Download the document (10.02 MB) - Hillsborough Independent Panel

Download the document (10.02 MB) - Hillsborough Independent Panel

Download the document (10.02 MB) - Hillsborough Independent Panel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I<br />

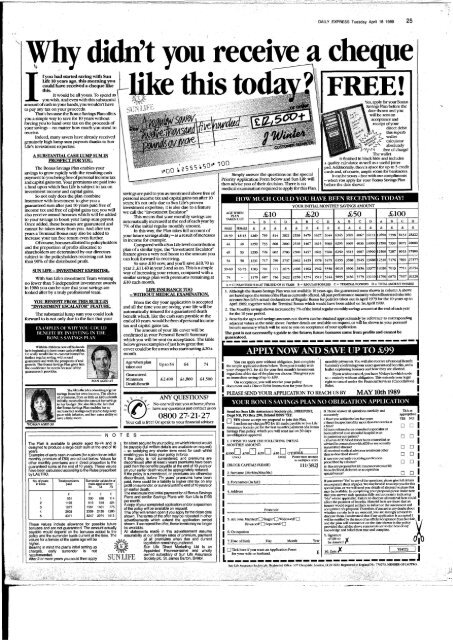

DAILY EXPRESS Tuesday April 18 1989 25<br />

Why didn’t you receive a cheque<br />

f you had started saving with Sun<br />

life 10 y ean ago, this m orning you<br />

could have received a cheque like<br />

this.<br />

It would be all yours. To spend as<br />

you wish. And even with this substantial<br />

amount of cash in your hands, you wouldn’t have<br />

to pay any tax on your proceeds.<br />

That’s because <strong>the</strong> Bonus Savings Plan offers<br />

you a simple way to save for 10 years without<br />

forcing you to hand over tax on <strong>the</strong> proceeds of<br />

your savings — no matter how much you stand to<br />

receive.<br />

Indeed, many savers have already received<br />

genuinely high lump sum payouts thanks to Sun<br />

Life’s investment expertise.<br />

A SUBSTANTIAL CASH LUMP SUM IN<br />

PROSPECT FOR YOU.<br />

The Bonus Savings Plan enables your<br />

savings to grow rapidly with <strong>the</strong> resulting cash<br />

payment to you being free of personal income tax<br />

and capital gains tax. Your premiums are paid into<br />

a fund upon which Sun Life is subject to tax on<br />

investment income and capital gains.<br />

So not only does <strong>the</strong> plan combine<br />

insurance with investment to give you a<br />

guaranteed sum after just 10 years paid free of<br />

income tax and free of capital gains tax; you will<br />

also receive annual bonuses which will be added<br />

to your savings to boost your lump sum payout<br />

Once added, <strong>the</strong>se bonuses are guaranteed and<br />

cannot be taken away from you. And after ten<br />

years a Terminal Bonus may also be added to<br />

increase your tax free return even fur<strong>the</strong>r.<br />

Of course, bonuses allotted to policyholders<br />

and <strong>the</strong> proportion of profits allocated to<br />

shareholders are determined by our directors<br />

subject to <strong>the</strong> policyholders receiving not less<br />

than 9Q% of <strong>the</strong> distributed profit.<br />

SUN LIFE - INVESTMENT EXPERTISE.<br />

With Sun Life’s investment Team winning<br />

no fewer than 5 independent investment awards<br />

in 1986 you can be sure that your savings are<br />

looked it e r by a truly professional team.<br />

YOU BENEFIT FROM THIS BUILT-IN<br />

“INVESTMENT ESCALATOR” FEATURE.<br />

The substantial lump sum you could look<br />

forward EXAMPLES to is not only OF due WHY to YOU <strong>the</strong> feet COULD that your<br />

BENEFIT BY INVESTING IN THE<br />

BONUS SAVINGS PLAN<br />

With his children now off his hands<br />

he is beginning to have more cash available.<br />

He really would like to commit himself to<br />

fur<strong>the</strong>r regular saving, with sound<br />

guarantees and with <strong>the</strong> prospects of real<br />

growth. The Bonus Savings Plan gives him<br />

<strong>the</strong> confidence he needs because of <strong>the</strong><br />

guarantees it provides.<br />

WOMAN AGED 30<br />

MAN AGED 45<br />

She likes <strong>the</strong> idea of making regular<br />

savings from her own income. The choice<br />

of premiums, from as little as £10 a month<br />

initially, means that she can suit her savings<br />

to her budget. She also likes <strong>the</strong> fact that<br />

<strong>the</strong> Bonus Savings Plan enables her to<br />

increase her savings each year to help keep<br />

pace with inflation, and her extra ability to<br />

save a little more.<br />

The Plan is available to people aged 18-74 and is<br />

designed to produce a large cash sum at <strong>the</strong> end of 10<br />

years.<br />

Examples of early cash-in values (for a plan for an initial<br />

monthly premium of £50) are set out below. Values for<br />

o<strong>the</strong>r monthly premiums are in direct proportion to <strong>the</strong><br />

