min max pension letter allocated pension - transition to retirement (ttr)

min max pension letter allocated pension - transition to retirement (ttr)

min max pension letter allocated pension - transition to retirement (ttr)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

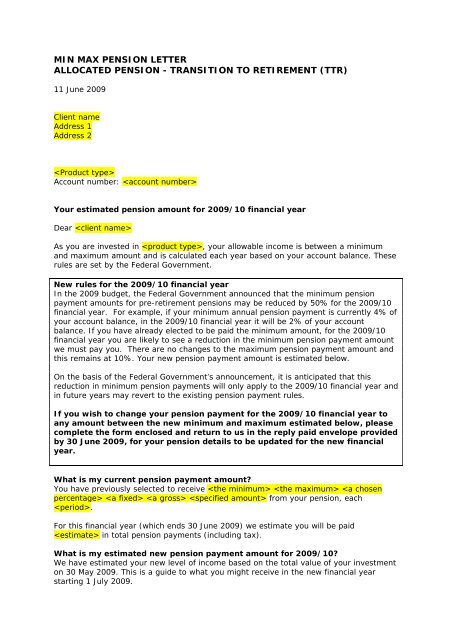

MIN MAX PENSION LETTERALLOCATED PENSION - TRANSITION TO RETIREMENT (TTR)11 June 2009Client nameAddress 1Address 2Account number: Your estimated <strong>pension</strong> amount for 2009/10 financial yearDear As you are invested in , your allowable income is between a <strong>min</strong>imumand <strong>max</strong>imum amount and is calculated each year based on your account balance. Theserules are set by the Federal Government.New rules for the 2009/10 financial yearIn the 2009 budget, the Federal Government announced that the <strong>min</strong>imum <strong>pension</strong>payment amounts for pre-<strong>retirement</strong> <strong>pension</strong>s may be reduced by 50% for the 2009/10financial year. For example, if your <strong>min</strong>imum annual <strong>pension</strong> payment is currently 4% ofyour account balance, in the 2009/10 financial year it will be 2% of your accountbalance. If you have already elected <strong>to</strong> be paid the <strong>min</strong>imum amount, for the 2009/10financial year you are likely <strong>to</strong> see a reduction in the <strong>min</strong>imum <strong>pension</strong> payment amountwe must pay you. There are no changes <strong>to</strong> the <strong>max</strong>imum <strong>pension</strong> payment amount andthis remains at 10%. Your new <strong>pension</strong> payment amount is estimated below.On the basis of the Federal Government’s announcement, it is anticipated that thisreduction in <strong>min</strong>imum <strong>pension</strong> payments will only apply <strong>to</strong> the 2009/10 financial year andin future years may revert <strong>to</strong> the existing <strong>pension</strong> payment rules.If you wish <strong>to</strong> change your <strong>pension</strong> payment for the 2009/10 financial year <strong>to</strong>any amount between the new <strong>min</strong>imum and <strong>max</strong>imum estimated below, pleasecomplete the form enclosed and return <strong>to</strong> us in the reply paid envelope providedby 30 June 2009, for your <strong>pension</strong> details <strong>to</strong> be updated for the new financialyear.What is my current <strong>pension</strong> payment amount?You have previously selected <strong>to</strong> receive from your <strong>pension</strong>, each.For this financial year (which ends 30 June 2009) we estimate you will be paid in <strong>to</strong>tal <strong>pension</strong> payments (including tax).What is my estimated new <strong>pension</strong> payment amount for 2009/10?We have estimated your new level of income based on the <strong>to</strong>tal value of your investmen<strong>to</strong>n 30 May 2009. This is a guide <strong>to</strong> what you might receive in the new financial yearstarting 1 July 2009.