Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

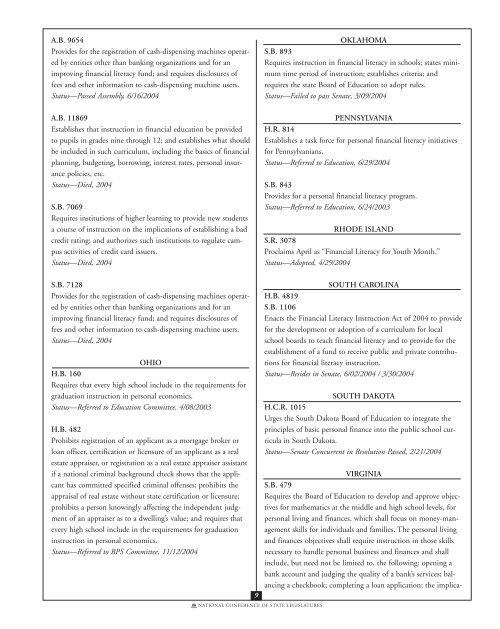

A.B. 9654<br />

Provides for the registration <strong>of</strong> cash-dispensing machines operated<br />

by entities other than banking organizations and for an<br />

improving financial literacy fund; and requires disclosures <strong>of</strong><br />

fees and other information to cash-dispensing machine users.<br />

Status—Passed Assembly, 6/16/2004<br />

A.B. 11869<br />

Establishes that instruction in financial education be provided<br />

to pupils in grades nine through 12; and establishes what should<br />

be included in such curriculum, including the basics <strong>of</strong> financial<br />

planning, budgeting, borrowing, interest rates, personal insurance<br />

policies, etc.<br />

Status—Died, 2004<br />

S.B. 7069<br />

Requires institutions <strong>of</strong> higher learning to provide new students<br />

a course <strong>of</strong> instruction on the implications <strong>of</strong> establishing a bad<br />

credit rating; and authorizes such institutions to regulate campus<br />

activities <strong>of</strong> credit card issuers.<br />

Status—Died, 2004<br />

S.B. 7128<br />

Provides for the registration <strong>of</strong> cash-dispensing machines operated<br />

by entities other than banking organizations and for an<br />

improving financial literacy fund; and requires disclosures <strong>of</strong><br />

fees and other information to cash-dispensing machine users.<br />

Status—Died, 2004<br />

OHIO<br />

H.B. 160<br />

Requires that every high school include in the requirements for<br />

graduation instruction in personal economics.<br />

Status—Referred to Education Committee, 4/08/2003<br />

H.B. 482<br />

Prohibits registration <strong>of</strong> an applicant as a mortgage broker or<br />

loan <strong>of</strong>ficer, certification or licensure <strong>of</strong> an applicant as a real<br />

estate appraiser, or registration as a real estate appraiser assistant<br />

if a national criminal background check shows that the applicant<br />

has committed specified criminal <strong>of</strong>fenses; prohibits the<br />

appraisal <strong>of</strong> real estate without state certification or licensure;<br />

prohibits a person knowingly affecting the independent judgment<br />

<strong>of</strong> an appraiser as to a dwelling’s value; and requires that<br />

every high school include in the requirements for graduation<br />

instruction in personal economics.<br />

Status—Referred to BPS Committee, 11/12/2004<br />

OKLAHOMA<br />

S.B. 893<br />

Requires instruction in financial literacy in schools; states minimum<br />

time period <strong>of</strong> instruction; establishes criteria; and<br />

requires the state Board <strong>of</strong> Education to adopt rules.<br />

Status—Failed to pass Senate, 3/09/2004<br />

PENNSYLVANIA<br />

H.R. 814<br />

Establishes a task force for personal financial literacy initiatives<br />

for Pennsylvanians.<br />

Status—Referred to Education, 6/29/2004<br />

S.B. 843<br />

Provides for a personal financial literacy program.<br />

Status—Referred to Education, 6/24/2003<br />

RHODE ISLAND<br />

S.R. 3078<br />

Proclaims April as “Financial Literacy for Youth Month.”<br />

Status—Adopted, 4/29/2004<br />

SOUTH CAROLINA<br />

H.B. 4819<br />

S.B. 1106<br />

Enacts the Financial Literacy Instruction Act <strong>of</strong> 2004 to provide<br />

for the development or adoption <strong>of</strong> a curriculum for local<br />

school boards to teach financial literacy and to provide for the<br />

establishment <strong>of</strong> a fund to receive public and private contributions<br />

for financial literacy instruction.<br />

Status—Resides in Senate, 6/02/2004 / 3/30/2004<br />

SOUTH DAKOTA<br />

H.C.R. 1015<br />

Urges the South Dakota Board <strong>of</strong> Education to integrate the<br />

principles <strong>of</strong> basic personal finance into the public school curricula<br />

in South Dakota.<br />

Status—Senate Concurrent in Resolution Passed, 2/21/2004<br />

VIRGINIA<br />

S.B. 479<br />

Requires the Board <strong>of</strong> Education to develop and approve objectives<br />

for mathematics at the middle and high school levels, for<br />

personal living and finances, which shall focus on money-management<br />

skills for individuals and families. The personal living<br />

and finances objectives shall require instruction in those skills<br />

necessary to handle personal business and finances and shall<br />

include, but need not be limited to, the following: opening a<br />

bank account and judging the quality <strong>of</strong> a bank’s services; balancing<br />

a checkbook; completing a loan application; the implica-<br />

9<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES