Reseña de Valores 2012 - Bolsa de Santiago

Reseña de Valores 2012 - Bolsa de Santiago

Reseña de Valores 2012 - Bolsa de Santiago

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

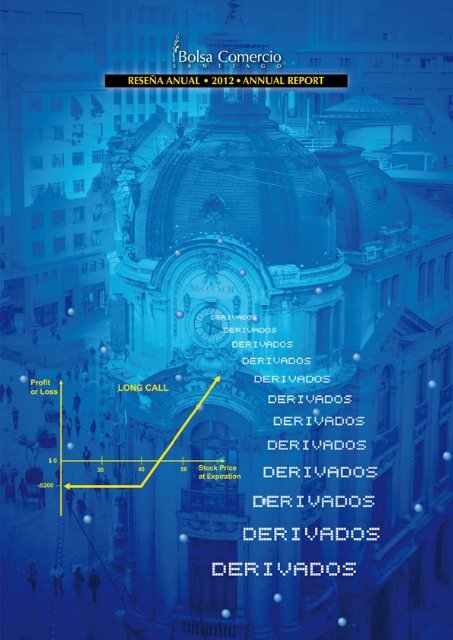

Reseña AnualAnnual Report2 0 1 21

Directorio • Board of DirectorsPresi<strong>de</strong>nte / ChairmanVicepresi<strong>de</strong>nte / Vice-ChairmanDirectores / Board of DirectorsSr. Pablo Yrarrázaval ValdésSr. Leonidas Vial EcheverríaSr. Juan Andrés Camus CamusSr. Juan Eduardo Correa GarcíaSr. Nicholas Davis LecarosSr. Juan Andrés Fontaine TalaveraSr. Pablo Granifo LavínSr. Jaime Larraín VialSr. Eduardo Muñoz VivaldiSr. Hernán Somerville SennSr. Óscar von Chrismar CarvajalComité <strong>de</strong> Buenas Prácticas l Best Practices CommitteeSr. Enrique Barros BourieSr. Leonidas Montes LiraSr. Lisandro Serrano Spoerer3 4Comité <strong>de</strong> Normas, Riesgo y Auditoría l Standards, Risk and Audit CommitteeSr. Juan Eduardo Correa GarcíaSr. Pablo Granifo LavínSr. Jaime Larraín VialSr. Eduardo Muñoz VivaldiSr. Óscar von Chrismar CarvajalComité <strong>de</strong> Negocios y Tecnología l Business and Technology CommitteeSr. Juan Andrés Camus CamusSr. Nicholas Davis LecarosSr. Juan Andrés Fontaine TalaveraSr. Hernán Somerville SennSr. Leonidas Vial Echeverría2Comité <strong>de</strong> Etica y Disciplina l Ethics and Discipline CommitteeTitulares / Head Members:Sr. Patricio Parodi GilSr. Juan Pablo Ugarte ValdésSuplentes / Alternate MembersSr. Mario Duque ArredondoSr. Francisco Ossa FrugoneSr. Gonzalo van Wersch Cal<strong>de</strong>rón

5 6 2 1 7 8 9 10 11Directorio • Board of Directors Sr. Pablo Yrarrázaval Valdés, Presi<strong>de</strong>nte / Chairman (1)Sr. Leonidas Vial Echeverría, Vicepresi<strong>de</strong>nte / Vice-Chairman (2)Sr. Pablo Granifo Lavín, Director (3)Sr. Juan Andrés Fontaine Talavera, Director (4)Sr. Eduardo Muñoz Vivaldi, Director (5)Sr. Óscar von Chrismar Carvajal, Director (6)Sr. Juan Andrés Camus Camus, Director (7)Sr. Hernán Somerville Senn, Director (8)Sr. Nicholas Davis Lecaros, Director (9)Sr. Juan Eduardo Correa García, Director (10)Sr. Jaime Larraín Vial, Director (11)3

4Presi<strong>de</strong>nte / ChairmanSr. Pablo Yrarrázaval Valdés

Mensaje <strong>de</strong>l Presi<strong>de</strong>nte • Chairman’s MessageAl igual que en años anteriores, <strong>2012</strong> fue un añocomplejo para la economía mundial. En lospaíses <strong>de</strong>sarrollados existe primordialmenteuna crisis <strong>de</strong>l empleo y día a día los gobiernos buscannuevas medidas para evitar el <strong>de</strong>scenso continuado<strong>de</strong>l crecimiento económico. Los problemas queafectan fundamentalmente a los mercados europeosson múltiples y se requerirá gran<strong>de</strong>s esfuerzos y untiempo prolongado para superarlos.En contraste, Chile y otros mercados <strong>de</strong> laregión, esencialmente Colombia y Perú, muestranun dinamismo <strong>de</strong> excepción, con un <strong>de</strong>sarrolloeconómico sostenido y mejoras continuas en susindicadores macroeconómicos.Precisamente, en lo que respecta a la economíanacional el <strong>2012</strong> fue un año favorable en términoseconómicos. El país finalizó con una tasa <strong>de</strong>crecimiento <strong>de</strong>l producto interno bruto <strong>de</strong> un 5,66%anual, cifra que es superior al crecimiento promediomundial y latinoamericano <strong>de</strong> un 3,20% y 3,00%,respectivamente, y anotó una baja histórica en el<strong>de</strong>sempleo, alcanzando una tasa <strong>de</strong> 5,2% a fines <strong>de</strong>laño <strong>2012</strong>.En contraste con las positivas cifras económicasque nos acompañaron durante el <strong>2012</strong>, el mercadoaccionario nacional mostró un crecimiento bajo,igualándose en este caso a la ten<strong>de</strong>ncia que mostrarongran parte <strong>de</strong> los mercados internacionales. Losprincipales índices <strong>de</strong>l mercado nacional, el IPSA eIGPA, terminaron el año con una variación anual <strong>de</strong>2,96% y 4,67%, respectivamente.En relación a los precios <strong>de</strong> las acciones en losdistintos sectores, los que terminaron con mejor<strong>de</strong>sempeño en <strong>2012</strong> fueron Consumo, Retail, Bancay Utilities, anotando un aumento en el año en susrespectivos índices <strong>de</strong> 14,97%, 7,48%, 6,79% y 4,70%.Por otra parte, los índices sectoriales con rendimientosmenos favorables fueron el índice Salmón, con un-25,95%, Commodities con un -3.93%, Industrial conun -1.56% y Constructoras e Inmobiliarias con un-0.12%.Debido al escenario plano en los precios <strong>de</strong> lasacciones, el año <strong>2012</strong> se mantuvo como un año <strong>de</strong>mo<strong>de</strong>rada actividad, tanto en número <strong>de</strong> negocioscomo en montos transados. En el caso <strong>de</strong> las acciones,el volumen total transado el <strong>2012</strong> alcanzó una cifraequivalente a US$ 45.812 millones, bajando un 16,4%Following the past year´s behavior, <strong>2012</strong>was a complicated year for the worl<strong>de</strong>conomy. In <strong>de</strong>veloped countries there isan unemployment crisis and it is an everydaystruggle to avoid the continuous <strong>de</strong>crease of theeconomic growth. European markets are beingaffected by numerous problems. Time and bigefforts must be ma<strong>de</strong> in or<strong>de</strong>r to overcome them.On the other hand, Chile and other markets ofthe region, essentially Colombia and Peru haveshow an exceptional dynamism, with a sustaine<strong>de</strong>conomic growth and continuous improvementsin their macroeconomic indicators.Precisely, <strong>2012</strong> was a remarkable year forthe national economy. Our country en<strong>de</strong>dthe year with an annual GDP - GeographicDomestic Product– increase of 5.66%, anundoubtedly higher figure than the worldwi<strong>de</strong>and Latin American growth, of 3.2% and 3.00%respectively. Chile also registered an historicminimum of unemployment rate, reaching a 5.2%by the end of <strong>2012</strong>.Unlike the positive economic figuresthroughout the entire <strong>2012</strong>, the local equitymarket experienced a minor growth, showinga similar ten<strong>de</strong>ncy as international markets. Themain in<strong>de</strong>xes of our national market, IPSA andIGPA, en<strong>de</strong>d the year with an annual variationof 2.96% and 4.67% respectively.Concerning the stock prices of the differentindustrial sectors, those with the best performancethrough <strong>2012</strong> were Consumer Goods, Retail,Banks and Utilities, achieving increases of14.97%, 7.48%, 6.79% and 4.70%. On theother hand, the sector´s in<strong>de</strong>xes with thehighest downfall were Salmon with 25.95%,Commodities with 3.93%, Industrial with 1.56%and Construction and Real State with 0.12%.Due to the mo<strong>de</strong>rated scenery in stock prices,year <strong>2012</strong> was characterized by a low activity,both in number of business and tra<strong>de</strong>d amounts.In the equity market, the total tra<strong>de</strong>d volume5

