Commonwealth of Puerto Rico - Departamento de Hacienda

Commonwealth of Puerto Rico - Departamento de Hacienda

Commonwealth of Puerto Rico - Departamento de Hacienda

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Commonwealth</strong> <strong>of</strong> <strong>Puerto</strong> <strong>Rico</strong>Department <strong>of</strong> the TreasuryPUBLICATION 03-02INFORMATIVE RETURNSMAGNETIC MEDIA REPORTING REQUIREMENTSFOR TAX YEAR 2003Analysis and Programming DivisionNovember, 2003

WHAT’S NEWRecord Changes• The “Tax Withheld from Distributions un<strong>de</strong>r Section 1169A” field in Form 480.7was <strong>de</strong>leted from the record layout. See Exhibit D.• The “Employer’s Id. No.” field, location 541-552, was ad<strong>de</strong>d to Form 480.6Crecord layout. If the Payee is a foreign person that does not have a SocialSecurity No. or Employer’s Id. No., enter here any other i<strong>de</strong>ntification number.See Exhibit C.Future Changes• TAX YEAR 2004 is the last year we will accept tape or cartridgesubmission.• Starting TAX YEAR 2005 all submissions must be in diskettes or CDs.

FILING REMINDERS We accept diskettes, CDs, tapes and cartridges. Remember to usethe correct Magnetic Media Specifications see pages 8-10. The magnetic media must be accompanied with a Transmittal Formas the one shown at the end <strong>of</strong> this Publication. Affix an external label to the magnetic media as the one shown inpage 11. In the case <strong>of</strong> tape or cartridge, must indicate the fileformat EBCDIC or ASCII. Make sure the data file submitted is complete. Review the Record Layouts. To avoid an error report, verify that the following fields are validand correct:••••••••Form Type.Taxable Year.Name.Address.Sequence Number.Record Type.Amounts.I<strong>de</strong>ntification Number, Social Security Number or AccountNumber. The Department <strong>of</strong> the Treasury will return all data files that do notmeet the specifications <strong>de</strong>tailed in this Publication.2

Below are the mailing addresses for the magnetic media:Via U.S. Postal Service:Department <strong>of</strong> the TreasuryTechnology Information AreaProduction Control SectionPO Box 9022501San Juan, PR 00902-2501Via carrier OTHER than the U.S. Postal Service:Department <strong>of</strong> the TreasuryTechnology Information AreaProduction Control SectionInten<strong>de</strong>nte Ramírez Building10 Paseo CovadongaSan Juan, PR 009023

May I send a paper Informative Returns along with my magnetic media?No, do not inclu<strong>de</strong> any paper Informative Returns with any magnetic media.How may I send you my Informative Returns information?Use diskettes, CDs, tapes or cartridges (we prefer diskettes or CDs).Is this the only alternative for filing the Informative Returns on magnetic media?No, if you have less than 250 Informative Returns you can use the 2003 W-2 andInformative Returns Program <strong>de</strong>veloped by the Department <strong>of</strong> the Treasury.To obtain this Program you may access our web site:www.hacienda.gobierno.prIf you do not have access to the Internet, call (787) 721-2020 extension 4511 orsend a fax to (787) 977-1337 or (787) 977-1338, the Department <strong>of</strong> the Treasurywill provi<strong>de</strong> you a CD with the Program.5

Filing DeadlineWhen is my file due to you?FormDue DateWhat if I file late?480.7A and 480.5 February 2, 2004480.6A, 480.6B, 480.7 and 480.5 March 1, 2004480.6C and 480.5 April 15, 2004480.7, 480.7B and 480.5 August 30, 2004You may be subject to the penalties imposed by the <strong>Puerto</strong> <strong>Rico</strong> InternalRevenue Co<strong>de</strong> <strong>of</strong> 1994, as amen<strong>de</strong>d.6

Processing a FileWill you notify me when the file is processed?No.Will you return the magnetic media to me if the file is processed?No.What if you can't process my file submitted on magnetic media?We will return the magnetic media to you with an explanation <strong>of</strong> the problemsthat we found. You will have 30 days to correct and return the file to us without apenalty.What should I do to correct my file?• Follow the instructions in the notice you receive.• Review and correct the information you sent us.If I use a service bureau or a reporting representative to submit my file, am Iresponsible for the accuracy and timeliness <strong>of</strong> the file?Yes.Do I need to keep a copy <strong>of</strong> the Informative Returns information I send you?Yes. The Department <strong>of</strong> the Treasury requires that you retain a copy <strong>of</strong> yourInformative Returns data, or to be able to reconstruct the data, for at least 4years after the due date <strong>of</strong> the report.7

MAGNETIC MEDIA SPECIFICATIONSDefinitionsEBCDICASCIIPayeePayer orWithholding Agent: Exten<strong>de</strong>d Binary Co<strong>de</strong>d.: American Standard Information Interchange.: Person or organization receiving payments from thereporting entity or for whom the informative return mustbe filed.: Person or organization making payments.Media and Data RequirementsCartridges (18 track) or tapes (9 track reels) will have the following characteristics:Character Co<strong>de</strong> Set : EBCDIC - No LabelsRecord Format : Fixed - No CompressBlock Size : 700Record Length : 700CDs or diskettes will have the following characteristics:Diskette Size : 3.5 HDCharacter Co<strong>de</strong> Set : ASCII (FILENAME.TXT)Record Format : FixedNo Compress8

RulesWhat rules do you have for money fields?• Right justified and zero fill to the left.• No <strong>de</strong>cimal points or commas.• No signed amounts (no dollar signs).• If no data, fill with zero.• Last two positions are for cents.• Example for amount field:♦If the format field is 9(9)v99 and the amount is $1,500.50 you will fill theeleven positions with 00000150050.What rules do you have for alpha/numeric fields?• Left justified.• If no data, leave the space in blank.Form TypeIt is necessary to complete the Form Type in the record layout as follows:• Type 2 - Indicates Form 480.6A• Type 3 - Indicates Form 480.6B• Type 4 - Indicates Form 480.7• Type 5 - Indicates Form 480.6C• Type 6 - Indicates Form 480.7A• Type 7 - Indicates Form 480.7B• For Form 480.5 see Exhibit G.9

Sequence NumberA sequence number is required for all records. Duplicate sequence numbers willNOT be allowed. The sequence numbers must be right justified. If you havemore than one magnetic media, the sequence number must be continuous untilend <strong>of</strong> file. This field must start at 0000000001.Example:Magnetic Media NumberSequence NumberMagnetic Media 1 0000000001 – 0000002000Magnetic Media 2 0000002001 – 000000300010

ADDRESSING/PACKAGINGHow do I label the magnetic media?Affix an external label like the one shown.Department <strong>of</strong> the TreasuryInformative ReturnsTax Year 2003EIN:______________________________Name:____________________________Tel:___________________Magnetic Media Sequence: ___ <strong>of</strong> ___Format (EBCDIC or ASCII):_________Do I have to inclu<strong>de</strong> a Transmittal Form with the magnetic media?Yes, for the Department <strong>of</strong> the Treasury you must always use a Transmittal Formsimilar to the one shown at the end <strong>of</strong> this Publication.How should I package my diskette or CD?• Do not use paper clips, rubber bands or staples on diskettes.• Insert each diskette in its own protective sleeve before packaging.• Send the diskette in a container to prevent damage in transit.• Use disposable containers. Special mailers for diskettes are availablecommercially.• We do not return special containers.11

How should I package my cartridge?• Send the cartridge in a box with proper packing to prevent damage in transit.• It is not necessary to use an oversized box, specially-sized boxes are availablecommercially.• We do not return special containers.• Use disposable tape containers.Where do I send the magnetic media?Via U.S. Postal Service send to:Department <strong>of</strong> the TreasuryTechnology Information AreaProduction Control SectionPO Box 9022501San Juan, PR 00902-2501Via carrier OTHER than the U.S. Postal Service:Department <strong>of</strong> the TreasuryTechnology Information AreaProduction Control SectionInten<strong>de</strong>nte Ramírez Building10 Paseo CovadongaSan Juan, PR 0090212

ASSISTANCEProgramming and Reporting QuestionsIf you have questions related to the magnetic media reporting, please send us an e-mail to w2info@hacienda.gobierno.prTax Related QuestionsIf you have questions regarding the rules for reporting and withholding <strong>of</strong> tax at sourceon income payments provi<strong>de</strong>d by the <strong>Puerto</strong> <strong>Rico</strong> Internal Revenue Co<strong>de</strong> <strong>of</strong> 1994, asamen<strong>de</strong>d, you should contact the General Consulting Section at (787) 721-2020extension 3611 or toll free (1) (800) 981-9236, Monday through Friday from 8:00 a.m. to4:30 p.m.13

FILE DESCRIPTIONEXHIBIT AANALYST : DATE : AUGUST 2003 PAGE : 1 OF 2FILE NAME : F4806A03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE USED FORM 480.6A RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 2 INDICATES FORM 480.6A *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. PAYMENT DATE (DDMMCCYY) 9(8) C 8 22-29 DEC 31 IF DATE IS NOT AVAILABLE *9. FILLER X(2) C 2 30-31 SPACES *PAYER’S INFORMATION10. IDENTIFICATION NUMBER 9(9) C 9 32-40 *11. NAME X(30) C 30 41-70 *12. ADDRESS LINE NUMBER 1 X(35) C 35 71-105 ADDRESS LINE NUMBER 1 *13. ADDRESS LINE NUMBER 2 X(35) C 35 106-140 ADDRESS LINE NUMBER 214. TOWN X(13) C 13 141-153 *15. STATE X(2) C 2 154-155 *16. ZIP-CODE 9(5) C 5 156-160 *17. ZIP-CODE EXTENSION 9(4) C 4 161-164 ZEROS, IF NOT AVAILABLE18. FILLER X(2) C 2 165-166 SPACES *PAYEE’S INFORMATION19. SOCIAL SECURITY NUMBER 9(9) C 9 167-175SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *20. BANK ACCOUNT NUMBER X(20) C 20 176-19521. NAME X(30) C 30 196-225 *22. ADDRESS LINE NUMBER 1 X(35) C 35 226-260 *23. ADDRESS LINE NUMBER 2 X(35) C 35 261-29524. T0WN X(13) C 13 296-308 *25. STATE X(2) C 2 309-310 *26. ZIP-CODE 9(5) C 5 311-315 ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6A

