Annual Report (PDF) - Feintool

Annual Report (PDF) - Feintool

Annual Report (PDF) - Feintool

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

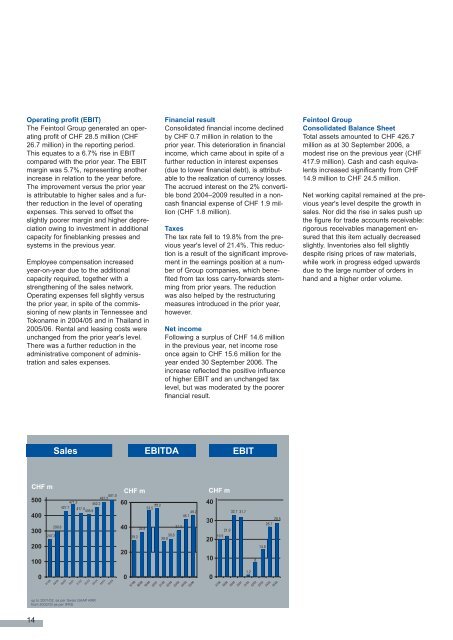

Operating profit (EBIT)<br />

The <strong>Feintool</strong> Group generated an operating<br />

profit of CHF 28.5 million (CHF<br />

26.7 million) in the reporting period.<br />

This equates to a 6.7% rise in EBIT<br />

compared with the prior year. The EBIT<br />

margin was 5.7%, representing another<br />

increase in relation to the year before.<br />

The improvement versus the prior year<br />

is attributable to higher sales and a further<br />

reduction in the level of operating<br />

expenses. This served to offset the<br />

slightly poorer margin and higher depreciation<br />

owing to investment in additional<br />

capacity for fineblanking presses and<br />

systems in the previous year.<br />

Employee compensation increased<br />

year-on-year due to the additional<br />

capacity required, together with a<br />

strengthening of the sales network.<br />

Operating expenses fell slightly versus<br />

the prior year, in spite of the commissioning<br />

of new plants in Tennessee and<br />

Tokoname in 2004/05 and in Thailand in<br />

2005/06. Rental and leasing costs were<br />

unchanged from the prior year's level.<br />

There was a further reduction in the<br />

administrative component of administration<br />

and sales expenses.<br />

14<br />

Financial result<br />

Consolidated financial income declined<br />

by CHF 0.7 million in relation to the<br />

prior year. This deterioration in financial<br />

income, which came about in spite of a<br />

further reduction in interest expenses<br />

(due to lower financial debt), is attributable<br />

to the realization of currency losses.<br />

The accrued interest on the 2% convertible<br />

bond 2004–2009 resulted in a noncash<br />

financial expense of CHF 1.9 million<br />

(CHF 1.8 million).<br />

Taxes<br />

The tax rate fell to 19.8% from the previous<br />

year's level of 21.4%. This reduction<br />

is a result of the significant improvement<br />

in the earnings position at a number<br />

of Group companies, which benefited<br />

from tax loss carry-forwards stemming<br />

from prior years. The reduction<br />

was also helped by the restructuring<br />

measures introduced in the prior year,<br />

however.<br />

Net income<br />

Following a surplus of CHF 14.6 million<br />

in the previous year, net income rose<br />

once again to CHF 15.6 million for the<br />

year ended 30 September 2006. The<br />

increase reflected the positive influence<br />

of higher EBIT and an unchanged tax<br />

level, but was moderated by the poorer<br />

financial result.<br />

<strong>Feintool</strong> Group<br />

Consolidated Balance Sheet<br />

Total assets amounted to CHF 426.7<br />

million as at 30 September 2006, a<br />

modest rise on the previous year (CHF<br />

417.9 million). Cash and cash equivalents<br />

increased significantly from CHF<br />

14.9 million to CHF 24.5 million.<br />

Net working capital remained at the previous<br />

year's level despite the growth in<br />

sales. Nor did the rise in sales push up<br />

the figure for trade accounts receivable:<br />

rigorous receivables management ensured<br />

that this item actually decreased<br />

slightly. Inventories also fell slightly<br />

despite rising prices of raw materials,<br />

while work in progress edged upwards<br />

due to the large number of orders in<br />

hand and a higher order volume.