20020217_Cariboo Observer_03.pdf - the Quesnel & District ...

20020217_Cariboo Observer_03.pdf - the Quesnel & District ...

20020217_Cariboo Observer_03.pdf - the Quesnel & District ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AIS QUESNEKARIBOO OBSERVER Sunday, February 17, 2002<br />

Are mutual<br />

funds really<br />

as risky as<br />

<strong>the</strong>y seem?<br />

It's impossible to<br />

compare funds "across<br />

<strong>the</strong> board." Mutual funds<br />

not only differ in <strong>the</strong>ir financial<br />

objectives but also<br />

invest in different kind of<br />

securities that reflect <strong>the</strong><br />

ultimate objective of <strong>the</strong><br />

fund.<br />

• Thus, depending on<br />

<strong>the</strong> securities <strong>the</strong> fund is<br />

investing in, or <strong>the</strong> mix of<br />

securities chosen for a<br />

specific fund, <strong>the</strong> element<br />

of 'risk' varies substantially.<br />

The fund's objective is<br />

what <strong>the</strong> fund seeks to<br />

achieve by investing. This<br />

Stait planning ear^<br />

for your retirem<br />

Saving for retirement<br />

is one of those things<br />

many people find hard to<br />

do:..: :<br />

With <strong>the</strong>ir full working<br />

careers still ahead,<br />

young adults see retirement<br />

as a distant goal.<br />

There's plenty of time yet,<br />

<strong>the</strong>y say, to worry about<br />

<strong>the</strong> golden years. Older<br />

people may feel closer to<br />

retirement, but o<strong>the</strong>r fi^<br />

nahcial commitments -<br />

such as buying homes,<br />

funding children's education<br />

- loom larger in <strong>the</strong>ir<br />

minds.<br />

So opening a registered<br />

retirement savings<br />

plan and contributing to<br />

it regularly - seen by financial<br />

planners as crucial<br />

to providing reasonable<br />

retirement income -<br />

often gets put on <strong>the</strong> back<br />

burner.<br />

The hesitation to saVe<br />

may be understandable,<br />

but planners say <strong>the</strong> sooner<br />

you begin to put<br />

money into an RRSP, <strong>the</strong><br />

better. Building a pool of<br />

assets to see you into a<br />

comfortable retirement<br />

will be much easier if you<br />

begin <strong>the</strong> process early in<br />

life. And you should also<br />

make your contributions<br />

at <strong>the</strong> beginning of <strong>the</strong> tax<br />

year, ra<strong>the</strong>r than <strong>the</strong> end,<br />

<strong>the</strong> unfortunate custom of<br />

many RRSP holders.<br />

Why is earlier better?<br />

Remember that RRSP<br />

contributions are tax deductible<br />

and that earnings<br />

in an RRSP are allowed to<br />

compound tax-deferred<br />

until <strong>the</strong>y are withdrawn.<br />

So <strong>the</strong> younger you are<br />

when you make your contributions,<br />

<strong>the</strong> longer <strong>the</strong>y<br />

will betiefit from <strong>the</strong><br />

magic of compounding.<br />

Contributing as early as<br />

possible each year will<br />

also bolster <strong>the</strong> cortipounding<br />

process.<br />

Here's how compounding<br />

works. Let's say<br />

you put $1,000 into a<br />

two-year term deposit<br />

that pays 10 per cent<br />

compounded annually. In<br />

a year's time, you've<br />

earned $100 in interest.<br />

That $100 is added, to<br />

your principal. For <strong>the</strong><br />

second year of <strong>the</strong> term<br />

you get 10 per cent interest<br />

on $1,100, or $110.<br />

You can see how this interest-6n-interest<br />

couJd<br />

quickly mount over a long<br />

term.<br />

When you combine<br />

<strong>the</strong> benefits of compounding<br />

with tax deferral,<br />

you've got a very potent<br />

force.<br />

Let's say Mike and<br />

