ANNUAL REPORT 2011/12 - IC Companys A/S

ANNUAL REPORT 2011/12 - IC Companys A/S

ANNUAL REPORT 2011/12 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report<br />

PAGE 28<br />

MANAGEMENT<br />

COMMENTARY; SOLID<br />

CASH FLOW IN SPITE<br />

OF CHALLENGING<br />

MARKET CONDITIONS<br />

Consolidated revenue for <strong>2011</strong>/<strong>12</strong> amounted to DKK 3,819 million<br />

corresponding to a reduction of 3% compared to 2010/11. Efficient price<br />

campaigns and sales promoting activities resulted in the Group being able<br />

to retain its market position, but did at the same time, however, increase<br />

the pressure on the Group’s gross margin which suffered a substantial<br />

decline. The Group has embarked on a number of structural changes to<br />

reduce the cost base which started to have an impact in H2 <strong>2011</strong>/<strong>12</strong>.<br />

Consolidated operating profit for <strong>2011</strong>/<strong>12</strong> amounted to DKK 130<br />

million corresponding to a setback of 60%. However, the sales promoting<br />

efforts ensured a solid cash flow and a positive inventory development.<br />

Revenue development<br />

Consolidated revenue for <strong>2011</strong>/<strong>12</strong> amounted to DKK 3,819<br />

million (DKK 3,925 million) corresponding to a setback of<br />

3%. Revenue for H1 <strong>2011</strong>/<strong>12</strong> was at the same level as<br />

H1 2010/11 whereas revenue for H2 <strong>2011</strong>/<strong>12</strong> suffered a<br />

setback of 6% compared to H2 2010/11. This fi nancial year<br />

has been challenging and both of the Group’s segments<br />

reported lower revenues than expected at the beginning of<br />

the fi nancial year under review. The retail segment declined<br />

and the wholesale segment reported growth for H1 <strong>2011</strong>/<strong>12</strong><br />

whereas both segments suffered setbacks for H2 <strong>2011</strong>/<strong>12</strong>.<br />

Both segments also declined during Q4 <strong>2011</strong>/<strong>12</strong> where a<br />

revenue setback of 5% was reported.<br />

Revenue for <strong>2011</strong>/<strong>12</strong> has been affected negatively by net<br />

store openings and store closures amounting to DKK 5<br />

million and positively by foreign currency translations of DKK<br />

24 million. Since foreign currency exposure risks generally<br />

are hedged, the total earnings, as a consequence of foreign<br />

currency fl uctuations, are considerably lower.<br />

<strong>IC</strong> COMPANYS <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong>/<strong>12</strong><br />

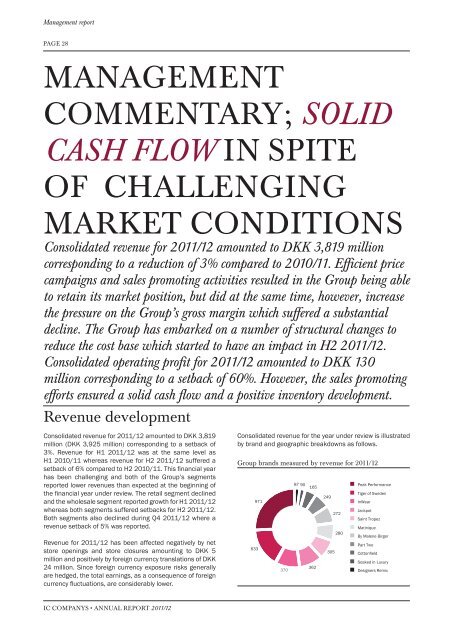

Consolidated revenue for the year under review is illustrated<br />

by brand and geographic breakdowns as follows.<br />

Group brands measured by revenue for <strong>2011</strong>/<strong>12</strong><br />

633<br />

971<br />

370<br />

87 90 165<br />

362<br />

249<br />

305<br />

272<br />

280<br />

Peak Performance<br />

Tiger of Sweden<br />

InWear<br />

Jackpot<br />

Saint Tropez<br />

Matinique<br />

By Malene Birger<br />

Part Two<br />

Cottonfield<br />

Soaked in Luxury<br />

Designers Remix