators in Europe in recent years have shown mixed signs. The European economy remained weak in<br />

the third quarter of 2010, which is expected to affect the Company’s business, financial condition and results of<br />

operations. In particular, several economies within Europe are showing significant signs of weakness, and further<br />

bailouts of European governments may occur. Due in large part to the economic conditions in Europe, the<br />

Company’s sales in Europe decreased from Rs. 809,967 million in Financial Year 2009 to Rs. 474,756 million in<br />

Financial Year 2010. Any future deterioration of the European and global economy, or a prolonged period of limited<br />

growth, could adversely affect the Company’s business, financial condition, results of operations and prospects.<br />

Developments that could have an adverse impact on Europe’s economy include:<br />

• continuing difficulties in the global financial markets;<br />

• sovereign defaults of certain European countries;<br />

• a slowdown in consumer spending;<br />

• adverse changes or volatility in foreign currency reserve levels, <strong>com</strong>modity prices (including iron ore,<br />

coal and oil prices), exchange rates (including fluctuation of the U.S. dollar, GBP or Euro exchange<br />

rates), interest rates or stock markets;<br />

xv

• social and labour unrest;<br />

• a decrease in tax revenues and a substantial increase in the expenditures by European governments for<br />

unemployment <strong>com</strong>pensation and other social programs that, together, would lead to an increased<br />

government budget deficit;<br />

• financial problems or lack of progress in restructuring large troubled European <strong>com</strong>panies, their<br />

suppliers or the financial sector; and<br />

• geo-political uncertainty and risk of further attacks by terrorist groups around the world.<br />

4. Developments in the <strong>com</strong>petitive environment in the steel industry could have an adverse effect on the<br />

Company’s <strong>com</strong>petitive position and hence its business, financial condition, results of operations or<br />

prospects.<br />

The Company believes that the key <strong>com</strong>petitive factors affecting its business include product quality, changes in<br />

manufacturing technology, workforce skill and productivity, cash operating costs, pricing power with large buyers,<br />

access to outside funds, the degree of regulation and access to low-cost raw materials. Although the Company<br />

believes that it is a <strong>com</strong>petitive steel producer, it cannot assure prospective investors that it will be able to <strong>com</strong>pete<br />

effectively against its current or emerging <strong>com</strong>petitors with respect to each of these key <strong>com</strong>petitive factors.<br />

In recent years, there has been a trend toward industry consolidation among the Company’s <strong>com</strong>petitors. For<br />

example, the merger of Mittal and Arcelor in 2006 created a <strong>com</strong>pany that continues to be the largest steel producer<br />

in the world, representing approximately 6.3% of total global steel production in 2009, according to WSA.<br />

Competition from global steel producers with expanded production capacities such as ArcelorMittal and new market<br />

entrants, especially from China and India, could result in significant price <strong>com</strong>petition, declining margins and<br />

reductions in revenue. For example, these <strong>com</strong>panies may be able to negotiate preferential prices for certain<br />

products or receive discounted prices for bulk purchases of certain raw materials that may not be available to the<br />

Company. Larger <strong>com</strong>petitors may also use their resources, which may be greater than the Company’s, against the<br />

Company in a variety of ways, including by making additional acquisitions, investing more aggressively in product<br />

development and capacity and displacing demand for the Company’s export products. If the trend towards<br />

consolidation continues, the Company could be placed in a disadvantageous <strong>com</strong>petitive position relative to other<br />

steel producers and its business, results of operations, financial condition and prospects could be materially and<br />

adversely affected. In addition, a variety of known and unknown events could have a material adverse impact on the<br />

Company’s ability to <strong>com</strong>pete. For example, changes in the level of marketing undertaken by <strong>com</strong>petitors,<br />

governmental subsidies provided to foreign <strong>com</strong>petitors, dramatic reductions in pricing policies, exporters selling<br />