Bob each have $5,000 of<br />

<strong>the</strong>ir salaries to invest, but<br />

follow different paths,<br />

Mike invests in an RRSP -<br />

earning 8 per cent a year -<br />

where his funds are not<br />

subject to tax until <strong>the</strong>y<br />

are Withdrawn. In 20<br />

years, <strong>the</strong> original amount<br />

would have grown to<br />

$23,305 at which point<br />

Mike decides to cash out.<br />

Assume for simplicity's<br />

sake that Mike is in <strong>the</strong><br />

50 per cent bracket, and<br />

he would end up with<br />

$11,623. .<br />

Bob, also in <strong>the</strong> 50<br />

per cent tax bracket, decides<br />

to invest outside his<br />

RRSP in <strong>the</strong> same investment<br />

earning 8 per cent<br />

annually. He's subject to<br />

tax on <strong>the</strong> original<br />

amount, which reduces<br />

his starting investment by<br />

half to $2,500. He'II also<br />

pay taxes on <strong>the</strong> investments<br />

earnings over <strong>the</strong><br />

years. After 20 years, he's<br />

got $5,478.<br />

True, <strong>the</strong>re would be<br />

no tax to pay at. that<br />

point but <strong>the</strong> end amount<br />

doesn't come close to<br />

making up for <strong>the</strong> tax-free<br />

compounding of interest.<br />

Ano<strong>the</strong>r benefit of<br />

starting early is that you'll<br />

need to put away less<br />

each year to reach your<br />

retirement goal.<br />

Let's say you'll need<br />

$500,000 including CPP<br />

and OAS to retire comfortably<br />

by age 65 and<br />

your investments will<br />

average 8 per cent annual'<br />

growth with inflation at 3<br />

per cent. If you're 25<br />

now, you'll need to invest<br />

$1,254 per year to reach<br />

your goal, according to<br />

Scotiabank's RRSP Reality<br />

Check. But if you wait<br />

until 35 to begin saving,<br />

you'll have to set aside<br />

$3,032 a year. Hold off<br />

until your 45 and you<br />

must come up with<br />

$8,109 a year.<br />

The figures clearly<br />

show <strong>the</strong>re is a price to be<br />

paid in <strong>the</strong> form of a reduced<br />

retirement nest-egg<br />

by those who put off saving<br />

until tomorrow.<br />

Bruce Armstrong is<br />

vice-president, financial<br />

planning and investment<br />

saving programs.<br />

Rigsby Lea Barr & Go.<br />

"Helping People in Business "<br />

Put our long-term planning expertise to work<br />

for you and your business.<br />

Business Planning • Inconae Tax Advice<br />

• FInqncial Consulting • Estate Planning<br />

101-455 McLean Street<br />

992-5547 Fax: 992-5372<br />

e-niail: ribco@que8nelbc.c^ ^<br />

will determine what kind<br />

of securities <strong>the</strong> fuiid will<br />

buy, and in what economic<br />

sectors or countries.<br />

For example, a fund seeking<br />

<strong>the</strong> highest possible<br />

return on capital may invest<br />

in more speculative<br />

common stocks than one<br />

seeking niaximum income<br />

from dividends. The risk<br />

in <strong>the</strong> first objective is<br />

much higher than in <strong>the</strong><br />

second.<br />

You can see, <strong>the</strong>refore,<br />

that <strong>the</strong> amount of<br />

risk involved is directly<br />

related to <strong>the</strong> fund's ob<br />

jective; Generally speak-:<br />

ing, it can be assumed<br />

that <strong>the</strong> higher <strong>the</strong> return,<br />

<strong>the</strong> higher <strong>the</strong> risk involved.<br />

However, mutuak<br />

funds remove much of <strong>the</strong><br />

risk from investing.<br />

Drowning In a sea of RRSP choices? investing in an RRSP can be pretty oonflasing. Talk to<br />

your Qarica agent about putting toge<strong>the</strong>r a plan to help you get <strong>the</strong> most out of your retirement savings.<br />

