Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Secondary Report<br />

Historical Chart<br />

JCI<br />

JPRS<br />

5.500<br />

5.000<br />

600<br />

4.500<br />

500<br />

4.000<br />

3.500<br />

400<br />

3.000<br />

2.500<br />

300<br />

2.000<br />

1.500<br />

200<br />

1.000<br />

100<br />

500<br />

JCI JPRS<br />

0<br />

0<br />

Feb-12 Apr-12 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13<br />

Source : Bloomberg<br />

Stock Information<br />

Contact:<br />

Equity & Index Valuation Division<br />

Phone: (6221) 7278 2380<br />

info-equityindexvaluation@pefindo.co.id<br />

“Disclaimer statement in the last page is an<br />

integral part of this report”<br />

www.pefindo.com<br />

IDR<br />

Ticker code JPRS<br />

Market price as of March 19, 2013 360<br />

Market price – 52 week high 560<br />

Market price – 52 week low 320<br />

Market cap – 52 week high (bn) 420<br />

Market cap – 52 week low (bn) 240<br />

Stock Valuation Last Current<br />

High 403 590<br />

Low 339 380<br />

Market Value Added & Market Risk<br />

Market Value Added<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

-80<br />

-100<br />

9M11 9M12<br />

Market Value Added Market Risk<br />

Source : Bloomberg, Pefindo Equity & Index Valuation Division<br />

Shareholders<br />

1.12<br />

1.1<br />

1.08<br />

1.06<br />

1.04<br />

1.02<br />

1<br />

Market Risk<br />

(%)<br />

Gwie Gunawan 15.53<br />

International Magnificent Fortune Limited 35.70<br />

Vihara Limited 32.72<br />

Public (each below 5% ownership) 16.05<br />

*Notes: as of September 30, 2012<br />

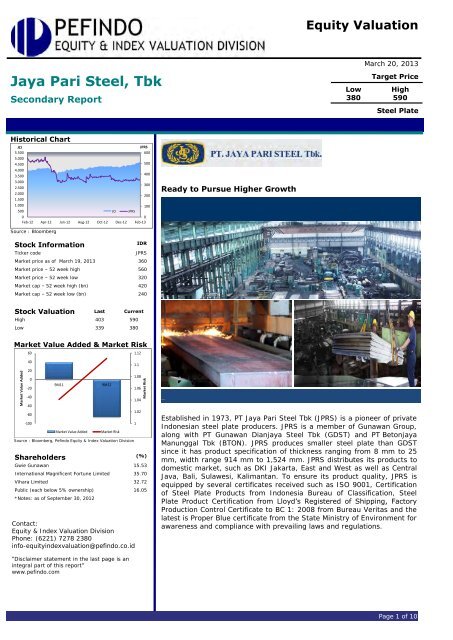

Ready to Pursue Higher Growth<br />

Equity Valuation<br />

March 20, 2013<br />

Target Price<br />

Low High<br />

380 590<br />

<strong>Steel</strong> Plate<br />

Property<br />

Established in 1973, <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong> (JPRS) is a pioneer of private<br />

Indonesian steel plate producers. JPRS is a member of Gunawan Group,<br />

along with <strong>PT</strong> Gunawan Dianjaya <strong>Steel</strong> <strong>Tbk</strong> (GDST) and <strong>PT</strong> Betonjaya<br />

Manunggal <strong>Tbk</strong> (BTON). JPRS produces smaller steel plate than GDST<br />

since it has product specification of thickness ranging from 8 mm to 25<br />

mm, width range 914 mm to 1,524 mm. JPRS distributes its products to<br />

domestic market, such as DKI Jakarta, East and West as well as Central<br />

Java, Bali, Sulawesi, Kalimantan. To ensure its product quality, JPRS is<br />

equipped by several certificates received such as ISO 9001, Certification<br />

of <strong>Steel</strong> Plate Products from Indonesia Bureau of Classification, <strong>Steel</strong><br />

