PDF (2.63 MB) - Geberit International AG

PDF (2.63 MB) - Geberit International AG

PDF (2.63 MB) - Geberit International AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16<br />

Despite the acquisition, the equity ratio amounted to a<br />

sound 43.5 % at the end of 2004. In terms of average<br />

shareholders’ equity, the Group was able to increase its<br />

return on equity to 24.0 % (prior year 21.5 %) in 2004.<br />

As a result of the acquisition, the gearing (net debt/<br />

shareholders’ equity) rose from 15.7 % in the prior year<br />

to 52.1% as of 31 December 2004.<br />

The Group’s liquidity situation was comfortable. In addition<br />

to liquid funds in the amount of MCHF 81.6, the<br />

Group had access to operating credit facilities of MCHF<br />

174.1, which remained un-drawn as of 31 December<br />

2004.<br />

As of 31 December 2004, the <strong>Geberit</strong> Group held<br />

66,480 of its own shares in treasury, corresponding to<br />

only a minor increase versus the prior year. Treasury<br />

shares are primarily earmarked for stock ownership plans.<br />

In the year under review, total assets rose by approximately<br />

MCHF 500 to MCHF 2,003.9 (prior year<br />

MCHF 1,507.8) as a result of the Mapress acquisition.<br />

Also due to the acquisition, net working capital increased<br />

to MCHF 130.9, goodwill and intangible assets<br />

to MCHF 878.8 and property, plant and equipment<br />

to MCHF 538.8.<br />

Operating capital, comprising net working capital, property,<br />

plant and equipment as well as goodwill and<br />

intangible assets, amounted to MCHF 1,548.5 (prior<br />

year MCHF 1,038.2) as of the end of 2004. The return<br />

on operating assets, expressed as the ratio of operating<br />

profit before amortization (EBITA) to average operating<br />

capital, amounted to 28.5 % (prior year 23.2 %) in the<br />

year under review.<br />

Business and Financial Review<br />

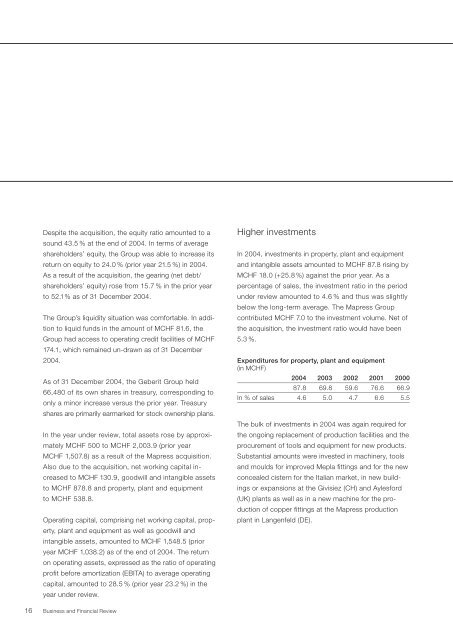

Higher investments<br />

In 2004, investments in property, plant and equipment<br />

and intangible assets amounted to MCHF 87.8 rising by<br />

MCHF 18.0 (+25.8%) against the prior year. As a<br />

percentage of sales, the investment ratio in the period<br />

under review amounted to 4.6 % and thus was slightly<br />

below the long-term average. The Mapress Group<br />

contributed MCHF 7.0 to the investment volume. Net of<br />

the acquisition, the investment ratio would have been<br />

5.3 %.<br />

Expenditures for property, plant and equipment<br />

(in MCHF)<br />

2004 2003 2002 2001 2000<br />

87.8 69.8 59.6 76.6 66.9<br />

In % of sales 4.6 5.0 4.7 6.6 5.5<br />

The bulk of investments in 2004 was again required for<br />

the ongoing replacement of production facilities and the<br />

procurement of tools and equipment for new products.<br />

Substantial amounts were invested in machinery, tools<br />

and moulds for improved Mepla fittings and for the new<br />

concealed cistern for the Italian market, in new buildings<br />

or expansions at the Givisiez (CH) and Aylesford<br />

(UK) plants as well as in a new machine for the production<br />

of copper fittings at the Mapress production<br />

plant in Langenfeld (DE).