PRESENTED BY - InfoVista

PRESENTED BY - InfoVista

PRESENTED BY - InfoVista

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DRAFT REPLY DOCUMENT<br />

<strong>PRESENTED</strong> <strong>BY</strong><br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 1 –<br />

NON BINDING TRANSALTION<br />

BASED ON FRENCH VERSION DATED<br />

FEBRUARY 1 ST , 2012<br />

IN REPLY TO THE SIMPLIFIED TENDER OFFER MADE <strong>BY</strong> PROJECT METRO ACQUCO<br />

TO ACQUIRE THE SHARES OF INFOVISTA<br />

This draft reply document was filed with the Autorité des Marchés Financiers (hereinafter "AMF") on<br />

February 1 st , 2012, in accordance with Articles 231-19 and 231-26 of the AMF General Regulations.<br />

The proposed tender offer, the draft offer document prepared by Project Metro Acquco and this draft<br />

reply document prepared by <strong>InfoVista</strong> are subject to review by the AMF.<br />

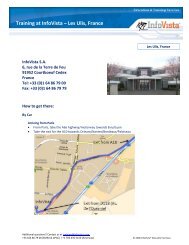

This draft reply document is available on the AMF website (www.amf-france.org) and the <strong>InfoVista</strong> website<br />

(www.infovista.com) and is available to the public free of charge at the headquarters of <strong>InfoVista</strong> (6, rue de la<br />

Terre de Feu, 91940 Les Ulis).<br />

In accordance with Article 231-28 of the AMF General Regulations, legal, financial, accounting and other<br />

information on Project Metro Acquco SAS will be made available to the public in the same manner no later<br />

than the day before the commencement date of the Offer.<br />

A notice will be published in a national daily financial newspaper no later than the day before the<br />

commencement date of the Offer, in order to inform the public of the terms on which these documents are<br />

made available.

TABLE OF CONTENTS<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 2 -<br />

Pages<br />

1 OVERVIEW OF THE SIMPLIFIED TENDER OFFER <strong>PRESENTED</strong> <strong>BY</strong> PROJECT METRO ACQUCO 3<br />

1.1 REMINDER OF THE TERMS OF THE OFFER ............................................................................................................. 3<br />

1.2 BACKGROUND TO THE OFFER .............................................................................................................................. 4<br />

1.3 TERMS OF ACQUISITION OF THE BLOCK OF SHARES .............................................................................................. 5<br />

1.3.1 Share Purchase Agreements ....................................................................................................................... 5<br />

1.3.2 Investment Agreement ................................................................................................................................. 5<br />

2 TIES BETWEEN THE COMPANY AND THE OFFEROR.............................................................................. 12<br />

3 AGREEMENTS THAT MAY AFFECT THE ASSESSMENT OR OUTCOME OF THE OFFER .............. 12<br />

4 INFORMATION ON THE COMPANY............................................................................................................... 13<br />

4.1 SHARE OWNERSHIP OF THE COMPANY ............................................................................................................... 13<br />

4.2 RESTRICTION ON THE EXERCISE OF VOTING RIGHTS AND ON THE TRANSFER OF SHARES OF THE COMPANY,<br />

PROVISIONS BROUGHT TO THE KNOWLEDGE OF THE COMPANY ..................................................................................... 15<br />

4.3 DIRECT OR INDIRECT HOLDINGS IN THE CAPITAL OF THE COMPANY, AS FAR AS IT IS AWARE............................. 15<br />

4.4 LIST OF HOLDERS OF SECURITIES CARRYING SPECIAL CONTROL RIGHTS ............................................................ 15<br />

4.5 CONTROL MECHANISMS PROVIDED FOR IN ANY EMPLOYEE SHAREHOLDING SYSTEM, WHERE CONTROL RIGHTS<br />

ARE NOT EXERCISED <strong>BY</strong> EMPLOYEES ............................................................................................................................. 16<br />

4.6 SHAREHOLDERS’ AGREEMENTS OF WHICH THE COMPANY IS AWARE THAT MAY LEAD TO RESTRICTIONS ON THE<br />

SHARE TRANSFERS AND ON THE EXERCISE OF VOTING RIGHTS ....................................................................................... 16<br />

4.7 COMPOSITION OF THE GOVERNING BODIES OF INFOVISTA ................................................................................. 16<br />

4.8 RULES FOR APPOINTING AND REPLACING THE MEMBERS OF THE BOARD OF DIRECTORS .................................... 16<br />

4.9 RULES FOR AMENDING THE <strong>BY</strong>LAWS OF THE COMPANY .................................................................................... 16<br />

4.10 POWERS OF THE BOARD OF DIRECTORS, IN PARTICULAR AS TO THE ISSUANCE OR BUYBACK OF SHARES............ 16<br />

4.11 AGREEMENTS ENTERED INTO <strong>BY</strong> THE COMPANY THAT ARE AMENDED OR TERMINATED IN THE EVENT OF A<br />

CHANGE IN CONTROL OF THE COMPANY ........................................................................................................................ 18<br />

4.12 AGREEMENTS PROVIDING FOR COMPENSATION TO BE PAID TO THE MEMBERS OF THE BOARD OF DIRECTORS OR<br />

THE EMPLOYEES IF THEY RESIGN OR ARE TERMINATED WITHOUT CAUSE OR IF THEIR EMPLOYMENT IS TERMINATED<br />

BECAUSE OF A TENDER OFFER ........................................................................................................................................ 18<br />

5 INDEPENDENT EXPERT REPORT ................................................................................................................... 20<br />

6 REASONED OPINION OF THE BOARD OF DIRECTORS OF INFOVISTA .............................................. 46<br />

7 INTENTION OF THE MEMBERS OF THE BOARD OF DIRECTORS OF INFOVISTA .......................... 49<br />

8 ADDITIONAL INFORMATION ON INFOVISTA ............................................................................................ 50<br />

9 PERSONS TAKING RESPONSIBILITY FOR THE REPLY DOCUMENT .................................................. 51

1 OVERVIEW OF THE SIMPLIFIED TENDER OFFER <strong>PRESENTED</strong> <strong>BY</strong> PROJECT<br />

METRO ACQUCO<br />

1.1 Reminder of the terms of the Offer<br />

Project Metro Acquco is a French société par actions simplifiée with a share capital of 1,000 euros, whose<br />

registered office is located at 102, avenue des Champs Elysées, 75008 Paris, registered with the Paris Trade<br />

and Companies Registry under number 538 584 178 (the “Offeror” or “Acquco”).<br />

<strong>InfoVista</strong> is a French société anonyme with a share capital of 8,899,219.98 euros, whose registered office is<br />

located at 6, rue de la Terre de Feu, 91940 Les Ulis, and registered with the Trade and Companies Registry<br />

in Evry under number 334 088 275 (“<strong>InfoVista</strong>” or the “Company”). <strong>InfoVista</strong>’s shares are admitted to trading<br />

in compartment C of the regulated market of NYSE Euronext Paris under ISIN FR0004031649.<br />

Pursuant to Title III of Book II and more specifically Articles 233-1 2°), 234-2 and following of the AMF<br />

General Regulations, the Offeror filed, on January 30, 2012, a draft simplified tender offer to acquire<br />

<strong>InfoVista</strong>’s shares (the “Offer”).<br />

In accordance with Article 231-6 of the AMF General Regulations, the Offer is for all outstanding <strong>InfoVista</strong><br />

shares not directly or indirectly held by the Offeror, except for the 344,746 treasury shares held by <strong>InfoVista</strong>.<br />

Therefore, the Offer is for 5,307,599 shares, representing 32.21 % of the capital of the Company.<br />

The Offer is also for all tenderable shares issuable upon exercise of the 227,725 options to subscribe new<br />

shares and 156,050 options to acquire existing shares (the “Options”) that have been awarded and are<br />

currently exercisable. Each Option entitles its holder to acquire one <strong>InfoVista</strong> share.<br />

However, the Offer does not extend to shares issued upon exercise of the 205,250 Options awarded to the<br />

managers of the Company (the “Managers’ Options”), whose transfer is governed by the investment<br />

agreement entered into between the Offeror and the Managers on December 20, 2011, the main provisions<br />

of which are described in Section 1.3.2 below (the “Investment Agreement”). Nor does the Offer extend to<br />

shares resulting from the exercise of the Options (other than the Managers’ Options) covered by the Options<br />

