REACH SUBSEA ASA

REACH SUBSEA ASA

REACH SUBSEA ASA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

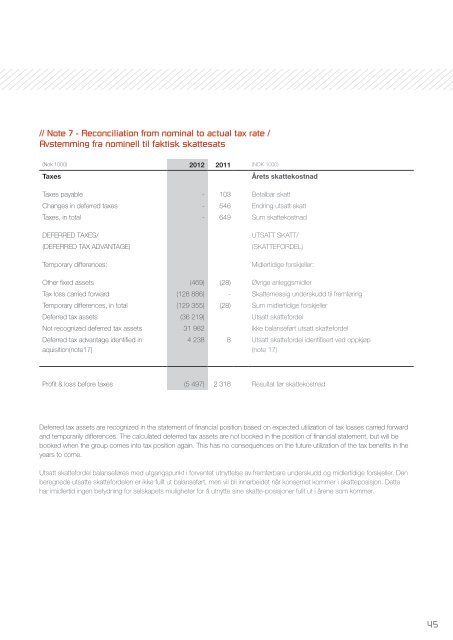

Note 7 - Reconciliation from nominal to actual tax rate /<br />

Avstemming fra nominell til faktisk skattesats<br />

(Nok 1000) 2012 2011 (NOK 1000)<br />

Taxes Årets skattekostnad<br />

Taxes payable -<br />

Changes in deferred taxes -<br />

Taxes, in total -<br />

103 Betalbar skatt<br />

546 Endring utsatt skatt<br />

649 Sum skattekostnad<br />

DEFERRED TAXES/ UTSATT SKATT/<br />

(DEFERRED TAX ADVANTAGE) (SKATTEFORDEL)<br />

Temporary differences: Midlertidige forskjeller:<br />

Other fixed assets (469) (28) Øvrige anleggsmidler<br />

Tax loss carried forward (128 886) -<br />

Skattemessig underskudd til fremføring<br />

Temporary differences, in total (129 355) (28) Sum midlertidige forskjeller<br />

Deferred tax assets (36 219) Utsatt skattefordel<br />

Not recognized deferred tax assets 31 982 Ikke balanseført utsatt skattefordel<br />

Deferred tax advantage identified in<br />

aquisition(note17)<br />

4 238 8 Utsatt skattefordel identifisert ved oppkjøp<br />

(note 17)<br />

Profit & loss before taxes (5 497) 2 318 Resultat før skattekostnad<br />

Deferred tax assets are recognized in the statement of financial position based on expected utilization of tax losses carried forward<br />

and temporarily differences. The calculated deferred tax assets are not booked in the position of financial statement, but will be<br />

booked when the group comes into tax position again. This has no consequences on the future utilization of the tax benefits in the<br />

years to come.<br />

Utsatt skattefordel balanseføres med utgangspunkt i forventet utnyttelse av fremførbare underskudd og midlertidige forskjeller. Den<br />

beregnede utsatte skattefordelen er ikke fullt ut balanseført, men vil bli innarbeidet når konsernet kommer i skatteposisjon. Dette<br />

har imidlertid ingen betydning for selskapets muligheter for å utnytte sine skatte-posisjoner fullt ut i årene som kommer.<br />

45