guaranteed sums at <strong>the</strong> end of 10 years. These values<br />

have been calculated according to <strong>the</strong> Rules prescribed<br />

by LAUTRO.<br />

No. of years<br />

in force<br />

Total premiums<br />

paid<br />

Surrender values for a<br />

male aged at entry<br />

34 : 54 74<br />

£ £ £ £<br />

1 551 330 288 114<br />

2 1133 919 818 424<br />

3 1877 1561 1401 775<br />

4 2603 2359 2138 1286<br />

5 3371 3247 2974 1913<br />

These values include allowance for possible future<br />

bonuses and are not guaranteed. The amount actually<br />

payable would depend on <strong>the</strong> bonuses added to <strong>the</strong><br />

policy and <strong>the</strong> surrender basis current at <strong>the</strong> time. The<br />

values for a female of <strong>the</strong> same age will be<br />

higher.<br />

Bearing in mind <strong>the</strong> plan’s initial setting up<br />

charges, early surrender is not<br />

recommended.<br />

After 2 or more years you could <strong>the</strong>n apply<br />

N O T E S<br />

S U N L I F E<br />

savings are paid to you as mentioned above free of<br />

personal income tax and capital gains tax after 10<br />

years; it’s not only due to Sun Life’s proven<br />

investment expertise; it is also due to a feature<br />

we call <strong>the</strong> “Investment Escalator.”<br />

This means that your monthly savings are<br />

automatically increased at <strong>the</strong> end of each year by<br />

7% of <strong>the</strong> initial regular monthly amount.<br />

In this way, <strong>the</strong> Plan takes full account of<br />

your future savings ability - as a result of increases<br />

in income for example.<br />

Compared with a Sun Life level contribution<br />

plan of a similar type, <strong>the</strong> “Investment Escalator”<br />

feature gives a very real boost to <strong>the</strong> amount you<br />

can look forward to receiving.<br />

So save £10 now, and you’ll save £10.70 in<br />

year 2, £11.40 in year 3 and so on: This is a simple<br />

way of increasing your return, compared with a<br />

similar savings plan with premiums remaining at<br />

£10 each month.<br />

LIFE INSURANCE TOO<br />

- WITIIOI IT MF.DICAL EXAMINATION.<br />

From <strong>the</strong> day your application is accepted<br />

and all <strong>the</strong> time you are saving, your life will be<br />

automatically insured for a guaranteed death<br />

benefit which, like <strong>the</strong> cash sum payable at <strong>the</strong><br />

end of 10 years, would be free of personal income<br />

tax and capital gains tax.<br />

The amount of your life cover will be<br />

confirmed in your Personal Benefit Summary<br />

which you will be sent on acceptance. The table<br />

below gives examples of just how great that<br />

cover could be for a man who starts saving £20 a<br />

month.<br />

Age when plan<br />

taken out<br />

Up to 54 64 74<br />

Guaranteed<br />

Minimum £2,400 £1,860 £1,500<br />

Death Benefit<br />

ANY QUESTIONS?<br />

f No-one will visit you at home; ifyou<br />

have any questions just contact us on<br />

0 8 0 0 2 7 -2 1 -2 7<br />

Your call is free! Or speak to your financial adviser.<br />

for a loan secured by your policy, on which interest would<br />

be payable (full written details are available on request)<br />

- so satisfying any shorter term need for cash whilst<br />

enabling you to keep your policy in force.<br />

If <strong>the</strong> policy is not surrendered, and premiums are<br />

discontinued after at least 2 years premiums have been<br />

paid <strong>the</strong>n <strong>the</strong> benefits payable at <strong>the</strong> end of 10 years or<br />

on your earlier death would be appropriately reduced.<br />

If <strong>the</strong> policy is surrendered, or premiums are o<strong>the</strong>rwise<br />

discontinued, before 7V4 years’ premiums have been<br />

paid, <strong>the</strong>re could be a liability to higher rate tax on any<br />

profit on surrender, or survival until <strong>the</strong> end of 10 years or<br />

on earlier death.<br />

The maximum total initial payment for all Bonus Savings<br />

Plans and similar Savings Plans with Sun Life is £100<br />

per month.<br />

A copy of your completed application and/or a specimen<br />

of <strong>the</strong> policy will be available on request.<br />

This offer will remain open if you apply by <strong>the</strong> close date<br />