Liquidity Agreements (as defined below) referred to in the Investment Agreement, the main terms of which<br />

are described in Section 1.3.2 below.<br />

For the avoidance of doubt, the Offeror specifies that the Offer does not extend to any <strong>InfoVista</strong> shares<br />

resulting from the exercise of the 1,178,060 bons de souscription et/ou d’acquisition d’actions remboursables<br />

(warrants to acquire new or existing redeemable shares - the “BSAAR”) issued by <strong>InfoVista</strong>.<br />

In compliance with Article 231-13 of the AMF General Regulations, Bryan, Garnier & Co., as the bank<br />

presenting the Offer, filed the draft Offer with the AMF on January 30, 2012, and guarantees the content and<br />

irrevocable nature of the commitments made by the Offeror in connection with the Offer.<br />

On the commencement date of the Offer, Acquco will hold 67.11 % of the capital and voting rights of <strong>InfoVista</strong><br />

(after deduction of treasury shares) and the Offer will therefore be conducted in accordance with the<br />

simplified procedure described in Articles 233-1 and following of the AMF General Regulations.<br />

The board of directors of the Company has called a specially convened ordinary meeting of <strong>InfoVista</strong>’s<br />

shareholders to be held on February 8, 2012, to approve, in particular, a special distribution in the amount of<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 3 -

1.40 euros per share (the “Special Distribution”), i.e., a total distribution of 23,072,051.80 euros (the capital<br />

consisting of 16,480,037 shares) 1 to be paid out before the commencement date of the Offer.<br />

The Offeror has expressed its intention to vote in favor of this Special Distribution. The ex-dividend date for<br />

the Special Distribution will be February 9, 2012 and it will be paid out on February 14, 2012.<br />

The shareholders will therefore be asked to tender their shares to the Offer for a price of 3.65 euros, exspecial<br />

dividend.<br />

The Offer will be effective for a period of 20 trading days.<br />

1.2 Background to the Offer<br />

In the year 2011, the Offeror expressed an interest in acquiring a controlling stake in the Company. On<br />

December 20, 2011, Acquco acquired through a competitive bidding process 10,827,692 <strong>InfoVista</strong> shares<br />

representing 65.70% of the capital <strong>InfoVista</strong>, i.e., 67.11% of its voting rights after deduction of treasury<br />

shares. In connection with this acquisition an Investment Agreement was entered into, the main terms of<br />

which are described in Section 1.3.2 below.<br />

<strong>InfoVista</strong>’s shares being admitted to trading in Compartment C of the regulated market of NYSE Euronext<br />

Paris, Acquco filed a simplified tender offer with the AMF, in respect of all the <strong>InfoVista</strong> shares it did not hold,<br />

for a price of 3.65 euros per share, in accordance with, inter alia, Articles 233-1 and 234-2 of the AMF<br />

General Regulations.<br />

Acquco’s shares are held by Project Metro Holdings, a French société par actions simplifiée with a capital of<br />

1,000 euros, whose registered office is located at 102, avenue des Champs-Elysées, 75008 Paris, registered<br />

with the Paris Trade and Companies Registry under number 538 589 110.<br />

All the shares of Project Metro Holdings SAS are held by Project Metro Holding SCA, a société en<br />

commandite par actions organized under the laws of Luxembourg, whose registered office is located at 1A,<br />

rue Thomas Edison, L-1445 Strassen, Luxembourg (“Project Metro Holding SCA”). The managing general<br />

partner (gérant commandité) of Project Metro Holding SCA is Project Metro S.à.r.l., a Luxembourg société à<br />

responsabilité limitée registered with the Luxembourg trade and companies registry under number B 165279.<br />

Finally, 100% of the capital of Project Metro Holding SCA is directly or indirectly held by Thoma Bravo Fund<br />

IX Limited Partnership (“Thoma Bravo”), an American company whose registered office is located at 300,<br />

North LaSalle Street, Chicago, IL, 60654 United States, and whose general partner is Thoma Bravo Fund IX<br />

General partnership, whose registered office is located at 300, North LaSalle Street, Chicago, IL, 60654<br />

United States, registered in the state of Delaware under number 4426450.<br />

Thoma Bravo also owns the entire capital of Project Metro S.à.r.l., the managing general partner of Project<br />

Metro Holding SCA.<br />

In compliance with Article 261-1 of the AMF General Regulations, the board of directors of the Company<br />

appointed the firm Ricol & Lasteyrie as independent expert for the purpose of this Offer. The report prepared<br />

by Ricol & Lasteyrie is copied below.<br />

1 i.e., an actual payment of 22,589,407.40 euros given the 344,746 treasury shares existing on the date hereof; the dividend<br />

corresponding to these treasury shares, i.e., 482,644.40 euros, will be credited to the “retained earnings” account.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 4 -

1.3 Terms of acquisition of the block of shares<br />

1.3.1 Share Purchase Agreements<br />

On December 20, 2011 (the “Block Transfer Date”), Acquco entered into 16 share purchase agreements<br />

governed by French law (the “Share Purchase Agreements”), pursuant to which Acquco acquired, through<br />

over-the-counter transactions, a total of 10,827,692 shares representing the 65.70% of the share capital and<br />

voting rights of <strong>InfoVista</strong> (the “Controlling Block”). The Offeror thus acquired 67.11% of the share capital<br />

and voting rights, after deduction of the treasury shares from the total share capital of the Company.<br />

The Share Purchase Agreements provide that Acquco is to acquire shares composing the Controlling Block<br />

for a price of 5.05 euros per share, payable as follows:<br />

- 3.65 euros per share (i.e., a total amount of 39,521,075.80 euros) paid on the Block Transfer Date;<br />

- the balance (the “Balance of the Price”), in the amount of 1.40 euros per share (i.e., a total amount<br />

of 15,158,768.80 euros), payable on or before the earlier of the following dates:<br />

(i) 90 calendar days after the Block Transfer Date, i.e., on or before March 20, 2012, or<br />

(ii) the expiration date of the Offer.<br />

Thoma Bravo also guaranteed the payment of the Balance of the Price by Acquco.<br />

In addition the assignment of the payment of the Balance of the Price (the “Assignment of Payment”) was<br />

provided pursuant to which <strong>InfoVista</strong>, acting in the name and on behalf of the Offeror, is to make this<br />

payment directly to the shareholders having signed the Share Purchase Agreements, at the time of payment<br />

of the Special Distribution.<br />

1.3.2 Investment Agreement<br />

On December 20, 2011, Acquco also entered into an Investment Agreement governed by French Law (the<br />

“Investment Agreement”) with the managers of the Company (the “Managers”). The Investment Agreement<br />

includes the following provisions:<br />

Commitments for the sale and contribution of the BSAAR held by the Managers<br />

Under the Investment Agreement, the Managers agreed to sell a portion of their BSAAR to Acquco and to<br />

contribute the rest to Project Metro Holding SCA as soon as possible after the Block Transfer Date and no<br />

later than March 31, 2012 (the “Initial Closing Date”), as follows:<br />

- Commitment by the Managers to sell to Acquco the number of BSAAR specified below (each<br />

BSAAR entitling its holder to one <strong>InfoVista</strong> share), at a price of 1.54 euros per BSAAR paid in cash<br />

on the Initial Closing Date, corresponding to the difference between the Offer price before the exdividend<br />

date for the Special Distribution (i.e., 5.05 euros per share) and the exercise price of each<br />

BSAAR (i.e., 3.51 euros) (the “Transferred BSAAR”):<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 5 -

- Commitment by the Managers to contribute to Project Metro Holding SCA, on the Initial Closing<br />

Date, the number of BSAAR (the « Contributed BSAAR ») specified below (each BSAAR entitling its<br />

holder to one <strong>InfoVista</strong> share), for a consideration of 1.54 euros per BSAAR, corresponding to the<br />

difference between the Offer price before the ex-dividend date for the Special Distribution (i.e., 5.05<br />

euros per share) and the exercise price of each BSAAR (i.e., 3.51 euros). The number and value of<br />

the relevant BSAAR are as follows:<br />

Transferors<br />

Transferors<br />

Number of<br />

Transferred<br />

BSAAR<br />

Number of<br />

contributed<br />

BSAAR<br />

Philippe Ozanian 389,610 €599,999.40<br />

Manuel Stopnicki 32,468 €50,000.72<br />

Vikas Trehan 22,727 €34,999.58<br />

David Forlizzi 14,286 €22,000.44<br />

Marc Benrey 29,221 €45,000.34<br />

Total 488,312 €752,000.48<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 6 -<br />

