RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

RITC 2012 Case Package - Rotman International Trading ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

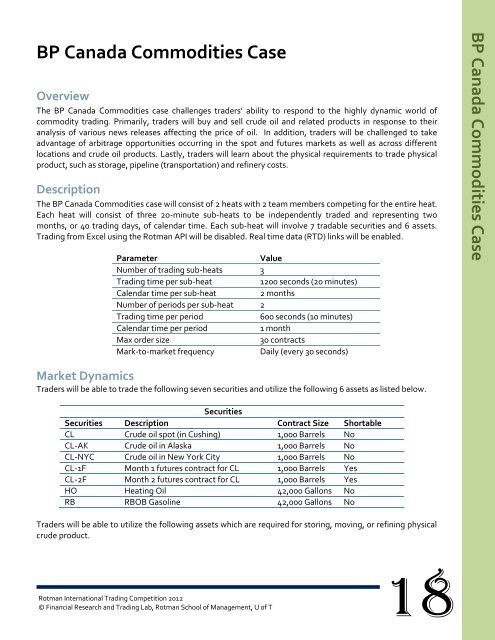

BP Canada Commodities <strong>Case</strong><br />

Overview<br />

The BP Canada Commodities case challenges traders’ ability to respond to the highly dynamic world of<br />

commodity trading. Primarily, traders will buy and sell crude oil and related products in response to their<br />

analysis of various news releases affecting the price of oil. In addition, traders will be challenged to take<br />

advantage of arbitrage opportunities occurring in the spot and futures markets as well as across different<br />

locations and crude oil products. Lastly, traders will learn about the physical requirements to trade physical<br />

product, such as storage, pipeline (transportation) and refinery costs.<br />

Description<br />

The BP Canada Commodities case will consist of 2 heats with 2 team members competing for the entire heat.<br />

Each heat will consist of three 20-minute sub-heats to be independently traded and representing two<br />

months, or 40 trading days, of calendar time. Each sub-heat will involve 7 tradable securities and 6 assets.<br />

<strong>Trading</strong> from Excel using the <strong>Rotman</strong> API will be disabled. Real time data (RTD) links will be enabled.<br />

Parameter Value<br />

Number of trading sub-heats 3<br />

<strong>Trading</strong> time per sub-heat 1200 seconds (20 minutes)<br />

Calendar time per sub-heat 2 months<br />

Number of periods per sub-heat 2<br />

<strong>Trading</strong> time per period 600 seconds (10 minutes)<br />

Calendar time per period 1 month<br />

Max order size 30 contracts<br />

Mark-to-market frequency Daily (every 30 seconds)<br />

Market Dynamics<br />

Traders will be able to trade the following seven securities and utilize the following 6 assets as listed below.<br />

Securities<br />

Securities Description Contract Size Shortable<br />

CL Crude oil spot (in Cushing) 1,000 Barrels No<br />

CL-AK Crude oil in Alaska 1,000 Barrels No<br />

CL-NYC Crude oil in New York City 1,000 Barrels No<br />

CL-1F Month 1 futures contract for CL 1,000 Barrels Yes<br />

CL-2F Month 2 futures contract for CL 1,000 Barrels Yes<br />

HO Heating Oil 42,000 Gallons No<br />

RB RBOB Gasoline 42,000 Gallons No<br />

Traders will be able to utilize the following assets which are required for storing, moving, or refining physical<br />

crude product.<br />

<strong>Rotman</strong> <strong>International</strong> <strong>Trading</strong> Competition <strong>2012</strong><br />

© Financial Research and <strong>Trading</strong> Lab, <strong>Rotman</strong> School of Management, U of T<br />

18<br />

BP BP Canada Canada Commodities Commodities <strong>Case</strong> <strong>Case</strong>