Plate Product Certification from Lloyd’s Registered of Shipping, Factory<br />

Production Control Certificate to BC 1: 2008 from Bureau Veritas and the<br />

latest is Proper Blue certificate from the State Ministry of Environment for<br />

awareness and compliance with prevailing laws and regulations.<br />

Page 1 of 10

INVESTMENT PARAMETER<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

Target Price Adjustment<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

We have made several adjustments to our previous forecast and adjust our<br />

Target Price upward to the range of IDR380 – IDR590 per share, based<br />

on the following considerations:<br />

Indonesian steel market this year is forecasted to reach IDR71 trillion,<br />

up by 7% YoY compared to IDR66 trillion in 2012, mainly due to solid<br />

economic growth in domestic that could drive to the increasing of<br />

manufacture, automotive and infrastructure activities, further boosting<br />

steel consumption.<br />

Financial performance during 9M12. We view that JPRS’s achievement<br />

up to 9M12 was in line with our revenue projection in the previous<br />

report for 2012 period. Despite a decline performance in 9M12,<br />

however, in line with increasing trend of steel price and augmented with<br />

positive growth of national steel industry, we believe JPRS will be able to<br />

perform better in the years ahead.<br />

Risk free rate, equity premium, and beta assumption are 5.5%, 7.6%,<br />

and 1.0x respectively.<br />

Business Prospects<br />

In line with the positive growth of infrastructure, construction,<br />

infrastructure and automotive sectors, we believe steel industry has<br />

prospective outlook in the years ahead. This year, steel consumption in<br />

domestic is estimated to increase by 9% YoY or about 11 million tons,<br />

compared to 10.4 million tons in 2012. Meanwhile, domestic production<br />

capacity is predicted only 6.3 million tons this year. By considering above<br />

factors and augmented with JPRS product distribution for domestic market,<br />

we foresee that JPRS’s revenue will be able to grow by 5% CAGR during<br />

2011 – 2016 periods.<br />

Table 1: Performance Summary<br />

2009 2010 2011 2012P 2013P<br />

Revenue [IDR bn] 303 428 641 461 533<br />

Pre-tax Profit [IDR bn] 1 39 48 15 29<br />

Net Profit [IDR bn] 1 28 37 11 22<br />

EPS [IDR] 0.7 37.9 49.9 15.1 29.1<br />

EPS Growth [%] (99.0) 5,437.5 31.5 (69.7) 92.2<br />

P/E [x] 103.5 15.3 9.7 23.8* 12.4*<br />

PBV [x] 0.7 1.3 1.0 0.8* 0.7*<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>, Pefindo Equity & Index Valuation Division Estimates<br />

*) Based on share Price as of March 19, 2013 – IDR 360 per share<br />

March 20, 2013 Page 2 of 10

GROWTH VALUE MAP<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Growth-Value Map below provides an overview of market expectations for the<br />

companies listed on the IDX. Current Performance (CP) metric, running along the<br />

horizontal axis, is a portion of current stock market value that can be linked to<br />

the perpetuity of current company’s performance in profitability. Growth<br />

Expectations (GE) metric, plotted on the vertical axis, is the difference between<br />

the current stock market value and the value of current performance. Both<br />

metrics are normalized by the company’s book value.<br />

Growth-Value Map divides companies into four clusters:<br />

Excellent Value Managers (“Q-1”)<br />

Market expects companies in Q-1 to surpass their benchmark in<br />

profitability and growth.<br />

Expectation Builders (“Q-2”)<br />

Market has relatively low expectations of profitability in the short term<br />

from companies in Q-2, but has growth expectations exceed the<br />

benchmark.<br />

Traditionalists (“Q-3”)<br />

Market has low growth expectations of companies in the Q-3, although<br />

they showed good profitability in the short term.<br />

Asset-loaded Value Managers (“Q-4”)<br />

Market has low expectations in terms of profitability and growth for<br />

companies in Q-4.<br />

Growth Expectations<br />

Figure 1: Growth-Value Map of JPRS (<strong>Steel</strong> Industry)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