Purchase price of the<br />

BSAAR<br />

(€1,54 per BSAAR)<br />

Philippe Ozanian 295,075 €454,415.50<br />

Manuel Stopnicki 67,532 €103,999.28<br />

Vikas Trehan 32,273 €49,700.42<br />

David Forlizzi 24,089 €37,097.06<br />

Marc Benrey 70,779 €108,999.66<br />

Total 489,748 €754,211.92<br />

Consideration for the<br />

BSAAR (€1.54 per BSAAR)<br />

As compensation for their contributions, US tax resident Managers will receive class 1 limited<br />

partner’s shares (actions de commanditaires) issued by Project Metro SCA and giving them the<br />

same economic rights as those granted to Thoma Bravo, in proportion to their investment. On top of<br />

this, the remainder of the contributions made by the Managers will be compensated by offsetting<br />

against class 1 preferred equity certificates (“PECs 1”) and class 2 preferred equity certificates<br />

(“PECs 2”, and together with PECs 1 “PECs”) issued by Project Metro SCA, on the same terms and<br />

conditions as Thoma Bravo.<br />

As compensation for his contribution, the French resident Manager Mr. Marc Benrey will receive<br />

class 2 limited partner’s preferred shares (actions de commanditaires de préférence) issued by<br />

Project Metro SCA and giving him the same economic rights as those granted to Thoma Bravo and<br />

the other transferors in respect of their PECs and class 1 limited partner’s shares, in proportion to his<br />

investment.<br />

After these contributions, Thoma Bravo and each of the US tax resident transferring Managers<br />

mentioned above will be pari passu as to the breakdown of their investment in Project Metro SCA<br />

into equity (class 1 limited partner’s preferred shares) and quasi-equity (PECs), except for the holder<br />

of class 2 shares, which are to be reinvested solely in equity.

The PECs 1 referred to above will bear interest at a rate �ranging from 7.72% to 8.12%� per year,<br />

payable on the anniversary date of the subscription for PECs 1 by Thoma Bravo and the relevant<br />

transferring Managers. The redemption of the principal amount of the PECs 1 (plus any unpaid<br />

interest accrued thereon) will occur (i) at the redemption date, which is the thirtieth anniversary of the<br />

initial subscription date of the PECs 1 or (ii) at any time, in whole or in part, at the sole option of<br />

Project Metro Holding SCA; in the event of the liquidation of Project Metro Holding SCA, PECs<br />

subscribers will not be entitled to request any redemption before the above-mentioned redemption<br />

date.<br />

The PECs 2 referred to above will bear interest at a rate �ranging from 9.03% to 9.43%� per year,<br />

payable on the anniversary date of the subscription for PECs 2 by Thoma Bravo and the relevant<br />

transferring Managers. The redemption of the principal amount of the PECs 2 (plus any unpaid<br />

interest accrued thereon) will occur (i) at the redemption date, which is the thirtieth anniversary of the<br />

initial subscription date of the PECs 2 or (ii) at any time, in whole or in part, at the sole option of<br />

Project Metro Holding SCA; in the event of the liquidation of Project Metro Holding SCA, PECs<br />

subscribers will not be entitled to request any redemption before the above-mentioned redemption<br />

date.<br />

The class 2 limited partner’s preferred shares received by the French tax resident transferring<br />

Manager as compensation for his Contributed BSAAR carry a preferred dividend right reflecting the<br />

economic rights attached to PECs. The other terms and conditions of class 2 limited partner’s<br />

preferred shares are identical to those of class 1 limited partner’s shares.<br />

The reinvestment by all the Managers of a portion of their BSAAR into Project Metro Holding SCA<br />

will account for approximately 11.26% of Project Metro Holding SCA’s equity and 1.69% of its PECs.<br />

Therefore, the capital and quasi-equity (PECs) of Project Metro Holding SCA are owned as follows:<br />

- Thoma Bravo: 98.20% of equity and quasi-equity, broken down as follows:<br />

� 41,035,382 class 1 shares, representing 88.74% of the shares; and<br />

� 4,062,502,764 PECs, representing 98.31% of the PECs, including 1,625,001,046<br />

PECs 1 and 2,437,501,718 PECs 2<br />

- The Managers, collectively: of equity and quasi-equity, broken down as follows:<br />

Managers Shares PECs 1 PECs 2<br />

David Forlizzi 22,022 class 1 shares 871,208<br />

1,306,814<br />

Philippe Ozanian 599,984 class 1 shares 23,759,982<br />

Vikas Trehan 34,958 class 1 shares 1,386,000<br />

Manuel Stopnicki 50,050 class 1 shares 1,980,008<br />

Marc Benrey 4,500,034 class 2<br />

shares<br />

Total 5,207,048 (11.26% of<br />

the shares)<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 7 -<br />

27,997,198 (1.69% of<br />

PECs 1)<br />

35,639,974<br />

2,079,000<br />

2,970,014<br />

0 0<br />

41,995,802 (1.69% of<br />

PECs 2)

As a result, the contributed BSAAR held by Project Metro Holding SCA will be transferred to Project<br />

Metro Holdings SAS, then to Project Metro Acquco, at a price equal to the compensation for the<br />

BSAAR, i.e., 1.54 euros per BSAAR.<br />

Commitments to sell shares resulting from the exercise of Options by the Managers<br />

Moreover, all the Managers holding Options (that is, all the Managers except Vikas Trehan) have agreed to<br />

exercise their Options (the “Exercised Options”) and sell the resulting shares to the Offeror on the date<br />

chosen by Thoma Bravo, but no sooner than the expiration date of the Offer and no later than September 30,<br />

2012 (the “Deferred Closing Date”), at the price of 3.65 euros per share after the ex-dividend date for the<br />

Special Distribution. This commitment is for the number of shares resulting from the exercise of Options and<br />

for the transfer price indicated in the table below:<br />

Transferors<br />

Number of shares<br />

resulting from the<br />

exercise of Options<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 8 -<br />

Purchase price of the shares<br />

resulting from the exercise of<br />

Options<br />

(€ 3.65 per share).<br />

Philippe Ozanian 96,250 €351,312.50<br />

Manuel<br />

Stopnicki<br />

65,000 €237,250.00<br />

David Forlizzi 22,000 €80,300.00<br />

Marc Benrey 22,000 €80,300.00<br />

Total 205,250 €749,162.50<br />

The purchase price of the shares resulting from the exercise of Options may be adjusted, if appropriate, in<br />

the event of corporate actions in accordance with Article L.225-181 of the French Commercial Code.<br />

Signature of a shareholders’ agreement regarding the shares of Project Metro Holding SCA<br />

pursuant to the Investment Agreement, the Managers, Thoma Bravo and Project Metro S.à r.l will sign, on<br />

the initial Closing Date, a shareholders’ agreement regarding the shares of Project Metro Holding SCA (the<br />

“Shareholders’ Agreement”), the main provisions of which will be the following :<br />

- the managers of Project Metro Holding SCA and its subsidiaries shall obtain the prior consent of one<br />

of the directors appointed on the nomination of Thoma Bravo for any material decision as listed in<br />

the Shareholders’ Agreement;<br />

- Mr. Philippe Ozanian will continue to serve as Chairman of the board and CEO (Directeur Général)<br />

of <strong>InfoVista</strong>; the provisions of the Shareholders’ Agreement relating to the governance of Project<br />

Metro Holding SCA will apply mutatis mutandis to <strong>InfoVista</strong> and its subsidiaries;<br />

- the Managers may not transfer their Project Metro Holding SCA securities before the expiration of a<br />

period of 10 years following the conclusion of the Shareholders’ Agreement, except in the limited<br />

cases specified by the Shareholders’ Agreement (such as transfers to spouses, children and holding

companies owned by the Managers) and except for transfers resulting from any of the provisions of<br />

the Shareholders’ Agreement;<br />

- the Managers are entitled to maintain their equity interest in Project Metro Holding SCA in the<br />

proportion that their shares bear to the capital before any immediate or future issue of shares is<br />

decided, subject to the limited exceptions set out in the Shareholders’ Agreement;<br />

- Thoma Bravo has a pre-emptive right to acquire any securities a Manager proposes to transfer;<br />

