- Page 1 and 2:

BALANCES CONSOLIDADOS / GRUPOS / Ma

- Page 3 and 4:

1.3.1. Reservas (pérdidas) acumula

- Page 5 and 6:

F) RESULTADO CONSOLIDADO DEL EJERCI

- Page 7 and 8:

BANCO SANTANDER0049 0182 0075 0081B

- Page 9 and 10:

37.983.709 18.034.356 3.716.892 3.1

- Page 11 and 12:

1.507.599 1.940.807 104.665 60.4961

- Page 13 and 14:

0128 0061 0093 0019BANKINTER BANCA

- Page 15 and 16:

1.818.641 1.441.115 -2.171.798 528.

- Page 17 and 18:

50.371 107.316 -23.532 -29.01150.37

- Page 19 and 20:

0130 0046 0138 0078BANCO CAIXA GERA

- Page 21 and 22:

-51.921 -108.405 53.183 88.1130 -18

- Page 23 and 24:

326 -14.470 1.320 1.145326 -14.471

- Page 25 and 26:

0236 0186 0094 0232LLOYDS BANKINTER

- Page 27 and 28:

-76.626 62.302 86.304 -72.2700 0 0

- Page 29 and 30:

-894 10.831 -166 3.972-894 10.831 -

- Page 31 and 32:

0083 0226 0059 0225RENTA 4 BANCO UB

- Page 33 and 34:

37.274 -9.248 27.312 207.349531 0 0

- Page 35 and 36:

2.080 2.459 1.206 22.4422.037 2.459

- Page 37 and 38:

0058 0188 0235 0200BNP PARIBAS ESPA

- Page 39 and 40:

17.421 6.363 -7.171 1.2510 0 0 00 0

- Page 41 and 42:

761 117 -830 -449761 117 -830 -4490

- Page 43 and 44:

TOTAL GRUPOS ACTIVO BANESTOBALANCES

- Page 45 and 46:

64.782.531 1.3.1. Reservas (pérdid

- Page 47 and 48:

3.748.561 F) RESULTADO CONSOLIDADO

- Page 49 and 50:

TOTALGRUPOSTOTALSUBGRUPOS112.845.17

- Page 51 and 52:

64.782.531 5.056.579método de la p

- Page 53 and 54:

3.748.561 170.6393.160.212 164.4555

- Page 55 and 56:

BALANCES CONSOLIDADOS / GRUPOS / Ju

- Page 57 and 58:

1.3. Reservas1.3.1. Reservas (pérd

- Page 59 and 60:

F.1) Resultado atribuido a la entid

- Page 61 and 62:

0049 0182 0081 0075BANCO SANTANDERB

- Page 63 and 64:

38.205.069 20.011.886 3.393.405 3.6

- Page 65 and 66:

2.255.250 2.881.584 123.418 170.360

- Page 67 and 68:

0128 0065 0093 0061BANKINTER BARCLA

- Page 69 and 70:

1.741.938 313.377 -2.261.970 1.601.

- Page 71 and 72:

102.296 -202.948 -1.033 39.3690 0 -

- Page 73 and 74:

0019 0198 0130 0046DEUTSCHE BANK,S.

- Page 75 and 76:

528.876 130.083 -51.921 -127.354528

- Page 77 and 78:

-20.920 22.957 -2.619 -11.7310 -3 0

- Page 79 and 80:

0031 0122 0234 0138BANESCO HOLDING

- Page 81 and 82:

154.761 -26.067 57.491 55.244154.76

- Page 83 and 84:

164 -8.917 3.144 2.294599 -4.097 77

- Page 85 and 86:

0078 0232 0186 0059BANCA PUEYO INVE

- Page 87 and 88:

87.513 -72.270 62.302 27.85187.513

- Page 89 and 90:

2.171 2.084 9.522 2.8890 0 0 02.171

- Page 91 and 92:

0094 0083 0226 0211RBC INVESTORSERV

- Page 93 and 94:

86.304 37.805 -9.248 -9.23086.304 3

- Page 95:

-144 4.718 5.702 -1090 63 0 0-144 4

- Page 98 and 99:

8.966 379 6.734 36352.957 14.583 0

- Page 100 and 101:

181.308 3.648 4.445 2.57533.570 603

- Page 102 and 103:

0 0 0 00 0 0 00 0 0 00 0 0 00 0 0 0

- Page 104 and 105:

69 19 603 8.692.9531.906 609 0 38.9

- Page 106 and 107:

3.808 933 2.400 45.799.0751.449 110

- Page 108 and 109:

0 0 0 68.2400 0 0 -24.8310 0 0 00 0

- Page 110 and 111:

15.1. Corrientes 247.444 247.44415.

- Page 112 and 113:

CUENTAS CONSOLIDADAS1. Intereses y

- Page 114 and 115:

5.1. Ganancias (pérdidas) por valo

- Page 116 and 117:

8.692.953 247.44438.962.180 856.679

- Page 118 and 119:

45.799.075 1.768.60622.113.776 718.