Kevin McKelvie* CFP CLUCH.F.C.<br />

McKelvie Financial Services Ltd. RWS<br />

250992^5790 HI TT ARirA<br />

333 Reid St. \^LJ\IS.L%^J\.<br />

<strong>Quesnel</strong> BC investment and tmurance solutions-since 1870<br />

«Rcg.stCTed trademark of clarica ufe Insurance Company. Representing CbrJca ife Insurance Qmpany and *Clarica InvEStoo Inc<br />

5 year» 5.10% Term<br />

Compounding<br />

Effective yield 5.64%<br />

CALL TODAY 992-9216<br />

NEW MEMBERS WELCOME<br />

www,{|ue$nelGu.com<br />

<strong>Quesnel</strong> & <strong>District</strong> Credit Union<br />

253 Reid Street 992-9216<br />

INSTANT<br />

RRSP<br />

LOANS<br />

Fixed rates as<br />

low as prime<br />

NO FEES<br />

NORTHLAND MORTGAGES<br />

SBLf ADMmmTBBED<br />

RRSP'S<br />

Your RRSP can purchase and Northland can<br />

service a safe secure 1st Mortgage earning<br />

you exceptional yield on your investment.<br />

It need not be complicated.<br />

Talk to <strong>the</strong> experts at Northland Mortgages.<br />

Francine or Dennis at 992-7295<br />

252 Reid Street <strong>Quesnel</strong><br />

millennium<br />

MILLENNIUM FINANCIAL GROUP INC<br />

(Mutual Funds Dealership)<br />

Prince George, <strong>Quesnel</strong>, Williams Lake<br />

CALL TOLL FREE<br />

1-888-581-1042<br />

to arrange your appointment in Quesnei<br />

1<br />

Mike Groves<br />

Branch Manager<br />

•RRSP'S •Mutual Funds •RRIF's •Portfolio Review<br />

•Investment and Retirement Planning<br />

MONEY<br />

QUESNEI CARIBOO OBSERVER Sunday.'February 17,2002 A19<br />

Don't be intimidated by difficult markets<br />

The task mciy be daunting^ but ajewjucts can lessen thai load<br />

When volatility afflicts<br />

<strong>the</strong> marketSj investors<br />

get nervous. And<br />

many, ra<strong>the</strong>r than sticking<br />

to <strong>the</strong>ir guns, are prone to<br />

panic. They pick up <strong>the</strong><br />

phone, call <strong>the</strong>ir brokers<br />

or financial planners, and<br />

head for <strong>the</strong> exits.<br />

Why stay invested in<br />

stocks or equity mutual<br />

funds, <strong>the</strong>y wonder, if<br />

prices could head down<br />

even more.^ Their idea is<br />

to sell now before <strong>the</strong><br />

market deteriorates fur<strong>the</strong>r,<br />

<strong>the</strong>n buy back in<br />

when <strong>the</strong>y feel <strong>the</strong> market<br />

has stabilized and is<br />

poised for big gains.<br />

While this may give<br />

some investors temporary<br />

peace of mind, financial<br />

planners say it is definitely<br />

not <strong>the</strong> best way to<br />

build wealth. It smacks of<br />

trying to time <strong>the</strong> market,<br />

a dicey investment strategy<br />

that involves attempting<br />

to match buys and<br />

sells with inarket valleys<br />

and peaks. Even most investment<br />

professionals<br />

shun <strong>the</strong> practice.<br />

It's far more effective,<br />

planners contend, to buy<br />

a diversified portfolio of<br />

good, solid investments,<br />

and stick with <strong>the</strong>m. Investors<br />

who are constantly<br />

moving in and out of<br />

<strong>the</strong> stock and bond mar-<br />

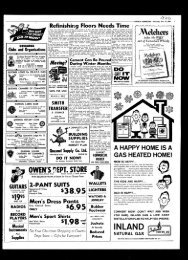

Al Paterson's stress level doesn't need to go through <strong>the</strong> roof over <strong>the</strong> challenges of personal financial planning.<br />