FILE DESCRIPTIONEXHIBIT AANALYST : DATE : AUGUST 2003 PAGE : 2 OF 2FILE NAME : F4806A03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE USED FORM 480.6A RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC27. ZIP-CODE EXTENSION 9(4) C 4 316-319 ZEROS, IF NOT AVAILABLE28. FILLER X C 1 320-320 SPACES *PAYMENTS SERVICES RENDERED BY29. INDIVIDUALS 9(10)V99 C 12 321-332 SEE FORM 480.6A ITEM 1PAYMENTS SERVICES RENDERED BY30. CORPORATIONS AND PARTNERSHIPS 9(10)V99 C 12 333-344 SEE FORM 480.6A ITEM 231. COMMISSIONS AND FEES 9(10) V99 C 12 345-356 SEE FORM 480.6A ITEM 332. RENTS 9(10) V99 C 12 357-368 SEE FORM 480.6A ITEM 433. INTEREST 9(10)V99 C 12 369-380 SEE FORM 480.6A ITEM 534. PARTNERSHIPS DISTRIBUTIONS 9(10)V99 C 12 381-392 SEE FORM 480.6A ITEM 635. DIVIDENDS 9(10)V99 C 12 393-404 SEE FORM 480.6A ITEM 7PENSION PLANS DISTRIBUTIONS NOT36. SUBJECT TO WITHHOLDING 9(10)V99 C 12 405-416 SEE FORM 480.6A ITEM 837. OTHER PAYMENTS 9(10)V99 C 12 417-428 SEE FORM 480.6A ITEM 938. GROSS PROCEEDS 9(10)V99 C 12 429-440 SEE FORM 480.6A ITEM 1039. FILLER X(260) C 260 441-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6A

FILE DESCRIPTIONEXHIBIT BANALYST : DATE : AUGUST 2003 PAGE : 1 OF 2FILE NAME : F4806B03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.6B RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 3 INDICATES FORM 480.6B *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. PAYMENT DATE (DDMMCCYY) 9(8) C 8 22-29 DEC 31 IF DATE IS NOT AVAILABLE *9. FILLER X(2) C 2 30-31 SPACES *WITHHOLDING AGENT’S INFORMATION10. IDENTIFICATION NUMBER 9(9) C 9 32-40 *11. NAME X(30) C 30 41-70 *12. ADDRESS LINE NUMBER 1 X(35) C 35 71-105 ADDRESS LINE NUMBER 1 *13. ADDRESS LINE NUMBER 2 X(35) C 35 106-140 ADDRESS LINE NUMBER 214. TOWN X(13) C 13 141-153 *15. STATE X(2) C 2 154-155 *16. ZIP-CODE 9(5) C 5 156-160 *17. ZIP-CODE EXTENSION 9(4) C 4 161-164 ZEROS, IF NOT AVAILABLE18. FILLER X(2) C 2 165-166 SPACES *PAYEE’S INFORMATION19. SOCIAL SECURITY NUMBER 9(9) C 9 167-175SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *20. BANK ACCOUNT NUMBER X(20) C 20 176-19521. NAME X(30) C 30 196-225 *22. ADDRESS LINE NUMBER 1 X(35) C 35 226-260 *23. ADDRESS LINE NUMBER 2 X(35) C 35 261-29524. T0WN X(13) C 13 296-308 *25. STATE X(2) C 2 309-310 *26. ZIP-CODE 9(5) C 5 311-315 ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6B

FILE DESCRIPTIONEXHIBIT BANALYST : DATE : AUGUST 2003 PAGE : 2 OF 2FILE NAME : F4806B03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.6B RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC27. ZIP-CODE EXTENSION 9(4) C 4 316-319 ZEROS, IF NOT AVAILABLE28. FILLER X C 1 320-320 SPACES *AMOUNT PAID29. SERVICES RENDERED INDIVIDUALS 9(10)V99 C 12 321-332 SEE FORM 480.6B ITEM 1AMOUNT WITHHELD30. SERVICES RENDERED INDIVIDUALS 9(8)V99 C 10 333-342 SEE FORM 480.6B ITEM 1AMOUNT PAID31. SERVICES CORPORATIONS PARTNERSHIPS 9(10)V99 C 12 343-354 SEE FORM 480.6B ITEM 2AMOUNT WITHHELD32. SERVICES CORPORATIONS PARTNERSHIPS 9(8) V99 C 10 355-364 SEE FORM 480.6B ITEM 2AMOUNT PAID33. JUDICIAL - EXTRAJUDICIAL 9(10)V99 C 12 365-376 SEE FORM 480.6B ITEM 3AMOUNT WITHHELD34. JUDICIAL - EXTRAJUDICIAL 9(8)V99 C 10 377-386 SEE FORM 480.6B ITEM 3AMOUNT PAID35. DIVIDENDS 9(10)V99 C 12 387-398 SEE FORM 480.6B ITEM 4AMOUNT WITHHELD36. DIVIDENDS 9(8)V99 C 10 399-408 SEE FORM 4806.B ITEM 4AMOUNT PAID37. PARTNERSHIPS DISTRIBUTIONS 9(10)V99 C 12 409-420 SEE FORM 480.6B ITEM 5AMOUNT WITHHELD38. PARTNERSHIPS DISTRIBUTIONS 9(8)V99 C 10 421-430 SEE FORM 480.6B ITEM 5AMOUNT PAID39. INTEREST 9(10)V99 C 12 431-442 SEE FORM 480.6B ITEM 6AMOUNT WITHHELD40. INTEREST 9(8)V99 C 10 443-452 SEE FORM 480.6B ITEM 6AMOUNT PAID41. DIVIDENDS IND. DEVEL. (ACT 26 2/6/78) 9(10)V99 C 12 453-464 SEE FORM 480.6B ITEM 7AMOUNT WITHHELD42. DIVIDENDS IND.DEVEL (ACT 26 2/6/78) 9(8)V99 C 10 465-474 SEE FORM 480.6B ITEM 7AMOUNT PAID43. DIVIDENDS IND. DEVEL. (ACT 8 1/24/87) 9(10)V99 C 12 475-486 SEE FORM 480.6B ITEM 8AMOUNT WITHHELD44. DIVIDENDS IND.DEVEL (ACT 8 1/24/87) 9(8)V99 C 10 487-496 SEE FORM 480.6B ITEM 8AMOUNT PAID45. PENSION PLANS DISTRIBUTIONS 9(10)V99 C 12 497-508 SEE FORM 480.6B ITEM 9AMOUNT WITHHELD46. PENSION PLANS DISTRIBUTIONS 9(8)V99 C 10 509-518 SEE FORM 480.6B ITEM 9AMOUNT PAID47. OTHER PAYMENTS 9(10)V99 C 12 519-530 SEE FORM 480.6B ITEM 10AMOUNT WITHHELD48. OTHER PAYMENTS 9(8)V99 C 10 531-540 SEE FORM 480.6B ITEM 1049. FILLER X(160) C 160 541-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6B

FILE DESCRIPTIONEXHIBIT CANALYST : DATE : AUGUST 2003 PAGE : 1 OF 2FILE NAME : F4806C03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.6C RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 5 INDICATES FORM 480.6C *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. PAYMENT DATE (DDMMCCYY) 9(8) C 8 22-29 DEC 31 IF DATE IS NOT AVAILABLE *9. FILLER X(2) C 2 30-31 SPACES *WITHHOLDING AGENT’S INFORMATION10. IDENTIFICATION NUMBER 9(9) C 9 32-40 *11. NAME X(30) C 30 41-70 *12. ADDRESS LINE NUMBER 1 X(35) C 35 71-105 ADDRESS LINE NUMBER 1 *13. ADDRESS LINE NUMBER 2 X(35) C 35 106-140 ADDRESS LINE NUMBER 214. TOWN X(13) C 13 141-153 *15. STATE X(2) C 2 154-155 *16. ZIP-CODE 9(5) C 5 156-160 *17. ZIP-CODE EXTENSION 9(4) C 4 161-164 ZEROS, IF NOT AVAILABLE18. FILLER X(2) C 2 165-166 SPACES *PAYEE’S INFORMATION19. SOCIAL SECURITY NUMBER 9(9) C 9 167-17520. BANK ACCOUNT NUMBER X(20) C 20 176-195IF NOT NUMERIC OR LONGER THAN 9 USE THEEMPLOYER’S ID FIELD AND FILL WITH ZEROSHERE*21. NAME X(30) C 30 196-225 *22. ADDRESS LINE NUMBER 1 X(35) C 35 226-260 *23. ADDRESS LINE NUMBER 2 X(35) C 35 261-29524. T0WN X(13) C 13 296-308 *25. STATE X(2) C 2 309-310 *26. ZIP-CODE 9(5) C 5 311-315 ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6C

FILE DESCRIPTIONEXHIBIT CANALYST : DATE : AUGUST 2003 PAGE : 2 OF 2FILE NAME : F4806C03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.6C RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC27. ZIP-CODE EXTENSION 9(4) C 4 316-319 ZEROS, IF NOT AVAILABLE28. FILLER X C 1 320-320 SPACES *AMOUNT PAID29. SALARIES ,WAGES OR COMPENSATIONS 9(10)V99 C 12 321-332 SEE FORM 480.6C ITEM 1AMOUNT WITHHELD30. SALARIES ,WAGES OR COMPENSATIONS 9(8)V99 C 10 333-342 SEE FORM 480.6C ITEM 1AMOUNT PAID31. PARTNERSHIPS DISTRIBUTIONS 9(10)V99 C 12 343-354 SEE FORM 480.6C ITEM 2AMOUNT WITHHELD32. PARTNERSHIPS DISTRIBUTIONS 9(8) V99 C 10 355-364 SEE FORM 480.6C ITEM 2AMOUNT PAID33. SALE OF PROPERTY 9(10)V99 C 12 365-376 SEE FORM 480.6C ITEM 3AMOUNT WITHHELD34. SALE OF PROPERTY 9(8)V99 C 10 377-386 SEE FORM 480.6C ITEM 3AMOUNT PAID35. DIVIDENDS 9(10)V99 C 12 387-398 SEE FORM 480.6C ITEM 4AMOUNT WITHHELD36. DIVIDENDS 9(8)V99 C 10 399-408 SEE FORM 4806.C ITEM 4AMOUNT PAID37. ROYALTIES 9(10)V99 C 12 409-420 SEE FORM 480.6C ITEM 5AMOUNT WITHHELD38. ROYALTIES 9(8)V99 C 10 421-430 SEE FORM 480.6C ITEM 5AMOUNT PAID39. INTEREST 9(10)V99 C 12 431-442 SEE FORM 480.6C ITEM 6AMOUNT WITHHELD40. INTEREST 9(8)V99 C 10 443-452 SEE FORM 480.6C ITEM 6AMOUNT PAID41. RENTS 9(10)V99 C 12 453-464 SEE FORM 480.6C ITEM 7AMOUNT WITHHELD42. RENTS 9(8)V99 C 10 465-474 SEE FORM 480.6C ITEM 7AMOUNT PAID43. PENSION PLANS DISTRIBUTIONS 9(10)V99 C 12 475-486 SEE FORM 480.6C ITEM 8AMOUNT WITHHELD44. PENSION PLANS DISTRIBUTIONS 9(8)V99 C 10 487-496 SEE FORM 480.6C ITEM 8AMOUNT PAID45. PUBLIC SHOWS 9(10)V99 C 12 497-508 SEE FORM 480.6C ITEM 9AMOUNT WITHHELD46. PUBLIC SHOWS 9(8)V99 C 10 509-518 SEE FORM 480.6C ITEM 9AMOUNT PAID47. OTHERS 9(10)V99 C 12 519-530 SEE FORM 480.6C ITEM 10AMOUNT WITHHELD48. OTHERS 9(8)V99 C 10 531-540 SEE FORM 480.6C ITEM 1049. EMPLOYER’S ID X(12) C 12 541-552IF APLICABLE, ENTER HERE ANIDENTIFICATION NO. OTHER THAN THESOCIAL SECURITY NO. OR EMPLOYER ID. NO.OTHERWISE, FILL WITH BLANKS.50. FILLER X(148) C 148 553-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.6C

