Curriculum vitae et studiorum of Giorgio Ferrari - Memotef - Sapienza

Curriculum vitae et studiorum of Giorgio Ferrari - Memotef - Sapienza

Curriculum vitae et studiorum of Giorgio Ferrari - Memotef - Sapienza

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

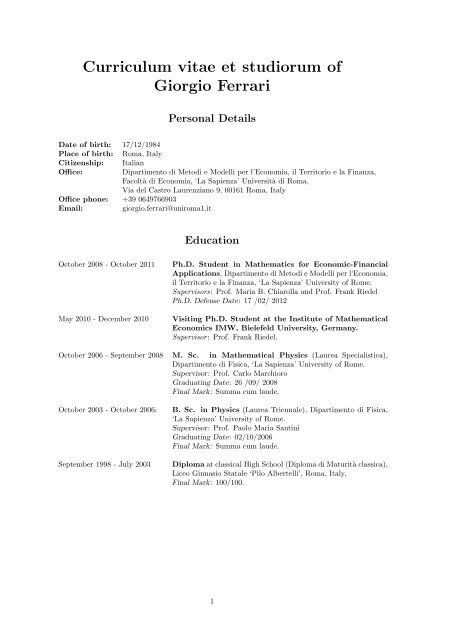

<strong>Curriculum</strong> <strong>vitae</strong> <strong>et</strong> <strong>studiorum</strong> <strong>of</strong><br />

<strong>Giorgio</strong> <strong>Ferrari</strong><br />

Personal D<strong>et</strong>ails<br />

Date <strong>of</strong> birth: 17/12/1984<br />

Place <strong>of</strong> birth: Roma, Italy<br />

Citizenship: Italian<br />

Office: Dipartimento di M<strong>et</strong>odi e Modelli per l’Economia, il Territorio e la Finanza,<br />

Facoltà di Economia, ‘La <strong>Sapienza</strong>’ Università di Roma,<br />

Via del Castro Laurenziano 9, 00161 Roma, Italy<br />

Office phone: +39 0649766903<br />

Email: giorgio.ferrari@uniroma1.it<br />

Education<br />

October 2008 - October 2011 Ph.D. Student in Mathematics for Economic-Financial<br />

Applications, Dipartimento di M<strong>et</strong>odi e Modelli per l’Economia,<br />

il Territorio e la Finanza, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome.<br />

Supervisors: Pr<strong>of</strong>. Maria B. Chiarolla and Pr<strong>of</strong>. Frank Riedel<br />

Ph.D. Defense Date: 17 /02/ 2012<br />

May 2010 - December 2010 Visiting Ph.D. Student at the Institute <strong>of</strong> Mathematical<br />

Economics IMW, Bielefeld University, Germany.<br />

Supervisor: Pr<strong>of</strong>. Frank Riedel.<br />

October 2006 - September 2008 M. Sc. in Mathematical Physics (Laurea Specialistica),<br />

Dipartimento di Fisica, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome.<br />

Supervisor: Pr<strong>of</strong>. Carlo Marchioro<br />

Graduating Date: 26 /09/ 2008<br />

Final Mark: Summa cum laude.<br />

October 2003 - October 2006: B. Sc. in Physics (Laurea Triennale), Dipartimento di Fisica,<br />

‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome.<br />

Supervisor: Pr<strong>of</strong>. Paolo Maria Santini<br />

Graduating Date: 02/10/2006<br />

Final Mark: Summa cum laude.<br />

September 1998 - July 2003 Diploma at classical High School (Diploma di Maturità classica),<br />

Liceo Ginnasio Statale ‘Pilo Albertelli’, Roma, Italy.<br />

Final Mark: 100/100.<br />

1

Fellowships and Awards<br />

• Winner <strong>of</strong> the scholarship ‘Percorso di Eccellenza’ (Excellent Student Program) sponsored<br />

by the Faculty <strong>of</strong> Mathematical, Physical and Natural Sciences <strong>of</strong> ‘La <strong>Sapienza</strong>’ University<br />

<strong>of</strong> Rome for the academic year 2007/2008.<br />

• Winner <strong>of</strong> a Ph.D. scholarship in Mathematics for Economic-Financial Applications at<br />

