ANNUAL REPORT 2011/12 - IC Companys A/S

ANNUAL REPORT 2011/12 - IC Companys A/S

ANNUAL REPORT 2011/12 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

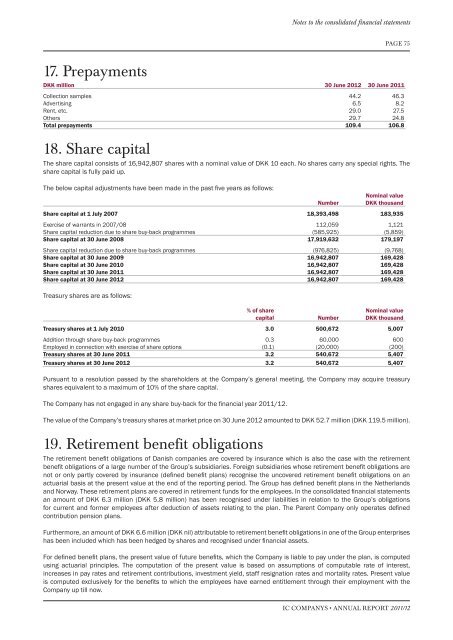

17. Prepayments<br />

Notes to the consolidated financial statements<br />

PAGE 75<br />

DKK million 30 June 20<strong>12</strong> 30 June <strong>2011</strong><br />

Collection samples 44.2 46.3<br />

Advertising 6.5 8.2<br />

Rent, etc. 29.0 27.5<br />

Others 29.7 24.8<br />

Total prepayments 109.4 106.8<br />

18. Share capital<br />

The share capital consists of 16,942,807 shares with a nominal value of DKK 10 each. No shares carry any special rights. The<br />

share capital is fully paid up.<br />

The below capital adjustments have been made in the past fi ve years as follows:<br />

Nominal value<br />

Number DKK thousand<br />

Share capital at 1 July 2007 18,393,498 183,935<br />

Exercise of warrants in 2007/08 1<strong>12</strong>,059 1,<strong>12</strong>1<br />

Share capital reduction due to share buy-back programmes (585,925) (5,859)<br />

Share capital at 30 June 2008 17,919,632 179,197<br />

Share capital reduction due to share buy-back programmes (976,825) (9,768)<br />

Share capital at 30 June 2009 16,942,807 169,428<br />

Share capital at 30 June 2010 16,942,807 169,428<br />

Share capital at 30 June <strong>2011</strong> 16,942,807 169,428<br />

Share capital at 30 June 20<strong>12</strong> 16,942,807 169,428<br />

Treasury shares are as follows:<br />

% of share Nominal value<br />

capital Number DKK thousand<br />

Treasury shares at 1 July 2010 3.0 500,672 5,007<br />

Addition through share buy-back programmes 0.3 60,000 600<br />

Employed in connection with exercise of share options (0.1) (20,000) (200)<br />

Treasury shares at 30 June <strong>2011</strong> 3.2 540,672 5,407<br />

Treasury shares at 30 June 20<strong>12</strong> 3.2 540,672 5,407<br />

Pursuant to a resolution passed by the shareholders at the Company’s general meeting, the Company may acquire treasury<br />

shares equivalent to a maximum of 10% of the share capital.<br />

The Company has not engaged in any share buy-back for the fi nancial year <strong>2011</strong>/<strong>12</strong>.<br />

The value of the Company’s treasury shares at market price on 30 June 20<strong>12</strong> amounted to DKK 52.7 million (DKK 119.5 million).<br />

19. Retirement benefit obligations<br />

The retirement benefi t obligations of Danish companies are covered by insurance which is also the case with the retirement<br />

benefi t obligations of a large number of the Group’s subsidiaries. Foreign subsidiaries whose retirement benefi t obligations are<br />

not or only partly covered by insurance (defi ned benefi t plans) recognise the uncovered retirement benefi t obligations on an<br />

actuarial basis at the present value at the end of the reporting period. The Group has defi ned benefi t plans in the Netherlands<br />

and Norway. These retirement plans are covered in retirement funds for the employees. In the consolidated fi nancial statements<br />

an amount of DKK 6.3 million (DKK 5.8 million) has been recognised under liabilities in relation to the Group’s obligations<br />

for current and former employees after deduction of assets relating to the plan. The Parent Company only operates defi ned<br />

contribution pension plans.<br />

Furthermore, an amount of DKK 6.6 million (DKK nil) attributable to retirement benefi t obligations in one of the Group enterprises<br />

has been included which has been hedged by shares and recognised under fi nancial assets.<br />

For defi ned benefi t plans, the present value of future benefi ts, which the Company is liable to pay under the plan, is computed<br />

using actuarial principles. The computation of the present value is based on assumptions of computable rate of interest,<br />

increases in pay rates and retirement contributions, investment yield, staff resignation rates and mortality rates. Present value<br />

is computed exclusively for the benefi ts to which the employees have earned entitlement through their employment with the<br />

Company up till now.<br />

<strong>IC</strong> COMPANYS <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2011</strong>/<strong>12</strong>