- under certain circumstances, the Managers have a proportional tag-along right;<br />

- under certain circumstances, Thoma Bravo has an irrevocable put option (promesse d’achat) on all<br />

the securities of Project Metro Holding SCA held by the Managers;<br />

- in addition, each Manager grants Thoma Bravo an irrevocable call option (promesse de vente) in<br />

respect of their Project Metro Holding SCA securities, exercisable upon the occurrence of specifically<br />

defined events (standard “cessation of service” provisions);<br />

- the Managers agree to vote in favor of any resolution and to cooperate in any initial public offering of<br />

Project Metro Holding SCA that Thoma Bravo may contemplate; in the event of a secondary public<br />

offering, the Managers will be entitled to sell proportionally the same number of shares as Thoma<br />

Bravo;<br />

- Thoma Bravo may cause Project Metro Holding SCA to effect a “Registration” of its shares,<br />

especially on the American markets and in accordance with American law; the Managers will be<br />

entitled to a proportionate participation in this Registration;<br />

- Messrs. Philippe Ozanian, David Forlizzi and Vikas Trehan are bound by a non-compete and an<br />

exclusivity covenant.<br />

Liquidity Agreements with Option and BSAAR holders other than the Managers (the “Beneficiaries”)<br />

The Managers have agreed to use their best efforts, as of the Block Transfer Date, to enable Acquco to enter<br />

into liquidity agreements with the holders of Options and BSAAR other than the Managers (the “Option<br />

Liquidity Agreements” and “BSAAR Liquidity Agreements”) pursuant to which:<br />

- A call option is granted to Acquco in respect of the BSAAR and the shares resulting from the<br />

exercise of the Options by the Beneficiaries, for the same consideration as the Exercised Options or<br />

Transferred BSAAR, which option is exercisable for a period of three months from the<br />

commencement date of the Offer; and<br />

- a put option is granted to the Beneficiaries under which they may sell to Acquco, for the same price,<br />

their BSAAR and the shares resulting from the exercise of the Options; this put option is exercisable<br />

for a period of one month from the expiry of the call option exercise period; it being specified that the<br />

Beneficiaries have agreed to exercise their Options if the Offeror exercises the call options granted<br />

to Acquco.<br />

As at the date hereof, no Option Liquidity Agreement and two (2) BSAAR Liquidity Agreements were entered<br />

into, in respect of a total of zero (0) Options and 200,000 BSAAR (representing all the BSAAR not covered<br />

by the Investment Agreement) i.e., a total of 200,000 shares.<br />

Establishment of a profit-sharing scheme<br />

After the Offer and the squeeze-out procedure that will follow, if applicable, Project Metro Holding SCA will<br />

set up a profit-sharing scheme for the benefit of the Managers and other key individuals. Under this scheme<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 9 -

share warrants (the “Warrants”) would be issued, which have the following main characteristics, it being<br />

specified, however, that the technical terms of this plan may be subject to post-Offer adjustments to optimize<br />

said terms. The awardees will not be entitled to any guaranteed exit price or price supplement:<br />

- the Warrants will become exercisable successively as follows: (a) 50% over a period of 4 years<br />

following their issuance and (b) 50% if annual performance targets are achieved over a period of 4<br />

years;<br />

- the Warrants exercise period may be accelerated in the event of a change in control event of Project<br />

Metro Holding SCA;<br />

- these Warrants will entitle their holders to subscribe at par limited partners’ shares of Project Metro<br />

Holding SCA, depending on their country of tax residence, which shares will be subject to a lock-up<br />

period expiring in 2022 under the Shareholders Agreement;<br />

- the Warrant holders will forfeit their rights, under certain circumstances and in certain proportions, if<br />

they leave the group before the agreed upon exercise period (standard “cessation of service”<br />

provisions);<br />

- no liquidity is guaranteed to the awardees after they exercise their Warrants.<br />

The Warrants will represent no more than 10% of the equity investment of the current shareholders of<br />

Project Metro Holding SCA in that company and will be awarded to the officers and employees of the<br />

Company.<br />

Amendments to the Managers’ employment contracts<br />

In accordance with the provisions of the Investment Agreement, Mr. Philippe Ozanian’s employment<br />

agreement governed by French Law dated September 7, 2000, pursuant to which he served as Vice<br />

Executive President in charge of global operations, was terminated. On December 20, 2011, a new<br />

agreement governed by U.S. Law was entered into with Project Metro Inc., a sister company of Project Metro<br />

Holding SCA. Under this new agreement, Mr. Philippe Ozanian now serves as Chairman of the board and<br />

CEO of Project Metro Inc. and holds management positions within the group. His fixed annual compensation<br />

was increased only to compensate the loss of benefits he previously had under French social security laws.<br />

The other provisions of his current employment agreement remain unchanged, subject to certain<br />

adjustments required under U.S. law, to which the agreement is now subject.<br />

Furthermore, the Investment Agreement provides that the employment agreements of the other Managers<br />

(namely, Messrs. Vikas Trehan, Marc Benrey, David Forlizzi and Manuel Stopnicki) will have to be amended,<br />

though not substantially, by a written agreement.<br />

Other provisions of the Investment Agreement<br />

The Investment Agreement also contains a list (identical to that contained in the Shareholders’ Agreement)<br />

of the decisions that, during the interim period until the signature of the Shareholders’ Agreement (that is,<br />

until the Initial Closing Date), will require the prior approval of a representative of Thoma Bravo on the board<br />

of directors of <strong>InfoVista</strong>.<br />

Furthermore, as collateral for the commitments to transfer the Transferred BSAAR and the commitments to<br />

contribute the Contributed BSAAR, Messrs. Manuel Stopnicki, David Forlizzi and Vikas Trehan entered into,<br />

on December 20, 2011, statements of pledge of securities accounts] for the benefit of the Offeror, in respect<br />

of the following BSAAR:<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 10 -

Managers<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 11 -<br />

Number of BSAAR in the pledged<br />

securities account<br />

Manuel Stopnicki 100,000<br />

David Forlizzi 38,375<br />

Vikas Trehan 55,000<br />

TOTAL 193,375<br />

Finally, the Investment Agreement contains standard representations and warranties for the benefit of the<br />

Offeror.

2 TIES BETWEEN THE COMPANY AND THE OFFEROR<br />

Prior to the negotiations for the acquisition of the Controlling Block, there were no ties between Acquco and<br />

the Company or their respective officers and directors, nor was the Company a party to any agreement with<br />

Acquco.<br />

3 AGREEMENTS THAT MAY AFFECT THE ASSESSMENT OR OUTCOME OF THE<br />

OFFER<br />

Except for the agreements described in Section 1.3 above and the facts detailed below, the Company is not<br />

aware of any agreement that may have a significant influence on the assessment or outcome of the Offer.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 12 -

4 INFORMATION ON THE COMPANY<br />

4.1 Share ownership of the Company<br />

As far as the Company is aware, before the transfer of the Controlling Block, the capital and voting rights of<br />

<strong>InfoVista</strong> were owned as follows:<br />

Shareholder Number of shares<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 13 -<br />

% of share capital and<br />

voting rights<br />

TOTAL EMANCIPATION 3,250,856 19.73%<br />

Emancipation Capital Master Ltd 1,500,958 9.11%<br />

Emancipation Capital SPV I LLC 1,749,898 10.62%<br />

TOTAL ODYSSEE 2,476,919 15.03%<br />

Oddo Innovation 1 21,000 0.13%<br />

Oddo Innovation 2 50,000 0.30%<br />

Oddo Innovation 3 80,000 0.49%<br />

Capital Innovation 211,000 1.28%<br />

Capital Innovation 2 343,648 2.09%<br />

Croissance Innovation 35,900 0.22%<br />

Equilibre Innovation 55,000 0.33%<br />

Boursinnovation 663,640 4.03%<br />

Capital Proximité 99,500 0.60%<br />

UFF Innovation 6 466,560 2.83%<br />

Odyssée Innovation 42,066 0.26%<br />

Capital Proximité 2 208,500 1.27%<br />

Cap Innovation 2007 126,156 0.77%<br />

Odyssée Innovation 2 13,441 0.08%<br />

Boursinnovation 3 60,508 0.37%<br />

Gensym Cayman L.P 1,045,043 6.34%<br />

Total RAININ GROUP 811,328 4.92%<br />

Kenneth Rainin Charitable Lead Annuity<br />

Trust N°1 dtd 3/26/90<br />

Kenneth Rainin Charitable Lead Annuity<br />

Trust N°2, dtd 3/26/90<br />

270,442 1.64%<br />

270,443 1.64%

Shareholder Number of shares<br />

Kenneth Rainin Charitable Lead Annuity<br />

Trust N°3, dtd 3/26/90<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 14 -<br />

