Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

essAR poRts limited (formerly known as essar shipping ports & logistics limited)<br />

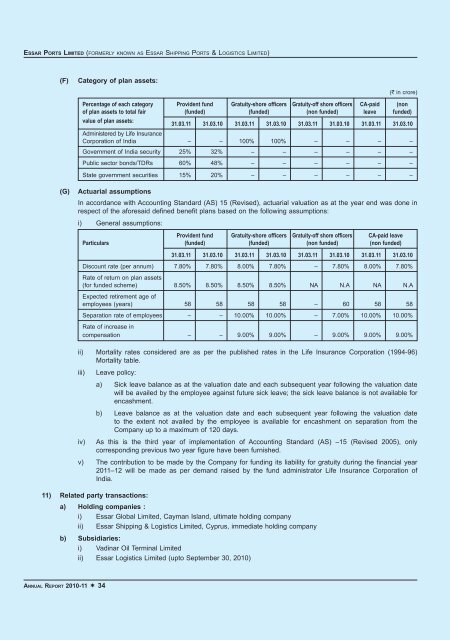

(F) Category of plan assets:<br />

AnnuAl RepoRt <strong>2010</strong>-<strong>11</strong> ¬ 34<br />

(` in crore)<br />

Percentage of each category Provident fund Gratuity-shore officers Gratuity-off shore officers CA-paid (non<br />

of plan assets to total fair (funded) (funded) (non funded) leave funded)<br />

value of plan assets: 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10<br />

Administered by Life Insurance<br />

Corporation of India – – 100% 100% – – – –<br />

Government of India security 25% 32% – – – – – –<br />

Public sector bonds/TDRs 60% 48% – – – – – –<br />

State government securities 15% 20% – – – – – –<br />

(G) Actuarial assumptions<br />

In accordance with Accounting Standard (AS) 15 (Revised), actuarial valuation as at the year end was done in<br />

respect of the aforesaid defined benefit plans based on the following assumptions:<br />

i) General assumptions:<br />

Provident fund Gratuity-shore officers Gratuity-off shore officers CA-paid leave<br />

Particulars (funded) (funded) (non funded) (non funded)<br />

31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10 31.03.<strong>11</strong> 31.03.10<br />

Discount rate (per annum)<br />

Rate of return on plan assets<br />

7.80% 7.80% 8.00% 7.80% – 7.80% 8.00% 7.80%<br />

(for funded scheme)<br />

Expected retirement age of<br />

8.50% 8.50% 8.50% 8.50% NA N.A NA N.A<br />

employees (years) 58 58 58 58 – 60 58 58<br />

Separation rate of employees<br />

Rate of increase in<br />

– – 10.00% 10.00% – 7.00% 10.00% 10.00%<br />

compensation – – 9.00% 9.00% – 9.00% 9.00% 9.00%<br />

ii) Mortality rates considered are as per the published rates in the Life Insurance Corporation (1994-96)<br />

Mortality table.<br />

iii) Leave policy:<br />

a) Sick leave balance as at the valuation date and each subsequent year following the valuation date<br />

will be availed by the employee against future sick leave; the sick leave balance is not available for<br />

encashment.<br />

b) Leave balance as at the valuation date and each subsequent year following the valuation date<br />

to the extent not availed by the employee is available for encashment on separation from the<br />

Company up to a maximum of 120 days.<br />

iv) As this is the third year of implementation of Accounting Standard (AS) –15 (Revised 2005), only<br />

corresponding previous two year figure have been furnished.<br />

v) The contribution to be made by the Company for funding its liability for gratuity during the financial year<br />

20<strong>11</strong>–12 will be made as per demand raised by the fund administrator Life Insurance Corporation of<br />

India.<br />

<strong>11</strong>) Related party transactions:<br />

a) Holding companies :<br />

i) <strong>Essar</strong> Global Limited, Cayman Island, ultimate holding company<br />

ii) <strong>Essar</strong> Shipping & Logistics Limited, Cyprus, immediate holding company<br />

b) Subsidiaries:<br />

i) Vadinar Oil Terminal Limited<br />

ii) <strong>Essar</strong> Logistics Limited (upto September 30, <strong>2010</strong>)