- Page 120 and 121:

68.240 0-24.831 00 0-3.869.339 -94.

- Page 122 and 123:

0182 0081 0075 0128 0061 0019BANCO

- Page 124 and 125:

0186 0059 0094 0083 0226 0225BANCOM

- Page 126 and 127:

2. OTROS PASIVOS FINANCIEROS A VALO

- Page 128 and 129:

0 0 0 0 0 00 0 0 0 0 00 0 0 0 0 00

- Page 130:

0 0 0 0 52.046.1010 0 0 0 1.872.084

- Page 147 and 148:

17.589.570 3.688.036 3.787.395 1.11

- Page 149 and 150:

24.359 27.619 646 7.036 8.506 274.4

- Page 156 and 157:

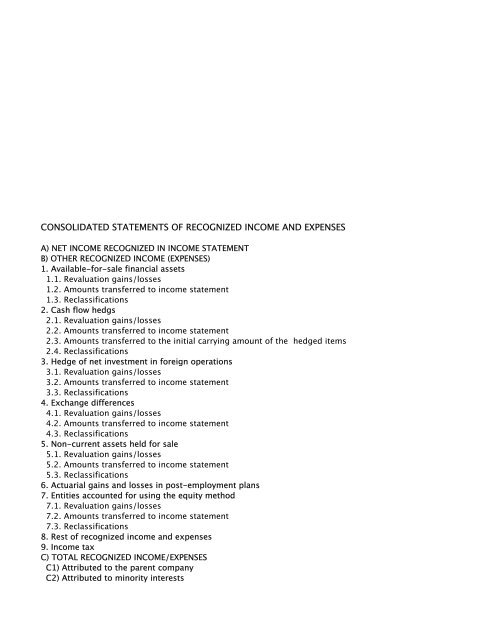

ESTADO DE INGRESOS Y GASTOS RECONOC

- Page 158 and 159:

-10.156 -77.824 1.267 3.127 2.945 4

- Page 160 and 161:

11 -1.526 45 -629 8.459.873-855 0 7

- Page 162 and 163:

15.1. Corrientes15.2. Diferidos16.

- Page 164 and 165:

CUENTAS DE PÉRDIDAS Y GANANCIAS CO

- Page 166 and 167:

6. Ganancias (pérdidas) actuariale

- Page 168 and 169:

5.750.904 2.502.087 660.696 454.170

- Page 170 and 171:

51.447.378 23.511.936 4.863.170 4.9

- Page 172 and 173:

-294.168 -1.310.136 22.332 0-283.15

- Page 174 and 175: 83.645 11.427 40.155 979132.300 725

- Page 176 and 177: 1.476.230 544.238 328.494 392.35184

- Page 178 and 179: 1.668 0 22.059 01.668 0 22.059 00 0

- Page 180 and 181: 5.641 750 3.322 1.06713.498 98.852

- Page 182 and 183: 408.153 177.731 35.767 303.247329.9

- Page 184 and 185: -82 0 0 0-82 0 0 00 0 0 00 0 0 00 0

- Page 186 and 187: 2.203 190 1.153 1.8174.600 1.126 4.

- Page 188 and 189: 39.216 45.357 45.481 34.19719.332 2

- Page 190 and 191: 0 0 0 00 0 0 00 0 0 00 0 0 00 0 0 0

- Page 192 and 193: 2.408 199 57 41425.137 543 1.519 2.

- Page 194 and 195: 39.225 843 9.246 11.83615.141 64 3.

- Page 196 and 197: 0 0 0 00 0 0 00 0 0 00 0 0 00 0 0 0

- Page 198 and 199: 341 0 216 15.47723.574 67.097 14.12

- Page 200 and 201: 22.690 371.131 7.630 8.2394.958 65.

- Page 202 and 203: 69 0 0 069 0 0 00 0 0 00 0 0 00 0 0

- Page 204 and 205: 286 69 1 9.539.674610 2.625 550 41.

- Page 206 and 207: 4.458 9.470 1.818 89.056.576700 3.7

- Page 208 and 209: 00 0 0 -1.558.2580 0 0 -1.619.7090

- Page 210 and 211: 15.1. Corrientes 147.548 1.044 148.

- Page 212 and 213: CUENTAS DE PÉRDIDAS Y GANANCIAS CO

- Page 214 and 215: 6. Ganancias (pérdidas) actuariale

- Page 216 and 217: IDAS Y GANANCIASto)

- Page 218 and 219: to)y gananciasérdidas y gananciasi

- Page 220 and 221: ltados

- Page 222 and 223: 16.2. RestTOTAL ASSETSLIABILITIES1.

- Page 226 and 227: Estados Financieros Consolidados de