% of share capital and<br />

voting rights<br />

270,443 1.64%<br />

ARGOS 562,000 3.41%<br />

TOTAL TINGAUD 541,490 3.29%<br />

EURL Alain Tingaud Innovations 470,000 2.85%<br />

Alain Tingaud 71,490 0.43%<br />

TOTAL SOPHROSYNE CAPITAL LLC 493,898 3.00%<br />

Compass Offshore HTV PCC Limited 72,711 0.44%<br />

Compass HTV LLC 59,487 0.36%<br />

Sophrosyne Technology Fund Ltd 361,700 2.19%<br />

HERALD INVESTMENT TRUST PLC 300,000 1.82%<br />

TRISTAN PARTNERS LP 296,131 1.80%<br />

RUFFER EUROPEAN FUND 200,000 1.21%<br />

MALKO TRUST 175,217 1.06%<br />

EDALE EUROPE MASTER FUND<br />

LIMITED<br />

156,224 0.95%<br />

TOTAL BNP 152,963 0.93%<br />

Antin FCPI 4 9,314 0.06%<br />

Antin FCPI 5 12,680 0.08%<br />

Antin FCPI 6 16,804 0.10%<br />

Antin FCPI 7 14,720 0.09%<br />

Antin FCPI 8 61,590 0.37%<br />

Antin FCPI 9 37,855 0.23%<br />

PLUVALCA FRANCE SMALL CAPS 126,106 0.77%<br />

TOTAL JUPITER 121,517 0.74%<br />

Jupiter Global Fund – Jupiter Europa 110,799 0.67%<br />

Lyxor / Jupiter Europa Hedge Fund 10,718 0.07%<br />

FCP 123 CONVICTIONS 118,000 0.72%<br />

TREASURY SHARES 382,934 2.32%<br />

PUBLIC (OTHER) 5,269,411 31.97%<br />

TOTAL 16,480,037 100.00%

As far as the Company is aware and based on the information available on the date of filing this draft reply<br />

document, after the transfer of the Controlling Block, the capital and voting rights of <strong>InfoVista</strong> are owned as<br />

follows:<br />

Shareholder Number of shares<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 15 -<br />

% of share capital and<br />

voting rights<br />

PROJECT METRO ACQUCO SAS 10,827,692 65.70%<br />

TREASURY SHARES 382,934 2.32%<br />

PUBLIC 5,269,411 31.97%<br />

TOTAL 16,480,037 100.00%<br />

4.2 Restriction on the exercise of voting rights and on the transfer of shares of the Company,<br />

provisions brought to the knowledge of the Company<br />

The bylaws of the Company do not provide for any restriction on the exercise of voting rights.<br />

Nor do they restrict the free transfer of shares. However, article 12 of the bylaws of the Company provides<br />

that if a shareholder, acting alone or in concert with others, exceeds the 2% share ownership or voting rights<br />

threshold, that shareholder must so notify the Company within 5 trading days. This notification should be<br />

renewed whenever a percentage threshold that is a multiple of 2 is exceeded, up to 50%, failing which one or<br />

more shareholders of the Company representing more than 2% of the capital or voting rights of the Company<br />

may request the suspension of the voting rights attached to the shares in excess of the threshold in respect<br />

of which the notification requirement was not met, until the expiration of a period of two years from the date<br />

the failure to comply with the notification requirement is remedied.<br />

No agreement among the shareholders was brought to the knowledge of the Company pursuant to Article<br />

L. 233-11 of the French Commercial Code.<br />

4.3 Direct or indirect holdings in the capital of the Company, as far as it is aware<br />

Subject to the following and as far as the Company is aware, on the date of this draft reply document, the<br />

capital of the Company is owned as indicated in Section 4.1 above.<br />

On January 16, 2012, BRED Banque Populaire notified the Company that it had exceeded the threshold of<br />

5% of the capital and voting rights of <strong>InfoVista</strong> and that it then held 5.49% of the capital and voting rights of<br />

the Company. This information was published on the AMF website on January 19, 2012.<br />

Since the beginning of the current fiscal year on July 1 st , 2011, the Company has not received any<br />

notification of crossing of statutory voting right ownership thresholds, other than the notification described<br />

above and those made by the Offeror in connection with the acquisition of the Controlling Block.<br />

4.4 List of holders of securities carrying special control rights<br />

In accordance with Article 12 of the Company’s bylaws, the shares issued by the Company all carry the<br />

same rights. The shares of the Company entitle their holders to vote and be represented at the shareholders’<br />

meetings in the manner prescribed by law and none of the Company’s securities carries special control<br />

rights.

4.5 Control mechanisms provided for in any employee shareholding system, where control rights<br />

are not exercised by employees<br />

The Company has not established any employee shareholding system in which control rights are not<br />

exercised by employees.<br />

4.6 Shareholders’ agreements of which the Company is aware that may lead to restrictions on the<br />

share transfers and on the exercise of voting rights<br />

Except for the Shareholders’ Agreement entered into under the Investment Agreement as described in<br />

Section 1.3.2 above, the Company is not aware of any agreement among the shareholders that may lead to<br />

restrictions on the share transfers and on the exercise of voting rights.<br />

4.7 Composition of the governing bodies of <strong>InfoVista</strong><br />

On the date of filing this draft reply document, the board of directors of <strong>InfoVista</strong> was composed as follows:<br />

- Mr Philippe Ozanian, President,<br />

- Mr Robert Sayle,<br />

- Mr James Kevin Lines.<br />

4.8 Rules for appointing and replacing the members of the board of directors<br />

The Company is managed by a board of directors composed of no less than three members and no more<br />

than 18 members, in accordance with the law. During the life of the Company, the directors are appointed or<br />

replaced by the ordinary shareholders’ meeting.<br />

Article 13 of the bylaws of the Company provides that the directors are appointed for a one-year term. Each<br />

director is required to own at least one share of the Company through his term of office.<br />

The bylaws of the Company also provide that the number of directors who are 75 years of age or older may<br />

not exceed one third of the members of the board of directors. If this limit is reached, the oldest director is<br />

automatically deemed to be resigning at the next shareholders’ meeting.<br />

Moreover, the Shareholders’ Agreement entered into under the Investment Agreement described in Section<br />

1.3.2 provides that Mr. Philippe Ozanian will remain in office as a director, President and CEO of the<br />

Company for renewable one-year terms.<br />

4.9 Rules for amending the bylaws of the Company<br />

The special shareholders’ meeting of the Company has authority to amend the bylaws, in accordance with<br />

applicable statutory and regulatory provisions, it being specified that the Shareholders’ Agreement entered<br />

into under the Investment Agreement described in Section 1.3.2 provides that any proposed amendment<br />

submitted to the special shareholders’ meeting will require the prior approval of one of the directors<br />

appointed on the nomination of Thoma Bravo.<br />

4.10 Powers of the board of directors, in particular as to the issuance or buyback of shares<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 16 -

The board of directors is responsible for setting the general direction of the Company’s operations and for<br />

overseeing its implementation. Subject to the powers expressly granted to the shareholders’ meetings and<br />

within the limits of the corporate purpose, the board examines any matter affecting the smooth operation of<br />

the Company and makes decisions on the matters that concern it.<br />

In dealings with third parties, the Company is bound by the acts of the board, even if they exceed the<br />

corporate purpose, unless the Company can prove that the third party knew that the act exceeded that<br />

purpose or could not have been unaware of it given the circumstances, it being specified, as provided by the<br />

law, that the publication of these bylaws alone does not constitute sufficient proof thereof.<br />

The board of directors may conduct any audit or inspection it deems appropriate. The president or the CEO<br />

is responsible for providing each director with all the documents necessary to carry out that task.<br />

In the discharge of its statutory or regulatory, the board of directors examines regularly the general direction<br />

of the Company. The board of directors authorizes all guarantees, sureties and endorsements that the<br />