Q-2 Q-1<br />

JPRS<br />

Q-4 Q-3<br />

0 1 2 3 4<br />

Current Performance (CP)<br />

Source: Bloomberg, Pefindo Equity & Index Valuation Division<br />

Based on financial report and market data, JPRS is classified in the Expectation<br />

Builders (Q-2) cluster. Market has higher growth expectation in the long term,<br />

but relatively lower expectation of profitability in the short term. JPRS has the<br />

opportunity to move to Excellent Value Managers by way of strengthening its<br />

internal growth and regularly updating its economic success to public.<br />

March 20, 2013 Page 3 of 10

BUSINESS INFORMATION<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Supported by Domestic Market Optimism in 2013<br />

Indonesian steel market is forecasted to reach IDR71 trillion, up by 7% YoY<br />

compared to IDR66 trillion in 2012. It is mainly caused by solid economic growth<br />

in domestic that could drive to the increasing of manufacture, automotive and<br />

infrastructure activities. Despite shadowed by financial crisis in USA and Europe,<br />

we believe it will not affect domestic steel manufacturers since they can maintain<br />

their sales volume by selling the products in domestic market.<br />

in IDR trillion<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Figure 2: Indonesia <strong>Steel</strong> Market and <strong>Steel</strong><br />

Consumption<br />

41.5<br />

March 20, 2013 Page 4 of 10<br />

63.7<br />

66.4<br />

71.05<br />

2010 2011 2012P 2013P<br />

National <strong>Steel</strong> Market National <strong>Steel</strong> Consumption<br />

Source: IISA, various source processed by Pefindo Equity & Index Valuation Division<br />

Meanwhile, there is an increasing raw material price since early this year. As a<br />

result, several steel manufacturer has increased their selling price around 13%-<br />

15%. Raw material price in January 2013 compared to October 2012 has<br />

increased significantly, particularly scrap and iron ore which rose by 15% and<br />

30%, respectively.<br />

in USD<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Figure 3: Iron Ore Price<br />

0<br />

Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13<br />

China iron ore spot price Hebei/Tangshan<br />

Source: Bloomberg, Pefindo Equity & Index Valuation Division<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

in million ton

FINANCE<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Better Financial Position<br />

In the last few years, JPRS financial position looks better, as depicted by the<br />

increasing liquidity and decreasing debt to equity ratio (DER). We noted that<br />

JPRS current ratio and DER were recorded by 2.9x and 0.3x in 2009, then it<br />

became 10.0x and 0.1x, respectively in 9M12. Considering above historical result,<br />

we believe JPRS will be able to maintain stable balance sheet ahead.<br />

(IDR billion)<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

218<br />

Figure 4: Parts of JPRS Balance Sheet<br />

76 82<br />

286<br />

272<br />

103111<br />

300 305<br />

March 20, 2013 Page 5 of 10<br />

90100<br />

338<br />

243<br />

24<br />

35<br />

2009 2010 2011 9M12<br />

Current Asset Current Liabilities Total Liabilities Total Equity<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>, Pefindo Equity & Index Valuation Division<br />

Business Prospect<br />

In line with the positive growth of infrastructure, construction as well as<br />

automotive sectors, we believe steel industry has prospective outlook in the years<br />

ahead. This year, steel consumption is estimated to increase by 9% YoY or about<br />

11 million tons, compared to 10.4 million tons in 2012. Meanwhile, domestic<br />

production capacity is predicted only 6.3 million tons this year. By considering<br />

above factors, we foresee that JPRS’s revenue will be able to grow by 5% CAGR<br />

during 2011 – 2016 periods.<br />

IDR billion<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

641<br />

Figure 5: JPRS’s Revenue Estimation<br />

461<br />

533<br />

614<br />

709<br />

822<br />

2011 2012P 2013P 2014P 2015P 2016P<br />

Revenue Estimation<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>, Pefindo Equity & Index Valuation Division Estimates<br />

