RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

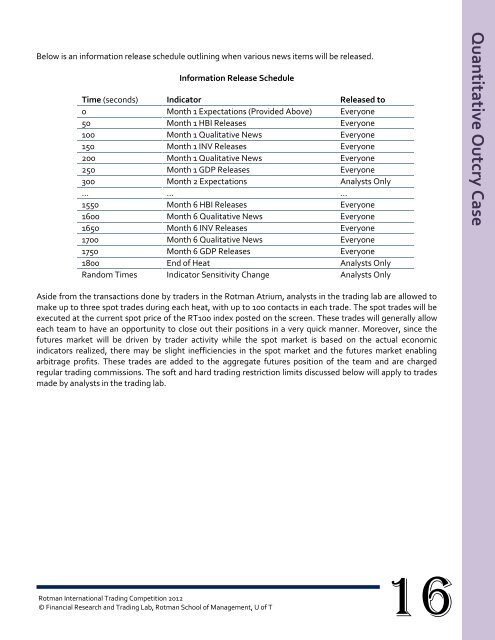

Below is an information release schedule outlining when various news items will be released.<br />

Information Release Schedule<br />

Time (seconds) Indicator Released to<br />

0 Month 1 Expectations (Provided Above) Everyone<br />

50 Month 1 HBI Releases Everyone<br />

100 Month 1 Qualitative News Everyone<br />

150 Month 1 INV Releases Everyone<br />

200 Month 1 Qualitative News Everyone<br />

250 Month 1 GDP Releases Everyone<br />

300 Month 2 Expectations Analysts Only<br />

… … …<br />

1550 Month 6 HBI Releases Everyone<br />

1600 Month 6 Qualitative News Everyone<br />

1650 Month 6 INV Releases Everyone<br />

1700 Month 6 Qualitative News Everyone<br />

1750 Month 6 GDP Releases Everyone<br />

1800 End of Heat Analysts Only<br />

Random Times Indicator Sensitivity Change Analysts Only<br />

Aside from the transactions done by traders in the <strong>Rotman</strong> Atrium, analysts in the trading lab are allowed to<br />

make up to three spot trades during each heat, with up to 100 contacts in each trade. The spot trades will be<br />

executed at the current spot price of the RT100 index posted on the screen. These trades will generally allow<br />

each team to have an opportunity to close out their positions in a very quick manner. Moreover, since the<br />

futures market will be driven by trader activity while the spot market is based on the actual economic<br />

indicators realized, there may be slight inefficiencies in the spot market and the futures market enabling<br />

arbitrage profits. These trades are added to the aggregate futures position of the team and are charged<br />

regular trading commissions. The soft and hard trading restriction limits discussed below will apply to trades<br />

made by analysts in the trading lab.<br />

<strong>Rotman</strong> <strong>International</strong> <strong>Trading</strong> Competition <strong>2012</strong><br />

© Financial Research and <strong>Trading</strong> Lab, <strong>Rotman</strong> School of Management, U of T<br />

16<br />

Quantitative Outcry <strong>Case</strong>