Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

Printer Friendly Version - National Conference of State Legislatures

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consumer Debt and Bankruptcy on the Rise.<br />

American consumers now owe about $1.7 trillion in credit<br />

card and other debt, an amount roughly equal to the gross<br />

national product <strong>of</strong> England and Russia combined. 1<br />

Of those polled in a 2000 national survey, 53 percent report<br />

that they live from paycheck to paycheck. This statistic jumps to<br />

64 percent for those who earn between $20,000 and $50,000<br />

annually. 2<br />

Furthermore, more than 40 percent <strong>of</strong> American families live<br />

<strong>of</strong>f <strong>of</strong> 110 percent <strong>of</strong> their incomes. 3<br />

Bankruptcy cases filed in federal courts fell 2.6 percent in fiscal<br />

year 2004, according to the Administrative Office <strong>of</strong> the U.S.<br />

Courts. Despite the drop in filings, bankruptcies remain at historic<br />

highs, well above the 1.5 million record first set in 2002. 4<br />

Children Spending More.<br />

One-third <strong>of</strong> high school students use a credit card. 5<br />

In 2003, teens spent $175 billion, averaging about $103 per<br />

week. 6<br />

Children’s spending has roughly doubled every 10 years for<br />

the past three decades and tripled in the 1990s. 7<br />

The Jump$tart Coalition administered its annual financial<br />

survey in 2004 to 4,074 high school seniors representing 215<br />

schools in 33 states. Survey scores were slightly better than in<br />

previous years, but students answered only 52.3 percent <strong>of</strong> the<br />

questions correctly.<br />

College Student Debt.<br />

Eighty-three percent <strong>of</strong> undergraduate students have at least<br />

one credit card, a 24 percent increase from 1998. 8<br />

The average monthly credit card balance <strong>of</strong> an undergraduate<br />

student is $2,237, and 21 percent <strong>of</strong> undergraduates have a<br />

high balance <strong>of</strong> between $3,000 and $7,000. This is a 61 percent<br />

increase from 2000.<br />

By the time students graduate from college, they have an<br />

average <strong>of</strong> $20,402 in combined education loan and credit card<br />

balances. Students also double their average credit card debt and<br />

triple the number <strong>of</strong> credit cards they carry by the time they<br />

graduate. 9<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

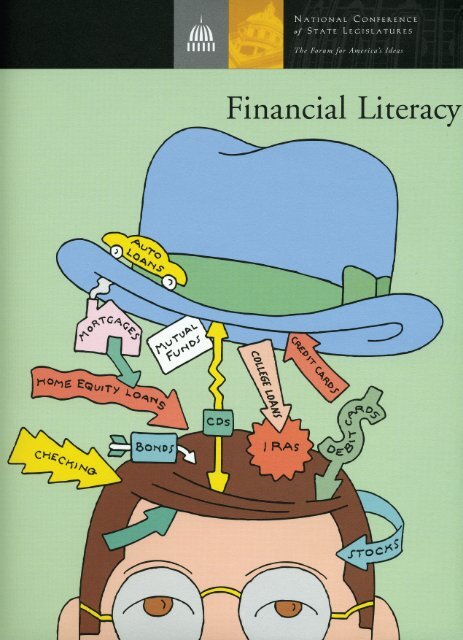

Personal Finance Education:<br />

Overview<br />

As state legislators tackle pressing education issues<br />

such as funding, teacher quality, access to higher<br />

education and implementation <strong>of</strong> the No Child Left<br />

Behind Act, they also are struck by the reality that<br />

the nation is failing miserably in one subject: managing<br />

personal finances. The following statistics foretell a dismal<br />

financial future for our nation’s children.<br />

Each year, more Americans continue to spend beyond their<br />

means and amass thousands <strong>of</strong> dollars in personal debt.<br />

However, research indicates that a greater understanding <strong>of</strong> economic<br />

issues leads to wiser economic activity and greater financial<br />

independence for individuals. In light <strong>of</strong> this, many state<br />

legislators are spearheading efforts to educate students and<br />

adults about personal finance. In 2004, 23 states introduced legislation<br />

that addressed personal finance education, and at least<br />

30 states introduced similar legislation in 2005.<br />

<strong>State</strong> and local policymakers are implementing various policies<br />