Mensaje <strong>de</strong>l Presi<strong>de</strong>nteChairman’s Messagesus miembros a principios que, inspirados en unaautorregulación, nos permitan mantener el li<strong>de</strong>razgoen el mercado accionario local y a<strong>de</strong>más potenciarnuestro posicionamiento regional.En el ámbito <strong>de</strong> <strong>de</strong>sarrollo <strong>de</strong> mercado, <strong>de</strong>staca lainiciativa conocida como MILA, Mercado IntegradoLatinoamericano, la cual cumplió su primer aniversarioen mayo <strong>de</strong>l <strong>2012</strong>, convirtiéndose en el segundomercado con la capitalización bursátil más importante<strong>de</strong> América Latina. Esta iniciativa <strong>de</strong> integración, queagrupa a las tres economías que muestran mayordinamismo en la región, Chile, Colombia y Perú,ha permitido potenciar los negocios financieros <strong>de</strong>los tres países miembros, ofreciendo una mayorgama <strong>de</strong> alternativas <strong>de</strong> inversión para sus clientes,acompañando a las empresas locales en sus procesos<strong>de</strong> internacionalización regional, generando nuevasoportunida<strong>de</strong>s <strong>de</strong> expansión a sus intermediarios yampliando la <strong>de</strong>manda por los títulos <strong>de</strong> los emisores<strong>de</strong> estos tres mercados.MILA ha generado muchas expectativas, tanto localcomo internacionalmente, por lo que preten<strong>de</strong>mosseguir fortaleciendo este proceso <strong>de</strong> integración. Parael año en curso los esfuerzos estarán <strong>de</strong>stinados a laincorporación <strong>de</strong> otros valores <strong>de</strong> renta variable, comoETF’s (Exchange Tra<strong>de</strong>d Funds) y cuotas <strong>de</strong> fondos,ampliando <strong>de</strong> esta forma las posibilida<strong>de</strong>s <strong>de</strong> inversiónen la región; a la mejora <strong>de</strong> ciertos temas operativos,como son los procesos <strong>de</strong> custodia, compensacióny liquidación; y a la implementación <strong>de</strong> una activacampaña <strong>de</strong> difusión y promoción <strong>de</strong> MILA entre lacomunidad financiera internacional.Asimismo, a fines <strong>de</strong>l <strong>2012</strong> se firmó un acuerdo <strong>de</strong>cooperación con la <strong>Bolsa</strong> <strong>de</strong> Canadá, TMX VentureExchange, para estudiar y evaluar la creación en Chile<strong>de</strong> un segmento en <strong>Bolsa</strong> especial para las empresasmineras, en particular para aquellas compañías oproyectos en etapa <strong>de</strong> exploración. Esta iniciativaconsi<strong>de</strong>ra el trabajo conjunto entre ambas bolsas paraestudiar las perspectivas y condiciones requeridas <strong>de</strong>este nuevo mercado en nuestro país. Chile siendoun país minero no ha logrado generar un espacio <strong>de</strong>acercamiento entre el sector minero y el mercado <strong>de</strong>capitales, y creemos que este proyecto se constituiráen un aporte al financiamiento <strong>de</strong> esta industria.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> también ha dadoprioridad al <strong>de</strong>sarrollo <strong>de</strong> iniciativas vinculadas aampliar la oferta <strong>de</strong> instrumentos financieros en nuestrasubmitting the exchange’s and each one of itsmembers performances to principles inspired inself regulation, which will allow us to maintain thelea<strong>de</strong>rship in the local equity market and enhanceour regional position.In terms of market <strong>de</strong>velopment, the initiativecalled MILA, Integrated Latin American Market,is an outstanding enterprise, which turned its firstanniversary on May <strong>2012</strong>. MILA has becomethe second largest market cap in Latin America.This integration, which brings together the threemost dynamic economies in the region; Chile,Colombia and Peru, has allowed the promotionof the financial business of the countries, awi<strong>de</strong>r range of investment alternatives to clients,the support for the local companies in theirregional internationalization, creating newexpansion opportunities for their intermediariesand increasing the <strong>de</strong>mand for the securities ofthese three markets.MILA has generated local and internationalexpectation; therefore, we will keep on workingto strengthen this integration. For the year2013 our efforts will be concentrated in theincorporation of other equity securities, such asETF´s (Exchange Tra<strong>de</strong>d Funds), and quota funds,increasing the investment alternatives in theregion; upgra<strong>de</strong>s in the operative aspects, suchas custody processes, clearing and settlement;and the implementation of an active promotioncampaign of MILA amongst the financialinternational community.At the end of <strong>2012</strong>, the <strong>Santiago</strong> Stock Exchangesigned a cooperation agreement with the CanadianExchange, TMX Venture Exchange, to study an<strong>de</strong>valuate the creation of a special stock exchangein Chile for mining companies, especially for thosein an exploration phase. This initiative means ajoint effort between both exchanges to study theperspectives and requirements for this new marketin our country. Chile being a mining country hasnot been able to generate a space in the capitalmarket for the mining sector, and we believe thatthis project will help the finance of this industry.The <strong>Santiago</strong> Stock Exchange has also prioritized7

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE1944 •1944 •1950 •1958 •Se inician en la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong> las transacciones <strong>de</strong> monedas<strong>de</strong> oro acuñadas por el Banco Central<strong>de</strong> Chile, constituyéndose la moneda <strong>de</strong>$100 en la más negociada. The <strong>Santiago</strong>Stock Exchange begins the transactionsof gold coins minted by the ChileanCentral Bank. The $ 100 coin is the bestseller.Se inician en la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong> las transacciones <strong>de</strong> dólares.The <strong>Santiago</strong> Stock Exchange begins itsdollar transactions.Se inicia la distribución <strong>de</strong>l Boletín InformativoDiario <strong>de</strong> la Institución. Theinstitution’s Daily Bulletin begins to bedistributed.La <strong>Bolsa</strong> crea el Indice General <strong>de</strong> Precios<strong>de</strong> Acciones (IGPA) que consi<strong>de</strong>ra a lacasi totalidad <strong>de</strong> las acciones inscritas,agrupadas por los distintos sectores <strong>de</strong>actividad. The <strong>Santiago</strong> Stock Exchangecreates the Stocks Prices General In<strong>de</strong>x(IGPA) which inclu<strong>de</strong>s practically allits registered stock grouped by activity.1967 •1973 •1977 •1978 •1980 •Asume como Presi<strong>de</strong>nte <strong>de</strong>l Directoriodon Eugenio Blanco Ruiz, quien se <strong>de</strong>sempeñapor espacio <strong>de</strong> 21 años en elcargo. Mr. Eugenio Blanco Ruiz assumesas Presi<strong>de</strong>nt of the Board of Directors.He was to remain in this position for21 years.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> seincorpora como miembro fundador a laFe<strong>de</strong>ración Iberoamericana <strong>de</strong> <strong>Bolsa</strong>s <strong>de</strong><strong>Valores</strong>, FIABV. The <strong>Santiago</strong> Stock Exchangebecomes a founding member ofthe Ibero-American Fe<strong>de</strong>ration of StockExchanges, FIABV.La <strong>Bolsa</strong> crea el Indice <strong>de</strong> Precios Selectivo<strong>de</strong> Acciones (IPSA), cuya carteraconsi<strong>de</strong>ra a las 40 acciones con mayorpresencia bursátil. The Stock Exchangecreates a Selective Stock Prices In<strong>de</strong>x(IPSA), a portfolio of 40 of the mostrelevant stocks in the Exchange.El Alcal<strong>de</strong> <strong>de</strong> <strong>Santiago</strong>, don PatricioMekis, y el Presi<strong>de</strong>nte <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio,don Eugenio Blanco, inauguranel paseo peatonal <strong>de</strong> calle La <strong>Bolsa</strong>. Mr.Patricio Mekis, Mayor of <strong>Santiago</strong>, andthe Presi<strong>de</strong>nt of the Stock Exchange, Mr.Eugenio Blanco, inaugurate the La <strong>Bolsa</strong>pe<strong>de</strong>strian walkway.Se realiza en <strong>Santiago</strong> la VII Asamblea <strong>de</strong>la Fe<strong>de</strong>ración Iberoamericana <strong>de</strong> <strong>Bolsa</strong>s<strong>de</strong> <strong>Valores</strong>, FIABV, organizada por la<strong>Bolsa</strong> <strong>de</strong> Comercio. The VII Assembly ofthe Ibero-American Fe<strong>de</strong>ration of StockExchanges, FIABV is held in <strong>Santiago</strong> organizedby the <strong>Santiago</strong> Stock Exchange.1981 •1981 •1981 •En la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> seinicia la era <strong>de</strong> la informática, siendo enChile una <strong>de</strong> las entida<strong>de</strong>s lí<strong>de</strong>res en estamateria, instalando una red <strong>de</strong> terminales<strong>de</strong> computación con información en tiemporeal, para las instituciones <strong>de</strong>l mercado<strong>de</strong> capitales. The age of informatics beginsat the <strong>Santiago</strong> Stock Exchange. It becomesone of the leading institutions in this area,installing a network of computer terminalsthat provi<strong>de</strong> real-time information for institutionsin the capital market.Se realiza la primera mo<strong>de</strong>rnizaciónestructural <strong>de</strong>l mercado <strong>de</strong> capitales, alpromulgarse una nueva Ley <strong>de</strong> <strong>Valores</strong>y <strong>de</strong> Socieda<strong>de</strong>s Anónimas. Asimismo,nacen las Administradoras <strong>de</strong> Fondos <strong>de</strong>Pensiones AFP, entida<strong>de</strong>s <strong>de</strong>l nuevo sistemaprevisional chileno <strong>de</strong> capitalizaciónindividual, transformándose en los principalesinversionistas institucionales en la<strong>Bolsa</strong>. The first structural mo<strong>de</strong>rnizing ofthe capital market takes place with thepassing of the new Law of Securities andStock Companies. Also, privately-ownedPension Funds Administrators, AFPs arecreated as part of the new Chilean socialsecurity system based on individualcapitalization. These companies were tobecome the Stock Exchange´s leadinginstitutional investors.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> poneen marcha el Sistema <strong>de</strong> Remate Manual<strong>de</strong> Instrumentos <strong>de</strong> Renta Fija e IntermediaciónFinanciera, a través <strong>de</strong>l cual13