FILE DESCRIPTIONEXHIBIT DANALYST : DATE : AUGUST 2003 PAGE : 1 OF 3FILE NAME : F4807Y03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM 480.7 RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 4 INDICATES FORM 480.7 *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. PAYMENT DATE (DDMMCCYY) 9(8) C 8 22-29 DEC 31 IF DATE IS NOT AVAILABLE *9. FILLER X(2) C 2 30-31 SPACES *WITHHOLDING AGENT’S INFORMATION10. IDENTIFICATION NUMBER 9(9) C 9 32-40 *11. NAME X(30) C 30 41-70 *12. ADDRESS LINE NUMBER 1 X(35) C 35 71-105 ADDRESS LINE NUMBER 1 *13. ADDRESS LINE NUMBER 2 X(35) C 35 106-140 ADDRESS LINE NUMBER 214. TOWN X(13) C 13 141-153 *15. STATE X(2) C 2 154-155 *16. ZIP-CODE 9(5) C 5 156-160 *17. ZIP-CODE EXTENSION 9(4) C 4 161-164 ZEROS, IF NOT AVAILABLE18. FILLER X(2) C 2 165-166 SPACES *PAYEE’S INFORMATION19. SOCIAL SECURITY NUMBER 9(9) C 9 167-175SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *20. IRA ACCOUNT NUMBER X(20) C 20 176-19521. NAME X(30) C 30 196-225 *22. ADDRESS LINE NUMBER 1 X(35) C 35 226-260 *23. ADDRESS LINE NUMBER 2 X(35) C 35 261-29524. T0WN X(13) C 13 296-308 *25. STATE X(2) C 2 309-310 *26. ZIP-CODE 9(5) C 5 311-315 ** REQUIRED FIELDSTAX YEAR 2003FORM 480.7

FILE DESCRIPTIONEXHIBIT DANALYST : DATE : AUGUST 2003 PAGE : 2 OF 3FILE NAME : F4807Y03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.7 RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC27. ZIP-CODE EXTENSION 9(4) C 4 316-319 ZEROS, IF NOT AVAILABLE28. FILLER X C 1 320-320 SPACES *29. TOTAL BALANCE OF THE ACCOUNT ATTHE BEGINNING OF THE YEAR 9(10)V99 C 12 321-332 SEE FORM 480.7 ITEM 130. CONTRIBUTIONS FOR THE TAXABLE YEAR 9(10)V99 C 12 333-344 SEE FORM 480.7 ITEM 231. CONTRIBUTIONS THROUGH TRANSFER 9(10)V99 C 12 345-356 SEE FORM 480.7 ITEM 332. WITHDRAWALS THROUGH TRANSFER 9(10)V99 C 12 357-368 SEE FORM 480.7 ITEM 433. REFUND OF EXCESS CONTRIBUTIONS 9(10)V99 C 12 369-380 SEE FORM 480.7 ITEM 534. PENALTY WITHHELD 9(10)V99 C 12 381-392 SEE FORM 480.7 ITEM 635. TAX WITHHELD FROM INTEREST(17% LINE 12D) 9(10)V99 C 12 393-404 SEE FORM 480.7 ITEM 736. TAX WITHHELD INCOME FROM SOURCESWITHIN P.R. (17% LINE 12E) 9(10)V99 C 12 405-416 SEE FORM 480.7 ITEM 837. TAX WITHHELD FROM GOVERNMENTPENSIONERS (10% LINES 12G2 AND 12G3) 9(10)V99 C 12 417-428 SEE FORM 480.7 ITEM 938. TAX PREPAID UNDER SECTION 1169A(10% LINE 12H) 9(10)V99 C 12 429-440 SEE FORM 480.7 ITEM 1039. TAX WITHHELD FROM DISTRIBUTIONSUNDER SECTION 1169B (12.5% LINE 12I) 9(10)V99 C 12 441-452 SEE FORM 480.7 ITEM 11BREAKDOWN OF AMOUNT DISTRIBUTED40. A- CONTRIBUTIONS 9(10)V99 C 12 453-464 SEE FORM 480.7 ITEM 12A41. B- VOLUNTARY CONTRIBUTIONS 9(10)V99 C 12 465-476 SEE FORM 480.7 ITEM 12B42. C- EXEMPT INTEREST 9(10)V99 C 12 477-488 SEE FORM 480.7 ITEM 12C43. D- INTEREST FROM ELEGIBLEFINANCIAL INSTITUTIONS 9(10)V99 C 12 489-500 SEE FORM 480.7 ITEM 12D44. E- INCOME FORM SOURCES WITHIN P.R. 9(10)V99 C 12 501-512 SEE FORM 480.7 ITEM 12E45. F- OTHER INCOME 9(10)V99 C 12 513-524 SEE FORM 480.7 ITEM 12F46. G- GOVERNMENT PENSIONERS1. CONTRIBUTIONS 9(10)V99 C 12 525-536 SEE FORM 480.7 ITEM 12G147. G- GOVERNMENT PENSIONERS2. ELEGIBLE INTEREST 9(10)V99 C 12 537-548 SEE FORM 480.7 ITEM 12G248. G- GOVERNMENT PENSIONERS3. OTHER INCOME 9(10)V99 C 12 549-560 SEE FORM 480.7 ITEM 12G349. G- GOVERNMENT PENSIONERSTOTAL 9(10)V99 C 12 561-572 SEE FORM 480.7 ITEM 12G50. H- UNDER SECTION 1169A1. CONTRIBUTIONS 9(10)V99 C 12 573-584 SEE FORM 480.7 ITEM 12H151. H- UNDER SECTION 1169A2. ELEGIBLE INTEREST 9(10)V99 C 12 585-596 SEE FORM 480.7 ITEM 12H252. H- UNDER SECTION 1169A3. OTHER INCOME 9(10)V99 C 12 597-608 SEE FORM 480.7 ITEM 12H353. H- UNDER SECTION 1169ATOTAL 9(10)V99 C 12 609-620 SEE FORM 480.7 ITEM 12H* REQUIRED FIELDSTAX YEAR 2003FORM 480.7

EXHIBIT DFILE DESCRIPTIONANALYST : DATE : AUGUST 2003 PAGE : 3 OF 3FILE NAME : F4807Y03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – FORM TYPE 480.7 RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC54. I- THROUGH TRANSFER UNDER SEC. 1169B1. CONTRIBUTIONS 9(10)V99 C 12 621-632 SEE FORM 480.7 ITEM 12I155. I- THROUGH TRANSFER UNDER SEC. 1169B2. ELEGIBLE INTEREST 9(10)V99 C 12 633-644 SEE FORM 480.7 ITEM 12I256. I- THROUGH TRANSFER UNDER SEC. 1169B3. OTHER INCOME 9(10)V99 C 12 645-656 SEE FORM 480.7 ITEM 12I357. I- THROUGH TRANSFER UNDER SEC. 1169BTOTAL 9(10)V99 C 12 657-668 SEE FORM 480.7 ITEM 12I58. J- TOTAL (ADD LINES 12A THROUGH 12I) 9(10)V99 C 12 669-680 SEE FORM 480.7 ITEM 12J59. FILLER X(20) C 20 681-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.7

FILE DESCRIPTIONEXHIBIT EANALYST : DATE : AUGUST 2003 PAGE : 1 OF 2FILE NAME : F4807AY03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: MORTGAGE INTEREST – FORM 480.7A RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 6 INDICATES FORM 480.7A *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. PAYMENT DATE (DDMMCCYY) 9(8) C 8 22-29 DEC 31 IF DATE IS NOT AVAILABLE *9. FILLER X(2) C 2 30-31 SPACES *RECIPIENT’S INFORMATION10. EMPLOYER’S IDENTIFICATION NUMBER 9(9) C 9 32-40 *11. NAME X(30) C 30 41-70 *12. ADDRESS LINE NUMBER 1 X(35) C 35 71-105 ADDRESS LINE NUMBER 1 *13. ADDRESS LINE NUMBER 2 X(35) C 35 106-140 ADDRESS LINE NUMBER 214. TOWN X(13) C 13 141-153 *15. STATE X(2) C 2 154-155 *16. ZIP-CODE 9(5) C 5 156-160 *17. ZIP-CODE EXTENSION 9(4) C 4 161-164 ZEROS, IF NOT AVAILABLE18. FILLER X(2) C 2 165-166 SPACES *BORROWER’S INFORMATION19. SOCIAL SECURITY NUMBER 9(9) C 9 167-175SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *20. NAME X(30) C 30 176-205 *21. ADDRESS LINE NUMBER 1 X(35) C 35 206-240 *22. ADDRESS LINE NUMBER 2 X(35) C 35 241-27523. T0WN X(13) C 13 276-288 *24. STATE X(2) C 2 289-290 *25. ZIP-CODE 9(5) C 5 291-295 *26. ZIP-CODE EXTENSION 9(4) C 4 296-299 ZEROS, IF NOT AVAILABLE* REQUIRED FIELDSTAX YEAR 2003FORM 480.7A

FILE DESCRIPTIONEXHIBIT EANALYST : DATE : AUGUST 2003 PAGE : 2 OF 2FILE NAME : F4807AY03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: MORTGAGE INTEREST - FORM TYPE 480.7A RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SECJOINT BORROWER’S INFORMATION27. SOCIAL SECURITY NUMBER 9(9) C 9 300-308SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER28. NAME X(30) C 30 309-33829. FILLER X C 1 339-339 SPACES30. INTEREST PAID BY BORROWER 9(10)V99 C 12 340-351 SEE FORM 480.7A ITEM 131. LOAN ORIGINATION FEES(POINTS) PAIDDIRECTLY BY BORROWER 9(10)V99 C 12 352-363 SEE FORM 480.7A ITEM 232. LOAN ORIGINATION FEES PAID ORFINANCED X C 1 364-364P = PAIDF = FINANCED33. LOAN DISCOUNT (POINTS) PAIDDIRECTLY BY BORROWER 9(10) V99 C 12 365-376 SEE FORM 480.7A ITEM 334. LOAN DISCOUNT PAID OR FINANCED X C 1 377-377P = PAIDF = FINANCED***35. REFUND OF INTEREST 9(10) V99 C 12 378-389 SEE FORM 480.7A ITEM 4*36. PROPERTY TAXES 9(10) V99 C 12 390-401 SEE FORM 480.7A ITEM 537. PRINCIPAL BALANCE 9(10) V99 C 12 402-413 SEE FORM 480.7A ITEM 638. FILLER X C 1 414-414 SPACES39. LOAN ACCOUNT NUMBER X(25) C 25 415-43940. LOAN TERM 9(3) C 3 440-442 NUMBER OF YEARS41. FILLER X(258) C 258 443-700 SPACES** REQUIRED FIELDSTAX YEAR 2003FORM 480.7A