Company may grant to third parties and examines their maximum amount.<br />

The board of directors may decide to form committees to examine any matter on which the board or its<br />

chairman may require their opinion. It establishes the composition and duties of the committees operating<br />

under its supervision and establishes the compensation of their members.<br />

Moreover, the Shareholders’ Agreement entered into under the Investment Agreement, the key provisions of<br />

which are described in Section 1.3.2, provides that material decisions require the prior approval of one of the<br />

directors appointed on the nomination of Thoma Bravo.<br />

In addition to the general authority conferred upon it, the board of directors has received the following<br />

delegations of authority:<br />

Type of delegation of authority Date of<br />

shareholders’<br />

meeting<br />

Delegation of authority given to the board<br />

to increase the capital by capitalizing<br />

reserves, profits, premiums or other sums<br />

permitted to be capitalized.<br />

Delegation of authority given to the board<br />

to increase the capital to compensate inkind<br />

contributions made to the Company.<br />

Delegation of authority given to the board<br />

to complete a rights issue reserved for the<br />

participants in a company savings plan<br />

(plan d’épargne d’entreprise), by issuing<br />

up to 500,000 shares of common stock,<br />

without any preemptive right being granted<br />

to the employees of the Company and<br />

companies related to it.<br />

Delegation of authority given to the board<br />

to complete a rights issue reserved for the<br />

participants in a company savings plan, by<br />

issuing up to 500,000 shares of common<br />

stock, without any preemptive right being<br />

granted to the employees of the Company<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 17 -<br />

Expiration of the<br />

delegation<br />

11/16/2011 26 months from<br />

the meeting, i.e.,<br />

01/15/2014<br />

11/16/2011 26 months from<br />

the meeting, i.e.,<br />

01/15/2014<br />

02/07/2008 5 years from the<br />

meeting, i.e.,<br />

02/09/2013<br />

12/15/2009 5 years from the<br />

meeting, i.e.,<br />

12/15/2014<br />

Restrictions<br />

Reserves, share<br />

premiums, profits as<br />

legally available<br />

10% of the capital<br />

500,000 shares<br />

500,000 shares

and companies related to it.<br />

Delegation of authority to be given to the<br />

board to buy back the shares of the<br />

Company under a share buyback scheme,<br />

pursuant to Article L.225-209 of the French<br />

Commercial Code<br />

Delegation of authority given to the board<br />

to reduce the capital by cancelling shares<br />

previously bought back under a share<br />

buyback scheme, pursuant to Article L.225-<br />

209 of the French Commercial Code.<br />

Delegation of authority to be given to the<br />

board to reduce the capital by cancelling<br />

shares purchased under a share buyback<br />

tender offer, pursuant to Article L.225-207<br />

of the French Commercial Code.<br />

Authorization for the board to award free<br />

shares, whether existing or to be issued.<br />

Authorization for the board to award<br />

options to purchase existing shares.<br />

11/16/2011 18 months from<br />

the meeting, i.e.,<br />

05/15/2013<br />

11/16/2011 1 year from the<br />

meeting, i.e.,<br />

11/15/2012<br />

11/16/2011 1 year from the<br />

meeting, i.e.,<br />

11/15/2012<br />

11/16/2011 38 months from<br />

the meeting, i.e.,<br />

01/15/2015<br />

11/16/2011 38 months from<br />

the meeting, i.e.,<br />

01/15/2015<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 18 -<br />

10% of the capital, in<br />

an aggregate amount<br />

not to exceed<br />

7,000,000 euros, at a<br />

maximum purchase<br />

price of 6 euros per<br />

share<br />

10% of the capital<br />

over 24 months<br />

2,500,000 shares, at<br />

a maximum purchase<br />

price of 6 euros per<br />

share and a<br />

maximum overall<br />

price of 10,000,000<br />

euros<br />

200,000 shares<br />

200,000 shares<br />

4.11 Agreements entered into by the Company that are amended or terminated in the event of a<br />

change in control of the Company<br />

To the best of the Company’s knowledge, the Offer does not entail the amendment or the termination of any<br />

agreement entered into <strong>InfoVista</strong> that may have a material adverse effect on the interest of the Company.<br />

4.12 Agreements providing for compensation to be paid to the members of the board of directors<br />

or the employees if they resign or are terminated without cause or if their employment is<br />

terminated because of a tender offer<br />

To the best of the Company’s knowledge, there is one agreement governed by the laws of the State of<br />

Virginia, between Project Metro Inc. and Mr. Philippe Ozanian, defining the sums payable to Mr. Philippe<br />

Ozanian in the event of termination of his employment with Project Metro Inc. These sums may be paid in<br />

the event of dismissal that may be considered as a dismissal without cause under French law (licenciement<br />

sans cause réelle et sérieuse) and, in certain circumstances, in the event of the resignation of Mr. Philippe<br />

Ozanian. These payments are calculated as follows:<br />

- an amount equal to his fixed gross annual salary as at the date of his termination, minus eighty<br />

thousand, four hundred sixty (80,460) US dollars, plus

- an amount equal to the higher of:<br />

(i) the annual bonus paid to Mr. Philippe Ozanian in the fiscal year preceding his<br />

termination; or<br />

(ii) the bonus that would have been paid to Mr. Philippe Ozanian for his performance<br />

during the fiscal year of his termination, calculated on an annual basis; this annual<br />

basis will be calculated based on the bonus to which Mr. Philippe Ozanian would have<br />

been entitled given his performance during the portion of the fiscal year up to his<br />

separation.<br />

In addition to these payments, Mr. Philippe Ozanian would be entitled to supplemental health benefits<br />

provided by Project Metro Inc. during a 12-month period following his separation.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 19 -

5 INDEPENDENT EXPERT REPORT<br />

Simplified Tender Offer made by Project Metro Acquco SAS for the<br />

shares of <strong>InfoVista</strong><br />

Report of the independent expert - Ricol Lasteyrie<br />

In connection with the simplified tender offer (“the Offer”) initiated by Project Metro Acquco SAS<br />

(“Project Metro” or “the Offeror”) for the shares of <strong>InfoVista</strong> (“the Company”), we were asked, as the<br />

independent expert appointed by the Company, to evaluate the fairness of the financial terms and conditions<br />

of the Offer.<br />

Our appointment by the Board of Directors at its meeting on December 20, 2011, was based on Article 261-<br />

1 I of the General Regulations of the French financial markets authority (Autorité des Marchés Financiers –<br />

AMF) in view of the possibility that the Offer may generate conflicts of interest within the Board of Directors,<br />

especially given that (i) at the time the Offer is filed, the Company will already be controlled by the Offeror,<br />

within the meaning of Article 233-3 of the French Commercial Code, and (ii) agreements were entered into<br />

between the Company’s managers and the Offeror for the takeover of <strong>InfoVista</strong>. We were also asked, in<br />

accordance with Article 261-1 II, to issue an opinion on the fairness of the compensation to be offered to<br />

shareholders in case of a possible squeeze-out.<br />

The price offered to the Company’s minority shareholders, €3.65 per share after distribution of a special<br />

dividend, corresponds to the price of the sale to Project Metro by 16 investors of 10,827,692 shares<br />

representing 65.70% of capital equity before dilution and 61.18% after dilution and exclusion of treasury<br />

shares. Managers who hold BSAAR warrants or options to subscribe to and/or to acquire shares (“the<br />

Options”) potentially representing 6.69% of equity after dilution and exclusion of treasury shares have agreed<br />

to sell or contribute their warrants and sell the shares resulting from exercise of their Options based on the<br />

same value.<br />

An exceptional distribution of €1.40 will be brought to a vote at a specially convened ordinary general<br />

meeting on February 8, 2012. The Offeror has stated its intention to vote in favor of this exceptional<br />

distribution. The shares will go ex-dividend on February 9, 2012 for payment on February 14, 2012.<br />

We have carried out our examinations in accordance with the provisions of Article 262-1 of the AMF General<br />

Regulations and its implementing instruction No. 2006-08 of July 25, 2006 relative to fairness opinions<br />

(augmented by the AMF’s recommendations of September 28, 2006, amended on October 19, 2006 and<br />

July 27, 2010). Our examinations are described in Part 3 and detailed in Appendix 5.<br />

To accomplish our assignment, we made use of documents and information transmitted to us by the<br />

Company and its advisors, for the accuracy of which we cannot vouch. Consistent with accepted practice in<br />

fairness opinions, we did not audit or examine the historical and forecast data used, but limited our checks to<br />

the likelihood and consistency of the data.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 20 -

