AnnuAl report 2010 - Walter Meier

AnnuAl report 2010 - Walter Meier

AnnuAl report 2010 - Walter Meier

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

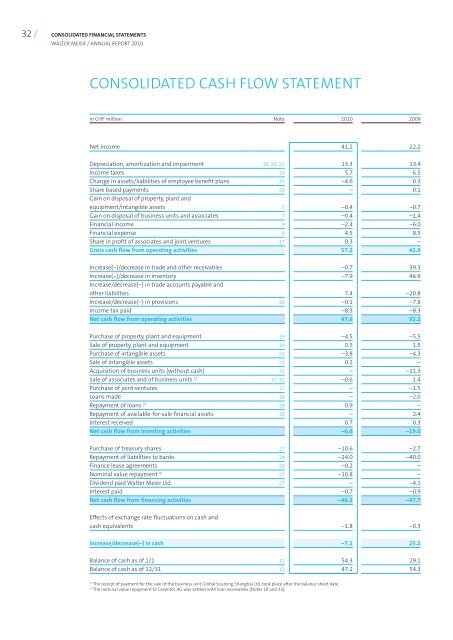

32 / Consolidated finanCial statements<br />

WAlter meier / <strong>AnnuAl</strong> <strong>report</strong> <strong>2010</strong><br />

ConSolidAted CASH FloW StAtement<br />

in CHF million note <strong>2010</strong> 2009<br />

net income 41.2 22.2<br />

depreciation, amortization and impairment 19, 20, 21 13.3 13.4<br />

income taxes 10 5.7 6.5<br />

Change in assets/liabilities of employee benefit plans 25 –4.6 0.3<br />

Share based payments 28 – 0.1<br />

Gain on disposal of property, plant and<br />

equipment/intangible assets 7 –0.4 –0.7<br />

Gain on disposal of business units and associates 7 –0.4 –1.4<br />

Financial income 9 –2.4 –6.0<br />

Financial expense 9 4.5 8.5<br />

Share in profit of associates and joint ventures 17 0.3 –<br />

gross cash flow from operating activities 57.2 42.9<br />

increase(–)/decrease in trade and other receivables –0.7 39.3<br />

increase(–)/decrease in inventory –7.9 46.9<br />

increase/decrease(–) in trade accounts payable and<br />

other liabilities 7.4 –20.8<br />

increase/decrease(–) in provisions 26 –0.1 –7.8<br />

income tax paid –8.3 –8.3<br />

net cash flow from operating activities 47.6 92.2<br />

purchase of property, plant and equipment 19 –4.5 –5.5<br />

Sale of property, plant and equipment 19 0.5 1.5<br />

purchase of intangible assets 21 –3.8 –4.3<br />

Sale of intangible assets 21 0.2 –<br />

Acquisition of business units (without cash) 31 – –11.3<br />

Sale of associates and of business units 1) 17, 32 –0.6 1.4<br />

purchase of joint ventures 17 – –1.5<br />

loans made 18 – –2.0<br />

repayment of loans 2) 18 0.9 –<br />

repayment of available-for-sale financial assets 18 – 2.4<br />

interest received 0.7 0.3<br />

net cash flow from investing activities –6.6 –19.0<br />

purchase of treasury shares 27 –10.6 –2.7<br />

repayment of liabilities to banks 24 –24.0 –40.0<br />

Finance lease agreements 29 –0.2 –<br />

nominal value repayment 2) 27 –10.8 –<br />

dividend paid <strong>Walter</strong> meier ltd. 27 – –4.1<br />

interest paid –0.7 –0.9<br />

net cash flow from financing activities –46.3 –47.7<br />

effects of exchange rate fluctuations on cash and<br />

cash equivalents –1.8 –0.3<br />

increase/decrease(–) in cash –7.1 25.2<br />

Balance of cash as of 1/1 12 54.3 29.1<br />

Balance of cash as of 12/31 12 47.2 54.3<br />

1) the receipt of payment for the sale of the business unit Global Sourcing Shanghai ltd. took place after the balance sheet date.<br />

2) the nominal value repayment to Greentec AG was settled with loan receivables (notes 18 and 33).