Colonial First State Wholesale Geared Global Share

Colonial First State Wholesale Geared Global Share

Colonial First State Wholesale Geared Global Share

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

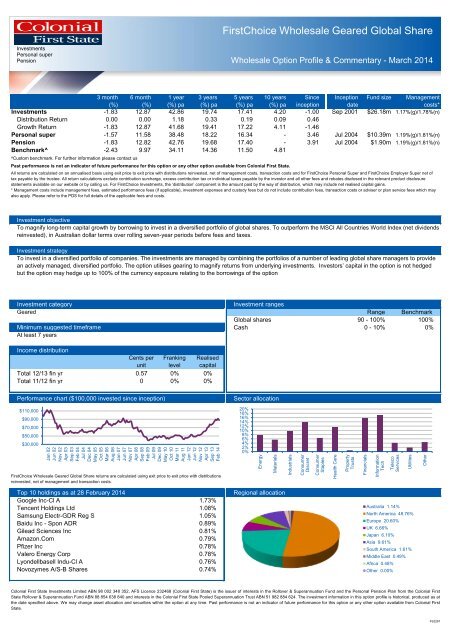

Jan 02Jun 02Nov 02Apr 03Sep 03Feb 04Jul 04Dec 04May 05Oct 05Mar 06Aug 06Jan 07Jun 07Nov 07Apr 08Sep 08Feb 09Jul 09Dec 09May 10Oct 10Mar 11Aug 11Jan 12Jun 12Nov 12Apr 13Sep 13Feb 14EnergyMaterialsIndustrialsConsumerDiscretConsumerStaplesHealth CarePropertyTrustsFinancialsInformationTechTelecoServicesUtilitiesOther<strong>First</strong>Choice <strong>Wholesale</strong> <strong>Geared</strong> <strong>Global</strong> <strong>Share</strong>InvestmentsPersonal superPension<strong>Wholesale</strong> Option Profile & Commentary - March 20143 month 6 month 1 year 3 years 5 years 10 years Since Inception Fund size Management(%) (%) (%) pa (%) pa (%) pa (%) pa inception datecosts*Investments -1.83 12.87 42.86 19.74- 17.41 4.20 -1.00 Sep 2001 $26.18m 1.17%(g)/1.78%(n)Distribution Return 0.00 0.00 1.18 0.33- 0.19 0.09 0.46Growth Return -1.83 12.87 41.68 19.41- 17.22 4.11 -1.46Personal super -1.57 11.58 38.48 18.22- 16.34 - 3.46 Jul 2004 $10.39m 1.19%(g)/1.81%(n)Pension -1.83 12.82 42.76 19.68- 17.40 - 3.91 Jul 2004 $1.90m 1.19%(g)/1.81%(n)Benchmark^ -2.43 9.97 34.11 14.36- 11.50 4.81^Custom benchmark. For further information please contact usPast performance is not an indicator of future performance for this option or any other option available from <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>.All returns are calculated on an annualised basis using exit price to exit price with distributions reinvested, net of management costs, transaction costs and for <strong>First</strong>Choice Personal Super and <strong>First</strong>Choice Employer Super net oftax payable by the trustee. All return calculations exclude contribution surcharge, excess contribution tax or individual taxes payable by the investor and all other fees and rebates disclosed in the relevant product disclosurestatements available on our website or by calling us. For <strong>First</strong>Choice Investments, the ‘distribution’ component is the amount paid by the way of distribution, which may include net realised capital gains.* Management costs include management fees, estimated performance fees (if applicable), investment expenses and custody fees but do not include contribution fees, transaction costs or adviser or plan service fees which mayalso apply. Please refer to the PDS for full details of the applicable fees and costs.Investment objectiveTo magnify long-term capital growth by borrowing to invest in a diversified portfolio of global shares. To outperform the MSCI All Countries World Index (net dividendsreinvested), in Australian dollar terms over rolling seven-year periods before fees and taxes.Investment strategyTo invest in a diversified portfolio of companies. The investments are managed by combining the portfolios of a number of leading global share managers to providean actively managed, diversified portfolio. The option utilises gearing to magnify returns from underlying investments. Investors’ capital in the option is not hedgedbut the option may hedge up to 100% of the currency exposure relating to the borrowings of the optionInvestment categoryInvestment ranges<strong>Geared</strong>Range Benchmark<strong>Global</strong> shares 90 - 100% 100%Minimum suggested timeframe Cash 0 - 10% 0%At least 7 yearsIncome distributionCents perunitFrankinglevelRealisedcapitalTotal 12/13 fin yr 0.57 0% 0%Total 11/12 fin yr 0 0% 0%Performance chart ($100,000 invested since inception)$110,000$90,000$70,000$50,000$30,000Sector allocation20%18%16%14%12%10%8%6%4%2%0%<strong>First</strong>Choice <strong>Wholesale</strong> <strong>Geared</strong> <strong>Global</strong> <strong>Share</strong> returns are calculated using exit price to exit price with distributionsreinvested, net of management and transaction costs.Top 10 holdings as at 28 February 2014Google Inc-Cl A 1.73%Tencent Holdings Ltd 1.08%Samsung Electr-GDR Reg S 1.05%Baidu Inc - Spon ADR 0.89%Gilead Sciences Inc 0.81%Amazon.Com 0.79%Pfizer Inc 0.78%Valero Energy Corp 0.78%Lyondellbasell Indu-Cl A 0.76%Novozymes A/S-B <strong>Share</strong>s 0.74%Regional allocationAustralia 1.14%North America 48.76%Europe 20.60%UK 6.66%Japan 6.10%Asia 9.61%South America 1.61%Middle East 0.49%Africa 0.48%Other 0.00%<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investments Limited ABN 98 002 348 352, AFS Licence 232468 (<strong>Colonial</strong> <strong>First</strong> <strong>State</strong>) is the issuer of interests in the Rollover & Superannuation Fund and the Personal Pension Plan from the <strong>Colonial</strong> <strong>First</strong><strong>State</strong> Rollover & Superannuation Fund ABN 88 854 638 840 and interests in the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Pooled Superannuation Trust ABN 51 982 884 624. The investment information in this option profile is historical, produced as atthe date specified above. We may change asset allocation and securities within the option at any time. Past performance is not an indicator of future performance for this option or any other option available from <strong>Colonial</strong> <strong>First</strong><strong>State</strong>.FS2267