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE141984 •1985 •1985 •las AFP canalizan sus inversiones en dichosinstrumentos. The <strong>Santiago</strong> Stock Exchangecreates the Manual Auction System forFixed Income Instruments and MoneyMarket through which the AFPs channeltheir investments in said instruments.El Gobierno inicia la privatización <strong>de</strong>importantes empresas públicas, siendola <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> laentidad principal a través <strong>de</strong> la cual se<strong>de</strong>sarrolla y materializa este proceso.The Government begins privatizing largestate-owned companies and the <strong>Santiago</strong>Stock Exchange plays a key role in the<strong>de</strong>velopment and materialization of thisprocess.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> organizalas “Jornadas Bursátiles <strong>de</strong>l CapitalismoPopular”, las cuales congregan el interés <strong>de</strong>las más altas personalida<strong>de</strong>s <strong>de</strong> los ámbitosempresarial, financiero y gubernamental.The <strong>Santiago</strong> Stock Exchange organizesthe “Stock Exchange Popular CapitalismConferences”, attracting the interest ofthe highest spheres of the country’s business,financial and government sectors.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> dainicio al programa <strong>de</strong> televisión, a través<strong>de</strong>l canal UCV Televisión, “La <strong>Bolsa</strong> <strong>de</strong>Comercio a sus Or<strong>de</strong>nes”. Conducidopor Enrique “Cote” Evans, el programatelevisivo es transmitido en directo<strong>de</strong>s<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio y tiene porfinalidad difundir la actividad bursátil yel proceso <strong>de</strong> privatización <strong>de</strong> gran<strong>de</strong>sempresas impulsado por el Gobierno,<strong>de</strong>nominado “Capitalismo Popular“.The <strong>Santiago</strong> Stock Exchange begins thetransmission of its TV program “La <strong>Bolsa</strong><strong>de</strong> Comercio a sus Or<strong>de</strong>nes” throughUCV Television. Un<strong>de</strong>r the directionof Enrique “Cote” Evans, the programtransmits directly from the <strong>Santiago</strong> StockExchange, informing the public about theStock Market Activity and the process ofprivatization of large companies that ispromoted by the Government un<strong>de</strong>r the“Popular Capitalism” scheme.Se autoriza a las AFP invertir parte <strong>de</strong> losFondos <strong>de</strong> Pensiones en acciones <strong>de</strong> empresasprivatizadas por el Estado, gestiónque se realiza a través <strong>de</strong> importantesremates en la Sala <strong>de</strong> Ruedas <strong>de</strong> la <strong>Bolsa</strong><strong>de</strong> Comercio. The AFPs are authorizedto invest part of the Pension Funds inshares issued by companies privatizedby the State, a process that is carried outthrough large stock auctions at the StockExchange’s Trading Floor.En este año se registra la mayor variaciónanual <strong>de</strong>l Indice <strong>de</strong> Precios Selectivo <strong>de</strong>Acciones (IPSA) en la historia bursátil<strong>de</strong> la Institución, la que alcanzó entérminos reales a un 139,4%. This year,the Selective Stock Prices In<strong>de</strong>x (IPSA)registers the highest annual variation inthe Institution’s history, reaching 139.4%in real terms.Especialmente invitado por el Directorio <strong>de</strong>la Institución, visita la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong> el Presi<strong>de</strong>nte <strong>de</strong> la República,Capitán General, don Augusto PinochetUgarte. By special invitation from theBoard of Directors of the Institution, thePresi<strong>de</strong>nt of the Republic, Captain GeneralAugusto Pinochet Ugarte visits the <strong>Santiago</strong>Stock Exchange.1986 •1986 •1986 •1988 •La <strong>Bolsa</strong> crea el Sistema <strong>de</strong> Calce Automático<strong>de</strong> Ofertas a Firme <strong>de</strong>nominadoTelepregón, siendo en Chile el primersistema computacional <strong>de</strong> negociación<strong>de</strong> acciones. The <strong>Santiago</strong> Stock Exchangecreates a system of Automatic executionof Or<strong>de</strong>rs known as “Telepregon” whichis the first computerized system for negotiationof stock in Chile.1989 •1989 •1989 •1990 •La <strong>Bolsa</strong> crea el Sistema Remate Electrónico<strong>de</strong> Instrumentos <strong>de</strong> Renta Fija eIntermediación Financiera, permitiéndoseparticipar directamente a los inversionistasinstitucionales: AFP, Compañías <strong>de</strong>Seguros, Fondos Mutuos y a los Bancosy Agentes <strong>de</strong> <strong>Valores</strong>. The <strong>Santiago</strong>Stock Exchange creates the System forElectronic Auction of Fixed Income andMoney Market Instruments which allowsfor a direct participation of institutionalinvestors such as AFPs, Insurance Companies,Mutual Funds, and Banks andSecurities’ Agents.Asume la Presi<strong>de</strong>ncia <strong>de</strong>l Directorio <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, don PabloYrarrázaval Valdés. Mr. Pablo YrarrázavalValdés becomes the Presi<strong>de</strong>nt of theBoard of Directors of the <strong>Santiago</strong> StockExchange.Se crean los Fondos <strong>de</strong> Inversión <strong>de</strong> CapitalExtranjeros (FICE’s), transformándoserápidamente en uno <strong>de</strong> los principalesinversionistas institucionales <strong>de</strong>l mercadoaccionario. Foreign Capital InvestmentFunds (FICEs) are created, rapidly becomingone of the main institutional investorsin the stock market.Se reanudan en la <strong>Bolsa</strong> las transacciones <strong>de</strong>dólares, en la forma <strong>de</strong> monedas y billetes, y <strong>de</strong>monedas <strong>de</strong> oro acuñadas por el Banco Central <strong>de</strong>Chile, las que habían <strong>de</strong>jado <strong>de</strong> realizarse en 1982y 1983, respectivamente. Dollar transactions areresumed in the stock exchange in the form ofcoins and bills as well as gold coins minted bythe Banco Central <strong>de</strong> Chile, which had ceasedto be produced in 1982 and 1983 respectively.

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE1990 •1990 •1991 • 1991 •1991 •CTC inscribe sus ADR´s en la <strong>Bolsa</strong><strong>de</strong> Nueva York, constituyéndose en laprimera empresa latinoamericana encolocar títulos representativos <strong>de</strong> susacciones en el exterior. CTC, the ChileanTelephone Company registers its ADR atthe New York Stock Exchange, becomingthe first Latin American company inplacing stock certificates abroad.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>incorpora el Mercado <strong>de</strong> Futurosconsi<strong>de</strong>rando los contratos <strong>de</strong> Futuro-Dólar y Futuro-Ipsa. The <strong>Santiago</strong> StockExchange creates the Futures Market,which <strong>de</strong>als in Future-Dollar and Future-Ipsa contracts.Se suscriben importantes convenios conlas <strong>Bolsa</strong>s <strong>de</strong> México, Buenos Aires y SaoPaulo para el intercambio <strong>de</strong> información yasistencia recíproca. Important agreementsare subscribed with stock exchanges inMexico, Buenos Aires and Sao Paulo forthe exchange of information and mutualassistance.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> seincorpora a la Fe<strong>de</strong>ración Internacional<strong>de</strong> <strong>Bolsa</strong>s <strong>de</strong> <strong>Valores</strong> FIBV, organismocuyos miembros pertenecen al selectogrupo <strong>de</strong> las <strong>Bolsa</strong>s más importantes <strong>de</strong>lmundo. The <strong>Santiago</strong> Stock Exchangejoins the International Fe<strong>de</strong>ration of StockExchanges FIBV whose members belongto the select group of the most importantstock exchanges in the world.Se crea el mercado <strong>de</strong> Cuotas <strong>de</strong> Fondos<strong>de</strong> Inversión (CFI) como una nuevaalternativa bursátil, siendo las cuotas<strong>de</strong> Fondos Inmobiliarios las primerasen iniciar su negociación en la <strong>Bolsa</strong><strong>de</strong> Comercio. Investment Fund Quotas(CFI) are created as a new alternative1993 •1993 •for investment. Real Estate InvestmentFunds are the first to be tra<strong>de</strong>d at theStock Exchange.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>inaugura la Pizarra Electrónica en la Sala<strong>de</strong> Ruedas con información en línea <strong>de</strong>las transacciones, reemplazando a lastradicionales y centenarias pizarras a tiza.The <strong>Santiago</strong> Stock Exchange inauguratesan Electronic Board on the Trading Floor,providing on-line information abouttransactions, replacing the traditional,century old chalk blackboards.Con una emotiva ceremonia en la Sala <strong>de</strong>Ruedas y una Cena <strong>de</strong> Gala en el Club<strong>de</strong> la Unión, a las cuales asistieron latotalidad <strong>de</strong> los corredores y operadores,y las más altas personalida<strong>de</strong>s <strong>de</strong> losdistintos sectores <strong>de</strong>l quehacer nacional,se celebró el Centenario <strong>de</strong> la Institución.With an emotive ceremony at the1993 •1993 •1993 •Trading Floor and a Gala Diner at theUnion Club, with the attendance of allbrokers and operators as well as themost distinguished personalities of thecountry’s different sectors, the <strong>Santiago</strong>Stock Exchange celebrated one hundredyears of existence.Se realiza en <strong>Santiago</strong> la XX AsambleaAnual <strong>de</strong> la Fe<strong>de</strong>ración Iberoamericana<strong>de</strong> <strong>Bolsa</strong>s <strong>de</strong> <strong>Valores</strong>, FIABV, en la cualel Presi<strong>de</strong>nte <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>, Sr. Pablo Yrarrázaval Valdés,es <strong>de</strong>signado miembro <strong>de</strong>l ComitéEjecutivo <strong>de</strong> ese organismo. The XXAnnual Assembly of the Ibero-AmericanFe<strong>de</strong>ration of Stock Exchanges (FIABV)took place in <strong>Santiago</strong>. At the meeting,Mr. Pablo Yrarrázaval Valdés, Presi<strong>de</strong>ntof the <strong>Santiago</strong> Stock Exchange, wasappointed member of the executivecommittee of that organization.Se publica el libro “Historia <strong>de</strong> la <strong>Bolsa</strong><strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> 1893-1993”,con motivo <strong>de</strong> conmemorarse los 100años <strong>de</strong> la Institución. The book “Historyof the <strong>Santiago</strong> Stock Exchange, 1893-1993” was published on occasion ofthe celebration of the institution’s onehundredth anniversary.La <strong>Bolsa</strong> migra sus sistemas a una nuevaplataforma computacional Tan<strong>de</strong>m bajoambiente Windows, lo que permiteaumentar significativamente la capacidady velocidad <strong>de</strong> procesamiento, y unmanejo más eficiente y funcional <strong>de</strong>las transacciones y bases <strong>de</strong> datos. The<strong>Santiago</strong> Stock Exchange adopts a newWindows-based Tan<strong>de</strong>m computerizedplatform. This implies a significantincrease in data processing capacityand speed as well as a more efficientand functional handling of transactionsand databases.15

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE1994 •Se pone en marcha en forma oficial elMercado <strong>de</strong> Opciones sobre acciones,autorizando inicialmente las opciones<strong>de</strong> acciones En<strong>de</strong>sa y CTC-A. The StockOptions Market is officially inaugurated.Options on En<strong>de</strong>sa and CTC-A stocks arethe first to be authorized.total of US$ 11,146 million are tra<strong>de</strong>d.This is the largest trading volume in thehistory of the <strong>Santiago</strong> Stock Exchange.1995 •La <strong>Bolsa</strong> <strong>de</strong> Comercio organiza en<strong>Santiago</strong> la 35ª Asamblea General <strong>de</strong>la Fe<strong>de</strong>ración Internacional <strong>de</strong> <strong>Bolsa</strong>s<strong>de</strong> <strong>Valores</strong> (FIBV), congregándose ennuestro país los presi<strong>de</strong>ntes y representantes<strong>de</strong> las más importantes bolsas <strong>de</strong>valores <strong>de</strong>l mundo. The Stock Exchangeorganizes in <strong>Santiago</strong> the 35 th GeneralAssembly of the International Fe<strong>de</strong>rationof Stock Exchanges (FIBV). Presi<strong>de</strong>ntsand representatives of the most importantstock exchanges in the world meetfor the occasion.1995 •Frei Ruiz-Tagle. The <strong>Santiago</strong> StockExchange and the District of <strong>Santiago</strong>organized this event.El Ministro <strong>de</strong> Hacienda, EduardoAninat, inaugura oficialmente las activida<strong>de</strong>s<strong>de</strong>l Depósito Central <strong>de</strong> <strong>Valores</strong>(DCV), entidad que cuenta entre susaccionistas a la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>. El objetivo <strong>de</strong>l DCV es mo<strong>de</strong>rnizary darle mayor seguridad a lastransacciones <strong>de</strong>l mercado financieronacional.1995 •En el marco <strong>de</strong> la 35ª Asamblea General<strong>de</strong> la Fe<strong>de</strong>ración Internacional <strong>de</strong> <strong>Bolsa</strong>s<strong>de</strong> <strong>Valores</strong> (FIBV) se realiza el Seminario“Presente y Futuro <strong>de</strong> los MercadosBursátiles en el Mundo”, don<strong>de</strong> exponenlos principales presi<strong>de</strong>ntes <strong>de</strong> las <strong>Bolsa</strong>sInternacionales. El evento es inauguradopor el Ministro <strong>de</strong> Hacienda, donEduardo Aninat. The seminar “Presentand Future of Stock Markets Worldwi<strong>de</strong>”was held as part of the 35 th GeneralAssembly of the International Fe<strong>de</strong>ration161995 •Con la asistencia <strong>de</strong>l Presi<strong>de</strong>nte<strong>de</strong> la República, don Eduardo FreiRuiz-Tagle, se inaugura, en el HotelCarrera, el Seminario “PrimeraConferencia <strong>Santiago</strong> Centro FinancieroInternacional”, que fue organizadopor la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>,Asociación <strong>de</strong> Bancos e InstitucionesFinancieras y la Ilustre Municipalidad <strong>de</strong><strong>Santiago</strong>. The seminar “First Conference<strong>Santiago</strong> as an International FinancialCenter” was inaugurated at the HotelCarrera, with the attendance of thePresi<strong>de</strong>nt of the Republic, Mr. Eduardo1995 •Eduardo Aninat, Treasury Secretary,inaugurates the activities of the DCV(Values Central Deposit), entity wherethe <strong>Santiago</strong> Stock Exchange is a sharehol<strong>de</strong>r. The main purpose of the DCV isto mo<strong>de</strong>rnize and give more security tothe transactions of the financial market.En este año se registra el mayor volumen<strong>de</strong> transacciones accionarias en la historiabursátil <strong>de</strong> la Institución, negociándoseun total <strong>de</strong> US$ 11.146 millones. Aof Stock Exchanges (FIBV). The speakersat this seminar were the presi<strong>de</strong>nts of themain international stock exchanges. TheMinister of Finance, Mr. Eduardo Aninat,inaugurated the event.

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE1997 •1998 • 1998 •El Presi<strong>de</strong>nte <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Nueva York(NYSE), Sr. Richard Grasso, realiza unavisita oficial a la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>. Mr. Richard Grasso, Presi<strong>de</strong>ntof the New York Stock Exchange (NYSE)came in official visit to the <strong>Santiago</strong> StockExchange.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> juntoa la Asociación <strong>de</strong> Bancos, EmbajadaBritánica y la Ilustre Municipalidad <strong>de</strong><strong>Santiago</strong>, entre otros, organizaron elSeminario Internacional “Desarrollo <strong>de</strong>Centros Internacionales <strong>de</strong> Negocios yServicios Financieros, Londres-<strong>Santiago</strong>”,realizado en el Hotel Carrera. The <strong>Santiago</strong>Stock Exchange, together with theBanks´Association, The British Embassyand the District of <strong>Santiago</strong>, amongothers, organized the International Seminar“Development of InternationalBusiness and Financial Services Centers,London-<strong>Santiago</strong>”, which was held at theHotel Carrera.El Presi<strong>de</strong>nte <strong>de</strong> la República, Sr. EduardoFrei Ruiz-Tagle, y el Presi<strong>de</strong>nte <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, Sr. PabloYrarrázaval Valdés, acompañados por Ministros<strong>de</strong> Estado y Directores <strong>de</strong> la <strong>Bolsa</strong>,realizan una visita oficial al New YorkStock Exchange (NYSE). The Presi<strong>de</strong>nt ofthe Republic, Mr. Eduardo Frei Ruiz-Tagleand the Presi<strong>de</strong>nt of the <strong>Santiago</strong> StockExchange, Mr. Pablo Yrarrázaval Valdés,1999 •1999 •accompanied by Ministers of States andDirectors of the <strong>Santiago</strong> Stock Exchangepaid an official visit to the New York StockExchange (NYSE).El Presi<strong>de</strong>nte <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>, Sr. Pablo Yrarrázaval Valdés, esnombrado Presi<strong>de</strong>nte <strong>de</strong> la Fe<strong>de</strong>raciónIberoamericana <strong>de</strong> <strong>Bolsa</strong>s <strong>de</strong> <strong>Valores</strong>,FIABV. The Presi<strong>de</strong>nt of the <strong>Santiago</strong>Stock Exchange, Mr. Pablo YrarrázavalValdés is appointed Presi<strong>de</strong>nt of theIbero-American Fe<strong>de</strong>ration of Stock Exchanges,FIABV.Se realizan los mayores remates <strong>de</strong> accionesen la historia bursátil chilena alnegociarse el 30% <strong>de</strong> En<strong>de</strong>sa S.A. y el21,7% <strong>de</strong> Enersis S.A., en montos totales<strong>de</strong> US$ 1.858 y US$ 975 millones, respectivamente,relacionados ambos con latoma <strong>de</strong> control <strong>de</strong> estas empresas porparte <strong>de</strong> En<strong>de</strong>sa España. The sale of 30%of En<strong>de</strong>sa S.A. and 21.7% of Enersis S.A.,with total amounts of US$ 1,858 millionand US$ 975 million respectively, werethe largest stock auctions in nationalstock brokering history. Both operationswere associated with the acquisition ofa controlling interest in these companiesby En<strong>de</strong>sa España.2000 •Bancos y Arthur An<strong>de</strong>rsen. Mr. NicolasEyzaguirre, Minister of Finance andChile’s leading economic authoritiesand businessmen attend the “Regulationof the Capital Market” seminar that isheld at CasaPiedra convention center.The <strong>Santiago</strong> Stock Exchange, The Associationof Banks and Arthur An<strong>de</strong>rsensponsored the event.En la Sala <strong>de</strong> Ruedas <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong> se presenta el Libro“Regulación <strong>de</strong>l Mercado <strong>de</strong> Capitales”.La edición cuenta con el auspicio <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, la Asociación<strong>de</strong> Bancos y Arthur An<strong>de</strong>rsen.A la presentación asiste el Ministro <strong>de</strong>Hacienda, Nicolás Eyzaguirre junto ala comunidad empresarial nacional. Ellibro reúne las ponencias sobre el tema<strong>de</strong> los principales lí<strong>de</strong>res económicos<strong>de</strong>l país. The book “Regulation of theCapital Market” is officially launched at2000 •Se realiza en CasaPiedra el seminario<strong>de</strong>nominado “Regulación <strong>de</strong>l Mercado<strong>de</strong> Capitales” a cuya inauguración asistenjunto al Ministro <strong>de</strong> Hacienda, NicolásEyzaguirre, las principales autorida<strong>de</strong>seconómicas y empresariales <strong>de</strong>l país.El evento es auspiciado por la <strong>Bolsa</strong> <strong>de</strong>Comercio <strong>de</strong> <strong>Santiago</strong>, la Asociación <strong>de</strong>the trading floor of the <strong>Santiago</strong> StockExchange. Present at the occasionwere the Minister of Finance, NicolasEyzaguirre and leading members of thebusiness community. Sponsored by17

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE2000 •the <strong>Santiago</strong> Stock Exchange and ArthurAn<strong>de</strong>rsen, the book is a compendiumof papers on the subject by lea<strong>de</strong>rs ofChile’s economy.Con la asistencia <strong>de</strong>l Presi<strong>de</strong>nte <strong>de</strong> laRepública, don Ricardo Lagos Escobary los Ministros <strong>de</strong> Hacienda, NicolásEyzaguirre, Economía, Minería y Energía,José <strong>de</strong> Gregorio, y Secretario General <strong>de</strong>la Presi<strong>de</strong>ncia, Alvaro García, se inaugurala “<strong>Bolsa</strong> Off-Shore”. Asistieron al actolos principales dirigentes gremiales<strong>de</strong>l país, empresarios, corredores yejecutivos <strong>de</strong>l sector. The <strong>Santiago</strong> StockExchange´s Off-Shore Market operation isinaugurated with the attendance of thePresi<strong>de</strong>nt of the Republic, Mr. RicardoLagos Escobar and lea<strong>de</strong>rs of the mainlabor and business organizations in thecountry as well as businessmen, brokersand executives of the stock-tradingsector.2000 • 2000 •Inicia sus operaciones en la <strong>Bolsa</strong>Off-Shore <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>, En<strong>de</strong>sa España. Asisten losprincipales ejecutivos <strong>de</strong> la empresaespañola, encabezada por el ConsejeroDelegado <strong>de</strong> En<strong>de</strong>sa España, RafaelMiranda. En<strong>de</strong>sa-España launches itsparticipation in the Off Shore StockExchange with the presence of leadingexecutives of the Spanish companyhea<strong>de</strong>d by the Deputy Counselor ofEn<strong>de</strong>sa-España, Rafael Miranda.Con motivo <strong>de</strong> dar a conocer los nuevosproductos <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>, la Institución organiza una fiestapara el mercado financiero nacional ala que asistieron más <strong>de</strong> 500 invitados.The <strong>Santiago</strong> Stock Exchange organizesa party to inform the national financialmarket about its new products. Over 500guests atten<strong>de</strong>d.2001 •podrán participar en el mercado <strong>de</strong>valores chileno y el Mercado Off-Shore<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, através <strong>de</strong> un corredor <strong>de</strong> esta Institución.The <strong>Santiago</strong> Stock Exchange signs aCoordination Agreement with Madrid’sStock Exchange. Un<strong>de</strong>r the terms of theagreement, <strong>Santiago</strong> Stock Exchangebrokers can become members of Latibexand operate in the Spanish market andother international markets throughbrokers of the Spanish Stock Exchanges.Likewise, members of Spanish stockexchanges may participate in the Chileanstock market and the Off Shore Market ofthe <strong>Santiago</strong> Stock Exchange through abroker belonging to this institution.Un nuevo salto tecnológico dio la<strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> alincorporar, en el Redon<strong>de</strong>l <strong>de</strong> la Sala <strong>de</strong>Ruedas, Terminales Computacionales<strong>de</strong> Negociación que permiten a loscorredores ingresar directamente ór<strong>de</strong>nes182001 •La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> firmaun Acuerdo <strong>de</strong> Coordinación con la<strong>Bolsa</strong> <strong>de</strong> Madrid, mediante el cual loscorredores <strong>de</strong> esta Institución podrán sermiembros <strong>de</strong>l Latibex, y participar a través<strong>de</strong> los corredores <strong>de</strong> las bolsas españolas,en el mercado español y en otrosmercados internacionales. Por su parte,los miembros <strong>de</strong> las bolsas españolas<strong>de</strong> compra y venta, realizar operacionesy estar conectados en tiempo real tanto alMercado Nacional como Internacional.The <strong>Santiago</strong> Stock Exchange ma<strong>de</strong>a new technology improvement byincorporating electronic trading stationsin the trading floor, allowing brokersto use both, manual and automaticmatching systems simultaneously, andconnecting them in real time to local andforeign markets.

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE202003 •the Superinten<strong>de</strong>nt of Banks and FinancialInstitutions Supervisor, it is officiallypresented to the financial market the newSystem of Stock-exchange Services andNetwork Applications of the <strong>Santiago</strong>Stock Exchange, S.E.B.R.A., which beganto operate in 2002. The ceremony wasma<strong>de</strong> in the Trading Floor of the Institution.En la Sala <strong>de</strong> Ruedas y con la asistencia<strong>de</strong> corredores y operadores <strong>de</strong> las mesas<strong>de</strong> dinero <strong>de</strong>l mercado financiero se realizó,por primera vez, el evento “Vinos<strong>de</strong> Excelencia en la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>”, con la participación <strong>de</strong> lasseis viñas que transan sus acciones en laInstitución: Concha y Toro, San Pedro,Santa Carolina, Santa Emiliana, Undurragay Santa Rita. In the Trading Floor,and with the assistance of many brokersand tra<strong>de</strong>rs of the financial market, tookplace for the first time “Wines of Excellencyin the <strong>Santiago</strong> Stock Exchange”,where the participants were six winerieswhich stocks are listed at our Exchangesuch as: Concha y Toro, San Pedro, SantaCarolina, Santa Emiliana, Undurraga ySanta Rita2004 • 2003 •El Alcal<strong>de</strong> <strong>de</strong> <strong>Santiago</strong>, Joaquín Lavín, yel Presi<strong>de</strong>nte <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>, Pablo Yrarrázaval, inauguranlas nuevas obras <strong>de</strong> mo<strong>de</strong>rnización <strong>de</strong>lpaseo peatonal <strong>de</strong> las calles La <strong>Bolsa</strong> yNueva York, que conectan la Alamedacon las calles Moneda y Ahumada.The Mayor of <strong>Santiago</strong>, Joaquín Lavín,and the Presi<strong>de</strong>nt of the <strong>Santiago</strong> StockExchange, Pablo Yrarrázaval, inauguratesnew works of mo<strong>de</strong>rnization of thepe<strong>de</strong>strian stroll of the street La <strong>Bolsa</strong>and New York, that connects Alamedaavenue with the streets Moneda andAhumada.Las empresas Cencosud S.A. (dueña<strong>de</strong> Jumbo, Alto Las Con<strong>de</strong>s y Easy) ySalfacorp S.A. realizan su apertura enel Mercado <strong>de</strong> Empresas Emergentes<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>,colocando acciones <strong>de</strong> primera emisiónpor un monto <strong>de</strong> US$ 258 millonesy US$ 23 millones, respectivamente.Cencosud S.A. (a companie that ownsJumbo, Alto Las Con<strong>de</strong>s and Easy) andSalfacorp S.A. open their companiesin the Emerging Companies Marketof the <strong>Santiago</strong> Stock Exchange, withan initial public offering (IPO) for anamount of US$ 258 million and US$23 million.2004 •La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> enconjunto con Ernst & Young realiza enCasapiedra el Seminario “<strong>Santiago</strong>,Centro <strong>de</strong> Negocios Financieros”, conel afán <strong>de</strong> contribuir al <strong>de</strong>sarrollo <strong>de</strong>lmercado <strong>de</strong> capitales chileno. Las exposiciones<strong>de</strong> los panelistas en dichoevento se plasmaron en un libro cuyolanzamiento se realizó en la Superinten<strong>de</strong>ncia<strong>de</strong> <strong>Valores</strong> y Seguros, enpresencia <strong>de</strong> su máxima autoridad, donAlejandro Ferreiro. The <strong>Santiago</strong> StockExchange with Ernst & Young, organizesa Seminar called “<strong>Santiago</strong>, Center ofFinancial Bussines”, with the purposeto contribute in the <strong>de</strong>velopment of theChilean capital market. All presentationsgiven during the seminar werecompiled in a book which introductionwas realized at the Superinten<strong>de</strong>nce ofValues and Insurances entity, with thepresence of its highest authority, Mr.Alejandro Ferreiro.