FILE DESCRIPTIONEXHIBIT FANALYST : DATE : AUGUST 2003 PAGE : 1 OF 2FILE NAME : F4807B03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: EDUCATIONAL CONTRIBUTION ACCOUNT – FORM TYPE 480.7B RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *3. FORM TYPE 9 C 1 13-13 7 INDICATES FORM 480.7B *4. RECORD TYPE 9 C 1 14-14 1 = DETAIL RECORD *D = DUPLICATE BLANK = ORIGINAL5. DOCUMENT TYPE X C 1 15-15 A = AMENDED6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. FILLER X C 1 22-22 SPACES *WITHHOLDING AGENT’S INFORMATION9. IDENTIFICATION NUMBER 9(9) C 9 23-31 *10. NAME X(30) C 30 32-61 *11. ADDRESS LINE NUMBER 1 X(35) C 35 62-96 ADDRESS LINE NUMBER 1 *12. ADDRESS LINE NUMBER 2 X(35) C 35 97-131 ADDRESS LINE NUMBER 213. TOWN X(13) C 13 132-144 *14. STATE X(2) C 2 145-146 *15. ZIP-CODE 9(5) C 5 147-151 *16. FILLER X C 1 152-152 SPACES *BENEFICIARY’S INFORMATION17. SOCIAL SECURITY NUMBER 9(9) C 9 153-161SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *18. BIRTH YEAR X(4) C 4 162-16519. BIRTH MONTH X(2) C 2 166-16720. BIRTH DAY X(2) C 2 168-16921. NAME X(30) C 30 170-199 *22. ADDRESS LINE NUMBER 1 X(35) C 35 200-234 *23. ADDRESS LINE NUMBER 2 X(35) C 35 235-26924. T0WN X(13) C 13 270-282 *25. STATE X(2) C 2 283-284 *26. ZIP-CODE 9(5) C 5 285-289 ** REQUIRED FIELDSTAX YEAR 2003FORM 480.7B

FILE DESCRIPTIONEXHIBIT FANALYST : DATE : AUGUST 2003 PAGE : 2 OF 2FILE NAME : F4807B03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: EDUCATIONAL CONTRIBUTION ACCOUNT – FORM TYPE 480.7B RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC27. BANK ACCOUNT NUMBER X(20) C 20 290-30928. FILLER X C 1 310-310 SPACES *CONTRIBUTOR’S INFORMATION29. SOCIAL SECURITY NUMBER 9(9) C 9 311-319SOCIAL SECURITY NUMBER ORIDENTIFICATION NUMBER *30. RELATIONSHIP X(10) C 10 320-32931. NAME X(30) C 30 330-359 *32. ADDRESS LINE NUMBER 1 X(35) C 35 360-394 *33. ADDRESS LINE NUMBER 2 X(35) C 35 395-42934. T0WN X(13) C 13 430-442 *35. STATE X(2) C 2 443-444 *36. ZIP-CODE 9(5) C 5 445-449 *TOTAL BALANCE OF ACCOUNT37. AT BEGINNING OF THE YEAR 9(5)V99 C 7 450-456 SEE FORM 480.7B ITEM 1CONTRIBUTIONS38. DURING THE TAXABLE YEAR 9(5)V99 C 7 457-463 SEE FORM 480.7B ITEM 2CONTRIBUTIONS39. THROUGH TRANSFER 9(5)V99 C 7 464-470 SEE FORM 480.7B ITEM 3WITHDRAWALS40. THROUGH TRANSFER 9(5)V99 C 7 471-477 SEE FORM 480.7B ITEM 4REFUND OF41. EXCESS CONTRIBUTIONS 9(5)V99 C 7 478-484 SEE FORM 480.7B ITEM 5TAX WITHHELD42. FROM INTEREST (17%) 9(5)V99 C 7 485-491 SEE FORM 480.7B ITEM 6TAX WITHHELD FROM DISTRIBUTIONS OF43. INCOME FROM SOURCES WITHIN P.R. (17%) 9(5)V99 C 7 492-498 SEE FORM 480.7B ITEM 7BREAKDOWN OF AMOUNT DISTRIBUTED44. CONTRIBUTIONS 9(5)V99 C 7 499-505 SEE FORM 480.7B ITEM 8A45. TAXABLE INTEREST 9(5)V99 C 7 506-512 SEE FORM 480.7B ITEM 8B-146. EXEMPT INTEREST 9(5)V99 C 7 513-519 SEE FORM 480.7B ITEM 8B-247. INCOME FROM SOURCES WITHIN P.R. 9(5)V99 C 7 520-526 SEE FORM 480.7B ITEM 8B-348. INCOME FROM SOURCES WITHOUT P.R. 9(5)V99 C 7 527-533 SEE FORM 480.7B ITEM 8B-449. TOTAL (ADD LINES 8A AND 8B) 9(5)V99 C 7 534-540 SEE FORM 480.7B ITEM 8C50. FILLER X(160) C 160 541-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.7B

FILE DESCRIPTIONEXHIBIT GANALYST : DATE : AUGUST 2003 PAGE : 1 OF 1FILE NAME : F4805Y03 FILE NUMBER :P=PACKED, B=BINARY, C=CHARACTERRECORD NAME: PAYMENTS MADE AND TAX WITHHELD – SUMMARY RECORD 480.5 RECORD LENGTH : 700FIELD NAME PICTURE BYTESFILELOCATION COMMENTS SEC1. SEQUENCE NUMBER 9(10) C 10 01-10 RIGHT JUSTIFIED *2. FILLER X(2) C 2 11-12 SPACES *2= 460.6A 3= 480.6B 4= 480.73. FORM TYPE 9 C 1 13-13 5= 480.6C 7= 480.7B *4. RECORD TYPE 9 C 1 14-14 2= SUMMARY *5. FILLER X C 1 15-15 SPACES *6. FILLER X(2) C 2 16-17 SPACES *YEAR IN WHICH THE PAYMENT WAS MADE7. TAXABLE YEAR 9(4) C 4 18-21 MUST BE 2003 *8. FILLER X(2) C 2 22-23 SPACES *WITHHOLDING AGENT’S INFORMATION9. IDENTIFICATION NUMBER 9(9) C 9 24-32 *10. NAME X(30) C 30 33-62 *11. ADDRESS LINE NUMBER 1 X(35) C 35 63-97 ADDRESS LINE NUMBER 1 *12. ADDRESS LINE NUMBER 2 X(35) C 35 98-132 ADDRESS LINE NUMBER 213. TOWN X(13) C 13 133-145 *14. STATE X(2) C 2 146-147 *15. ZIP-CODE 9(5) C 5 148-152 *16. ZIP-CODE EXTENSION 9(4) C 4 153-156 ZEROS, IF NOT AVAILABLE17. FILLER X(2) C 2 157-158 SPACES *NUMBER OF DOCUMENTS BY TYPE OF FORM18. NUMBER OF DOCUMENTS 9(10) C 10 159-168 RIGHT JUSTIFIED *19. TOTAL AMOUNT WITHHELD 9(13)V99 C 15 169-183 TOTAL WITHHELD BY TYPE OF FORM *20. TOTAL AMOUNT PAID 9(13)V99 C 15 184-198 TOTAL PAID BY TYPE OF FORM *21. FILLER X(502) C 502 199-700 SPACES ** REQUIRED FIELDSTAX YEAR 2003FORM 480.5

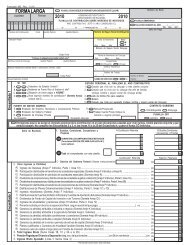

EXHIBIT HFormularioFormRev. 05.02Rep. 05.03480.6AAÑO CONTRIBUTIVO - TAXABLE YEAR: ______Número <strong>de</strong> I<strong>de</strong>ntificación Patronal - Employer's I<strong>de</strong>ntification NumberESTADO LIBRE ASOCIADO DE PUERTO RICO - COMMONWEALTH OF PUERTO RICO<strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> - Department <strong>of</strong> the TreasuryDECLARACION INFORMATIVA - INGRESOS NO SUJETOS A RETENCIONINFORMATIVE RETURN - INCOME NOT SUBJECT TO WITHHOLDINGDuplicado - Duplicate: ; Enmendado - Amen<strong>de</strong>d: ;Número <strong>de</strong> SerieINFORMACION DEL PAGADOR - PAYER'S INFORMATION Clase <strong>de</strong> Ingreso Cantidad PagadaType <strong>of</strong> IncomeUso Oficial - Official UseAmount PaidNombre - Name1 . Pagos por Servicios Prestados por IndividuosPayments for Services Ren<strong>de</strong>red by IndividualsDirección - Address2. Pagos por Servicios Prestados por Corporaciones y Socieda<strong>de</strong>sPayments for Services Ren<strong>de</strong>red by Corporations and Partnerships3. Comisiones y HonorariosCommissions and FeesCódigo Postal - Zip Co<strong>de</strong>INFORMACION DE QUIEN RECIBE EL PAGO - PAYEE'S INFORMATIONNúmero <strong>de</strong> Seguro Social o I<strong>de</strong>ntificación Patronal - Social Security or Employer'sI<strong>de</strong>ntification NumberNombre - Name4. RentasRents5. Intereses (excepto IRA)Interest (except IRA)6. Distribuciones <strong>de</strong> Socieda<strong>de</strong>s (Ver instrucciones)Partnerships Distributions (See instructions)Dirección - Address7. Divi<strong>de</strong>ndosDivi<strong>de</strong>nds8. Distribuciones <strong>de</strong> Planes <strong>de</strong> Pensiones No Sujetas a RetenciónPension Plans Distributions Not Subject to WithholdingNúmero <strong>de</strong> Cuenta BancariaBank Account NumberCódigo Postal - Zip Co<strong>de</strong>9. Otros PagosOther Payments10. Rédito BrutoGross ProceedsFECHA DE RADICACION: 28 DE FEBRERO, VEA INSTRUCCIONES AL DORSO - FILING DATE: FEBRUARY 28, SEE INSTRUCTIONS ON BACKORIGINAL PARA EL NEGOCIADO DE PROCESAMIENTO DE PLANILLAS - ORIGINAL FOR THE RETURNS PROCESSING BUREAU

