Annual Report 2007 - Muehlhan AG

Annual Report 2007 - Muehlhan AG

Annual Report 2007 - Muehlhan AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ManaGeMent divisions share Group ManaGeMent report group Consolidated FinanCial stateMents<br />

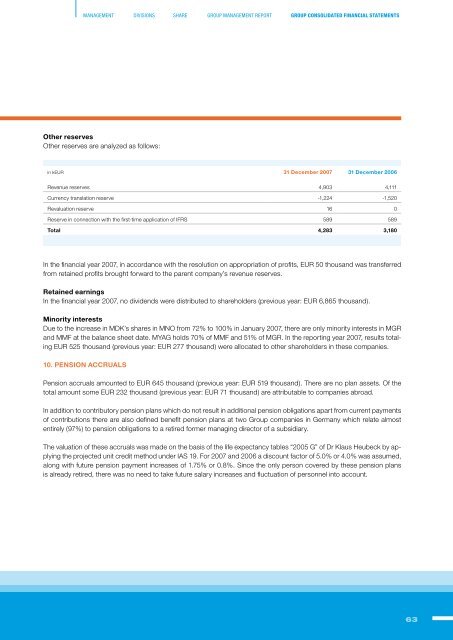

Other reserves<br />

other reserves are analyzed as follows:<br />

in kEur 31 December <strong>2007</strong> 31 December 2006<br />

revenue reserves 4,903 4,111<br />

Currency translation reserve -1,224 -1,520<br />

revaluation reserve 16 0<br />

reserve in connection with the first-time application of ifrS 589 589<br />

Total 4,283 3,180<br />

in the financial year <strong>2007</strong>, in accordance with the resolution on appropriation of profits, Eur 50 thousand was transferred<br />

from retained profits brought forward to the parent company’s revenue reserves.<br />

Retained earnings<br />

in the financial year <strong>2007</strong>, no dividends were distributed to shareholders (previous year: Eur 6,865 thousand).<br />

Minority interests<br />

due to the increase in MdK’s shares in MNo from 72% to 100% in January <strong>2007</strong>, there are only minority interests in MGr<br />

and MMf at the balance sheet date. MyaG holds 70% of MMf and 51% of MGr. in the reporting year <strong>2007</strong>, results totaling<br />

Eur 525 thousand (previous year: Eur 277 thousand) were allocated to other shareholders in these companies.<br />

10. PENSION ACCRUALS<br />

pension accruals amounted to Eur 645 thousand (previous year: Eur 519 thousand). there are no plan assets. of the<br />

total amount some Eur 232 thousand (previous year: Eur 71 thousand) are attributable to companies abroad.<br />

in addition to contributory pension plans which do not result in additional pension obligations apart from current payments<br />

of contributions there are also defined benefit pension plans at two Group companies in Germany which relate almost<br />

entirely (97%) to pension obligations to a retired former managing director of a subsidiary.<br />

the valuation of these accruals was made on the basis of the life expectancy tables “2005 G” of dr Klaus Heubeck by applying<br />

the projected unit credit method under iaS 19. for <strong>2007</strong> and 2006 a discount factor of 5.0% or 4.0% was assumed,<br />

along with future pension payment increases of 1.75% or 0.8%. Since the only person covered by these pension plans<br />

is already retired, there was no need to take future salary increases and fluctuation of personnel into account.<br />

63