1. Overview of the transaction<br />

1.1 Companies involved in the transaction<br />

1. 11 Overview of the Offeror<br />

Project Metro is a French société par actions simplifiée with registered capital of €1,000. It is a vehicle<br />

created specifically for the acquisition, having no prior activity. It is controlled by funds managed by the U.S.<br />

private equity fund Thoma Bravo.<br />

Project Metro is held by Project Metro Holdings, a French société par actions simplifiée with registered<br />

capital of €1,000, which is wholly owned by Project Metro SCA, a société en commandite par action<br />

organized and existing under the laws of the Grand Duchy of Luxembourg. Thoma Bravo directly or indirectly<br />

holds all shares of Project Metro SCA, and the general partner is Project Metro S.à r.l., a société à<br />

responsabilité limitée organized and existing under the laws of the Grand Duchy of Luxembourg, which is<br />

wholly owned by Thoma Bravo.<br />

1. 12 Overview of the Company<br />

<strong>InfoVista</strong> is a French société anonyme with a board of directors, having registered capital of €8,899,219.98.<br />

<strong>InfoVista</strong> shares have traded on Eurolist market (Compartment C) of the NYSE Euronext Paris since July<br />

2000, under ISIN code FR0004031649.<br />

<strong>InfoVista</strong> was created in 1995 by Alain Tingaud. In December 2011, when the controlling blocks were sold,<br />

Mr. Tingaud sold his entire interest of 3.4% of the Company’s share capital.<br />

<strong>InfoVista</strong> designs, develops and markets software for network performance and application performance<br />

management. The Company expanded into application performance management by acquiring Accellent in<br />

2007. <strong>InfoVista</strong> is a global leader in its market, and its clients include large international service providers<br />

(telecom operators) and the IT departments of large industrial and banking companies. The Company<br />

derives 57% of its revenues from Europe, the Middle East and Africa, 30% from the Americas, and 13% from<br />

the Asia-Pacific region.<br />

For the fiscal year ended June 30, 2011, telecom operators accounted for 70% of the Company’s revenues.<br />

Services (essentially maintenance, amounting to nearly 80%) accounted for 60.7% of revenues during the<br />

period. License sales reached €18 million, or 39.3% of revenues. The group signed a partnership agreement<br />

with Cisco in 2008, and this accounts for a significant portion of revenues developed via integrators. The ten<br />

largest clients accounted for 33% of total 2011 revenues.<br />

For the last five years, the Company’s business grew at a slow 2% on average, due to the lower license<br />

sales (sold exclusively in the form of perpetual licenses). The downturn largely reflects telecom operators’<br />

cost-cutting efforts and increasingly fierce competition due to sector consolidation.<br />

These negative factors were only partially offset by the Company’s new-product launches (for the last five<br />

fiscal years, the Company has devoted 22% of its revenues to research and development).<br />

During the same period, the Company achieved significant operating cost savings, moving from an EBIT loss<br />

of €2.6 million for the fiscal year ended June 30, 2007, to positive EBIT of €4.2 million for the June 30, 2011,<br />

fiscal year, for an EBIT margin of 9.1%.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 21 -

The Company had 221 employees as of June 30, 2011 (including 69 in research and development).<br />

1.2 Background and terms of the Offer<br />

On December 20, 2011, Project Metro reached an agreement with the largest shareholders of <strong>InfoVista</strong> 1 for<br />

the sale of the shares. Under the terms of this agreement, the shareholders sold to the Offeror, off-market, a<br />

total of 10,827,692 shares in the Company, representing 65.70% (61.18% on a fully diluted basis and<br />

excluding treasury shares) of its equity at a price of €5.05 per share.<br />

The price will be paid in two installments, as follows:<br />

- €3.65 on the Closing date;<br />

- €1.40 no later than the earlier of: (i) 90 days after the Closing date or (ii) the date when the Offer is<br />

closed. As part of the exceptional distribution, an assignment of rights to payment of the balance of the<br />

price was set up by Thoma Bravo, which has guaranteed the payment by the Offeror and, as such the<br />

balance of the price will be paid directly by the Company to the sellers of the controlling blocks when<br />

paying the dividend relating to the exceptional distribution.<br />

An Investment Agreement was also made on December 20, 2011 between the Offeror and certain<br />

managers 2 , under the terms of which they have committed to:<br />

- sell to the Offeror 489,748 BSAAR warrants potentially representing 2.77% of fully diluted equity<br />

excluding treasury shares, at a unit price of €1.54 (corresponding to the difference between the Offer<br />

price before the exceptional distribution and the exercise price of €3.51);<br />

- exercise 205,250 Options potentially representing 1.16% of fully diluted equity excluding treasury shares,<br />

and sell the shares to the Offeror on a date to be chosen by Thoma Bravo (no earlier than the closure of<br />

the Offer and no later than September 30, 2012) at a price of €5.05 per share less the exceptional<br />

distribution;<br />

- contribute 488,312 BSAAR warrants potentially representing 2.76% of fully diluted equity excluding<br />

treasury shares, based on a unit price of €1.54 (corresponding to the difference between the Offer price<br />

before the exceptional distribution and the exercise price of €3.51). It is expected that these contributions<br />

(and the BSAAR warrant sales) will be completed during the first week of February.<br />

A shareholders’ agreement will be signed by the parties on completion of the contributions and sales of<br />

BSAAR warrants by the managers, establishing all the rules for the management of Project Metro SCA, as<br />

well as the usual exit clauses.<br />

It is anticipated that an incentive plan for the managers will be set up to encourage them to participate in<br />

creating future value in the new entity.<br />

1 These shareholders are: two funds managed by Emancipation, 15 funds managed by Odyssée, Gensym Cayman L.P., three funds<br />

managed by Rainin Group, Argos, Alain Tingaud and the single person limited company Alain Tingaud Innovations, three funds<br />

managed by Sophrosyne Capital LLC, Herald Investment Trust PLC, Tristan Partners LP, Ruffer European Fund, Malko Trust,<br />

Edale Europe Master Fund Limited, six innovation-focused mutual funds managed by BNP Paribas, Pluvalca France Small Caps,<br />

two funds managed by Jupiter and the mutual fund 123 Convictions.<br />

2 Philippe Ozanian, Manuel Stopnicki, David Forlizzi, Marc Benrey and Vikas Trehan (Mr. Trehan is concerned only in the sale and<br />

contribution of the BSAAR warrants).<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 22 -

Liquidity contracts have been or will be put in place with holders of BSAAR warrants or Options other than<br />

the managers, under the same conditions. The liquidity contracts concern 200,000 BSAAR warrants and<br />

178,525 Options, or 2.14% of fully diluted equity after exclusion of treasury shares.<br />

Following the acquisition of these blocks of shares, the Offeror stated its intent to continue to follow the<br />

Company’s strategy and to provide support for <strong>InfoVista</strong>, so that under its own management it will continue<br />

its strategies for product development and expansion into new markets.<br />

2. Statement of independence<br />

Ricol Lasteyrie has no legal or capitalistic link with the companies concerned by the Offer or their advisors. It<br />

has no financial interest in the success of the Offer, and is not a creditor or debtor of any of the companies<br />

concerned by the Offer or any person controlled by these companies within the meaning of Article L.233-3 of<br />

the French commercial code.<br />

Ricol Lasteyrie has no conflict of interest with the companies concerned by the Offer or their advisors, in<br />

particular with respect to Articles 1.1 to 1.4 of AMF instruction No.2006-08 of July 25, 2006 relative to<br />

fairness opinions.<br />

For information, we note that the Company asked us to issue an opinion as an independent expert on the<br />

effects of the planned distribution of an exceptional dividend of €1.40 per share on the Company’s financial<br />

condition and investment capacity in view of its business plan and growth prospects. We addressed this<br />

matter in a separate report on January 18, 2012.<br />

In accordance with the AMF’s recommendations concerning relationships with the bank presenting the<br />

transaction, we note that during the last two years we have had no business relationship with<br />

Bryan, Garnier & Co, the presenting bank.<br />

For information, in Appendix 2 we list the independent valuations carried out by Ricol Lasteyrie during the<br />

last two years, with the name of the banks and/or firms presenting each transaction.<br />