INSTRUCCIONESDeclaración Informativa - Ingresos No Sujetos a RetenciónTodas las personas <strong>de</strong>dicadas a industria o negocio en <strong>Puerto</strong> <strong>Rico</strong> que hicieran pagos a corporaciones y socieda<strong>de</strong>s por concepto <strong>de</strong> servicios prestados o a individuos por cualesquiera <strong>de</strong> lossiguientes conceptos, <strong>de</strong>ben preparar el Formulario 480.6A:1.2.3.4.5.6.7.Pagos por servicios prestados por individuos, corporaciones y socieda<strong>de</strong>s entre $500 y $1,500; y aquellos mayores <strong>de</strong> $1,500 que poseen un relevo total <strong>de</strong> retención;Honorarios, comisiones (cuando no exista la relación obrero patronal), y otra compensación ascen<strong>de</strong>ntes a $500 ó más, que no hayan sido informados en el Comprobante <strong>de</strong> Retención(Formulario 499R-2/W-2PR) o en el Formulario 480.6B;Rentas, primas, anualida<strong>de</strong>s, regalías y otros ingresos fijos o <strong>de</strong>terminables ascen<strong>de</strong>ntes a $500 ó más hechos a individuos;Intereses (que no sean los exentos <strong>de</strong> tributación) ascen<strong>de</strong>ntes a $500 ó más hechos a individuos, no informados en el Formulario 480.6B. Los intereses pagados a una Cuenta <strong>de</strong> RetiroIndividual (IRA) o a una Cuenta <strong>de</strong> Aportación Educativa <strong>de</strong>berán ser informados en el Formulario 480.7 ó 480.7B, respectivamente;Distribuciones <strong>de</strong> socieda<strong>de</strong>s hechas a individuos;Divi<strong>de</strong>ndos (que no sean distribuciones en liquidación) ascen<strong>de</strong>ntes a $500 ó más hechos a individuos, no informados en el Formulario 480.6B;Distribuciones <strong>de</strong> planes <strong>de</strong> pensiones no sujetas a retención. Las distribuciones en suma global <strong>de</strong> planes <strong>de</strong> pensiones cualificados, relacionadas con la separación <strong>de</strong> empleo, <strong>de</strong>berán ser informadasen el Formulario 480.6B.La <strong>de</strong>claración <strong>de</strong>berá prepararse a base <strong>de</strong> año natural y <strong>de</strong>berá entregarse a la persona y rendirse al <strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong>, no más tar<strong>de</strong> <strong>de</strong>l 28 <strong>de</strong> febrero <strong>de</strong>l año siguiente al añonatural en que se efectúan los pagos. El original <strong>de</strong> la <strong>de</strong>claración <strong>de</strong>berá ser enviado al: DEPARTAMENTO DE HACIENDA PO BOX 9022501 SAN JUAN PR 00902-2501. En caso <strong>de</strong> que lacopia original se envíe en cinta magnética, no envíe la copia original en papel.El Código impone penalida<strong>de</strong>s por <strong>de</strong>jar <strong>de</strong> informar los ingresos en el Formulario 480.6A o por <strong>de</strong>jar <strong>de</strong> rendir el mismo.INSTRUCTIONSInformative Return - Income Not Subject to WithholdingAII persons engaged in tra<strong>de</strong> or business within <strong>Puerto</strong> <strong>Rico</strong>, that ma<strong>de</strong> payments to corporations and partnerships for services ren<strong>de</strong>red or to individuals for any <strong>of</strong> the following items, mustprepare Form 480.6A:1.2.3.4.5.6.7.Payments for services ren<strong>de</strong>red by individuals, corporations and partnerships between $500 and $1,500; and those over $1,500 that have total waiver from withholding;Fees, commissions (when an employer-employee relation does not exist), and other compensation amounting to $500 or more, that have not been reported on the Withholding Statement(Form 499R-2/W-2PR) or Form 480.6B;Rents, premiums, annuities, royalties and other fixed or <strong>de</strong>terminable income amounting to $500 or more ma<strong>de</strong> to individuals;Interest (other than tax exempt interest) amounting to $500 or more ma<strong>de</strong> to individuals, not reported on Form 480.6B. Interest paid to an Individual Retirement Account (IRA) or to anEducational Contribution Account must be informed on Form 480.7 or 480.7B, respectively;Partnerships distributions ma<strong>de</strong> to individuals;Divi<strong>de</strong>nds (other than distributions in liquidation) amounting to $500 or more ma<strong>de</strong> to individuals, not reported on Form 480.6B;Pension plans distributions not subject to withholding. Lump-sum distributions from qualified pension plans, resulting from a job termination, must be reported on Form 480.6B.The return must be prepared on the basis <strong>of</strong> a calendar year and must be given to the person and filed with the Department <strong>of</strong> the Treasury, not later than February 28 <strong>of</strong> the year following thecalendar year in which payments were ma<strong>de</strong>. The original <strong>of</strong> this return must be filed with the: DEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501. In case thatthe original copy is sent through magnetic tape, do not send the original paper copy.The Co<strong>de</strong> imposes penalties for not reporting the income on Form 480.6A or for not filing such return.

EXHIBIT IFormularioFormRev. 05.00Rep. 05.03480.6BAÑO CONTRIBUTIVO - TAXABLE YEAR: ______ESTADO LIBRE ASOCIADO DE PUERTO RICO - COMMONWEALTH OF PUERTO RICO<strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> - Department <strong>of</strong> the TreasuryDECLARACION INFORMATIVA - INGRESOS SUJETOS A RETENCIONINFORMATIVE RETURN - INCOME SUBJECT TO WITHHOLDINGDuplicado - Duplicate: ; Enmendado - Amen<strong>de</strong>d: ;Uso Oficial - Official UseNúmero <strong>de</strong> SerieINFORMACION DEL AGENTE RETENEDOR - WITHHOLDING AGENT'S INFORMATION Clase <strong>de</strong> Ingreso Cantidad Pagada Cantidad RetenidaNúmero <strong>de</strong> I<strong>de</strong>ntificación Patronal - Employer's I<strong>de</strong>ntification NumberType <strong>of</strong> IncomeAmount PaidAmount WithheldNombre - Name1 . Pagos por Servicios Prestados por IndividuosPayments for Services Ren<strong>de</strong>red by IndividualsDirección - Address2. Pagos por Servicios Prestados porCorporaciones y Socieda<strong>de</strong>s - Payments forServices Ren<strong>de</strong>red by Corporations and Partnerships3. Pagos por In<strong>de</strong>mnización Judicial o ExtrajudicialPayments for Judicial or Extrajudicial In<strong>de</strong>mnificationCódigo Postal - Zip Co<strong>de</strong>INFORMACION DE QUIEN RECIBE EL PAGO - PAYEE'S INFORMATIONNúmero <strong>de</strong> Seguro Social o I<strong>de</strong>ntificación Patronal - Social Security orEmployer's I<strong>de</strong>ntification NumberNombre - NameDirección - Address4. Divi<strong>de</strong>ndosDivi<strong>de</strong>nds5. Distribuciones <strong>de</strong> Socieda<strong>de</strong>sPartnerships Distributions6. Intereses (excepto IRA)Interest (except IRA)Número <strong>de</strong> Cuenta BancariaBank Account NumberNúmero Control - Control NumberCódigo Postal - Zip Co<strong>de</strong>7. Divi<strong>de</strong>ndos <strong>de</strong> Ingresos <strong>de</strong> Fomento Industrial (Ley26 <strong>de</strong> 2 <strong>de</strong> junio <strong>de</strong> 1978) - Divi<strong>de</strong>nds from IndustrialDevelopment Income (Act 26 <strong>of</strong> June 2, 1978)8. Divi<strong>de</strong>ndos <strong>de</strong> Ingresos <strong>de</strong> Fomento Industrial (Ley8 <strong>de</strong> 24 <strong>de</strong> enero <strong>de</strong> 1987) - Divi<strong>de</strong>nds from IndustrialDevelopment Income (Act 8 <strong>of</strong> January 24, 1987)9. Distribuciones <strong>de</strong> Planes <strong>de</strong> PensionesPension Plans Distributions10. Otros PagosOther PaymentsFECHA DE RADICACION: 28 DE FEBRERO, VEA INSTRUCCIONES AL DORSO - FILING DATE: FEBRUARY 28, SEE INSTRUCTIONS ON BACKORIGINAL PARA EL NEGOCIADO DE PROCESAMIENTO DE PLANILLAS - ORIGINAL FOR THE RETURNS PROCESSING BUREAU

INSTRUCCIONESDeclaración Informativa - Ingresos Sujetos a RetenciónPrepare el Formulario 480.6B para cada persona, natural o jurídica, a quien le retuvo contribución en el origen con respecto a pagos por ServiciosPrestados, In<strong>de</strong>mnización Judicial o Extrajudicial, Divi<strong>de</strong>ndos, Distribuciones <strong>de</strong> Socieda<strong>de</strong>s, Intereses, Divi<strong>de</strong>ndos <strong>de</strong> Ingresos <strong>de</strong> Fomento Industrial(Ley 26 <strong>de</strong> 2 <strong>de</strong> junio <strong>de</strong> 1978 ó Ley 8 <strong>de</strong> 24 <strong>de</strong> enero <strong>de</strong> 1987) y Distribuciones <strong>de</strong> Planes <strong>de</strong> Pensiones recibidas en suma global (un solo pago oen varios pagos <strong>de</strong>ntro <strong>de</strong> un solo año). A<strong>de</strong>más, se informarán otros pagos sujetos a retención no contemplados bajo las clases <strong>de</strong> ingresos antesmencionadas.Los intereses pagados a una Cuenta <strong>de</strong> Retiro Individual (IRA) o una Cuenta <strong>de</strong> Aportación Educativa <strong>de</strong>berán ser informados en el Formulario480.7 ó 480.7B, respectivamente.La <strong>de</strong>claración <strong>de</strong>berá entregarse a la persona natural o jurídica, y rendirse al <strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> no más tar<strong>de</strong> <strong>de</strong>l 28 <strong>de</strong> febrero <strong>de</strong>l añosiguiente al año natural para el cual se efectuó la retención. El original <strong>de</strong> la <strong>de</strong>claración <strong>de</strong>berá ser enviado al: DEPARTAMENTO DE HACIENDAPO BOX 9022501 SAN JUAN PR 00902-2501. En el caso que la copia original se envíe en cinta magnética, no envíe la copia original en papel.INSTRUCTIONSInformative Return - Income Subject to WithholdingPrepare Form 480.6B for each person, natural or juridical, from whom you withheld tax at source for payments for Services Ren<strong>de</strong>red, Judicial orExtrajudicial In<strong>de</strong>mnification, Divi<strong>de</strong>nds, Partnerships Distributions, Interest, Divi<strong>de</strong>nds from Industrial Development Income (Act 26 <strong>of</strong> June 2, 1978or Act 8 <strong>of</strong> January 24, 1987) and Pension Plans Distributions received in a lump-sum (one payment or various payments during one year). Also, itmust be prepared for other payments subject to withholding not consi<strong>de</strong>red un<strong>de</strong>r the above mentioned types <strong>of</strong> income.Interest paid to an Individual Retirement Account (IRA) or an Educational Contribution Account must be informed on Form 480.7 or 480.7B, respectively.The return must be given to each natural or juridical person, and filed to the Department <strong>of</strong> the Treasury not later than February 28 <strong>of</strong> the yearfollowing the calendar year for which the withholding was ma<strong>de</strong>. The original <strong>of</strong> this return must be sent to: DEPARTMENT OF THE TREASURY POBOX 9022501 SAN JUAN PR 00902-2501. In the case that the original copy is sent through magnetic tape, do not send the original paper copy.