to ensure that students and adults learn how to manage personal<br />

finances. Policy options include requiring personal finance classes<br />

for graduation, funding teacher pr<strong>of</strong>essional development, prohibiting<br />

a gift exchange for a student credit card application, creating<br />

adult financial literacy initiatives, and revamping consumer<br />

credit counseling. Education <strong>of</strong>ficials also are forming public-private<br />

partnerships to create curriculum, establish teacher training<br />

programs, and initiate student activities to foster personal finance<br />

education at the national, state and local levels. Such organizations<br />

include various banking and financial institutions, the<br />

Jump$tart Coalition, Junior Achievement, the <strong>National</strong> Academy<br />

<strong>of</strong> Finance, the <strong>National</strong> Council on Economics Education, and<br />

the <strong>National</strong> Endowment for Financial Education.<br />

1. “NPR Special Report: A Nation in Debt.” All Things Considered (<strong>National</strong><br />

Public Radio, Jan. 31, 2003);<br />

www.npr.org/programs/atc/features/2003/jan/debt/index.html.<br />

2. “CFA Research Reveals Most Americans Have Built Little Wealth,” Consumer<br />

Federation <strong>of</strong> America Press Release, Feb. 20, 2001.<br />

3. Junior Achievement Inkline, A Case for Economic Education,<br />

http://www.ja.org/about/about_res_inkline_case_11.shtml.<br />

4. Administrative Office <strong>of</strong> the U.S. Courts, Dec. 3, 2004.<br />

5. R.D. Manning, Credit Cards on Campus: Costs and Consequences <strong>of</strong> Student Debt<br />

(Washington, D.C.: Consumer Federation <strong>of</strong> America, 1999).<br />

6. Ibid.<br />

7. Teenage Research Unlimited, Jan. 9, 2004.<br />

8. The U.S. Kids Market, Packaged Facts 2002;<br />

http://www.marketresearch.com/product/display.asp?ProductID=928713&g=1.<br />

9. Nellie Mae, Undergraduate Students and Credit Cards: An Analysis <strong>of</strong> Usage Rates<br />

and Trends (Washington, D.C.: Nellie Mae, 2002).

In 2004, the <strong>National</strong> Endowment for Financial<br />

Education commissioned a study to evaluate the effects<br />

<strong>of</strong> its personal finance high school curriculum on students<br />

across the country. Researchers found that, “…even<br />

relatively limited exposure to financial education can<br />

impart significant, lasting and practical personal financial<br />

knowledge to young people from all walks <strong>of</strong> life.” 1 <strong>State</strong> policymakers<br />

hope to reap similar benefits by enacting state policy to<br />

ensure that personal finance education is taught in their schools.<br />

In 2004, in fact, almost half <strong>of</strong> the states introduced legislation<br />

that addressed personal finance education, and at least 30 states<br />

introduced legislation in 2005. As policymakers grapple with<br />

personal finance education issues, they will want to understand<br />

their policy options and whether the policies are effectively<br />

helping individuals manage their personal finances. These policy<br />

options include the following:<br />

■ Emphasizing the importance <strong>of</strong> personal finance education;<br />

■ Requiring or encouraging personal finance education in state<br />

education standards;<br />

■ Requiring or encouraging specific personal finance education<br />

course work; and<br />

■ Partnering with organizations and private institutions to<br />

provide curriculum, programs and other unique opportunities<br />

for students.<br />

THE IMPORTANCE OF THE ISSUE<br />

<strong>State</strong> legislatures across the country are drawing attention to<br />

statistics about bankruptcy and financial mismanagement and<br />

are emphasizing the importance <strong>of</strong> personal finance education.<br />

In 2004, at least four states—including Arizona, Hawaii,<br />

Michigan and Rhode Island—approved resolutions recognizing<br />

the importance <strong>of</strong> youth financial literacy and designated April<br />

as Financial Literacy Month. In 2005, at least eight states—<br />

including California, Florida, Iowa, Michigan, Pennsylvania,<br />

Rhode Island, South Carolina and Wyoming—passed similar<br />

resolutions.<br />

K-12 Personal Finance Education<br />

<strong>State</strong> Policy Analysis<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