342

INDUSTRY COMPARISON<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Table 2: JPRS and Peers Performance Summary as of September 2012<br />

JPRS GDST BTON BAJA KRAS<br />

Sales [IDR, bn] 244 1,222 118 779 15,878<br />

Gross Profit [IDR, bn] 15 112 23 56 1,150<br />

Net Profit [IDR, bn] 4 36 19 14 8<br />

Total Asset [IDR, bn] 377 1,164 144 840 23,376<br />

Total Liabilities [IDR, bn] 35 382 36 588 13,254<br />

Total Equity [IDR, bn] 342 782 107 252 10,122<br />

Growth YoY<br />

Sales [%] (41.2) (22.3) 2.9 24.7 25.5<br />

Gross Profit [%] (69.8) (48.1) 25.9 129.9 (5.0)<br />

Net Profit [%] (86.3) (64.4) 57.8 (13.8) (99.3)<br />

Profitability<br />

Gross Margin [%] 6.1 9.2 19.3 7.2 7.2<br />

Net Margin [%] 1.5 3.0 16.0 1.8 0.0<br />

ROA [%] 1.0 3.1 13.1 1.6 0.0<br />

ROE [%] 1.1 4.6 17.5 5.4 0.1<br />

Leverage<br />

DER [x] 0.1 0.5 0.3 2.3 1.3<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>, <strong>PT</strong> Gunawan Dianjaya <strong>Steel</strong> <strong>Tbk</strong>, <strong>PT</strong> Betonjaya Manunggal <strong>Tbk</strong>, <strong>PT</strong> Saranacentral Bajatama <strong>Tbk</strong>, <strong>PT</strong> Krakatau<br />

<strong>Steel</strong> <strong>Tbk</strong>, Pefindo Equity & Index Valuation Division<br />

March 20, 2013 Page 6 of 10

TARGET PRICE<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

VALUATION<br />

Methodology<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

We apply Discounted Cash Flow (DCF) method as the main valuation<br />

approach considering the income growth is a value driver in JPRS instead of<br />

asset growth.<br />

Furthermore, we also apply Guideline Company Method (GCM) as comparison<br />

method.<br />

This valuation is based on 100% shares price as of March 19, 2013, using<br />

JPRS’s financial report as of September 30, 2012, for our fundamental<br />

analysis.<br />

Value Estimation<br />

We use Cost of Capital of 13.5% and Cost of Equity of 13.5% based on the<br />

following assumptions:<br />

Table 3: Assumption<br />

Risk free rate [%]* 5.5<br />

Risk premium [%]* 7.6<br />

Beta [x]* 1.0<br />

Cost of Equity [%] 13.5<br />

Marginal tax rate [%] 25.0<br />

WACC [%] 13.5<br />

Source: Bloomberg, Pefindo Equity & Index Valuation Division Estimates<br />

Notes: * As of March 19, 2013<br />

Target price for 12 months based on valuation as per March 19, 2013 is as<br />

follows:<br />

Using DCF method with discount rate assumption 13.5% is IDR430 –<br />

IDR470 per share.<br />

Using GCM method (PBV 1.9X and P/E 18.1X) is IDR280 – IDR880<br />

per share.<br />

In order to obtain a value which represents both value indications, we have<br />

weighted both DCF and GCM methods by 70%:30%.<br />

Based on the above calculation, target price of JPRS for 12 month is IDR380<br />