EXHIBIT JESTADO LIBRE ASOCIADO DE PUERTO RICO - COMMONWEALTH OF PUERTO RICOUso Oficial - Official UseFormulario 480.6C<strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> - Department <strong>of</strong> the TreasuryFormRev. 05.00DECLARACION INFORMATIVA - INGRESOS SUJETOS A RETENCION - NO RESIDENTESRep. 05.03INFORMATIVE RETURN - INCOME SUBJECT TO WITHHOLDING - NONRESIDENTSAÑO CONTRIBUTIVO - TAXABLE YEAR: _______ Duplicado - Duplicate: ; Enmendado - Amen<strong>de</strong>d: ;Número SerieINFORMACION DEL AGENTE RETENEDOR-WITHHOLDING AGENT'S INFORMATION Clase <strong>de</strong> Ingreso Cantidad Pagada Cantidad RetenidaNúmero <strong>de</strong> I<strong>de</strong>ntificación Patronal - Employer's I<strong>de</strong>ntification NumberType <strong>of</strong> Income Amount Paid Amount WithheldNombre - Name1.Salarios, Jornales o CompensacionesSalaries, Wages or CompensationsDirección - Address2. Distribuciones <strong>de</strong> Socieda<strong>de</strong>sPartnerships Distributions3.Venta <strong>de</strong> PropiedadSale <strong>of</strong> PropertyINFORMACION DE QUIEN RECIBE EL PAGO - PAYEE`S INFORMATIONNúmero <strong>de</strong> Seguro Social o I<strong>de</strong>ntificación Patronal - Social Security orEmployer's I<strong>de</strong>ntification NumberNombre - NameDirección - AddressCódigo Postal - Zip Co<strong>de</strong>4.5. RegalíasRoyalties6.Divi<strong>de</strong>ndosDivi<strong>de</strong>ndsInteresesInterest7. RentasRentsNúmero <strong>de</strong> Cuenta BancariaBank Account NumberNúmero Control - Control NumberCódigo Postal - Zip Co<strong>de</strong>8. Distribuciones <strong>de</strong> Planes <strong>de</strong> PensionesPension Plans Distributions9. Espectáculos PúblicosPublic Shows10. OtrosOthersFECHA DE RADICACION: 15 DE ABRIL, VEA INSTRUCCIONES AL DORSO - FILING DATE: APRIL 15, SEE INSTRUCTIONS ON BACKORIGINAL PARA EL NEGOCIADO DE PROCESAMIENTO DE PLANILLAS - ORIGINAL FOR THE RETURNS PROCESSING BUREAU

INSTRUCCIONESDeclaración Informativa - Ingresos Sujetos a Retención - No Resi<strong>de</strong>ntesPrepare el Formulario 480.6C por cada individuo o fiduciario no resi<strong>de</strong>nte o extranjero no resi<strong>de</strong>nte y por cada corporación o socieda<strong>de</strong>xtranjera no <strong>de</strong>dicada a industria o negocio en <strong>Puerto</strong> <strong>Rico</strong>, a quien le retuvo contribución sobre ingresos en el origen con respectoa Salarios, Jornales o Compensaciones, Distribuciones <strong>de</strong> Socieda<strong>de</strong>s, Venta <strong>de</strong> Propiedad, Divi<strong>de</strong>ndos, Regalías, Intereses, Rentas,Distribuciones <strong>de</strong> Planes <strong>de</strong> Pensiones, Espectáculos Públicos u Otros (como por ejemplo, pagos por In<strong>de</strong>mnización Judicial oExtrajudicial).La <strong>de</strong>claración <strong>de</strong>berá prepararse a base <strong>de</strong> año natural y <strong>de</strong>berá entregarse a la persona y rendirse al <strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong>, nomás tar<strong>de</strong> <strong>de</strong>l 15 <strong>de</strong> abril <strong>de</strong>l año siguiente al año natural en que se efectúan los pagos. El original <strong>de</strong> la <strong>de</strong>claración <strong>de</strong>berá ser enviadoal: DEPARTAMENTO DE HACIENDA PO BOX 9022501 SAN JUAN PR 00902-2501. En el caso <strong>de</strong> que la copia original se envíe encinta magnética, no envíe la copia original en papel.INSTRUCTIONSInformative Return - Income Subject to Withholding - Nonresi<strong>de</strong>ntsPrepare Form 480.6C for each nonresi<strong>de</strong>nt individual or fiduciary or nonresi<strong>de</strong>nt alien and for each foreign corporation or partnership notengaged in tra<strong>de</strong> or business in <strong>Puerto</strong> <strong>Rico</strong>, from whom you withheld tax at source for Salaries, Wages or Compensations, PartnershipsDistributions, Sale <strong>of</strong> Property, Divi<strong>de</strong>nds, Royalties, Interest, Rents, Pension Plans Distributions, Public Shows or Others (for example,payments for Judicial or Extrajudicial In<strong>de</strong>mnification).The return must be prepared on a calendar year basis and must be given to the person and filed with the Department <strong>of</strong> the Treasury,not later than April 15 <strong>of</strong> the year following the calendar year in which payments were ma<strong>de</strong>. The original <strong>of</strong> the return must be sent to:DEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501. In the case that the original copy is sent throughmagnetic tape, do not send the original paper copy.

Formulario 480.7FormRev. 05.03ESTADO LIBRE ASOCIADO DE PUERTO RICO - COMMONWEALTH OF PUERTO RICO<strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> - Department <strong>of</strong> the TreasuryDECLARACION INFORMATIVA - CUENTA DE RETIRO INDIVIDUALINFORMATIVE RETURN - INDIVIDUAL RETIREMENT ACCOUNTAÑO CONTRIBUTIVO - TAXABLE YEAR: 200____Duplicado - Duplicate: ; Enmendado - Amen<strong>de</strong>d: ;EXHIBIT KUso Oficial - Official UseNúmero <strong>de</strong> SerieINFORMACION DEL AGENTE RETENEDOR - WITHHOLDING AGENT'S INFORMATIONNúm. <strong>de</strong> I<strong>de</strong>ntificación Patronal - Employer's I<strong>de</strong>ntification NumberINFORMACION DE QUIEN RECIBE EL PAGO - PAYEE'S INFORMATIONNúm. <strong>de</strong> Seguro Social - Social Security No.Nombre - NameNombre - NameDirección - AddressDirección - AddressCódigo Postal - Zip Co<strong>de</strong>Código Postal - Zip Co<strong>de</strong>Descripción - DescriptionCantidad - AmountDistribuciones - Distributions1. Balance Total <strong>de</strong> la Cuenta a Principio <strong>de</strong> AñoTotal Balance <strong>of</strong> the Account at the Beginning <strong>of</strong> the Year12. Desglose <strong>de</strong> Cantidad Distribuida - Breakdown <strong>of</strong> Amount DistributedA. Aportaciones - Contributions2. Aportaciones para el Año ContributivoContributions for the Taxable YearB. Aportaciones Voluntarias - Voluntary Contributions3. Aportaciones Vía TransferenciaContributions Through Transfer4. Retiros Vía TransferenciaWithdrawals Through TransferC. Intereses Exentos - Exempt InterestD. Intereses <strong>de</strong> Instituciones Financieras ElegiblesInterest from Eligible Financial InstitutionsE. Ingresos <strong>de</strong> Fuentes Dentro <strong>de</strong> <strong>Puerto</strong> <strong>Rico</strong>Income from Sources Within <strong>Puerto</strong> <strong>Rico</strong>F. Otros Ingresos - Other Income5. Reembolso <strong>de</strong> Aportaciones en ExcesoRefund <strong>of</strong> Excess Contributions6. Penalidad RetenidaPenalty WithheldG. Pensionados <strong>de</strong>l Gobierno - Government Pensioners1. AportacionesContributions2. Intereses ElegiblesEligible Interest3. Otros IngresosOther Income7. Contribución Retenida <strong>de</strong> Intereses (17% línea 12D)Tax Withheld from Interest (17% line 12D)8. Contribución Retenida Ingreso <strong>de</strong> Fuentes Dentro <strong>de</strong><strong>Puerto</strong> <strong>Rico</strong> (17% línea 12E) - Tax Withheld Income fromSources Within <strong>Puerto</strong> <strong>Rico</strong> (17% line 12E)9. Contribución Retenida <strong>de</strong> Ingreso <strong>de</strong> Pensionados <strong>de</strong>lGobierno (10% líneas 12G2 y 12G3) - Tax Withheld Incomefrom Government Pensioners (10% lines 12G2 and 12G3)10. Contribución Prepagada bajo la Sección 1169A (10%línea 12H) - Tax Prepaid un<strong>de</strong>r Section 1169A (10% line12H)11. Contribución Retenida <strong>de</strong> Distribuciones bajo laSección 1169B (12.5% línea 12I) - Tax Withheld fromDistributions un<strong>de</strong>r Section 1169B (12.5% line 12I)Número <strong>de</strong> Cuenta IRA - IRA Account NumberH. Bajo la Sección 1169A - Un<strong>de</strong>r Section 1169A1. AportacionesContributions2. Intereses ElegiblesEligible Interest3. Otros IngresosOther IncomeI. Por Transferencia bajo la Sección 1169BThrough Transfer un<strong>de</strong>r Section 1169B1. AportacionesContributions2. Intereses ElegiblesEligible Interest3. Otros IngresosOther IncomeJ. Total (Sume líneas 12A a la 12I)Número <strong>de</strong> Control - Control NumberTotal (Add lines 12A through 12I)FECHA DE RADICACION: 28 DE FEBRERO O 30 DE AGOSTO, SEGUN APLIQUE. VEA INSTRUCCIONES AL DORSOFILING DATE: FEBRUARY 28 OR AUGUST 30, AS APPLICABLE. SEE INSTRUCTIONS ON BACKORIGINAL PARA EL NEGOCIADO DE PROCESAMIENTO DE PLANILLAS - ORIGINAL FOR THE RETURNS PROCESSING BUREAU

