Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

essAR poRts limited (formerly known as essar shipping ports & logistics limited)<br />

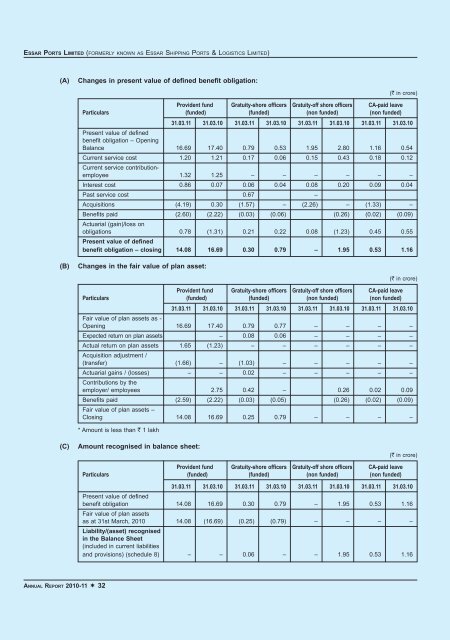

(A) Changes in present value of defined benefit obligation:<br />

AnnuAl RepoRt <strong>2010</strong>-<strong>11</strong> ¬ 32<br />

Provident fund Gratuity-shore officers Gratuity-off shore officers CA-paid leave<br />

Particulars (funded) (funded) (non funded) (non funded)<br />

(` in crore)<br />

31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10<br />

Present value of defined<br />

benefit obligation – Opening<br />

Balance 16.69 17.40 0.79 0.53 1.95 2.80 1.16 0.54<br />

Current service cost<br />

Current service contribution-<br />

1.20 1.21 0.17 0.06 0.15 0.43 0.18 0.12<br />

employee 1.32 1.25 – – – – – –<br />

Interest cost 0.86 0.07 0.06 0.04 0.08 0.20 0.09 0.04<br />

Past service cost 0.67 –<br />

Acquisitions (4.19) 0.30 (1.57) – (2.26) – (1.33) –<br />

Benefits paid<br />

Actuarial (gain)/loss on<br />

(2.60) (2.22) (0.03) (0.06) (0.26) (0.02) (0.09)<br />

obligations<br />

Present value of defined<br />

0.78 (1.31) 0.21 0.22 0.08 (1.23) 0.45 0.55<br />

benefit obligation – closing 14.08 16.69 0.30 0.79 – 1.95 0.53 1.16<br />

(B) Changes in the fair value of plan asset:<br />

(` in crore)<br />

Provident fund Gratuity-shore officers Gratuity-off shore officers CA-paid leave<br />

Particulars (funded) (funded) (non funded) (non funded)<br />

31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10<br />

Fair value of plan assets as -<br />

Opening 16.69 17.40 0.79 0.77 – – – –<br />

Expected return on plan assets – 0.08 0.06 – – – –<br />

Actual return on plan assets<br />

Acquisition adjustment /<br />

1.65 (1.23) – – – – – –<br />

(transfer) (1.66) – (1.03) – – – – –<br />

Actuarial gains / (losses)<br />

Contributions by the<br />

– – 0.02 – – – – –<br />

employer/ employees 2.75 0.42 – 0.26 0.02 0.09<br />

Benefits paid<br />

Fair value of plan assets –<br />

(2.59) (2.22) (0.03) (0.05) (0.26) (0.02) (0.09)<br />

Closing 14.08 16.69 0.25 0.79 – – – –<br />

* Amount is less than ` 1 lakh<br />

(C) Amount recognised in balance sheet:<br />

Provident fund Gratuity-shore officers Gratuity-off shore officers CA-paid leave<br />

Particulars (funded) (funded) (non funded) (non funded)<br />

(` in crore)<br />

31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10<br />

Present value of defined<br />

benefit obligation<br />

Fair value of plan assets<br />

14.08 16.69 0.30 0.79 – 1.95 0.53 1.16<br />

as at 31st March, <strong>2010</strong><br />

Liability/(asset) recognised<br />

in the Balance Sheet<br />

(included in current liabilities<br />

14.08 (16.69) (0.25) (0.79) – – – –<br />

and provisions) (schedule 8) – – 0.06 – – 1.95 0.53 1.16