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE2004 •E n l a B o l s a d e C o m e rcio d e<strong>Santiago</strong> se coloca el 20% <strong>de</strong> las acciones<strong>de</strong> la Compañía Cervecerías UnidasS.A. en un monto que bor<strong>de</strong>ó los US$300 millones, constituyéndose en la colocaciónmás importante <strong>de</strong> los últimos4 años. 20% of the stocks of CompañíaCervecerías Unidas S.A. are placed in the<strong>Santiago</strong> Stock Exchange, amount thatreached near US$ 300 millions, becomingthe most important stock offering inthe last 4 years.la compañía. Cencosud S.A. acquired71% of Almacenes Paris S.A. propertyafter launching a successful Take Over.2004 •2004 •2005 •Se realiza la mayor colocación <strong>de</strong> bonosen la historia bursátil nacional, alcolocar Autopista Vespucio Norte UF16.000.000. The mayor placement ofBonds in national exchange history takesplace this year when Autopista VespucioNorte places UF 16.000.000.-En términos anuales, el mercado accionariologra un récord histórico <strong>de</strong>transacciones, acumulando negociospor US$ 13.123 millones. Los índicesIPSA e IGPA, por su parte, alcanzarondurante el año sucesivos máximoshistóricos. In anual terms, the stockmarket reaches a historical record oftransactions, accumulating <strong>de</strong>als forUS$ 13.123 millions. The in<strong>de</strong>xes IPSAand IGPA, also reached maximum historicalrecords during 2004.En la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> seremata el 51,7% <strong>de</strong> la propiedad <strong>de</strong> LaPolar, adjudicándose en un monto <strong>de</strong>US$ 210 millones. 51.7% of La Polar’sproperty is sold for US$ 210 million in the<strong>Santiago</strong> Stock Exchange Auction System.2005 •2005 •En la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>se remata el 18,4% <strong>de</strong> la propiedad<strong>de</strong> Compañía SudAmericana <strong>de</strong> VaporesS.A., en un monto <strong>de</strong> US$ 304millones aproximadamente. 18.4% ofCompañía SudAmericana <strong>de</strong> Vaporesproperty is sold for US$ 304 million ina Public Auction at the <strong>Santiago</strong> StockExchange.La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, la<strong>Bolsa</strong> Electrónica <strong>de</strong> Chile y la <strong>Bolsa</strong> <strong>de</strong>Corredores <strong>de</strong> Valparaíso firman Acuerdossobre Intercambio <strong>de</strong> Informaciónen línea y Operaciones Interbolsas(OIB), conforme a lo establecido enel Oficio Circular N° 253 <strong>de</strong> la Superinten<strong>de</strong>ncia<strong>de</strong> <strong>Valores</strong> y Seguros<strong>de</strong> octubre <strong>de</strong> 2004. <strong>Santiago</strong> Stock2005 •Exchange, Electronic Stock Exchangeand Valparaíso Stock Exchange signedan agreement on Cross ExchangeTransactions and On-Line ExchangeInformation as established by Rule N°253 of the Government Commission ofSecurities and Insurances.El índice IPSA registró en abril máximoshistóricos superando los 2.000 puntos.During April IPSA, in<strong>de</strong>x surpassesthe 2,000 points level, marking a newhistoric record.2005 •Exitosamente finalizó la OPA <strong>de</strong> EmpresasAlmacenes Paris S.A. en virtud <strong>de</strong> lacual Cencosud S.A. adquirió el 71% <strong>de</strong>21

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE2005 •Comienzan a transarse en la <strong>Bolsa</strong>por primera vez las acciones <strong>de</strong> laconocida tienda Ripley, colocandoun 15% <strong>de</strong> la propiedad en títulos <strong>de</strong>primera emisión, recaudando US$ 218millones. La colocación adquiere granespectacularidad por la presencia en laSala <strong>de</strong> Ruedas <strong>de</strong> la conocida mo<strong>de</strong>loCindy Crawford. Ripley S.A. is listedin the <strong>Santiago</strong> Stock Exchange. TheIPO, for US$ 218 million, represented15% of the company’s property. Its firsttrading day counted with the presenceof Cindy Crawford.2005 •Invertec hace su apertura <strong>de</strong> accionesen <strong>Bolsa</strong> colocando un 23% <strong>de</strong> sucapital accionario. La firma recaudóUS$ 22,2 millones. Invertec lists in the<strong>Santiago</strong> Stock Exchange selling 23%of its property for US$ 22.2 million inits Initial Public Offering.Colocación <strong>de</strong> Ripley2005 •2005 •2005 •Colo Colo se convierte en el primerClub <strong>de</strong> Fútbol Profesional en transarsus acciones en la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>. Se coloca el 100% <strong>de</strong> lapropiedad y se recaudan US$ 31,7millones. Colo Colo becomes the firstProfessional Soccer Team listed in the<strong>Santiago</strong> Stock Exchange. 100% of itsproperty is sold for US$ 31.7 million ina Public Auction.Inversiones Aguas Metropolitanascoloca en el mercado local y extranjeroel 49% <strong>de</strong> su propiedad obteniendoUS$ 460 millones. A través <strong>de</strong> la<strong>Bolsa</strong> colocó un 10% <strong>de</strong> las acciones.Inversiones Aguas Metropolitanas sells49% of its property for US$ 460 millionin a simultaneous auction offered inlocal (10%) and foreign (90%) stockmarkets.Sigdo Koppers se abrió a la <strong>Bolsa</strong> alcolocar en el mercado un 25% <strong>de</strong>la propiedad. La colocación recaudóUS$ 156 millones. Sigdo Koppers sells25% of its property for US$ 156 millionin its Initial Public Offering.2006 •Se efectuó el remate <strong>de</strong> 73.205.259acciones <strong>de</strong> CENCOSUD (3,68% <strong>de</strong> lacompañía), las que fueron adjudicadasen un monto <strong>de</strong> $ 79.567 millones(US MM$ 150). 73,205,259 shares ofCENCOSUD, equivalent to 3.68% of itsproperty, was auctioned at the <strong>Santiago</strong>Stock Exchange for $150 millionsdollars.2006 •Colocación Aguas MetropolitanasSe realizaron fuera <strong>de</strong> bolsa las siguientesOPA’s: a) Inversiones Sanitarias <strong>de</strong>l SurS.A adquirió 1.348.044.608 accionesserie A <strong>de</strong> Empresa <strong>de</strong> ServiciosSanitarios <strong>de</strong>l Bío Bío S.A (ESSBIO-A)en $ 117.707 millones (US $ 221,7millones), b) Etex Latinamerica S.A.adquirió 26.506.227 acciones <strong>de</strong>Empresas Pizarreño S.A. (PIZARREÑO)en $36.711 millones (US$ 69,1millones). En ambas operaciones se22Colocación InvertecColocación Sigdo Koppers

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSEutilizó el sistema computacional <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio para la recepción<strong>de</strong> ór<strong>de</strong>nes. The followings takeoversen<strong>de</strong>d successfully: a) InversionesSanitarias <strong>de</strong> Sur S.A. purchased1,348,044,608 shares of Empresa <strong>de</strong>Servicios Sanitarios <strong>de</strong>l Bío Bío S.A.(ESSBIO-A) for $221.7 millions dollars,b) Etex Latinamerica S.A. acquired26,506,227 shares of EmpresasPizarreño S.A. (PIZARREÑO) for $69.1millions dollars. In both, the ElectronicSystem created by the <strong>Santiago</strong> StockExchange was used to receive the or<strong>de</strong>rsfrom the market.2006 •2006 •2006 •Comenzó a funcionar oficialmente laCámara Paga<strong>de</strong>ro Hoy (PH) <strong>de</strong>l SistemaSCL, a través <strong>de</strong> la cual se liquidan lastransacciones <strong>de</strong> IRF e IIF con dicha condición<strong>de</strong> liquidación.The Clearing andSettlement service for T+0 transactions,begun officially operating for the MoneyMarket and Fixed Income Market.En Junta Extraordinaria <strong>de</strong> Accionistas<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>celebrada el 27 <strong>de</strong> abril, se aprobóla reforma <strong>de</strong> Estatutos en lo referidoa: a) Creación <strong>de</strong>l Comité <strong>de</strong>Regulación, que reemplaza a laComisión Arbitral, b) Modificación<strong>de</strong> las faculta<strong>de</strong>s sancionatorias <strong>de</strong>lDirectorio, y c) Hacer públicas ycomunicar a la Superinten<strong>de</strong>ncia <strong>de</strong><strong>Valores</strong> y Seguros las sanciones queaplique tanto el Directorio comoel Comité <strong>de</strong> Regulación. On April27th, the reform of the followingstatements was approved in aSharehol<strong>de</strong>rs Extraordinary Meeting:a) Creation of the RegulationCommittee that replaces the ArbitralCommission b) Modificationof the sanction attributions ofthe Board of Directors, and c)Publish and communicate to theSuperinten<strong>de</strong>nce the sanctions thatapply both, the Board of Directorsand the Regulation Committee.“Paz Corp S.A.” realizó su aperturaen el Mercado <strong>de</strong> EmpresasEmergentes, colocando a través<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio 40.283.600acciones <strong>de</strong> primera emisión (25% <strong>de</strong>la compañía) en $ 15.509,6 millones(US$ 29,4 millones aprox.). “Paz CorpS.A.” company listed for the first timeon the Emergent Companies Market ofthe <strong>Santiago</strong> Stock Exchange, placing40,283,600 shares (equivalent to 25%of its property) for an amount of $ 29.4Colocación Paz CorpColocación Colo Colo2006 •millions dollars through the Or<strong>de</strong>rsBook Auction.En ceremonia realizada en la Sala<strong>de</strong> Ruedas se dio inicio oficial a lastransacciones <strong>de</strong> acciones <strong>de</strong> lasociedad minera canadiense “AurResources Inc.” en el Mercado <strong>de</strong> <strong>Valores</strong>Extranjeros (<strong>Bolsa</strong> Off Shore). Asistieronlos principales ejecutivos <strong>de</strong>la sociedad, <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong>Comercio y <strong>de</strong> Larraín Vial S.A.Corredora <strong>de</strong> <strong>Bolsa</strong>, corredoresy operadores <strong>de</strong> la Institución.In a ceremony celebrated in theFloor Room of the <strong>Santiago</strong> StockExchange, “Aur Resources Inc.”, aCanadian mining company, listedfor the first time on the ForeignSecurities Market (Off ShoreMarket). Important executivesof the company, <strong>Santiago</strong> StockExchange and Brokerages Houseswere attending.2006 •Se colocaron a través <strong>de</strong>l Sistema<strong>de</strong> Subasta <strong>de</strong> un Libro <strong>de</strong> Or<strong>de</strong>nes,un total <strong>de</strong> 1.413.983.995 acciones<strong>de</strong> Colbún S.A. en $ 117.643millones (US MM$ 222,5).1,413,983,995 Colbún S.A.’s shares,equivalent to US MM$ 222.5 wereplaced through the Or<strong>de</strong>rs BookAuction.23