‘Dipartimento di M<strong>et</strong>odi e Modelli per l’Economia, il Territorio e la Finanza’, Faculty <strong>of</strong><br />

Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome (October 2008).<br />

• Winner <strong>of</strong> a Ph.D. position in Mathematics at ‘Dipartimento di Matematica G. Castelnuovo’,<br />

‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome (October 2008).<br />

Favourite Fields <strong>of</strong> Research<br />

Singular Stochastic Optimal Control problems;<br />

Stochastic Optimal Stopping problems;<br />

Stochastic Processes with financial and economic applications;<br />

D<strong>et</strong>erministic and Stochastic Optimal Control;<br />

Malliavin Calculus with financial applications;<br />

Dynamical Systems.<br />

Attended Workshops, Conferences and Schools<br />

• 7th Workshop on Bayesian Nonparam<strong>et</strong>ric:<br />

Collegio Carlo Alberto, Moncalieri, 21st-25th June 2009<br />

• Alumni Workshop 2009:<br />

Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome, 26th June 2009<br />

• Summer School ‘Economic Growth: Mathematical Dimension’:<br />

Lomosonov Moscow State University, 5th-12th July 2009<br />

Attended Lecture:<br />

‘Infinite Horizon Optimal Control with application to Economics’ by S.M. Aseev<br />

Final Grade: A (Russian Grade: 5/5)<br />

• Summer School in Financial Mathematics:<br />

University <strong>of</strong> Ljubljana, 7th-20th September 2009<br />

Attended Lectures:<br />

1. ‘How Finanacial mathematics is used in practice’ by P.S. Hagan ;<br />

2. ‘Credit Risk’ by M. Jeanblanc ;<br />

3. ‘Optimal Stopping for American Options’ by D. Lamberton ;<br />

4. ‘Portfolio Theory’ by G. Brumen ;<br />

5. ‘Financial Econom<strong>et</strong>rics’ by E. Zakrajsec ;<br />

6. ‘Brownian motion and introduction to stochastic integration’ by A. Mijatovic.<br />

2

• Spring School ‘Stochastic Control in Finance’:<br />

Université de Br<strong>et</strong>agne Occidentale - ITN, Rosc<strong>of</strong>f, 8th-17th March 2010<br />

Attended Lectures:<br />

1. ‘Repeated games with incompl<strong>et</strong>e information and Finance’ by B. De Meyer ;<br />

2. ‘Optimal switching problems’ by Said Hamadene ;<br />

3. ‘Hamilton-Jacobi-Bellman equations in infinite dimensions’ by M. Fuhrman and F.<br />

Gozzi ;<br />

4. ‘Hamilton-Jacobi-Bellman equations in financial models with transactions costs’ by<br />

Y. Kabanov ;<br />

5. ‘Stochastic Integration with respect to the fractional brownian motion and some<br />

applications to SDEs’ by J.A. Leon Vasquez ;<br />

6. ‘2 Persons zero-sum stochastic differential games’ by J. Li and R. Buckdahn ;<br />

7. ‘Actuarial models and their connection with Finance’ by J. Ma ;<br />

8. ‘G-Expectation in stochastic control and Finance’ by S. Peng ;<br />

9. ‘Linear-Quadratic optimal stochastic control and its applications to Finance’ by S.<br />

Tang.<br />

• Summer School ‘Stochastic Finance’:<br />

University <strong>of</strong> Ulm - Ulm, 20th-24th September 2010<br />

Attended Lectures:<br />

1. ‘Optimal stopping with local times’ by A. Shiryaev ;<br />

2. ‘First passage in stochastic volatility models with jumps: applications in financial<br />

mark<strong>et</strong>s’ by A. Mijatovic ;<br />

3. ‘Markov decision processes with applications to Finance’ by U. Rieder ;<br />

4. ‘Duality m<strong>et</strong>hods in robust utility maximization’ by A. Gushchin ;<br />

5. ‘Introduction to energy mark<strong>et</strong>s’ by R. Kiesel ;<br />

6. ‘Understanding the behavior <strong>of</strong> credit correlations under stress’ by M. Kalkbrener ;<br />

