Financial statements - Mondi

Financial statements - Mondi

Financial statements - Mondi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the combined and<br />

consolidated financial <strong>statements</strong><br />

continued<br />

for the year ended 31 December 2010<br />

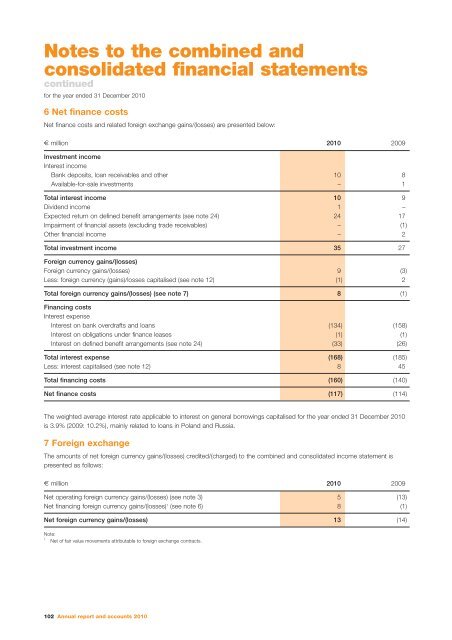

6 Net finance costs<br />

Net finance costs and related foreign exchange gains/(losses) are presented below:<br />

E million 2010 2009<br />

Investment income<br />

Interest income<br />

Bank deposits, loan receivables and other 10 8<br />

Available-for-sale investments – 1<br />

Total interest income 10 9<br />

Dividend income 1 –<br />

Expected return on defined benefit arrangements (see note 24) 24 17<br />

Impairment of financial assets (excluding trade receivables) – (1)<br />

Other financial income – 2<br />

Total investment income 35 27<br />

Foreign currency gains/(losses)<br />

Foreign currency gains/(losses) 9 (3)<br />

Less: foreign currency (gains)/losses capitalised (see note 12) (1) 2<br />

Total foreign currency gains/(losses) (see note 7) 8 (1)<br />

Financing costs<br />

Interest expense<br />

Interest on bank overdrafts and loans (134) (158)<br />

Interest on obligations under finance leases (1) (1)<br />

Interest on defined benefit arrangements (see note 24) (33) (26)<br />

Total interest expense (168) (185)<br />

Less: interest capitalised (see note 12) 8 45<br />

Total financing costs (160) (140)<br />

Net finance costs (117) (114)<br />

The weighted average interest rate applicable to interest on general borrowings capitalised for the year ended 31 December 2010<br />

is 3.9% (2009: 10.2%), mainly related to loans in Poland and Russia.<br />

7 Foreign exchange<br />

The amounts of net foreign currency gains/(losses) credited/(charged) to the combined and consolidated income statement is<br />

presented as follows:<br />

E million 2010 2009<br />

Net operating foreign currency gains/(losses) (see note 3) 5 (13)<br />

Net financing foreign currency gains/(losses) 1 (see note 6) 8 (1)<br />

Net foreign currency gains/(losses) 13 (14)<br />

Note:<br />

1 Net of fair value movements attributable to foreign exchange contracts.<br />

102 Annual report and accounts 2010