STATE STANDARDS<br />

Most states include personal finance education in their state<br />

K-12 curriculum and standards. According to a 2004 survey by<br />

the <strong>National</strong> Council for Economics Education (NCEE), 38<br />

states report that they include personal finance education in<br />

their standards, up from 31 states in 2002. 2 Twenty-one states<br />

have explicitly required that standards be implemented. 3<br />

Hawaii, for example, introduced legislation in 2004 to require<br />

the state Board <strong>of</strong> Education to include personal finance education<br />

in the curriculum. In Arkansas, legislators passed Senate<br />

Bill 41 in 2003, which requires the state Department <strong>of</strong><br />

Education to develop personal finance course content guidelines<br />

and recommend text books to be used in a personal finance<br />

course. In 2004, Colorado passed House Bill 1360, which<br />

encourages personal finance education to be included in state<br />

and district standards.<br />

Placement <strong>of</strong> personal finance education in the state standards<br />

varies from state to state. It may be included in social<br />

studies, economics, business, mathematics or consumer science<br />

standards. Consumer science standards <strong>of</strong>ten cover personal savings<br />

management, including how to manage a savings or checking<br />

account and budgeting. Kansas standards, for example,<br />

require economics curricula to include the determination <strong>of</strong><br />

costs and benefits <strong>of</strong> spending, saving and borrowing, as well as<br />

calculation <strong>of</strong> interest earned and account balances for checking<br />

and savings accounts. Students must learn their role in the economic<br />

system and how economic scarcity affects purchasing<br />

power. Several states call for personal finance education across<br />

content areas. Louisiana standards, for example, declare that<br />

components <strong>of</strong> financial literacy are benchmarks in mathematics<br />

and social studies content standards and in family and consumer<br />

science guidelines.<br />

<strong>State</strong>s also vary by the grade level at which the personal<br />

finance education standards are required. Eleven states—Kansas,<br />

Kentucky, Maine, Maryland, Massachusetts, New Hampshire,<br />

New Mexico, North Dakota, Oklahoma, Oregon and<br />

Vermont—require standards in grades K-12. Both Maine and<br />

Massachusetts start at the prekindergarten level. Twelve states—<br />

Louisiana, Mississippi, Montana, Nebraska, New Jersey, New

York, North Carolina, South Carolina, South Dakota,<br />

Tennessee, Texas and Utah—include personal finance education<br />

at the high school level. Three <strong>of</strong> these states—South Carolina,<br />

Texas and Utah—require personal finance education only in<br />

grades 10 through 12. Four states—Minnesota, Nevada,<br />

Pennsylvania and Rhode Island—place personal finance education<br />

in various middle and high school levels. Rhode Island, for<br />

example, places the curriculum in grades eight through 12,<br />

whereas Nevada places it in grades five through 12.<br />

ENCOURAGING AND MANDATING<br />

SPECIFIC COURSE WORK<br />

Encouraging Course Work<br />

In some states, legislators only encourage schools to include personal<br />

finance education. Legislators argue that this approach<br />

asserts their wishes, yet honors local control. School districts<br />

have the opportunity and flexibility to <strong>of</strong>fer the course work<br />

where and when it is most beneficial to their students. In 2005,<br />

legislators in California, Kentucky, Maine, Maryland, Missouri,<br />

Oregon, South Carolina, Texas and Washington considered such<br />

legislation.<br />

In 2003, North Carolina took a unique approach by creating<br />

a pilot program to determine best practices around personal<br />

finance education. Assistance will be <strong>of</strong>fered in up to five local<br />

school administrative units to implement programs on teaching<br />

personal financial literacy. The purpose <strong>of</strong> the pilot program is<br />

to determine the best methods <strong>of</strong> equipping students with necessary<br />

knowledge and skills before they become self-supporting<br />

and need to make critical decisions regarding their personal<br />

finances. The components <strong>of</strong> personal financial literacy include<br />

consumer financial education, personal finance and personal<br />

credit. Before the program sites are selected, the state Board <strong>of</strong><br />