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE242006 •2006 •2006 •2006 •Mediante OPA realizada a través<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio,Inversiones Santa Cecilia S.A.se adjudicó 12.299.302 acciones<strong>de</strong> Viña Undurraga S.A. en$ 18.547,6 millones (US MM$34,5). Through a takeover inthe <strong>Santiago</strong> Stock Exchange,Inversiones Santa Cecilia S.A.purchased 12,299,302 sharesof Undurraga S.A. Vineyard,equivalent to an amount of$34.5 millions dollars.El día 27 <strong>de</strong> julio se registróla transacción <strong>de</strong> una acción<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong>, <strong>Bolsa</strong> <strong>de</strong> <strong>Valores</strong>,en un precio histórico <strong>de</strong>$ 775.000.000. On July 27, itwas registered the transactionof one of the <strong>Santiago</strong> StockExchange stocks in a historicalprice of $ 775,000,000 CLP.Colocación SondaFinalizó la OPA <strong>de</strong> accionesCCT lanzada por InversionesPrecis Limitada, adjudicándosefuera <strong>de</strong> bolsa 18.200.536acciones <strong>de</strong> Compañía ChilenaColocación Forus<strong>de</strong> Tabacos S.A. en $ 91.002,7millones (US MM$ 169,2), utilizando el sistema electrónico<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio para la recepción <strong>de</strong> ór<strong>de</strong>nes. Thetakeover of Compañía Chilena <strong>de</strong> Tabacos S.A. (CCT) wassuccessfully finished when Inversiones Precis Limitada acquired18,200,536 shares of the company, for an amount of $169.2millions dollars, using the <strong>Santiago</strong> Stock Exchange electronicsystem to collect market or<strong>de</strong>rs.El Directorio <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>, ensesión celebrada eldía 30 <strong>de</strong> octubre,acordó nombrarmiembros <strong>de</strong>l Comité<strong>de</strong> Regulación<strong>de</strong> la Institución alos señores EnriqueBarros Bourie, LeonidasMontes Liray Lisandro SerranoSpoerer. In an ordinary session celebrated on October 30th,the <strong>Santiago</strong> Stock Exchange Board of Directors, agreed on <strong>de</strong>signatingMr. Enrique Barros Bourie, Mr. Leonidas Montes Lira2006 •and Mr. Lisandro SerranoSpoerer as members of theRegulation Committee.Se realizaron importantessubastas en la <strong>Bolsa</strong> <strong>de</strong>Comercio, <strong>de</strong>stacando losremates <strong>de</strong> 18.372.209acciones ANTARCHILE(4,02% <strong>de</strong> la compañía)en $ 148.190,2 millones(US MM$ 280), y <strong>de</strong>31.778.049 acciones LAN(9,96% <strong>de</strong> la sociedad)en $ 165.881,4 millones(US MM$ 313,4 aprox.).Important auctions wereplaced in the <strong>Santiago</strong> StockExchange; highlighting theauctions of 18,372,209shares of ANTARCHILE(4,02% of the company’sproperty) for $280 millionsdollars, and of 31,778,049shares of LAN (9,96% ofthe company’s property),which were sold for$ 313.4 millions dollars.“Sonda S.A.” efectuó suapertura en el Mercado <strong>de</strong>Empresas Emergentes, colocando a través <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio200.000.000 <strong>de</strong> acciones <strong>de</strong> primera emisión (26%<strong>de</strong> la sociedad) en $113.200 millones (US$ 215,3 millones).“Sonda S.A.” company listed for the first time on the EmergentCompanies Market of the <strong>Santiago</strong> Stock Exchange, placing200.000.000 shares (equivalent to 26% of its property)for an amount of$ 215.3 millions2007•2007 •dollars throughthe Or<strong>de</strong>rs BookAuction.“Forus S.A.” realizósu aperturaen el Mercado <strong>de</strong>Empresas Emergentes,colocandoa través <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio51.693.800acciones <strong>de</strong> primera emisión (20% <strong>de</strong> la sociedad) en$ 23.520,7 millones (US$ 44,7 millones). “Forus S.A.” companylisted for the first time on the Emergent Companies

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE2007 •2007 •Market of the <strong>Santiago</strong> StockExchange, placing 51.693.800shares (equivalent to 20% ofits property) for an amount of$ 44.7 millions dollars throughthe Or<strong>de</strong>rs Book Auction.La <strong>Bolsa</strong> <strong>de</strong> Comercio dio iniciooficial a sus nuevos ÍndicesSectoriales, los que fueronconcebidos con el objeto <strong>de</strong>constituirse en benchmarksaltamente representativos yrelevantes para el análisis diarioe histórico <strong>de</strong> los principalessectores componentes <strong>de</strong>l mercadoaccionario chileno. Estos nuevosíndices consi<strong>de</strong>ran los sectores Banca,Commodities, Comunicaciones yTecnología, Consumo, Industrial,Retail y Utilities. The <strong>Santiago</strong> StockExchange (SSE) officially launchedits new Sectorial Indices, with theintention of constituting itself inbenchmarks for the daily and historicalanalysis of the principal economicsectors of the Chilean equity-market.These new indices cover 7 differentindustries: Banking, Commodities,Communications and Technology,Consumer Goods, Industrial, Retailand Utilities.Los índices IPSA e IGPA marcaronrécord históricos superando los 3.100y 13.943 puntos, respectivamente,cuya ten<strong>de</strong>ncia creciente en ambosindicadores se observó <strong>de</strong>s<strong>de</strong>septiembre <strong>de</strong> 2006. February: IPSAand IGPA equity in<strong>de</strong>xes reached newhistorical records, raising above 3,100and 13,943 points respectively, thisincreasing trend was observed sinceSeptember 2006.2007 •2007 •Colocación Lan ChileMethanex Corporation, began in theOff Shore market of the SSE, registeringa monthly trading amount of USD6,119,066.Mediante el sistema Subasta <strong>de</strong> unLibro <strong>de</strong> Or<strong>de</strong>nes, se colocaron11.243.865 acciones <strong>de</strong> primeraemisión <strong>de</strong> Lan Airlines S.A. (LAN),las que fueron adjudicadas en unmonto <strong>de</strong> $ 94.459,7 millones(US$ 181 millones aprox.). Throughthe Or<strong>de</strong>r Book Auction TradingSystem, 11,243,865 primary issueshares of Lan Airlines S.A. (LAN) wereplaced for an amount of CLP 94,459.7million (USD 181 million approx.).Con la presencia <strong>de</strong> 14 marcas <strong>de</strong>prestigiosos vinos se efectúa en laSala <strong>de</strong> Ruedas la V Cata “Vinos <strong>de</strong>Excelencia en la <strong>Bolsa</strong> <strong>de</strong> Comercio2007 •<strong>de</strong> <strong>Santiago</strong>”. May: With thepresence of 14 pretigiouswineries, the 5th edition of˝Wines of Excellence in the<strong>Santiago</strong> Stock Exchange˝took place in the TradingFloor.La <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong> firmó con la<strong>Bolsa</strong> Mexicana <strong>de</strong> <strong>Valores</strong>y con la <strong>Bolsa</strong> <strong>de</strong> Brasil(BOVESPA) convenios <strong>de</strong>integración que permitiránestablecer los mecanismos necesariospara el reconocimiento mutuo <strong>de</strong>lInvitación V Cata˝Vinos <strong>de</strong> Excelencia˝2007 •En mayo se iniciaron las transacciones<strong>de</strong> la sociedad canadiense MethanexCorporation en el Mercado <strong>de</strong> <strong>Valores</strong>Extranjeros (<strong>Bolsa</strong> Off Shore) <strong>de</strong>la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>,registrándose negocios en el mes porun total <strong>de</strong> US$ 6.119.066.- In Maythe transactions of a Canadian Society:Colocación Multiexport Foods S.A.25