– IDR590 per share<br />

Table 4: Summary of DCF Method Valuation<br />

Conservative Moderate Aggressive<br />

PV of Free Cash Flows – IDR bn 62 65 68<br />

PV Terminal Value – IDR bn 250 263 276<br />

Non-Operating Assets – IDR bn 7 7 7<br />

Total Equity Value – IDR bn 319 336 352<br />

Number of Share, mn shares 750 750 750<br />

Fair Value per Share, IDR 430 450 470<br />

Source: Pefindo Equity & Index Valuation Division Estimates<br />

March 20, 2013 Page 7 of 10

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

Table 5: GCM Comparison<br />

Valuation, March 19, 2013<br />

JPRS GDST BAJA Average<br />

P/E, [x] 18.2 12.9 23.3 18.1<br />

P/BV, [x] 0.8 1.1 3.8 1.9<br />

Source: Bloomberg, Pefindo Equity & Index Valuation Division Estimates<br />

Table 6: Summary of GCM Method Valuation<br />

Multiples<br />

(x)<br />

Est. EPS<br />

(IDR)<br />

Est. BV/Share<br />

(IDR)<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Value<br />

(IDR)<br />

P/E 18.1 15 - 280<br />

P/BV 1.9 - 460 880<br />

Source: Bloomberg, Pefindo Equity & Index Valuation Division Estimates<br />

Table 7: Fair Value Reconciliation<br />

Fair Value per Share [IDR]<br />

DCF GCM Average<br />

Upper limit 470 880 590<br />

Bottom limit 430 280 380<br />

Weight 70% 30%<br />

Source: Pefindo Equity & Index Valuation Division Estimates<br />

March 20, 2013 Page 8 of 10

Table 8: Consolidated Statements of Comprehensive<br />

Income<br />

(IDR billion) 2009 2010 2011 2012P 2013P<br />

Net Sales 303 428 641 461 533<br />

COGS (267) (372) (585) (432) (488)<br />

Gross Profit 35 56 57 29 45<br />

Operating Expense (34) (17) (9) (14) (16)<br />

Pre-tax Profit 1 39 48 15 29<br />

Tax (1) (10) (11) (4) (7)<br />

Net Profit 1 28 37 11 22<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>., Pefindo Equity & Index Valuation Division Estimates<br />

Table 9: Consolidated Statements of Financial Position<br />

Assets<br />

(IDR billion) 2009 2010 2011 2012P 2013P<br />

Current Assets<br />

Cash and cash<br />

equivalents<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

1 49 12 32 41<br />

Receivables 128 94 192 160 185<br />

Inventory 79 117 94 57 66<br />

Other Assets 9 26 7 23 23<br />

Total Current Assets 218 286 305 272 315<br />

Fixed Assets 19 18 15 15 15<br />

Other Assets 117 108 118 118 118<br />

Total Assets 354 411 438 404 448<br />

Liabilities<br />

Trade payables 73 93 80 35 60<br />

Other Short-term<br />

payables<br />

3 11 10 12 13<br />

Other long-term payables 7 8 10 10 10<br />

Total Liabilities 82 111 100 58 84<br />

Total Equity 272 300 338 347 364<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>, Pefindo Equity & Index Valuation Division Estimates<br />

Figure 6: Historical P/E and P/BV<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>., Pefindo Equity & Index Valuation Division<br />

Figure 7: Historical ROA, ROE and TAT<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>., Pefindo Equity & Index Valuation Division<br />

Table 10 :Key Ratios<br />

Growth [%]<br />

Ratio 2009 2010 2011 2012P 2013P<br />

Sales (58.7) 41,2 49.9 (28.1) 15.6<br />

Operating Profit (98.2) 2,815.2 24.4 (68.5) 92.2<br />

EBITDA (97.6) 2,102.5 22.6 (62.3) 74.4<br />

Net Profit (99.0) 5,437.5 31.5 (69.7) 92.2<br />

Profitability [%]<br />

Gross Margin 11.7 13.0 8.9 6.3 8.4<br />

Operating Margin 0.4 9.0 7.5 3.3 5.5<br />

EBITDA Margin 0.6 9.5 7.8 4.1 6.2<br />

Net Margin 0.2 6.7 5.8 2.5 4.1<br />

ROA 0.1 6.9 8.5 2.8 4.9<br />

ROE 0.2 9.5 11.1 3.3 6.0<br />

Solvability [X]<br />

Debt to Equity 0.3 0.4 0.3 0.2 0.2<br />

Debt to Asset 0.2 0.3 0.2 0.1 0.2<br />

Liquidity [X]<br />

Current Ratio 2.9 2.8 3.4 5.8 4.3<br />

Quick Ratio 1.2 1.4 1.2 1.8 1.4<br />

Source: <strong>PT</strong> <strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong> <strong>Tbk</strong>. Pefindo Equity & Index Valuation Division Estimates<br />

