Employment Land Review 2012.indd - Calderdale Council

Employment Land Review 2012.indd - Calderdale Council

Employment Land Review 2012.indd - Calderdale Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Industrial and Warehouse Market<br />

Profile<br />

4.14 The industrial/ warehouse market within Halifax is predominantly locally based firms.<br />

It is more suitable for manufacturing than warehousing uses due to its less favourable<br />

location to the motorway.<br />

Demand<br />

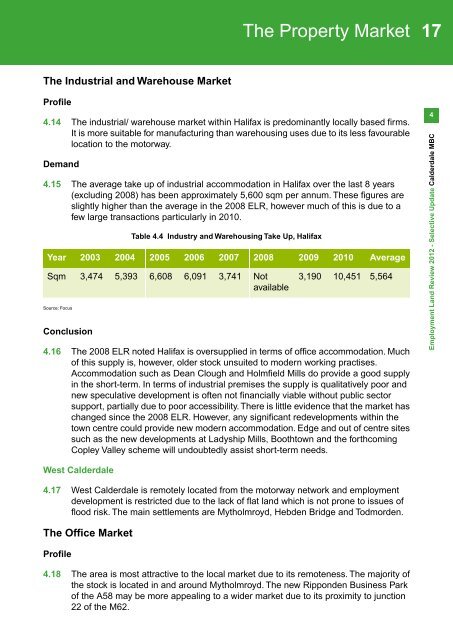

4.15 The average take up of industrial accommodation in Halifax over the last 8 years<br />

(excluding 2008) has been approximately 5,600 sqm per annum. These figures are<br />

slightly higher than the average in the 2008 ELR, however much of this is due to a<br />

few large transactions particularly in 2010.<br />

Year<br />

Sqm<br />

Source: Focus<br />

2003<br />

3,474<br />

Conclusion<br />

2004<br />

5,393<br />

Table 4.4 Industry and Warehousing Take Up, Halifax<br />

2005<br />

6,608<br />

2006<br />

6,091<br />

2007<br />

3,741<br />

2008<br />

Not<br />

available<br />

2009<br />

3,190<br />

2010<br />

10,451<br />

Average<br />

5,564<br />

4.16 The 2008 ELR noted Halifax is oversupplied in terms of office accommodation. Much<br />

of this supply is, however, older stock unsuited to modern working practises.<br />

Accommodation such as Dean Clough and Holmfield Mills do provide a good supply<br />

in the short-term. In terms of industrial premises the supply is qualitatively poor and<br />

new speculative development is often not financially viable without public sector<br />

support, partially due to poor accessibility. There is little evidence that the market has<br />

changed since the 2008 ELR. However, any significant redevelopments within the<br />

town centre could provide new modern accommodation. Edge and out of centre sites<br />

such as the new developments at Ladyship Mills, Boothtown and the forthcoming<br />

Copley Valley scheme will undoubtedly assist short-term needs.<br />

West <strong>Calderdale</strong><br />

4.17 West <strong>Calderdale</strong> is remotely located from the motorway network and employment<br />

development is restricted due to the lack of flat land which is not prone to issues of<br />

flood risk. The main settlements are Mytholmroyd, Hebden Bridge and Todmorden.<br />

The Office Market<br />

Profile<br />

The Property Market<br />

4.18 The area is most attractive to the local market due to its remoteness. The majority of<br />

the stock is located in and around Mytholmroyd. The new Ripponden Business Park<br />

of the A58 may be more appealing to a wider market due to its proximity to junction<br />

22 of the M62.<br />

17<br />

4<br />

<strong>Employment</strong> <strong>Land</strong> <strong>Review</strong> 2012 - Selective Update <strong>Calderdale</strong> MBC