7. ‘One-dimensional and multi-dimensional coherent risk measures’ by A. Kulikov .<br />

• Fifth EBIM Doctoral Workshop on Economic Theory:<br />

Institute <strong>of</strong> Mathematical Economics IMW, Bielefeld University, 18th-19th November 2010<br />

• Third Research Day:<br />

Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome, 22nd February 2011<br />

• 14th ASMDA International Soci<strong>et</strong>y Conference:<br />

Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome , 7th-10th June 2011<br />

• Workshop on Stochastic M<strong>et</strong>hods in Financial Mark<strong>et</strong>s:<br />

Faculty <strong>of</strong> Mathematics and Physics, Ljubljana University, 26th-27th August 2011<br />

• Fourth European Summer School in Financial Mathematics:<br />

ETH, Zurich, 5th-9th September 2011<br />

Attended Lectures:<br />

1. ‘Statistical Models for Finance’ by J. Jacod and P. Embrechts ;<br />

2. ‘Stochastic Control M<strong>et</strong>hods in Finance’ by M. Soner .<br />

3

• XXXV Convegno AMASES:<br />

University <strong>of</strong> Pisa, Pisa, 15th-17th September 2011<br />

• Sixth EBIM Doctoral Workshop on Economic Theory:<br />

Institute <strong>of</strong> Mathematical Economics IMW, Bielefeld University, 5th-7th December 2011<br />

• XIII Workshop on Quantitative Finance:<br />

University <strong>of</strong> L’Aquila, 26th-27th January 2012<br />

Papers presented at Conferences, Workshops and Schools<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong>, F. Riedel : ‘Generalized Kuhn-Tucker Conditions for Stochastic<br />

Irreversible Investments with Limited Resources’, presented at ‘14th ASMDA International<br />

Soci<strong>et</strong>y Conference’, Rome, June 7-10, 2011.<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong>, F. Riedel : ‘Generalized Kuhn-Tucker Conditions for Stochastic<br />

Irreversible Investments with Limited Resources’, presented at ‘Workshop on Stochastic<br />

M<strong>et</strong>hods in Financial Mark<strong>et</strong>s’, Ljubljana, August 26-27, 2011.<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong>, F. Riedel : ‘Generalized Kuhn-Tucker Conditions for Stochastic<br />

Irreversible Investments with Limited Resources’, presented at ‘Fourth European Summer<br />

School in Financial Mathematics’, Zurich, September 5-9, 2011.<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong>, F. Riedel : ‘Generalized Kuhn-Tucker Conditions for Stochastic<br />

Irreversible Investments with Limited Resources’, presented at ‘XXXV Convegno AMASES’,<br />

Pisa, September, 15-17 2011.<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong> : ‘Identifying the Free Boundary <strong>of</strong> a Stochastic, Irreversible<br />

Investment Problem via the Bank-El Karoui Representation Theorem’, presented at ‘Sixth<br />

EBIM Doctoral Workshop on Economic Theory’, Bielefeld, December 5-7, 2011.<br />

• L. Caramellino, G. <strong>Ferrari</strong>, R. Piersimoni: ‘Power Series Representations for European<br />

Option Prices under Stochastic Volatility Models’, presented at ‘XIII Workshop on Quantitative<br />

Finance’, L’Aquila, January 26-27, 2012.<br />

Publications and Working Papers<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong> : ‘Identifying the Free Boundary <strong>of</strong> a Stochastic, Irreversible<br />

Investment Problem via the Bank-El Karoui Representation Theorem’, arXiv:1108.4886,<br />

submitted to SIAM Journal on Control and Optimization, 2011.<br />

• L. Caramellino, G. <strong>Ferrari</strong>, R. Piersimoni : ‘Power Series Representations for European<br />

Option Prices under Stochastic Volatility Models’, arXiv:1105.0068v1, preprint 2011.<br />

• M.B. Chiarolla, G. <strong>Ferrari</strong>, F. Riedel : ‘Generalized Kuhn-Tucker Conditions for N-Firms<br />

Stochastic Irreversible Investment under Limited Resources’, preprint 2011.<br />