Education must develop curricula, materials and guidelines for<br />

local boards <strong>of</strong> education to implement a program <strong>of</strong> instruction<br />

for personal financial literacy. In 2005, Texas introduced<br />

legislation to develop a similar pilot program.<br />

Requiring Course Work<br />

Although some states have had success with only encouraging<br />

personal finance education, several states are finding that simply<br />

encouraging such education has led to a marked disparity in the<br />

delivery and results <strong>of</strong> personal finance education. Utah, for<br />

example, has reexamined and strengthened its original personal<br />

finance legislation. In 2002, the Legislature passed a resolution<br />

that encouraged school district boards, superintendents and principals<br />

to find ways to include financial literacy in existing curricula.<br />

After two years, legislators found that not much had changed.<br />

As a result, they amended the legislation in 2004 to mandate<br />

financial literacy course work as a requirement for graduation.<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

Other states also are moving beyond encouraging curricula<br />

to mandating instruction in personal finance education.<br />

Research supports this move. A report by the Credit Union<br />

<strong>National</strong> Association states that, “Requiring every student in the<br />

nation to study financial literacy is the most effective way to<br />

develop a credit smart society and combat the negative implications<br />

<strong>of</strong> debt-stressed families and increasing bankruptcies.” 4<br />

According to the <strong>National</strong> Council on Economic Education,<br />

eight states require schools to <strong>of</strong>fer a course, and seven states<br />

require students to take the course. 5 Examples <strong>of</strong> such legislation<br />

follow.<br />

■ In 2003, the Louisiana Legislature required the mandatory<br />

free enterprise curriculum to include instruction in personal<br />

finance beginning with the 2004-2005 school year. The new<br />

personal finance components must include income, money<br />

management, spending and credit, and savings and investment.<br />

In summer 2004, 280 teachers were trained in the NEFE High<br />

School Financial Planning Program at no charge for registration<br />

or materials and received a stipend for completing the six-hour<br />

workshop.<br />

■ Ohio legislators introduced legislation in 2005 to require<br />

that every high school include instruction in personal economics<br />

as a requirement for graduation.<br />

■ In 2005, Texas passed House Bill 492, directing the state<br />

Board <strong>of</strong> Education to include elements relating to personal<br />

finance as part <strong>of</strong> the essential knowledge and skill <strong>of</strong> economics<br />

and requiring course work in personal finance education for<br />

high school graduation.<br />

■ Virginia legislators enacted two laws in 2005 that address<br />

personal finance education. Chapter 741 requires economics<br />

education not only in all middle and high schools, but also<br />

requires that all public institutions <strong>of</strong> higher education make<br />

“….provisions for the promotion <strong>of</strong> the development <strong>of</strong> student<br />

life skills through inclusion <strong>of</strong> principles <strong>of</strong> economics education<br />

and financial literacy within an existing general education course,<br />

the freshman orientation process, or other appropriate venue.”<br />

Virginia law requires that financial literacy be systematically<br />

infused into the state standards; however, the objectives are not<br />

required in the state assessments. The law also encourages public<br />

schools to establish on-site banking programs for students.<br />

Virginia also passed Chapter 33, the Entrepreneurship<br />

Education Program. The program consists <strong>of</strong> grants administered<br />

by the Board <strong>of</strong> Education to public secondary schools to<br />

support innovative educational programs that are designed to<br />

help students develop their entrepreneurial, academic and life<br />

skills. The programs can incorporate experiential learning; can<br />

include partnerships with business and higher education; and<br />

can assist students in practicing and mastering business concepts,<br />

such as negotiation, pricing, and the development and<br />

implementation <strong>of</strong> plans for individual student businesses.

Although mandating personal finance education is potentially<br />

beneficial, policymakers will want to consider the effects <strong>of</strong><br />

adding such curricula to an already stretched staff and budget.<br />

Some argue this increases demands on teacher workload and<br />

pressure for students to succeed in the core curriculum on<br />

which they are annually tested. Implementing new curricula<br />

also can be both expensive and time-consuming; it involves<br />

adopting and purchasing new materials and providing appropriate<br />

pr<strong>of</strong>essional development to teachers. To be successful,<br />

schools will need to find time in an already full instructional<br />

load for personal finance education.<br />

PARTNERSHIPS<br />

In addition to encouraging or mandating personal finance<br />

education courses, states also are considering new and creative<br />

approaches to integrate personal finance education into the<br />

school day. <strong>State</strong>s such as Iowa, New Jersey and Louisiana are<br />