<strong>First</strong>Choice <strong>Wholesale</strong> <strong>Geared</strong> <strong>Global</strong> <strong>Share</strong>InvestmentsPersonal superPension<strong>Wholesale</strong> Option Profile & Commentary - March 2014We are currently working on the fund commentary, it will be available shortly.This document provides general advice only and is not personal advice. It does not take into account your individual objectives, financial situation or needs. Product Disclosure <strong>State</strong>ments (PDSs) for all <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>products are available at colonialfirststate.com.au or by contacting Investor Services on 13 13 36 or from your financial adviser. You should read the relevant PDS and assess whether the information in it is appropriate for you,and consider talking to a financial adviser before making an investment decision. Commonwealth Bank of Australia and its subsidiaries do not guarantee the performance of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>’s products or the repayment ofcapital by the products. Investments in these products are not deposits or other liabilities of the Commonwealth Bank of Australia or its subsidiaries and investment type products are subject to investment risk including loss ofincome and capital invested. Information used in this publication, which is taken from sources other than <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> is believed to be accurate. Information provided by the Investment Manager are views of the InvestmentManager only and can be subject to change. Subject to any contrary provision in any applicable law, neither <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> nor any of its related parties, their employees or directors, provides any warranty of accuracy orreliability in relation to such information or accept any liability to any person who relies on it.FS2267