Ricol Lasteyrie certifies that it knows of no past, present or future link between itself and the persons<br />

concerned by the Offer plan or their advisors that may have a bearing on its independence or objective<br />

judgment in this assignment.<br />

3. Examinations carried out<br />

Our examinations consisted mainly of understanding the background to the transaction, analyzing the block<br />

sales agreements and other agreements made in December 2011, implementing a multi-criterion approach<br />

to valuing <strong>InfoVista</strong>’s shares and analyzing the valuation report of the firm presenting the Offer.<br />

As a part of our assignment, we have examined accounting and financial information (annual and<br />

consolidated financial statements for the fiscal years ended June 30, 2009, 2010 and 2011 and quarterly<br />

consolidated financial statements at September 30, 2011 and December 31, 2011). In particular, we confirm<br />

that the Company’s annual and consolidated financial statements at June 30, 2011 called for no particular<br />

comment by the statutory auditors.<br />

We have met with the Company’s management on a number of occasions to understand the background of<br />

the Offer, the business outlook and the financial forecasts that follow from it.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 23 -

Our conversations with management mainly concerned:<br />

- the sale procedure;<br />

- the Company’s business;<br />

- forecast financial data, the process by which it is developed and the main underlying assumptions;<br />

- the group’s medium- and long-term growth outlook.<br />

We evaluated the reasonableness of the main economic assumptions used by the management as the basis<br />

for the forecast financial information.<br />

Concerning the comparative and stock market valuation methods, we have examined the public information<br />

on comparable companies and transactions that is available in our databases.<br />

We have examined the legal documentation made available to us, within strict limits and for the sole purpose<br />

of gathering information useful in carrying out our assignment. In particular, we examined the Share<br />

Purchase Agreements, the Investment Agreement and the Shareholders’ Agreement.<br />

We have also examined the auditor’s report on the value of contributions of the Company’s shares made by<br />

shareholding managers under the terms of the Investment Agreement.<br />

Lastly, we examined the work of Bryan, Garnier & Co, the firm presenting the Offer, as shown in the factors<br />

used to evaluate the price proposed for the simplified tender offer and as summarized in the draft offer<br />

document. We have met with representatives of Bryan, Garnier & Co on several occasions.<br />

Details of our examinations are shown in Appendix 5.<br />

4. Evaluation Valuation of <strong>InfoVista</strong> shares<br />

In accordance with provisions of Article 262-1 of the AMF General Regulations, we performed an<br />

independent valuation of the Company’s shares.<br />

We rejected the following valuation methods:<br />

- the book value method;<br />

- the adjusted book value method;<br />

- the dividend discount model method (capitalization of dividends).<br />

To value the Company, we have used a multi-criterion approach that is based mainly on the following<br />

references and valuation methods:<br />

- reference to recent acquisitions of blocks of <strong>InfoVista</strong> shares by Project Metro;<br />

- the discounted future cash flow method.<br />

On a secondary basis, we have also used:<br />

- the analysis of the Company’s share price;<br />

- a comparative method based on comparable stock market valuations;<br />

- comparable transactions.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 24 -

4.1 Rejected valuation methods<br />

Our work led us to reject the following methods:<br />

Book value<br />

We believe that this method is not relevant because the value of the group’s intangible assets, which are an<br />

essential factor in valuing the Company, is not shown on the individual balance sheet or on <strong>InfoVista</strong>’s<br />

consolidated balance sheet.<br />

As noted, the consolidated book value at June 30, 2011 was €38,251 thousand for 16,073,735 shares in<br />

circulation (after subtraction of 365,856 treasury shares), or €2.38 per share, corresponding to €0.98 after<br />

the exceptional dividend distribution of €1.40 per share planned for February 9, 2012. At December 31,<br />

2011, book value was €38,505 thousand for 16,101,008 shares in circulation, or a value of €2.39 per share,<br />

corresponding to €0.99 after the exceptional dividend distribution.<br />

Adjusted book value<br />

The adjusted book value method consists of valuing a company’s equity based on the market value of its<br />

assets and liabilities.<br />

We believe that this method is not appropriate for a software publisher, whose assets are essentially<br />

intangible. The value of the firm’s goodwill and its technology is better captured via an analysis of discounted<br />

future cash flows, the method which has been used.<br />

Dividend discount model method (capitalization of dividends)<br />

The valuation approach of discounting future dividends, or capitalizing a normative dividend, may be used to<br />

value a company that pays dividends regularly.<br />

During its history as a listed company, the Company has never distributed dividends, and it does not expect<br />

to distribute regular dividends in the foreseeable future (except for the exceptional distribution planned for<br />

February 9, 2012). Thus this method cannot be implemented.<br />

4.2 Main valuation methods used<br />

To apply the main methods used, we took the following factors into account:<br />

Forecast data<br />

<strong>InfoVista</strong>’s management has established a budget for 2011/2012 via its annual budgeting and forecast<br />

process. This budget was not modified following publication of quarterly results. The two-year business plan<br />

(2012/2013 and 2013/2014) has also been transmitted to us. We have extrapolated the business plan for<br />

three additional years in order to approach activity levels (growth, return on investment) that management<br />

considers normative.<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 25 -

Number of shares<br />

Our calculations are based on the number of shares issued plus those that would result from the exercise of<br />

the BSAAR warrants and in-the-money Options (1,549,835 shares), less the number of treasury shares<br />

(379,029 at December 31, 2011).<br />

The number of shares resulting from this calculation is 17,650,843.<br />

Valuing equity based on enterprise value<br />

The adjustment for using enterprise value to calculate equity was determined based on actual figures for<br />

cash and financial debt at December 31, 2011 as they appear in the half-yearly consolidated financial<br />

statements. The positive adjustment amounts to €12,586 thousand and includes the following factors:<br />

- cash position, €27,006 thousand,<br />

- plus the impact of the potential cash inflow from the exercise of BSAAR warrants and the Options,<br />

amounting to €5,196 thousand,<br />

- plus the discounted present value of tax savings linked to losses carried forward, estimated at<br />

€5,170 thousand,<br />

- less the amount of the exceptional distribution planned for February 9, 2012, or €24,786 thousand.<br />

4. 21 Reference to acquisitions of blocks of <strong>InfoVista</strong> shares<br />

Presentation of the acquisition of blocks and related transactions<br />

The price of €5.05 was obtained following the competitive sale procedure used on the initiative of the<br />

Company and a U.S. advisory bank.<br />

We requested an explanation of the sale process and we understand that the bank began contacting 50-odd<br />

potential investors (investment funds and actors in the industrial sector) in April 2011 based on an<br />

informational document.<br />

We further learned that representatives of about 15 companies signed confidentiality agreements, opening a<br />

period of discussions from mid-June to mid-September 2011 between <strong>InfoVista</strong> and potential acquirers.<br />

Following this period, <strong>InfoVista</strong> received four non-binding letters of intent from two industrial firms and two<br />

investment funds, one of which was Thoma Bravo, the high bidder.<br />

The price initially offered by Thoma Bravo was revised downward in November 2011 following additional<br />

examinations by the potential acquirer.<br />

On December 20, 2011, via the intermediary of Project Metro, Thoma Bravo signed contracts for the offmarket<br />

acquisition of 10,827,692 shares at a price of €5.05 per share, representing 65.70% of the<br />

The proposed offer and this draft reply document are subject to review by the AMF<br />

- 26 -

Company’s share capital (61.18% on a fully diluted basis assuming exercise of the BSAAR warrants and<br />

Options and excluding treasury shares) with 16 investors.<br />

The price will be paid in two installments as follows: €3.65 on the Closing date (December 20, 2011) and<br />

€1.40 no later than the earlier of the following two dates: (i) 90 days after the Closing date or (ii) the date on<br />

which the Offer is closed. As part of the exceptional distribution, assigning rights to payment of the balance<br />

of the price was set up by Thoma Bravo, which has guaranteed the payment by the Offeror and, as such the<br />

balance of the price will be paid directly by the Company to the sellers of the controlling blocks when paying<br />

the dividend relating to the exceptional distribution.<br />

An investment agreement was also signed on December 20, 2011 by Project Metro and certain managing<br />

shareholders, under the terms of which the managers must sell 489,748 BSAAR warrants and the shares<br />

resulting from the exercise of 205,250 Options, for a total of 3.93% of fully diluted share capital after<br />

exclusion of treasury shares, based on a value of €5.05 per share (before the exceptional distribution).<br />