Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

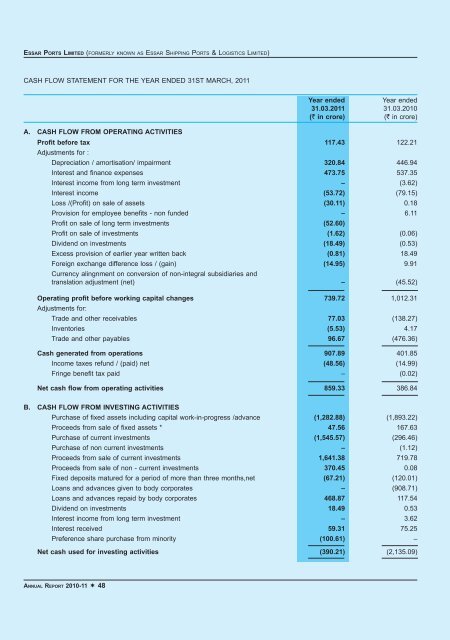

essAR poRts limited (formerly known as essar shipping ports & logistics limited)<br />

CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST MARCH, 20<strong>11</strong><br />

AnnuAl RepoRt <strong>2010</strong>-<strong>11</strong> ¬ 48<br />

Year ended Year ended<br />

31.03.20<strong>11</strong> 31.03.<strong>2010</strong><br />

(` in crore) (` in crore)<br />

A. CASH FLOW FROM OPERATING ACTIVITIES<br />

Profit before tax<br />

Adjustments for :<br />

<strong>11</strong>7.43 122.21<br />

Depreciation / amortisation/ impairment 320.84 446.94<br />

Interest and finance expenses 473.75 537.35<br />

Interest income from long term investment – (3.62)<br />

Interest income (53.72) (79.15)<br />

Loss /(Profit) on sale of assets (30.<strong>11</strong>) 0.18<br />

Provision for employee benefits - non funded – 6.<strong>11</strong><br />

Profit on sale of long term investments (52.60)<br />

Profit on sale of investments (1.62) (0.06)<br />

Dividend on investments (18.49) (0.53)<br />

Excess provision of earlier year written back (0.81) 18.49<br />

Foreign exchange difference loss / (gain)<br />

Currency alingnment on conversion of non-integral subsidiaries and<br />

(14.95) 9.91<br />

translation adjustment (net) – (45.52)<br />

Operating profit before working capital changes<br />

Adjustments for:<br />

739.72 1,012.31<br />

Trade and other receivables 77.03 (138.27)<br />

Inventories (5.53) 4.17<br />

Trade and other payables 96.67 (476.36)<br />

Cash generated from operations 907.89 401.85<br />

Income taxes refund / (paid) net (48.56) (14.99)<br />

Fringe benefit tax paid – (0.02)<br />

Net cash flow from operating activities 859.33 386.84<br />

B. CASH FLOW FROM INVESTING ACTIVITIES<br />

Purchase of fixed assets including capital work-in-progress /advance (1,282.88) (1,893.22)<br />

Proceeds from sale of fixed assets * 47.56 167.63<br />

Purchase of current investments (1,545.57) (296.46)<br />

Purchase of non current investments – (1.12)<br />

Proceeds from sale of current investments 1,641.38 719.78<br />

Proceeds from sale of non - current investments 370.45 0.08<br />

Fixed deposits matured for a period of more than three months,net (67.21) (120.01)<br />

Loans and advances given to body corporates – (908.71)<br />

Loans and advances repaid by body corporates 468.87 <strong>11</strong>7.54<br />

Dividend on investments 18.49 0.53<br />

Interest income from long term investment – 3.62<br />

Interest received 59.31 75.25<br />

Preference share purchase from minority (100.61) –<br />

Net cash used for investing activities (390.21) (2,135.09)