Contents - MiTAC

Contents - MiTAC

Contents - MiTAC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

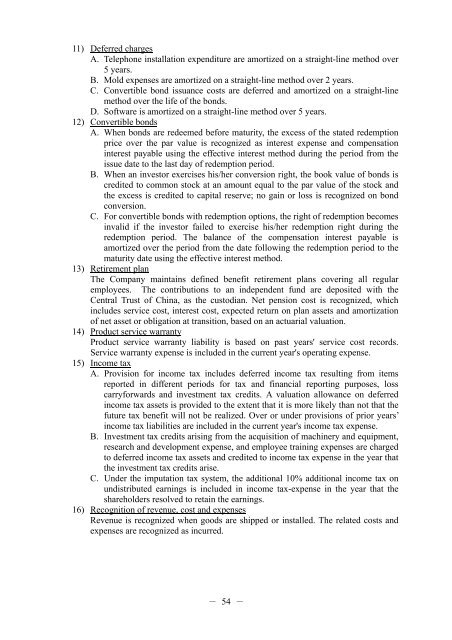

11) Deferred charges<br />

A. Telephone installation expenditure are amortized on a straight-line method over<br />

5 years.<br />

B. Mold expenses are amortized on a straight-line method over 2 years.<br />

C. Convertible bond issuance costs are deferred and amortized on a straight-line<br />

method over the life of the bonds.<br />

D. Software is amortized on a straight-line method over 5 years.<br />

12) Convertible bonds<br />

A. When bonds are redeemed before maturity, the excess of the stated redemption<br />

price over the par value is recognized as interest expense and compensation<br />

interest payable using the effective interest method during the period from the<br />

issue date to the last day of redemption period.<br />

B. When an investor exercises his/her conversion right, the book value of bonds is<br />

credited to common stock at an amount equal to the par value of the stock and<br />

the excess is credited to capital reserve; no gain or loss is recognized on bond<br />

conversion.<br />

C. For convertible bonds with redemption options, the right of redemption becomes<br />

invalid if the investor failed to exercise his/her redemption right during the<br />

redemption period. The balance of the compensation interest payable is<br />

amortized over the period from the date following the redemption period to the<br />

maturity date using the effective interest method.<br />

13) Retirement plan<br />

The Company maintains defined benefit retirement plans covering all regular<br />

employees. The contributions to an independent fund are deposited with the<br />

Central Trust of China, as the custodian. Net pension cost is recognized, which<br />

includes service cost, interest cost, expected return on plan assets and amortization<br />

of net asset or obligation at transition, based on an actuarial valuation.<br />

14) Product service warranty<br />

Product service warranty liability is based on past years' service cost records.<br />

Service warranty expense is included in the current year's operating expense.<br />

15) Income tax<br />

A. Provision for income tax includes deferred income tax resulting from items<br />

reported in different periods for tax and financial reporting purposes, loss<br />

carryforwards and investment tax credits. A valuation allowance on deferred<br />

income tax assets is provided to the extent that it is more likely than not that the<br />

future tax benefit will not be realized. Over or under provisions of prior years’<br />

income tax liabilities are included in the current year's income tax expense.<br />

B. Investment tax credits arising from the acquisition of machinery and equipment,<br />

research and development expense, and employee training expenses are charged<br />

to deferred income tax assets and credited to income tax expense in the year that<br />

the investment tax credits arise.<br />

C. Under the imputation tax system, the additional 10% additional income tax on<br />

undistributed earnings is included in income tax-expense in the year that the<br />

shareholders resolved to retain the earnings.<br />

16) Recognition of revenue, cost and expenses<br />

Revenue is recognized when goods are shipped or installed. The related costs and<br />

expenses are recognized as incurred.<br />

- 54 -