options

options

options

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P&L<br />

P&L<br />

P&L<br />

P&L<br />

Options Trading: The Hidden Reality 265<br />

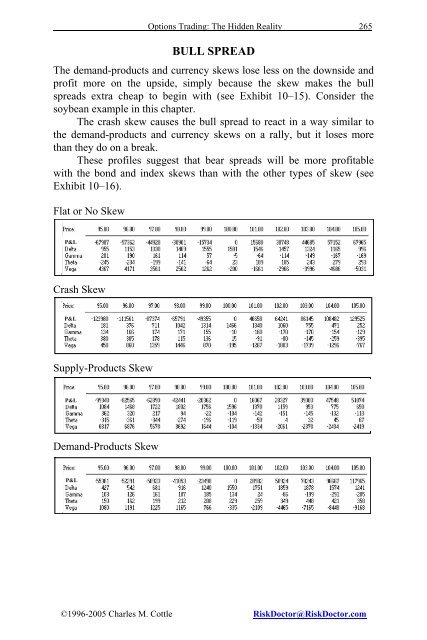

BULL SPREAD<br />

The demand-products and currency skews lose less on the downside and<br />

profit more on the upside, simply because the skew makes the bull<br />

spreads extra cheap to begin with (see Exhibit 10–15). Consider the<br />

soybean example in this chapter.<br />

The crash skew causes the bull spread to react in a way similar to<br />

the demand-products and currency skews on a rally, but it loses more<br />

than they do on a break.<br />

These profiles suggest that bear spreads will be more profitable<br />

with the bond and index skews than with the other types of skew (see<br />

Exhibit 10–16).<br />

Flat or No Skew<br />

Crash Skew<br />

Supply-Products Skew<br />

Demand-Products Skew<br />

©1996-2005 Charles M. Cottle RiskDoctor@RiskDoctor.com