• P. Buttà, G. <strong>Ferrari</strong>, C. Marchioro : ‘Speedy Motions <strong>of</strong> a Body Immersed in an Infinitely<br />

Extended Medium’, Journal <strong>of</strong> Statistical Physics, Volume 140, Issue 6 (2010), pp. 1182-1194.<br />

• G. <strong>Ferrari</strong>, D. Dell’ Arcipr<strong>et</strong>e : ‘Lecture Notes on Nonlinear Waves and Solitons’ on<br />

http : //www.phys.uniroma1.it/DipW eb/web disp/d3/dispense/DegasperisF isT eo.pdf,<br />

March 2008.<br />

4

Master Thesis students<br />

• Co-supervisor (with Pr<strong>of</strong>. Lucia Caramellino) <strong>of</strong> Roberta Piersimoni, Master Thesis in<br />

Applied Mathematics: ‘Un approccio in serie di potenze per il calcolo del prezzo di opzioni<br />

europee in modelli a volatilità stocastica’, Department <strong>of</strong> Mathematics, University <strong>of</strong> Rome<br />

‘Tor Vergata’, December 2010.<br />

Ph.D. Courses attended<br />

• ‘Probability’ by B. Liseo, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome ;<br />

• ‘Statistics’ by B. Liseo, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome ;<br />

• ‘Microeconomic Theory’ by L. Ventura and L. Spinesi, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’<br />

University <strong>of</strong> Rome ;<br />

• ‘Macroeconomic Theory’ by G. Rodano, Faculty <strong>of</strong> Engineering, ‘La <strong>Sapienza</strong>’ University<br />

<strong>of</strong> Rome ;<br />

• ‘Econom<strong>et</strong>rics’ by M. Franchi, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome ;<br />

• ‘Elements <strong>of</strong> Probability: Brownian Motion and Stochastic Differential Equations’<br />

by A. Calzolari and P. Baldi, Department <strong>of</strong> Mathematics, University <strong>of</strong> Rome ‘Tor<br />

Vergata’ ;<br />

• ‘Calculus <strong>of</strong> Variations’ by R. Peirone, Department <strong>of</strong> Mathematics, University <strong>of</strong> Rome<br />

‘Tor Vergata’ ;<br />

• ‘Mathematical Models for Financial Mark<strong>et</strong>s’ by L. Caramellino, Department <strong>of</strong> Mathematics,<br />

University <strong>of</strong> Rome ‘Tor Vergata’ ;<br />

• ‘Random Evolutions with Locally Independent Increments on increasing time intervals’ by<br />

V.S. Koroliuk, Institute <strong>of</strong> Mathematics, University <strong>of</strong> Kiev .<br />

Language skills<br />

Italian : Mother Tongue.<br />

English : Good knowledge, verbal and written.<br />

French : Fair knowledge, verbal and written.<br />

German : Basic knowledge, verbal and written.<br />

Computer skills<br />

Operating systems: Windows, Linux.<br />

S<strong>of</strong>twares: Micros<strong>of</strong>t Office, Open Office, LaTex.<br />

Programming Languages: C, HTML.<br />

Scientific S<strong>of</strong>twares: Origin, Mathematica, R, Gnuplot.<br />

Teaching Activities<br />

• October 2009-December 2009 : Teaching Assistant for the course ‘Mathematics I’,<br />

Pr<strong>of</strong>. A. Blasi, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome.<br />

• October 2011-December 2011 : Teaching Assistant for the course ‘Mathematics I’,<br />

Pr<strong>of</strong>. A. Blasi, Faculty <strong>of</strong> Economics, ‘La <strong>Sapienza</strong>’ University <strong>of</strong> Rome.<br />

• October 2011-December 2011 : Teaching Assistant for the course ‘Stochastic Processes<br />

with Financial Applications’, Pr<strong>of</strong>. M. Scarsini, Faculty <strong>of</strong> Economics, University <strong>of</strong> Rome<br />

‘Luiss Guido Carli’.<br />

Personal Interests<br />

Archeology, Classical Literature, History, Music, Art, Food, Wine, Nature and Wildlife.<br />

5