Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

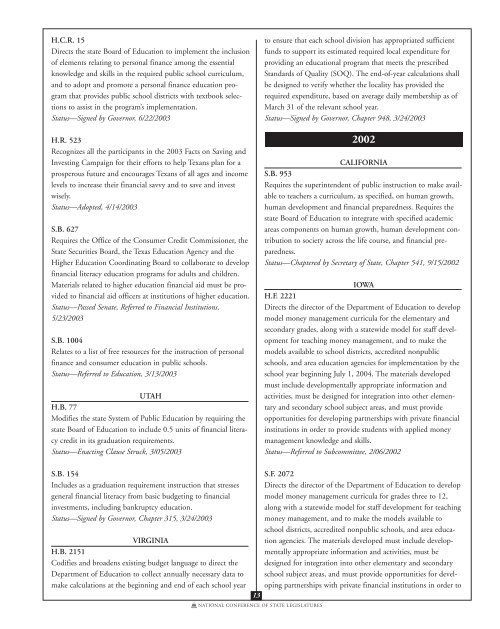

H.C.R. 15<br />

Directs the state Board <strong>of</strong> Education to implement the inclusion<br />

<strong>of</strong> elements relating to personal finance among the essential<br />

knowledge and skills in the required public school curriculum,<br />

and to adopt and promote a personal finance education program<br />

that provides public school districts with textbook selections<br />

to assist in the program’s implementation.<br />

Status—Signed by Governor, 6/22/2003<br />

H.R. 523<br />

Recognizes all the participants in the 2003 Facts on Saving and<br />

Investing Campaign for their efforts to help Texans plan for a<br />

prosperous future and encourages Texans <strong>of</strong> all ages and income<br />

levels to increase their financial savvy and to save and invest<br />

wisely.<br />

Status—Adopted, 4/14/2003<br />

S.B. 627<br />

Requires the Office <strong>of</strong> the Consumer Credit Commissioner, the<br />

<strong>State</strong> Securities Board, the Texas Education Agency and the<br />

Higher Education Coordinating Board to collaborate to develop<br />

financial literacy education programs for adults and children.<br />

Materials related to higher education financial aid must be provided<br />

to financial aid <strong>of</strong>ficers at institutions <strong>of</strong> higher education.<br />

Status—Passed Senate, Referred to Financial Institutions,<br />

5/23/2003<br />

S.B. 1004<br />

Relates to a list <strong>of</strong> free resources for the instruction <strong>of</strong> personal<br />

finance and consumer education in public schools.<br />

Status—Referred to Education, 3/13/2003<br />

UTAH<br />

H.B. 77<br />

Modifies the state System <strong>of</strong> Public Education by requiring the<br />

state Board <strong>of</strong> Education to include 0.5 units <strong>of</strong> financial literacy<br />

credit in its graduation requirements.<br />

Status—Enacting Clause Struck, 3/05/2003<br />

S.B. 154<br />

Includes as a graduation requirement instruction that stresses<br />

general financial literacy from basic budgeting to financial<br />

investments, including bankruptcy education.<br />

Status—Signed by Governor, Chapter 315, 3/24/2003<br />

VIRGINIA<br />

H.B. 2151<br />

Codifies and broadens existing budget language to direct the<br />

Department <strong>of</strong> Education to collect annually necessary data to<br />

make calculations at the beginning and end <strong>of</strong> each school year<br />

13<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

to ensure that each school division has appropriated sufficient<br />

funds to support its estimated required local expenditure for<br />

providing an educational program that meets the prescribed<br />

Standards <strong>of</strong> Quality (SOQ). The end-<strong>of</strong>-year calculations shall<br />

be designed to verify whether the locality has provided the<br />

required expenditure, based on average daily membership as <strong>of</strong><br />

March 31 <strong>of</strong> the relevant school year.<br />

Status—Signed by Governor, Chapter 948, 3/24/2003<br />

2002<br />

CALIFORNIA<br />

S.B. 953<br />

Requires the superintendent <strong>of</strong> public instruction to make available<br />

to teachers a curriculum, as specified, on human growth,<br />

human development and financial preparedness. Requires the<br />

state Board <strong>of</strong> Education to integrate with specified academic<br />

areas components on human growth, human development contribution<br />

to society across the life course, and financial preparedness.<br />

Status—Chaptered by Secretary <strong>of</strong> <strong>State</strong>, Chapter 541, 9/15/2002<br />

IOWA<br />

H.F. 2221<br />

Directs the director <strong>of</strong> the Department <strong>of</strong> Education to develop<br />

model money management curricula for the elementary and<br />

secondary grades, along with a statewide model for staff development<br />

for teaching money management, and to make the<br />

models available to school districts, accredited nonpublic<br />

schools, and area education agencies for implementation by the<br />

school year beginning July 1, 2004. The materials developed<br />

must include developmentally appropriate information and<br />

activities, must be designed for integration into other elementary<br />

and secondary school subject areas, and must provide<br />

opportunities for developing partnerships with private financial<br />

institutions in order to provide students with applied money<br />

management knowledge and skills.<br />

Status—Referred to Subcommittee, 2/06/2002<br />

S.F. 2072<br />

Directs the director <strong>of</strong> the Department <strong>of</strong> Education to develop<br />

model money management curricula for grades three to 12,<br />

along with a statewide model for staff development for teaching<br />

money management, and to make the models available to<br />

school districts, accredited nonpublic schools, and area education<br />

agencies. The materials developed must include developmentally<br />

appropriate information and activities, must be<br />

designed for integration into other elementary and secondary<br />

school subject areas, and must provide opportunities for developing<br />

partnerships with private financial institutions in order to