Developing Companies Fund - Colonial First State

Developing Companies Fund - Colonial First State

Developing Companies Fund - Colonial First State

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

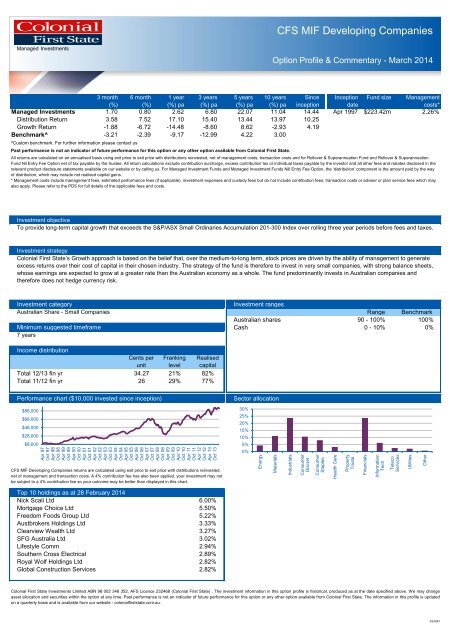

Apr 97Oct 97Apr 98Oct 98Apr 99Oct 99Apr 00Oct 00Apr 01Oct 01Apr 02Oct 02Apr 03Oct 03Apr 04Oct 04Apr 05Oct 05Apr 06Oct 06Apr 07Oct 07Apr 08Oct 08Apr 09Oct 09Apr 10Oct 10Apr 11Oct 11Apr 12Oct 12Apr 13Oct 13EnergyMaterialsIndustrialsConsumerDiscretConsumerStaplesHealth CarePropertyTrustsFinancialsInformationTechTelecoServicesUtilitiesOtherCFS MIF <strong>Developing</strong> <strong>Companies</strong>Managed InvestmentsOption Profile & Commentary - March 20143 month 6 month 1 year 3 years 5 years 10 years Since Inception <strong>Fund</strong> size Management(%) (%) (%) pa (%) pa (%) pa (%) pa inception datecosts*Managed Investments 1.70 0.80 2.62 6.80- 22.07 11.04 14.44 Apr 1997 $223.42m 2.26%Distribution Return 3.58 7.52 17.10 15.40- 13.44 13.97 10.25Growth Return -1.88 -6.72 -14.48 -8.60- 8.62 -2.93 4.19Benchmark^ -3.21 -2.39 -9.17 -12.99- 4.22 3.00^Custom benchmark. For further information please contact usPast performance is not an indicator of future performance for this option or any other option available from <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>.All returns are calculated on an annualised basis using exit price to exit price with distributions reinvested, net of management costs, transaction costs and for Rollover & Superannuation <strong>Fund</strong> and Rollover & Superannuation<strong>Fund</strong> Nil Entry Fee Option net of tax payable by the trustee. All return calculations exclude contribution surcharge, excess contribution tax or individual taxes payable by the investor and all other fees and rebates disclosed in therelevant product disclosure statements available on our website or by calling us. For Managed Investment <strong>Fund</strong>s and Managed Investment <strong>Fund</strong>s Nill Entry Fee Option, the ‘distribution’ component is the amount paid by the wayof distribution, which may include net realised capital gains.* Management costs include management fees, estimated performance fees (if applicable), investment expenses and custody fees but do not include contribution fees, transaction costs or adviser or plan service fees which mayalso apply. Please refer to the PDS for full details of the applicable fees and costs.Investment objectiveTo provide long-term capital growth that exceeds the S&P/ASX Small Ordinaries Accumulation 201-300 Index over rolling three year periods before fees and taxes.Investment strategy<strong>Colonial</strong> <strong>First</strong> <strong>State</strong>’s Growth approach is based on the belief that, over the medium-to-long term, stock prices are driven by the ability of management to generateexcess returns over their cost of capital in their chosen industry. The strategy of the fund is therefore to invest in very small companies, with strong balance sheets,whose earnings are expected to grow at a greater rate than the Australian economy as a whole. The fund predominantly invests in Australian companies andtherefore does not hedge currency risk.Investment categoryInvestment rangesAustralian Share - Small <strong>Companies</strong>Range BenchmarkAustralian shares 90 - 100% 100%Minimum suggested timeframe Cash 0 - 10% 0%7 yearsIncome distributionCents perunitFrankinglevelRealisedcapitalTotal 12/13 fin yr 34.27 21% 82%Total 11/12 fin yr 26 29% 77%Performance chart ($10,000 invested since inception)$88,000$68,000$48,000$28,000$8,000Sector allocation30%25%20%15%10%5%0%CFS MIF <strong>Developing</strong> <strong>Companies</strong> returns are calculated using exit price to exit price with distributions reinvested,net of management and transaction costs. A 4% contribution fee has also been applied, your investment may notbe subject to a 4% contribution fee so your outcome may be better than displayed in this chart.Top 10 holdings as at 28 February 2014Nick Scali Ltd 6.00%Mortgage Choice Ltd 5.50%Freedom Foods Group Ltd 5.22%Austbrokers Holdings Ltd 3.33%Clearview Wealth Ltd 3.27%SFG Australia Ltd 3.02%Lifestyle Comm 2.94%Southern Cross Electrical 2.89%Royal Wolf Holdings Ltd 2.82%Global Construction Services 2.82%<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investments Limited ABN 98 002 348 352, AFS Licence 232468 (<strong>Colonial</strong> <strong>First</strong> <strong>State</strong>) . The investment information in this option profile is historical, produced as at the date specified above. We may changeasset allocation and securities within the option at any time. Past performance is not an indicator of future performance for this option or any other option available from <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>. The information in this profile is updatedon a quarterly basis and is available from our website - colonialfirststate.com.au.FS1641

CFS MIF <strong>Developing</strong> <strong>Companies</strong>Managed InvestmentsOption Profile & Commentary - March 2014We are currently working on the fund commentary, it will be available shortly.This document provides general advice only and is not personal advice. It does not take into account your individual objectives, financial situation or needs. Product Disclosure <strong>State</strong>ments (PDSs) for all <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>products are available at colonialfirststate.com.au or by contacting Investor Services on 13 13 36 or from your financial adviser. You should read the relevant PDS and assess whether the information in it is appropriate for you,and consider talking to a financial adviser before making an investment decision. Commonwealth Bank of Australia and its subsidiaries do not guarantee the performance of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>’s products or the repayment ofcapital by the products. Investments in these products are not deposits or other liabilities of the Commonwealth Bank of Australia or its subsidiaries and investment type products are subject to investment risk including loss ofincome and capital invested. Information used in this publication, which is taken from sources other than <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> is believed to be accurate. Information provided by the Investment Manager are views of the InvestmentManager only and can be subject to change. Subject to any contrary provision in any applicable law, neither <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> nor any of its related parties, their employees or directors, provides any warranty of accuracy orreliability in relation to such information or accept any liability to any person who relies on it.FS1641