shown. The terms of <strong>the</strong> offer may be repeated in o<strong>the</strong>r<br />

advertisements which extend <strong>the</strong> application period<br />

shown. If we repeat <strong>the</strong> offer, <strong>the</strong>se terms may no longer<br />

be available.<br />

All statements made in this advertisement assume<br />

assurability at our ordinary rates of premium, payment<br />

of all premiums when due and current<br />

legislation remaining unaltered.<br />

Sun Life Direct Marketing Ltd is an<br />

Appointed Representative and wholly<br />

owned subsidiary of Sun Life Assurance<br />

Society pic, St. James Barton, Bristol.<br />

Simply answer <strong>the</strong> questions on <strong>the</strong> special<br />

Priority Application Form below and Sun Life will<br />

<strong>the</strong>n advise you of <strong>the</strong>ir decision. There is no<br />

medical examination required to apply for this Plan.<br />

I<br />

I<br />

AGE WHEN<br />

PLAN<br />

TAKEN OUT<br />

9<br />

FREE!<br />

Yes, apply for your Bonus<br />

Savings Plan before <strong>the</strong><br />

date shown and you<br />

will be sent on<br />

acceptance and<br />

receipt of your<br />

direct debit<br />

this superb<br />

wallet<br />

calculator<br />

absolutely<br />

free of charge!<br />

The wallet<br />

is finished in black hide and includes<br />

a quality calculator as well as a useful jotter<br />

pad. Additionally, <strong>the</strong>re’s space for up to 5 credit<br />

cards and, of course, ample room for banknotes.<br />

It can be yours - free with our compliments<br />

- when you apply for your Bonus Savings Plan<br />

before <strong>the</strong> date shown!<br />

HOW MUCH COULD YOU HAVE BEEN RECEIVING TODAY!<br />

Y O U R INITIAL M ONTHLY SAVINGS A M O U N T<br />

& ] 1 0 1 £ 2 0 I £ 5 0 |I £ 1 00 1<br />

A B c D A B C D A B C D A B C D<br />

MALE FEMALE £ £ £ £ £ £ - £ . £ £ £ £ £ £ £ £ £<br />

18*39 18-43 1269 739 814 2822 2538 1479 1627 5644 6345 3699 4067 14111 12690 7398 8134 28222<br />

44 48 1259 733 808 2800 2518 1467 1615 5600 6295 3669 4036 14000 12590 7339 8071 28000<br />

49 53 1250 728 802 2780 2500 1457 1603 5560 6250 3643 4007 13900 12500 7287 8013 27800<br />

54 58 1231 717 789 2737 2462 1435 1578 5475 6155 3588 3945 13688 12310 7176 7891 27377<br />

59-69 63-73 1203 701 771 2675 2406 1402 1542 5350 6015 3506 3856 13377 12030 7013 7711 26754<br />

74 - 1179 687 756 2622 2358 1374 1512 5244 5895 3436 3779 13110 11790 6873 7557 26220<br />

A = GUARANTEED SUM AT THE END OF 10 YEARS B = REGULAR BONUSES C = TERMINAL BONUSES D = TOTAL AMOUNT PAYABLE<br />

1. Although <strong>the</strong> Bonus Savings Plan was not available 10 years ago, <strong>the</strong> guaranteed sums shown in column A above<br />

are based upon <strong>the</strong> terms of <strong>the</strong> Plan as currently offered Ail past performance maturity values illustrated take into<br />

account Sun Life’s actual declarations of Regular Bonus for policies taken out in April 1979 for <strong>the</strong> 10 years up to<br />

April 1989, toge<strong>the</strong>r with <strong>the</strong> Terminal Bonus which would have been added on 1st April 1989.<br />

2. The Monthly savings shown increased by 7% of <strong>the</strong> initial regular monthly savings amount at <strong>the</strong> end of each year<br />

for <strong>the</strong> 10 year period.<br />

3. Benefits for ages and savings amounts not shown can be obtained approximately by reference to corresponding<br />

adjacent values in <strong>the</strong> table above. Fur<strong>the</strong>r details are available on request, or will be shown in your personal<br />

benefit summary which will be sent to you on acceptance of your application.<br />