INSTRUCCIONESDeclaración Informativa – Cuenta <strong>de</strong> Retiro IndividualPrepare el Formulario 480.7 por cada dueño o beneficiario <strong>de</strong> una Cuenta <strong>de</strong>Retiro Individual (IRA) que haya realizado cualesquiera <strong>de</strong> las transaccionesnumeradas en el formulario.En el encasillado 6, anote la penalidad retenida (10%) sobre una distribución <strong>de</strong>la IRA realizada con anterioridad a que el dueño o beneficiario alcance la edad<strong>de</strong> 60 años.Desglose la cantidad distribuida según las partidas <strong>de</strong> los encasillados 12Ahasta 12I.Incluya en el encasillado 12C el total <strong>de</strong> intereses exentos generados por la IRAque fueron distribuidos, incluyendo los distribuidos conforme a las Secciones1169A y 1169B <strong>de</strong>l Código.Las aportaciones voluntarias (encasillado 12B) constituyen aquellasaportaciones no diferidas hechas por un participante a un plan <strong>de</strong> retirocualificado que fueron transferidas a una IRA según se dispone en el Artículo1165-6(5) <strong>de</strong>l Reglamento.Si el dueño o beneficiario <strong>de</strong> la IRA recibe una distribución <strong>de</strong> intereses pagadoso acreditados por instituciones financieras elegibles, según establece la Sección1013 <strong>de</strong>l Código (intereses elegibles), indique la cantidad distribuida en elencasillado 12D. Si ejerce la opción <strong>de</strong> pagar la contribución <strong>de</strong>l 17% sobre losmismos, indique la cantidad <strong>de</strong> contribución retenida (17%) en el encasillado 7.Si el dueño o beneficiario <strong>de</strong> la IRA recibe una distribución que no sea unadistribución <strong>de</strong> intereses elegibles, ni una distribución <strong>de</strong> su aportación a la IRA,y que consista <strong>de</strong> ingresos <strong>de</strong> fuentes <strong>de</strong>ntro <strong>de</strong> <strong>Puerto</strong> <strong>Rico</strong> generados pordicha IRA, indique la cantidad distribuida en el encasillado 12E. Si ejerce laopción <strong>de</strong> pagar la contribución <strong>de</strong>l 17% sobre dicha distribución, indique lacantidad <strong>de</strong> contribución retenida (17%) en el encasillado 8.Por otro lado, si la distribución consiste <strong>de</strong> otros ingresos, no especificadosanteriormente, generados por la IRA, indique la cantidad distribuida en elencasillado 12F.Si el dueño o beneficiario <strong>de</strong> la IRA que recibe la distribución se encuentradisfrutando <strong>de</strong> los beneficios <strong>de</strong> retiro <strong>of</strong>recidos por:1. el Sistema <strong>de</strong> Retiro <strong>de</strong> los Empleados <strong>de</strong>l Estado Libre Asociado <strong>de</strong><strong>Puerto</strong> <strong>Rico</strong> y sus Instrumentalida<strong>de</strong>s;2. el Sistema <strong>de</strong> Retiro <strong>de</strong> la Judicatura; o3. el Sistema <strong>de</strong> Retiro para Maestros;<strong>de</strong>sglose la cantidad distribuida entre aportaciones, intereses elegibles y otrosingresos en el encasillado 12G. Si ejerce la opción <strong>de</strong> pagar la contribución <strong>de</strong>l10% sobre la distribución (que no constituya una distribución <strong>de</strong> su aportacióna la IRA), indique la contribución retenida (10%) en el encasillado 9.Desglose en el encasillado 12H, la distribución <strong>de</strong> una IRA cuyo dueño obeneficiario eligió pagar por a<strong>de</strong>lantado la contribución especial <strong>de</strong>l 10% <strong>de</strong>acuerdo con la Sección 1169A(a)(2) <strong>de</strong>l Código. Indique la cantidad <strong>de</strong>contribución prepagada (10%) en el encasillado 10.Si el dueño o beneficiario <strong>de</strong> la IRA realiza una aportación por transferenciacualificada <strong>de</strong> su IRA a una Cuenta <strong>de</strong> Retiro Individual No Deducible antes <strong>de</strong>l1 <strong>de</strong> julio <strong>de</strong> 2003 conforme a la Sección 1169B(d)(4) <strong>de</strong>l Código, <strong>de</strong>sglose lacantidad transferida entre aportaciones, intereses elegibles y otros ingresosen el encasillado 12I. Indique la cantidad <strong>de</strong> contribución retenida (12.5%) en elencasillado 11. Si la totalidad o parte <strong>de</strong> la cantidad aportada por transferenciacualificada fue prepagada <strong>de</strong> acuerdo con la Sección 1169A(a)(2) <strong>de</strong>l Código,indique la cantidad <strong>de</strong> contribución prepagada (10%) en el encasillado 10.La <strong>de</strong>claración <strong>de</strong>berá entregarse al dueño o beneficiario y al <strong>Departamento</strong> <strong>de</strong><strong>Hacienda</strong> no más tar<strong>de</strong> <strong>de</strong>l 30 <strong>de</strong> agosto siguiente al año contributivocorrespondiente para informar aportaciones y otras transacciones o eventosrelacionados con la cuenta. No obstante, la <strong>de</strong>claración <strong>de</strong>berá entregarse nomás tar<strong>de</strong> <strong>de</strong>l 28 <strong>de</strong> febrero siguiente al año contributivo correspondientepara informar distribuciones <strong>de</strong> dicha cuenta. El original <strong>de</strong> la <strong>de</strong>claración<strong>de</strong>berá ser enviado al DEPARTAMENTO DE HACIENDA PO BOX 9022501 SANJUAN PR 00902-2501.INSTRUCTIONSInformative Return – Individual Retirement AccountPrepare Form 480.7 for each owner or beneficiary <strong>of</strong> an Individual RetirementAccount (IRA) who has realized any <strong>of</strong> the transactions specified in the form.In box 6, enter the penalty withheld (10%) from an IRA distribution ma<strong>de</strong> beforethe beneficiary attained 60 years <strong>of</strong> age.Provi<strong>de</strong> a breakdown <strong>of</strong> the amount distributed according to the items in boxes12A through 12I.In box 12C, enter the total amount <strong>of</strong> exempt interest generated by an IRAwhich was distributed, including those distributed in accordance with Sections1169A and 1169B <strong>of</strong> the Co<strong>de</strong>.Voluntary contributions (box 12B) consist <strong>of</strong> those after tax contributionscontributed by a participant <strong>of</strong> a qualified retirement plan which were transferredto an IRA as provi<strong>de</strong>d by Article 1165-6(5) <strong>of</strong> the Regulations.If the owner or beneficiary <strong>of</strong> an IRA receives a distribution <strong>of</strong> interest fromeligible financial institutions, as provi<strong>de</strong>d by Section 1013 <strong>of</strong> the Co<strong>de</strong> (eligibleinterest), enter the amount distributed in box 12D. If the option to pay thespecial rate <strong>of</strong> 17% over the same was ma<strong>de</strong>, inclu<strong>de</strong> the income tax withheld(17%) in box 7.If the owner or beneficiary <strong>of</strong> an IRA receives a distribution that does notconstitute a distribution <strong>of</strong> eligible interest, nor a distribution <strong>of</strong> the contributionsto the IRA and which consists <strong>of</strong> income from sources within <strong>Puerto</strong> <strong>Rico</strong>generated by the IRA, enter the amount distributed in box 12E. If the option topay the special rate <strong>of</strong> 17% over the same was ma<strong>de</strong>, inclu<strong>de</strong> the income taxwithheld (17%) in box 8.On the other hand, if the distribution consists <strong>of</strong> other income generated by anIRA not specified above, enter the amount distributed in box 12F.If the owner or beneficiary <strong>of</strong> an IRA that receives the distribution is enjoyingthe retirement benefits provi<strong>de</strong>d by:1. the Retirement System <strong>of</strong> the Employees <strong>of</strong> the <strong>Commonwealth</strong> <strong>of</strong><strong>Puerto</strong> <strong>Rico</strong> and its Intrumentalities;2. the Judicial Retirement System; or3. the Teachers Retirement System;breakdown the amount distributed between contributions, eligible interest andother income in box 12G. If the option to pay the special rate <strong>of</strong> 10% on thedistribution (excluding that part <strong>of</strong> the distribution that consists <strong>of</strong> thecontributions to the IRA) was exercised by the owner or beneficiary <strong>of</strong> theIRA, inclu<strong>de</strong> the income tax withheld (10%) in box 9.Inclu<strong>de</strong> in box 12H the distribution from an IRA which the owner or beneficiaryelected to prepay the special income tax rate (10%) as provi<strong>de</strong>d by Section1169A(a)(2) <strong>of</strong> the Co<strong>de</strong>. Inclu<strong>de</strong> the income tax prepaid (10%) in box 10.If the owner or beneficiary <strong>of</strong> an IRA realizes a qualified rollover contributionfrom its IRA to a Non Deductible Individual Retirement Account before July 1,2003 in accordance with Section 1169B(d)(4) <strong>of</strong> the Co<strong>de</strong>, breakdown theamount transferred between contributions, eligible interest and other incomein box 12I. Inclu<strong>de</strong> the income tax withheld (12.5%) in box 11. If a part or all <strong>of</strong>the amount transferred as a qualified contribution was prepaid in accordanceto Section 1169A(a)(2) <strong>of</strong> the Co<strong>de</strong>, inclu<strong>de</strong> the income tax prepaid (10%) inbox 10.The return must be given to the owner or beneficiary and the Department <strong>of</strong>the Treasury not later than August 30 following the corresponding taxableyear to inform contributions and other transactions or events related to theaccount. However, the return must be given not later than February 28following the corresponding taxable year to inform distributions from saidaccount. The original <strong>of</strong> this return must be sent to DEPARTMENT OF THETREASURY PO BOX 9022501 SAN JUAN PR 00902-2501.

