RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

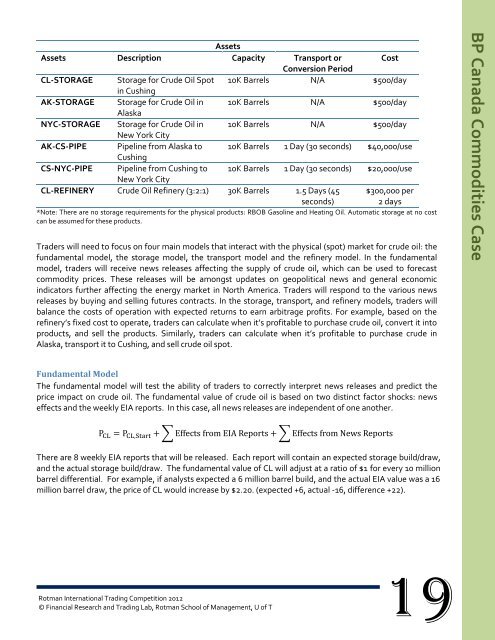

Assets Description<br />

Assets<br />

Capacity Transport or<br />

Conversion Period<br />

Cost<br />

CL-STORAGE Storage for Crude Oil Spot<br />

in Cushing<br />

10K Barrels N/A $500/day<br />

AK-STORAGE Storage for Crude Oil in<br />

Alaska<br />

10K Barrels N/A $500/day<br />

NYC-STORAGE Storage for Crude Oil in<br />

New York City<br />

10K Barrels N/A $500/day<br />

AK-CS-PIPE Pipeline from Alaska to<br />

Cushing<br />

10K Barrels 1 Day (30 seconds) $40,000/use<br />

CS-NYC-PIPE Pipeline from Cushing to 10K Barrels 1 Day (30 seconds) $20,000/use<br />

CL-REFINERY<br />

New York City<br />

Crude Oil Refinery (3:2:1) 30K Barrels 1.5 Days (45<br />

seconds)<br />

<strong>Rotman</strong> <strong>International</strong> <strong>Trading</strong> Competition <strong>2012</strong><br />

© Financial Research and <strong>Trading</strong> Lab, <strong>Rotman</strong> School of Management, U of T<br />

$300,000 per<br />

2 days<br />

*Note: There are no storage requirements for the physical products: RBOB Gasoline and Heating Oil. Automatic storage at no cost<br />

can be assumed for these products.<br />

Traders will need to focus on four main models that interact with the physical (spot) market for crude oil: the<br />

fundamental model, the storage model, the transport model and the refinery model. In the fundamental<br />

model, traders will receive news releases affecting the supply of crude oil, which can be used to forecast<br />

commodity prices. These releases will be amongst updates on geopolitical news and general economic<br />

indicators further affecting the energy market in North America. Traders will respond to the various news<br />

releases by buying and selling futures contracts. In the storage, transport, and refinery models, traders will<br />

balance the costs of operation with expected returns to earn arbitrage profits. For example, based on the<br />

refinery’s fixed cost to operate, traders can calculate when it’s profitable to purchase crude oil, convert it into<br />

products, and sell the products. Similarly, traders can calculate when it’s profitable to purchase crude in<br />

Alaska, transport it to Cushing, and sell crude oil spot.<br />

Fundamental Model<br />

The fundamental model will test the ability of traders to correctly interpret news releases and predict the<br />

price impact on crude oil. The fundamental value of crude oil is based on two distinct factor shocks: news<br />

effects and the weekly EIA reports. In this case, all news releases are independent of one another.<br />

There are 8 weekly EIA reports that will be released. Each report will contain an expected storage build/draw,<br />

and the actual storage build/draw. The fundamental value of CL will adjust at a ratio of $1 for every 10 million<br />

barrel differential. For example, if analysts expected a 6 million barrel build, and the actual EIA value was a 16<br />

million barrel draw, the price of CL would increase by $2.20. (expected +6, actual -16, difference +22).<br />

19<br />

BP Canada Commodities <strong>Case</strong>