IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12-Mar-2002<br />

- 9 -<br />

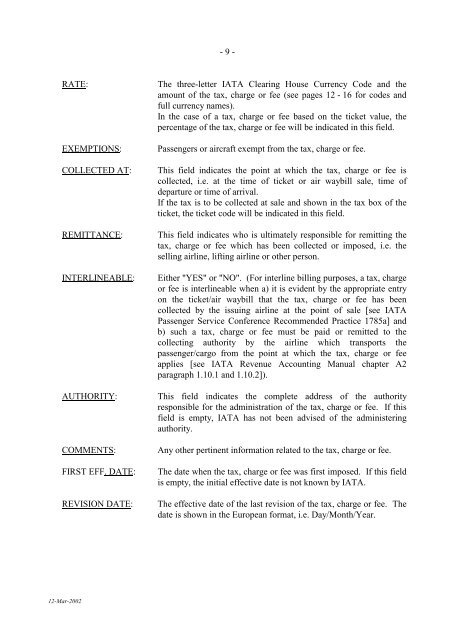

RATE: The three-letter <strong>IATA</strong> Clearing House Currency Code and the<br />

amount of the tax, charge or fee (see pages 12 - 16 for codes and<br />

full currency names).<br />

In the case of a tax, charge or fee based on the ticket value, the<br />

percentage of the tax, charge or fee will be indicated in this field.<br />

EXEMPTIONS: Passengers or aircraft exempt from the tax, charge or fee.<br />

COLLECTED AT: This field indicates the point at which the tax, charge or fee is<br />

collected, i.e. at the time of ticket or air waybill sale, time of<br />

departure or time of arrival.<br />

If the tax is to be collected at sale and shown in the tax box of the<br />

ticket, the ticket code will be indicated in this field.<br />

REMITTANCE: This field indicates who is ultimately responsible for remitting the<br />

tax, charge or fee which has been collected or imposed, i.e. the<br />

selling airline, lifting airline or other person.<br />

INTERLINEABLE: Either "YES" or "NO". (For interline billing purposes, a tax, charge<br />

or fee is interlineable when a) it is evident by the appropriate entry<br />

on the ticket/air waybill that the tax, charge or fee has been<br />

collected by the issuing airline at the point of sale [see <strong>IATA</strong><br />

Passenger Service Conference Recommended Practice 1785a] and<br />

b) such a tax, charge or fee must be paid or remitted to the<br />

collecting authority by the airline which transports the<br />

passenger/cargo from the point at which the tax, charge or fee<br />

applies [see <strong>IATA</strong> Revenue Accounting Manual chapter A2<br />

paragraph 1.10.1 and 1.10.2]).<br />

AUTHORITY: This field indicates the complete address of the authority<br />

responsible for the administration of the tax, charge or fee. If this<br />

field is empty, <strong>IATA</strong> has not been advised of the administering<br />

authority.<br />

COMMENTS: Any other pertinent information related to the tax, charge or fee.<br />

FIRST EFF. DATE: The date when the tax, charge or fee was first imposed. If this field<br />

is empty, the initial effective date is not known by <strong>IATA</strong>.<br />

REVISION DATE: The effective date of the last revision of the tax, charge or fee. The<br />

date is shown in the European format, i.e. Day/Month/Year.