INSTRUCCIONESDeclaración Informativa – Cuenta <strong>de</strong> Aportación EducativaPrepare el Formulario 480.7B por cada persona que aporte o que sea beneficiario <strong>de</strong> unaCuenta <strong>de</strong> Aportación Educativa (cuenta), y que haya realizado cualesquiera <strong>de</strong> lastransacciones enumeradas en el formulario. Deberá indicar a<strong>de</strong>más con una marca <strong>de</strong>cotejo en los espacios provistos, si la <strong>de</strong>claración se prepara para la persona que aportao para el beneficiario.Cuando el formulario se prepare para la persona que aportó a la cuenta, <strong>de</strong>be completarseel encasillado con la información <strong>de</strong>l beneficiario. Una persona pue<strong>de</strong> recibir más <strong>de</strong> unFormulario 480.7B, <strong>de</strong>pendiendo <strong>de</strong>l número <strong>de</strong> cuentas a las que aporte.Cuando el formulario se prepare para el beneficiario, no <strong>de</strong>be completarse el encasilladocon la información <strong>de</strong> quien aporta. El encasillado 2 <strong>de</strong>berá incluir el total <strong>de</strong> lasaportaciones recibidas, el cual no podrá exce<strong>de</strong>r <strong>de</strong> $500 por año contributivo.Desglose la cantidad distribuida según las partidas <strong>de</strong>l encasillado 8.Si el individuo que aporta o el beneficiario <strong>de</strong> la cuenta recibe una distribución <strong>de</strong>intereses tributables, indique la cantidad distribuida en el encasillado 8B(1). Si ejerce laopción <strong>de</strong> pagar la contribución <strong>de</strong>l 17% sobre los mismos, indique la cantidad <strong>de</strong>contribución retenida (17%) en el encasillado 6.Si el individuo que aporta o el beneficiario <strong>de</strong> la cuenta recibe una distribución total oparcial que no sea una distribución <strong>de</strong> intereses recibida <strong>de</strong> instituciones financieras<strong>de</strong>dicadas a industria o negocio en <strong>Puerto</strong> <strong>Rico</strong> (según establece la Sección 1013 <strong>de</strong>lCódigo), ni una distribución <strong>de</strong> la aportación, y que consista <strong>de</strong> ingresos <strong>de</strong> fuentes <strong>de</strong>ntro<strong>de</strong> <strong>Puerto</strong> <strong>Rico</strong>, indique la cantidad distribuida en el encasillado 8B(3). Si ejerce laopción <strong>de</strong> pagar la contribución <strong>de</strong>l 17% sobre dicha distribución, indique la cantidad <strong>de</strong>la contribución retenida (17%) en el encasillado 7. Por otro lado, si la distribución consiste<strong>de</strong> ingresos <strong>de</strong> fuentes fuera <strong>de</strong> <strong>Puerto</strong> <strong>Rico</strong>, indique la cantidad distribuida en elencasillado 8B(4).La <strong>de</strong>claración <strong>de</strong>berá entregarse a la persona que aporta, al beneficiario y al <strong>Departamento</strong><strong>de</strong> <strong>Hacienda</strong> no más tar<strong>de</strong> <strong>de</strong>l 30 <strong>de</strong> agosto siguiente al año contributivo correspondientepara informar aportaciones y otras transacciones o eventos relacionados con la cuenta.No obstante, la <strong>de</strong>claración <strong>de</strong>berá entregarse no más tar<strong>de</strong> <strong>de</strong>l 28 <strong>de</strong> febrero siguienteal año contributivo correspondiente para informar distribuciones <strong>de</strong> dicha cuenta. Eloriginal <strong>de</strong> la <strong>de</strong>claración <strong>de</strong>berá ser enviado al DEPARTAMENTO DE HACIENDA POBOX 9022501 SAN JUAN PR 00902-2501.INSTRUCTIONSInformative Return – Educational Contribution AccountPrepare Form 480.7B for each contributor or beneficiary <strong>of</strong> an Educational ContributionAccount (account), who has realized any <strong>of</strong> the transactions numbered on the form. Also,you must check in the spaces provi<strong>de</strong>d, if the return is prepared for the contributor or for thebeneficiary.When the form is prepared for the contributor, the box with the beneficiary's informationmust be completed. A person can receive more than one Form 480.7B, <strong>de</strong>pending onthe number <strong>of</strong> accounts to which a contribution is ma<strong>de</strong>.When the form is prepared for the beneficiary, the box with the contributor's informationmust not be completed. Box 2 must inclu<strong>de</strong> the total amount <strong>of</strong> contributions received,which can not exceed $500 per taxable year.Provi<strong>de</strong> a breakdown <strong>of</strong> the amount distributed according to the items in box 8.If the contributor or the beneficiary <strong>of</strong> the account receives a distribution <strong>of</strong> taxableinterest, enter the amount distributed in box 8B(1). If the option to pay the 17% tax on thesame was exercised, enter the amount <strong>of</strong> tax withheld (17%) in box 6.If the contributor or beneficiary <strong>of</strong> the account receives a total or partial distribution thatdoes not constitute a distribution <strong>of</strong> interest received from financial institutions engaged intra<strong>de</strong> or business in <strong>Puerto</strong> <strong>Rico</strong> (as provi<strong>de</strong>d in Section 1013 <strong>of</strong> the Co<strong>de</strong>), nor adistribution <strong>of</strong> the contributions to the account, and which consists <strong>of</strong> income from sourceswithin <strong>Puerto</strong> <strong>Rico</strong>, enter the amount distributed in box 8B(3). If the option to pay the 17%tax on said distribution was exercised, enter the amount <strong>of</strong> tax withheld (17%) in box 7. Onthe other hand, if the distribution consists <strong>of</strong> income from sources without <strong>Puerto</strong> <strong>Rico</strong>,enter the amount distributed in box 8B(4).The return must be given to the contributor, the beneficiary and the Department <strong>of</strong> theTreasury not later than August 30 following the corresponding taxable year to informcontributions and other transactions and events regarding the account. However, thereturn must be given not later than February 28 following the corresponding taxable yearto inform distributions from said account. The original <strong>of</strong> this return must be sent toDEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501.

EXHIBIT N480.5FormularioESTADO LIBRE ASOCIADO DE PUERTO RICO - COMMONWEALTH OF PUERTO RICOForm<strong>Departamento</strong> <strong>de</strong> <strong>Hacienda</strong> - Department <strong>of</strong> the TreasuryRev. 05.02Rep. 05.03RESUMEN DE LAS DECLARACIONES INFORMATIVASAÑO CONTRIBUTIVO - TAXABLE YEAR: ________ SUMMARY OF THE INFORMATIVE RETURNSUso Oficial - Official UseNúm. SerieNúmero <strong>de</strong> I<strong>de</strong>ntificación Patronal - Employer's I<strong>de</strong>ntification NumberNombre <strong>de</strong>l Pagador - Payer's NameClase <strong>de</strong> Contribuyente - Type <strong>of</strong> TaxpayerIndividuoIndividualSociedadPartnershipCorporaciónCorporationSucesión oFi<strong>de</strong>icomisoEstate or Trust; ; ; ; ;OtrosOthersDirección - AddressCódigo Postal - Zip Co<strong>de</strong>Número <strong>de</strong> Documentos - Number <strong>of</strong> DocumentsCantidad Retenida - Amount WithheldCantidad Total Pagada - Total Amount PaidMarque sólo un encasillado - Check only one box480.6A ; 480.6B ; 480.6C ; 480.7 ; 480.7B ;JURAMENTO - OATHDeclaro bajo las penalida<strong>de</strong>s <strong>de</strong> perjurio que esta <strong>de</strong>claración ha sido examinada por mí y que según mi mejor información y creencia es cierta, correcta y completa.I <strong>de</strong>clare un<strong>de</strong>r the penalties <strong>of</strong> perjury that this <strong>de</strong>claration has been examined by me and to the best <strong>of</strong> my knowledge and belief is true, correct and complete.Fecha - Date_____________________ Firma - Signature_______________________________________ Título - Title__________________________FECHA DE RADICACION: 28 DE FEBRERO, 15 DE ABRIL O 30 DE AGOSTO, SEGUN APLIQUE. VEA INSTRUCCIONES AL DORSO - FILING DATE: FEBRUARY 28, APRIL 15 OR AUGUST 30, AS APPLICABLE. SEE INSTRUCTIONS ON BACKORIGINAL PARA EL NEGOCIADO DE PROCESAMIENTO DE PLANILLAS - ORIGINAL FOR THE RETURNS PROCESSING BUREAU

INSTRUCCIONESResumen <strong>de</strong> las Declaraciones InformativasEsta <strong>de</strong>claración (Formulario 480. 5) se usará para resumir y tramitarlos Formularios 480.6A, 480.6B, 480.6C, 480.7 y 480.7B. La misma<strong>de</strong>be enviarse junto con dichas <strong>de</strong>claraciones al: DEPARTAMENTODE HACIENDA PO BOX 9022501 SAN JUAN PR 00902-2501.Envíe un Formulario 480.5 con cada clase <strong>de</strong> <strong>de</strong>claracióninformativa, no más tar<strong>de</strong> <strong>de</strong>l 28 <strong>de</strong> febrero (Formularios 480.6A,480.6B, 480.7 y 480.7B), 15 <strong>de</strong> abril (Formulario 480.6C) ó 30 <strong>de</strong>agosto (Formularios 480.7 y 480.7B) <strong>de</strong>l año siguiente al año naturalpara el cual se efectuaron los pagos.Firma Autorizada - Las <strong>de</strong>claraciones <strong>de</strong> individuos <strong>de</strong>berán serfirmadas por los individuos o sus agentes autorizados. Las<strong>de</strong>claraciones <strong>de</strong> corporaciones y socieda<strong>de</strong>s <strong>de</strong>berán serfirmadas por un <strong>of</strong>icial <strong>de</strong> la corporación o por un miembroautorizado <strong>de</strong> la sociedad. Las <strong>de</strong>claraciones <strong>de</strong> sucesiones y <strong>de</strong>fi<strong>de</strong>icomisos <strong>de</strong>berán ser firmadas por la persona <strong>de</strong>bidamenteautorizada.INSTRUCTIONSSummary <strong>of</strong> the Informative ReturnsThis return (Form 480.5) will be used to summarize and processForms 480.6A, 480.6B, 480.6C, 480.7 and 480.7B. The same mustbe sent along with said return to: DEPARTMENT OF THE TREASURYPO BOX 9022501 SAN JUAN PR 00902-2501. A Form 480.5 mustbe sent with each type <strong>of</strong> informative return, not later than February28 (Forms 480.6A, 480.6B, 480.7 and 480.7B), April15 (Form480.6C) or August 30 (Form 480.7 and 480.7B) <strong>of</strong> the year followingthe calendar year for which the payments were ma<strong>de</strong>.Authorized Signature - The returns <strong>of</strong> individuals must be signedby the individuals or their authorized agents. Corporations andpartnerships returns must be signed by an <strong>of</strong>ficer <strong>of</strong> the corporationor an authorized member <strong>of</strong> the partnership. Estate and trust returnsmust be signed by the duly authorized person.

Magnetic Media Transmittal FormFor Tax Year 2003INFORMATIVE RETURNSMail the Magnetic Media and this Form to:DEPARTMENT OF THE TREASURYTECHNOLOGY INFORMATION AREAPRODUCTION CONTROL SECTIONPO BOX 9022501SAN JUAN, PUERTO RICO 00902-2501ORBring the Magnetic Media and this Form to:DEPARTMENT OF THE TREASURYTECHNOLOGY INFORMATION AREAPRODUCTION CONTROL SECTIONINTENDENTE RAMIREZ BUILDING10 PASEO COVADONGASAN JUAN, PUERTO RICO 00902Company EIN: ____________________________Company Name: ____________________________________________________Company Phone: _________________________Address: ___________________________________________________________________________________________________Any inquiries may be directed to:Contact Person: ___________________________Contact Phone: ___________________________Date Submitted: __________________________Indicate which Forms are contained in the enclosed Magnetic Media:_____ 480.6A_____ 480.6B_____ 480.6C_____ 480.5_____ 480.7_____ 480.7A_____ 480.7BIndicate if the Magnetic Media contains an:___ Original File___ Corrected FileThe following Magnetic Media are enclosed:(Number <strong>of</strong> Magnetic Media) __________________ Reels__________________ Cartridges__________________ Diskettes__________________ CDsMedia Number___________________________________Sequence_1_ <strong>of</strong> ______ <strong>of</strong> ______ <strong>of</strong> ___Official Use OnlyNumber <strong>of</strong> Records___________________________________Received by:____________________________ Date: _____/_____/_____MM DD YYQuantity received:________________ Reels__________________ Cartridges__________________ Diskettes__________________ CDsDate referred to Production Control SectionDate: _____/_____/_____MM DD YY