2011 Registration Document - Valeo

2011 Registration Document - Valeo

2011 Registration Document - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5 Financial<br />

PAGE 242<br />

and accounting information<br />

Consolidated fi nancial statements for the year ended December 31, <strong>2011</strong><br />

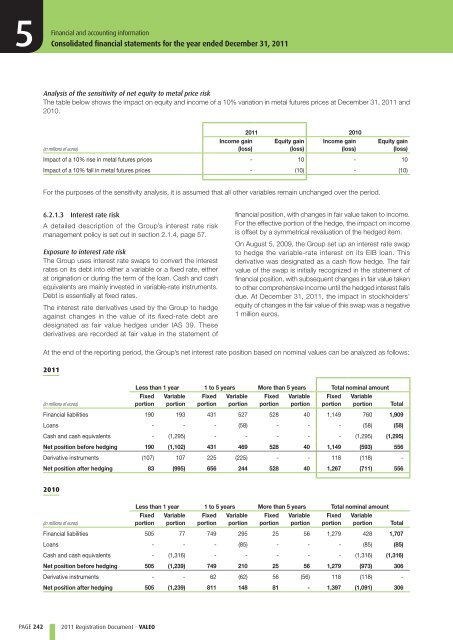

Analysis of the sensitivity of net equity to metal price risk<br />

The table below shows the impact on equity and income of a 10% variation in metal futures prices at December 31, <strong>2011</strong> and<br />

2010.<br />

<strong>2011</strong> 2010<br />

Income gain Equity gain Income gain Equity gain<br />

(in millions of euros)<br />

(loss)<br />

(loss)<br />

(loss)<br />

(loss)<br />

Impact of a 10% rise in metal futures prices - 10 - 10<br />

Impact of a 10% fall in metal futures prices - (10) - (10)<br />

For the purposes of the sensitivity analysis, it is assumed that all other variables remain unchanged over the period.<br />

6.2.1.3 Interest rate risk<br />

A detailed description of the Group’s interest rate risk<br />

management policy is set out in section 2.1.4, page 57 .<br />

Exposure to interest rate risk<br />

The Group uses interest rate swaps to convert the interest<br />

rates on its debt into either a variable or a fixed rate, either<br />

at origination or during the term of the loan. Cash and cash<br />

equivalents are mainly invested in variable-rate instruments.<br />

Debt is essentially at fixed rates.<br />

The interest rate derivatives used by the Group to hedge<br />

against changes in the value of its fixed-rate debt are<br />

designated as fair value hedges under IAS 39. These<br />

derivatives are recorded at fair value in the statement of<br />

<strong>2011</strong> <strong>Registration</strong> D ocument - VALEO<br />

financial position, with changes in fair value taken to income.<br />

For the effective portion of the hedge, the impact on income<br />

is offset by a symmetrical revaluation of the hedged item.<br />

On August 5, 2009, the Group set up an interest rate swap<br />

to hedge the variable-rate interest on its EIB loan. This<br />

derivative was designated as a cash flow hedge. The fair<br />

value of the swap is initially recognized in the statement of<br />

financial position, with subsequent changes in fair value taken<br />

to other comprehensive income until the hedged interest falls<br />

due. At December 31, <strong>2011</strong>, the impact in stockholders’<br />

equity of changes in the fair value of this swap was a negative<br />

1 million euros.<br />

At the end of the reporting period, the Group’s net interest rate position based on nominal values can be analyzed as follows:<br />

<strong>2011</strong><br />

Less than 1 year 1 to 5 years More than 5 years Total nominal amount<br />

Fixed Variable Fixed Variable Fixed Variable Fixed Variable<br />

(in millions of euros)<br />

portion portion portion portion portion portion portion portion Total<br />

Financial liabilities 190 193 431 527 528 40 1,149 760 1,909<br />

Loans - - - (58) - - - (58) (58)<br />

Cash and cash equivalents - (1,295) - - - - - (1,295) (1,295)<br />

Net position before hedging 190 (1,102) 431 469 528 40 1,149 (593) 556<br />

Derivative instruments (107) 107 225 (225) - - 118 (118) -<br />

Net position after hedging 83 (995) 656 244 528 40 1,267 (711) 556<br />

2010<br />

(in millions of euros)<br />

Less than 1 year 1 to 5 years More than 5 years Total nominal amount<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion<br />

Fixed<br />

portion<br />

Variable<br />

portion Total<br />

Financial liabilities 505 77 749 295 25 56 1,279 428 1,707<br />

Loans - - - (85) - - - (85) (85)<br />

Cash and cash equivalents - (1,316) - - - - - (1,316) (1,316)<br />

Net position before hedging 505 (1,239) 749 210 25 56 1,279 (973) 306<br />

Derivative instruments - - 62 (62) 56 (56) 118 (118) -<br />

Net position after hedging 505 (1,239) 811 148 81 - 1,397 (1,091) 306