The past is not necessarily a guide to <strong>the</strong> future; future bonuses come from profits and cannot be<br />

guaranteed. ' ___<br />

APPLY NOW AND SAVE UP TO £ 9 9<br />

You can apply now w ithout obligation. Just com plete<br />

<strong>the</strong> simple application form below. Then post it today with<br />

your cheque/P.O. for £1 for your first m onth’s investm ent<br />

regardless of <strong>the</strong> size of <strong>the</strong> plan you choose. This gives you<br />

an im m ediate saving of up to £99.<br />

On acceptance, you w ill receive your policy<br />

docum ent and a Direct D ebit Instruction for your future<br />

monthly payments. You will also receive a Personal Benefit<br />

Summary confirm ingyour exact guaranteed benefits, and a<br />

leaflet explaining bonuses and how <strong>the</strong>y are allotted.<br />

Ifyou wish to cancel, you have 30 days in w hich to do<br />

so - entirely w ithout obligation. This extends your legal<br />

right to cancel under <strong>the</strong> Financial Services (Cancellation)<br />

Rules.<br />

PLEASE SEND YOUR APPLICATION TO REACH US BY MAY 10th 1989<br />

YOUR BONUS SAVINGS PLAN NO OBLIGATION APPLICATION<br />

S end to : S u n Life A ssuran ce Society p ic, FREEPOST,<br />

D ep t NB, PO B ox 290, B risto l BS99 7XY.<br />

I—| YES please accept my proposal to join this Plan.<br />

*—' I enclose m y cheque/PO for £1 made payable to Sun Life<br />

Assurance Society pic for <strong>the</strong> first m onth’s paym ent of a Bonus<br />

Savings Plan policy, which you w ill send m e on 30 days<br />

no-obligation approval.<br />

1 .1 WISH TO SAVE THE FOLLOWING INITIAL<br />

MONTHLY AMOUNT:<br />

- ! £100<br />

[Z ] £ 5 0 CD £ 2 0 EH £10 EH O THErE<br />

I (m ax)<br />

(m in) Please state am ount<br />

in m ultiples o f &5<br />

| (BLOCK CAPITALS PLEASE)<br />

111/382J<br />

I 2. Surname (Mr/Mrs/Miss/Ms)<br />

I<br />

3. Forenames (in full)<br />

4. Address<br />

Postcode<br />

5. Are you: Married? Q Single? Q Widowed? Q<br />

Divorced? Q Separated? Q<br />

6. O ccupation<br />

7. Date o f Birth Day Month Year<br />

8. Please answer all questions carefully and Tick as<br />

accurately<br />

appropriate<br />

i. Have you within <strong>the</strong> last five years<br />

a) been incapacitated for more than two weeks at<br />

YES NO<br />

a time?<br />

b) been referred to or consulted a specialist Or<br />

been referred to or attended hospital as an<br />

n n<br />

in-patient or-out-patient?<br />

c) had an AIDS blood test or been counselled or<br />

advised in connection with AIDS or any sexually<br />

n □<br />

transmitted disease?<br />

d) received medical advice or treatment o<strong>the</strong>r<br />

n n<br />

than as described above?<br />

ii. Are you currently receiving medication<br />

□ □<br />

prescribed by a doctor?<br />

iii. Has any proposal for life insurance on your life<br />

been declined, deferred or accepted on<br />

□ □<br />

special terms? □ □<br />

Ifyou answer ‘Yes” to any of <strong>the</strong> questions, please give full details<br />

on a separate sheet of paper. We may be able to accept you for this<br />

special plan, or we wUl send you details of alternative plans that<br />

may be available. In completing your proposal please make sure<br />

that you answer each question fully and accurately indicating<br />

“No” where applicable. Failure to disclose all material facts could<br />

affect <strong>the</strong> payment of benefits. Material facts are those that an<br />

insurer would regard as likely to influence <strong>the</strong> assessment and<br />

acceptance of a proposal. Therefore, ifyou are in any doubt about<br />

whe<strong>the</strong>r certain facts are material, you are strongly advised to<br />

disclose <strong>the</strong>m. I understand that if my application is accepted I<br />

will be notified by <strong>the</strong> issue of an official acceptance from Sun Life<br />

and <strong>the</strong> plan will commence on <strong>the</strong> date shown in <strong>the</strong> policy<br />

provided that all <strong>the</strong> above statements are to <strong>the</strong> best of my<br />

knowledge and belief <strong>the</strong>n true and complete.<br />

9- Signature<br />

of Life to<br />

be Assured<br />

Tick here ifyou w ant an Application Form<br />

for your wife or husband.<br />

10. Date 4<br />

784T5<br />

L<br />

Sun life Assurance Society.plc. Registered Officc: 107 Cheapside, London, EC2V 6DU. Registered in England No. 776273. 7 ME<strong>MB</strong>ER OF LAUTRO.<br />

___<br />

.<br />

_______<br />

10ID