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSEand began working in the mechanismsthat will allow the integration of bothstock markets. The project is part ofa Latin American Fe<strong>de</strong>ration (FIAB)initiative.2008 •2008 •2008 •Presi<strong>de</strong>ntes <strong>de</strong> las <strong>Bolsa</strong>s <strong>de</strong> México y ChileRipley Corp S.A. were placed for anamount of CLP 54,390 million (USD108.8 million approx.).En mayo se realiza la sexta versión <strong>de</strong>la tradicional Cata <strong>de</strong> Vinos en el Salón<strong>de</strong> Ruedas con la asistencia <strong>de</strong> inversionistase intermediarios. The 6thversion of the traditional Annual WineTasting event took place at the TradingFloor with the presence of investorsand brokers.El 26 <strong>de</strong> agosto <strong>de</strong> 2008 se registróel remate <strong>de</strong> una acción <strong>de</strong> la <strong>Bolsa</strong><strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong>, <strong>Bolsa</strong> <strong>de</strong><strong>Valores</strong>, en un precio histórico <strong>de</strong>$ 1.631.000.000.- On August 26, ashare of the <strong>Santiago</strong> Stock Exchangewas sold at the trading floor auctionsystem reaching a historical price ofCLP 1,631,000,000.En septiembre la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong> <strong>de</strong> Chile y la <strong>Bolsa</strong>Mexicana <strong>de</strong> <strong>Valores</strong> (BMV) asícomo las <strong>de</strong>positarias <strong>de</strong> ambospaíses, In<strong>de</strong>val <strong>de</strong> México y DCV <strong>de</strong>Chile, formalizaron en septiembre suvoluntad y el inicio <strong>de</strong> los trabajospara instrumentar mecanismosque permitan la integración <strong>de</strong> susmercados <strong>de</strong> capitales en el marco <strong>de</strong>lproyecto que impulsa la Fe<strong>de</strong>raciónIberoamericana <strong>de</strong> <strong>Bolsa</strong>s (FIAB)entre las bolsas <strong>de</strong> América Latina.On September, the <strong>Santiago</strong> StockExchange and the Mexican StockExchange (BMV), as well as In<strong>de</strong>valand DCV, the Central SecuritiesDepositories of México and Chile,respectively, formalized a compromise2008 •2008 •2008 •En octubre la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong> incorpora un nuevo sistemaautomatizado <strong>de</strong> modificación y anulación<strong>de</strong> operaciones, introduciendofacilida<strong>de</strong>s y eficiencia en dicho proceso.On October, the <strong>Santiago</strong> StockExchange incorporated a new systemfor automatic elimination and modificationof tra<strong>de</strong>s, introducing moreefficiency in this process.El 18 <strong>de</strong> noviembre se materializó laapertura al mercado <strong>de</strong> la sociedadAzul Azul S.A., mediante la colocaciónfuera <strong>de</strong> <strong>Bolsa</strong> <strong>de</strong> 19.800.242acciones <strong>de</strong> primera emisión, enun monto total <strong>de</strong> $ 9.504 millones(US$ 14,7 millones aproximadamente),correspondiente a un precio <strong>de</strong>$ 480 por acción. On November18, “Azul Azul S.A.” ma<strong>de</strong> an off-exchangeinitial public offering, selling19,800,242 shares at CLP 480, raisinga total amount of CLP 9,504 millions(USD 14.7 million approximately).En noviembre se materializó con éxitofuera <strong>de</strong> bolsa la OPA <strong>de</strong> acciones CTC,en virtud <strong>de</strong> la cual Inversiones TelefónicaInternacional Holding Limitada seColocación Azul AzulCeremonia <strong>de</strong>l convenio con IBMadjudicó un total <strong>de</strong> 306.568.622 accionesserie A y 38.270.113 acciones serieB <strong>de</strong> Compañía <strong>de</strong> Telecomunicaciones<strong>de</strong> Chile S.A. , en un monto global <strong>de</strong>$375.112 millones (US$ 597,4 millones),permitiendo con ello al oferentealcanzar la propiedad <strong>de</strong>l 96,75% <strong>de</strong>las acciones emitidas por CTC. En estaoperación se utilizó el sistema computacional<strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong><strong>Santiago</strong> para la recepción <strong>de</strong> ór<strong>de</strong>nes<strong>de</strong> aceptación <strong>de</strong> dicha Oferta. On November,“Telefónica Internacional HoldingLimitada” successfully tookover“Compañía <strong>de</strong> Telecomunicaciones <strong>de</strong>Chile S.A.” (CTC) in an off-exchangetransaction, buying 306,568,622 sharesof the “A” series and 38,270,113 sharesof the B series of CTC, for a total amountof CLP 375,112 million (US$ 597.4 million),allowing the buyer to reach theproperty of 96.75% of the total issuedshares of the company.27

Principales Hitos <strong>de</strong> la BCSMilestones in the History of the SSE2008 •La <strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> oficializóel 2 <strong>de</strong> diciembre su alianza estratégicacon la empresa IBM, la quepermitirá <strong>de</strong>sarrollar una nueva generación<strong>de</strong> Sistemas <strong>de</strong> Negociación.Dentro <strong>de</strong> sus principales características<strong>de</strong>stacan la posibilidad <strong>de</strong> operarmás <strong>de</strong> 3.000 ór<strong>de</strong>nes por segundo,incrementando en más <strong>de</strong> cien vecessu capacidad operativa. On December2 2008, the <strong>Santiago</strong> Stock Exchangema<strong>de</strong> official its strategic agreementwith IBM, with the purpose of <strong>de</strong>velopinga new generation of electronictrading systems. One of the main goalsof this project is to process more than3,000 or<strong>de</strong>rs per second, increasingmore than one hundred times the currentcapacity.MBI Corredores <strong>de</strong> <strong>Bolsa</strong> S.A. inicia endiciembre el proceso <strong>de</strong> postulacióncomo corredor <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>. “MBI Corredores <strong>de</strong> <strong>Bolsa</strong>S.A.” began in December the processof application to become a member ofthe <strong>Santiago</strong> Stock Exchange.Colocación <strong>de</strong> Enjoydicándose 3.800.390.251 accionesD&S, representativas <strong>de</strong>l 58,2882%<strong>de</strong> la propiedad <strong>de</strong> la compañía, enun monto <strong>de</strong> $1.065.743 millones(US$ 1.722 millones), operación seutilizó el sistema computacional <strong>de</strong> la<strong>Bolsa</strong> <strong>de</strong> Comercio <strong>de</strong> <strong>Santiago</strong> parala recepción <strong>de</strong> ór<strong>de</strong>nes <strong>de</strong> aceptación<strong>de</strong> dicha Oferta. On December,Wal-Mart Stores Inc., the largest supermarketschain of the world, launchedthrough “Australes Tres Limitada”, atakeover for 6,520,000,000 shares of“Distribución y Servicio D&S S.A.”(D&S), corresponding to the 100% ofthe property. The takeover conclu<strong>de</strong>dsuccessfully in January 2009, buying3,800,390,251 shares, equivalent to58.2882% of the property, for a totalamount of CLP 1,065,743 million(USD 1,722 million).2009 •2009 •2009 •2009 •Con éxito se materializó fuera <strong>de</strong> bolsala OPA <strong>de</strong> acciones <strong>de</strong> Distribucióny Servicio D&S S.A., en virtud <strong>de</strong> lacual Wal-Mart, la mayor ca<strong>de</strong>na <strong>de</strong>supermercados <strong>de</strong>l mundo, se adjudicóun total <strong>de</strong> 3.800.390.251 acciones,representativas <strong>de</strong>l 58,2882% <strong>de</strong> lapropiedad <strong>de</strong> la compañía, en un montoequivalente a $ 1.065.743 millones(US$ 1.722,6 millones). (Enero 2009).Succesfully conclu<strong>de</strong>d the off floortakeover of “Distribución y ServicioD&S S.A.” in wich Wal-Mart, thelargest supermarket chain in the world,obtained a total of 3,800,390,251shares, representing the 58.2882%of the property, for a total amount of1,722.6 million dollars.El 1° <strong>de</strong> abril, MBI Corredores <strong>de</strong><strong>Bolsa</strong> S.A. inició sus operaciones comocorredor <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>. On April 1st, “MBICorredores <strong>de</strong> <strong>Bolsa</strong> S.A.” started itsoperations as a member of the <strong>Santiago</strong>Stock Exchange.El 25 <strong>de</strong> mayo se registró el remate<strong>de</strong> una acción <strong>de</strong> la <strong>Bolsa</strong> <strong>de</strong> Comercio<strong>de</strong> <strong>Santiago</strong>, en un precio <strong>de</strong>$ 1.600.000.000.- On May 25th tookplace an auction of one share of the<strong>Santiago</strong> Stock Exchange, with a priceof CLP 1,600,000,000.El 8 <strong>de</strong> junio se materializó la aperturaal mercado <strong>de</strong> la sociedad Enjoy S.A.,mediante la colocación <strong>de</strong> 462.004.782282008 •En diciembre Wal-Mart Stores Inc., lamayor ca<strong>de</strong>na <strong>de</strong> supermercados <strong>de</strong>lmundo, formuló a través <strong>de</strong> su filialInversiones Australes Tres Limitada,una OPA por 6.520.000.000 <strong>de</strong> acciones<strong>de</strong> la sociedad “Distribución yServicio D&S S.A.”, correspondienteal 100% <strong>de</strong> la propiedad accionaria<strong>de</strong> la compañía. La OPA concluyócon éxito en enero <strong>de</strong> 2009, adju-VII Cata <strong>de</strong> Vinos <strong>de</strong> Excelencia