March 20, 2013 Page 9 of 10

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

DISCLAIMER<br />

<strong>Jaya</strong> <strong>Pari</strong> <strong>Steel</strong>, <strong>Tbk</strong><br />

This report was prepared based on the trusted and reliable sources. Nevertheless, we do not<br />

guarantee its completeness, accuracy and adequacy. Therefore we do not responsible of any<br />

investment decision making based on this report. As for any assumptions, opinions and<br />

predictions were solely our internal judgments as per reporting date, and those judgments are<br />

subject to change without further notice.<br />

We do not responsible for mistake and negligence occurred by using this report. Last<br />

performance could not always be used as reference for future outcome. This report is not an<br />

offering recommendation, purchase or holds particular shares. This report might not be suitable<br />

for some investors. All opinion in this report has been presented fairly as per issuing date with<br />

good intentions; however it could be change at any time without further notice. The price, value<br />

or income from each share of the Company stated in this report might lower than the investor<br />

expectation and investor might obtain lower return than the invested amount. Investment is<br />

defined as the probable income that will be received in the future; nonetheless such return may<br />

possibly fluctuate. As for the Company which its share is denominated other than Rupiah, the<br />

foreign exchange fluctuation may reduce the value, price or investor investment return. This<br />

report does not contain any information for tax consideration in investment d ecision making.<br />

The share price target in this report is a fundamental value, not a fair market value nor a<br />

transaction price reference required by the regulations.<br />

The share price target issued by Pefindo Equity & Index Valuation Division is not a<br />

recommendation to buy, sell or hold particular shares and it could not be considered as an<br />

investment advice from Pefindo Equity & Index Valuation Division as its scope of service to, or<br />

in relation to some parties, including listed companies, financial adv isor, broker, investment<br />

bank, financial institution and intermediary, in correlation with receiving rewards or any other<br />

benefits from that parties.<br />

This report is not intended for particular investor and cannot be used as part of investment<br />

objective on particular shares and neither an investment recommendation on particular shares<br />

or an investment strategy. We strongly recommended investor to consider the suitable situation<br />

and condition at first before making decision in relation with the figure in thi s report. If it is<br />

necessary, kindly contact your financial advisor.<br />

<strong>PEFINDO</strong> keeps the activities of Equity Valuation separate from Ratings to preserve<br />

independence and objectivity of its analytical processes and products. <strong>PEFINDO</strong> has established<br />

policies and procedures to maintain the confidentiality of certain non -public information<br />

received in connection with each analytical process. The entire process, methodology and the<br />

database used in the preparation of the Reference Share Price Target Report as a whole is<br />

different from the processes, methodologies and databases used <strong>PEFINDO</strong> in doing the rating.<br />

This report was prepared and composed by Pefindo Equity & Index Valuation Division with the<br />

objective to enhance shares price transparency of listed companies in Indonesia Stock Exchange (IDX).<br />

This report is also free of other party’s influence, pressure or force either from IDX or the listed company<br />

which reviewed by Pefindo Equity & Index Valuation Division. Pefindo Equity & Index Valuation<br />

Division will earn reward amounting to IDR 20 mn each from IDX and the reviewed company for issuing<br />

report twice per year. For further information, please visit our website at http://www.pefindo.com<br />

This report is prepared and composed by Pefindo Equity & Index Valuation Division. In<br />

Indonesia, this report is published in our website and in IDX website.<br />

March 20, 2013 Page 10 of 10