You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

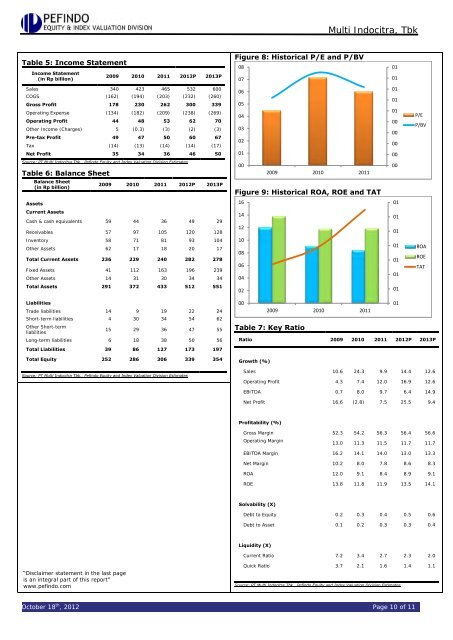

Table 5: Income Statement<br />

Income Statement<br />

(in Rp billion)<br />

“Disclaimer statement in the last page<br />

is an integral part of this report”<br />

www.pefindo.com<br />

2009 2010 2011 2012P 2013P<br />

Sales 340 423 465 532 600<br />

COGS (162) (194) (203) (232) (260)<br />

Gross Profit 178 230 262 300 339<br />

Operating Expense (134) (182) (209) (238) (269)<br />

Operating Profit 44 48 53 62 70<br />

Other Income (Charges) 5 (0.3) (3) (2) (3)<br />

Pre-tax Profit 49 47 50 60 67<br />

Tax (14) (13) (14) (14) (17)<br />

Net Profit 35 34 36 46 50<br />

Source: <strong>PT</strong> <strong>Multi</strong> <strong>Indocitra</strong> <strong>Tbk</strong>., Pefindo Equity and Index Valuation Division Estimates<br />

Table 6: Balance Sheet<br />

Balance Sheet<br />

(in Rp billion)<br />

Assets<br />

Current Assets<br />

2009 2010 2011 2012P 2013P<br />

Cash & cash equivalents 59 44 36 49 29<br />

Receivables 57 97 105 120 128<br />

Inventory 58 71 81 93 104<br />

Other Assets 62 17 18 20 17<br />

Total Current Assets 236 229 240 282 278<br />

Fixed Assets 41 112 163 196 239<br />

Other Assets 14 31 30 34 34<br />

Total Assets 291 372 433 512 551<br />

Liabilities<br />

Trade liabilities 14 9 19 22 24<br />

Short-term liabilities 4 30 34 54 62<br />

Other Short-term<br />

liabilities<br />

15 29 36 47 55<br />

Long-term liabilities 6 18 38 50 56<br />

Total Liabilities 39 86 127 173 197<br />

Total Equity 252 286 306 339 354<br />

Source: <strong>PT</strong> <strong>Multi</strong> <strong>Indocitra</strong> <strong>Tbk</strong>., Pefindo Equity and Index Valuation Division Estimates<br />

Figure 8: Historical P/E and P/BV<br />

<strong>Multi</strong> <strong>Indocitra</strong>, <strong>Tbk</strong><br />

October 18 th , 2012 Page 10 of 11<br />

08<br />

07<br />

06<br />

05<br />

04<br />

03<br />

02<br />

01<br />

00<br />

2009 2010 2011<br />

Figure 9: Historical ROA, ROE and TAT<br />

16<br />

14<br />

12<br />

10<br />

08<br />

06<br />

04<br />

02<br />

00<br />

2009 2010 2011<br />

Table 7: Key Ratio<br />

01<br />

01<br />

01<br />

01<br />

01<br />

00<br />

00<br />

00<br />

00<br />

00<br />

01<br />

01<br />

01<br />

01<br />

01<br />

01<br />

01<br />

01<br />

P/E<br />

P/BV<br />

Ratio 2009 2010 2011 2012P 2013P<br />

Growth (%)<br />

ROA<br />

Sales 10.6 24.3 9.9 14.4 12.6<br />

Operating Profit 4.3 7.4 12.0 16.9 12.6<br />

EBITDA 0.7 8.0 9.7 6.4 14.9<br />

Net Profit 16.6 (2.8) 7.5 25.5 9.4<br />

Profitability (%)<br />

Gross Margin 52.3 54.2 56.3 56.4 56.6<br />

Operating Margin<br />

ROE<br />

TAT<br />

13.0 11.3 11.5 11.7 11.7<br />

EBITDA Margin 16.2 14.1 14.0 13.0 13.3<br />

Net Margin 10.2 8.0 7.8 8.6 8.3<br />

ROA 12.0 9.1 8.4 8.9 9.1<br />

ROE 13.8 11.8 11.9 13.5 14.1<br />

Solvability (X)<br />

Debt to Equity 0.2 0.3 0.4 0.5 0.6<br />

Debt to Asset 0.1 0.2 0.3 0.3 0.4<br />

Liquidity (X)<br />

Current Ratio 7.2 3.4 2.7 2.3 2.0<br />

Quick Ratio 3.7 2.1 1.6 1.4 1.1<br />

Source: <strong>PT</strong> <strong>Multi</strong> <strong>Indocitra</strong> <strong>Tbk</strong>., Pefindo Equity and Index Valuation Division Estimates