Neil Horner photo<br />

kets in big way - often<br />

running to <strong>the</strong> sidelines<br />

when stock prices dip -<br />

will Hkely not achieve as<br />

good overall performance<br />

as those who stay invested.<br />

Not only are <strong>the</strong>y<br />

likely to miss some of best<br />

times in <strong>the</strong> market, but<br />

<strong>the</strong> frequent trading will<br />

increase transaction fees -<br />

commissions for trading<br />

stocks, for instance -<br />

which would be a drag on<br />

<strong>the</strong>ir returns.<br />

For registered retirement<br />

savings plan investors,<br />

<strong>the</strong> potential danger<br />

of frequently moving<br />

in and out of <strong>the</strong> market<br />

can hardly be Overstated,<br />

particularly if it results in<br />

poor investment performance.<br />

Sub-par performance<br />

jeopardizes <strong>the</strong><br />

creation of an asset pool<br />

large enough to backstop<br />

a comfortable retirement.<br />

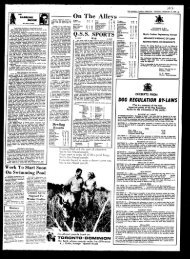

Global Securities<br />

Corporation<br />

Barhara J. Bachmeier, L A .<br />

Branch Operator<br />

Are your RRSP Investments on<br />

track to fiind your retirement?<br />

ISSUER RATINGS ONE YEAR FIVE YEARS<br />

Government<br />

of Canada Bond AAA 4.77'^<br />

CMHC AAA 2.76^' 4.42^'<br />

BC Provincial<br />

Bond<br />

Ontacio Hydro<br />

Bond<br />

Guaranteed<br />

Investment<br />

Certificate<br />

YIELDS<br />

AAlo 2.78^' 4.79^<br />

AAlo 2.76^° 5.18'^<br />

••••All Rates Subject To Change Based on Market Conditions & Availability<br />

Delhie Hanrahan, CFI^ Give I. A . Barb, Hedy or Debbie a call<br />

.•:ied\jSchulz,I.A. to find out how we can help><br />

Hours of Operation:<br />

Monday-Friday<br />

6:30am - 5:00pm<br />

#3-334 Front Street, ftuSslif^<br />

Tel: (250)992-7^8 ^ ' ^<br />

Although many investors<br />

claim <strong>the</strong>y buy<br />

and sell at just <strong>the</strong> right<br />

times, research shows that<br />

few actually walk <strong>the</strong><br />

talk. More than 90 per<br />

cent of investments by individuals<br />

are made near a<br />

market high, and <strong>the</strong> majority<br />

of sales take place<br />

after investors have lost<br />

more than 10 per cent.<br />

To see how staying<br />

invested can pay big dividends,<br />

let's look at <strong>the</strong><br />

impact of being out of <strong>the</strong><br />

market for various time<br />

periods. Let's say you put<br />

$10,000 into <strong>the</strong> stocks<br />

that make up <strong>the</strong> S&P<br />

500 Index on Oct. 1,<br />

1996.<br />

If you didn't budge,<br />

you'd have $15,106 on<br />

Oct. 1, 2001. But if you<br />

moved your money out of<br />

<strong>the</strong> market for its 10 best<br />

days, you would have<br />

only $9,843. Be out of <strong>the</strong><br />

market for <strong>the</strong> best 30<br />

days, and your investment<br />

would shrink to $5,505.<br />

Clearly, staying invested<br />

over <strong>the</strong> long term-is an<br />

effective way to build a<br />

nest egg.<br />

Bear in mind that investing<br />

means niixing different<br />

types of securities<br />

from <strong>the</strong> three major asset<br />

classes - equities, fixed income<br />

and cash or equivalents<br />

- in a portfolio that<br />

meets your goals and risk<br />

tolerance. But once you<br />

have <strong>the</strong> investments in<br />

place, stick to your plan.<br />

Bruce Armstrong is<br />

vice-president, financial<br />

planning and investment<br />

savings programs at Scotiabank.<br />

Stocks<br />

Bonds<br />

Mutual Funds<br />

Specialty Products<br />

Access to all major exchanges<br />

•Independent Canadian Co.<br />

Extended Hours:^<br />

Evenings & Weekends<br />

during February<br />

by appointment<br />

CIPF