making use <strong>of</strong> public-private partnerships to encourage and promote<br />

financial literacy. Such partnerships or networks target<br />

specific audiences and provide necessary information and financial<br />

support without adding layers to a saturated public school<br />

system. New York authorizes credit unions to open and maintain<br />

student branches within the elementary and secondary<br />

schools. By placing banks and credit unions inside the school,<br />

legislators hope to give students the skills, knowledge and experience<br />

necessary to manage their personal finances and obtain<br />

general financial literacy.<br />

■ Banks and Credit Unions are increasing their involvement<br />

in the public school arena. According to a 2004 Consumers<br />

Bankers Association study <strong>of</strong> bank-sponsored financial literacy<br />

programs, 89 percent <strong>of</strong> banks are involved in consumer financial<br />

education, representing a 16 percent increase from the previous<br />

year. They now reach approximately 142,967 students. 6<br />

The survey reports that 88 percent <strong>of</strong> employees tutor students<br />

when the bank works with public schools, and 70 percent <strong>of</strong><br />

banks participate in “adopt-a-school” programs. 7<br />

Currently, 74 credit unions in 25 states operate student-run<br />

branches in 238 schools. 8 The Credit Union <strong>National</strong><br />

Association also has partnered with the <strong>National</strong> Endowment<br />

for Financial Education (NEFE) to work with credit unions to<br />

provide financial planning classroom materials and volunteer<br />

teachers to high schools around the country. During the 2001-<br />

2002 school year, credit unions distributed financial education<br />

classroom materials to more than 71,000 students.<br />

■ Washington Mutual is one example <strong>of</strong> an institution that<br />

supports youth financial literacy. It <strong>of</strong>fers the Class Acts program,<br />

where employees volunteer to organize projects to support<br />

schools and financial literacy; the School Savings program<br />

that gives students hands-on lessons about how to handle<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

money responsibly using their Washington Mutual savings<br />

accounts and how to organize weekly Bank Days at school; the<br />

WaMoola for L.I.F.E. Lessons for grades K-12, an education<br />

program that teaches money basics, checking, credit and other<br />

skills through interactive lessons taught by employees; and a<br />

high school internship program that provides work experience<br />

for high school juniors and seniors. Washington Mutual also<br />

partners with a nonpr<strong>of</strong>it community development group,<br />

REACH, on its Youth$ave program. Youth$ave targets youth<br />

who live in REACH’s affordable housing communities.<br />

Youth$ave children attend nine financial education classes and<br />

use the program to save for a community-related, artistic, athletic<br />

or academic goal. 9 Other institutions that sponsor successful<br />

programs for K-12 students include Bank <strong>of</strong> America,<br />

Citigroup, Fleet, <strong>National</strong> City and Wells Fargo.<br />

■ The Jump$tart Coalition was established to improve personal<br />

finance literacy for young adults. The coalition has worked<br />

directly with state representatives who are familiar with their<br />

state’s needs for K-12 personal finance education to form coalitions<br />

for finance literacy in 26 states. In April 2005, the<br />

Jump$tart Coalition recognized Wisconsin as the first state<br />

coalition <strong>of</strong> 2005. This coalition was noted for its work with the<br />

<strong>National</strong> Institute <strong>of</strong> Financial and Economic Literacy and for<br />

organizing summer workshops to train teachers to teach student<br />

financial literacy. Several credit unions in Wisconsin sponsored<br />

local teachers to attend the training sessions.<br />

■ Junior Achievement works directly with schools on personal<br />

finance education. Through 145 American <strong>of</strong>fices, Junior<br />

Achievement reaches approximately 4 million students per year<br />

in inner cities, suburbs and rural areas. Junior Achievement programs<br />

which span grades K-12, focus on seven key content<br />

areas, including business, citizenship, economics, entrepreneurship,<br />

ethics/character, financial literacy and career development.<br />

Teachers in more than 169,000 classrooms use Junior<br />

Achievement programs each year.<br />

■ The <strong>National</strong> Academy <strong>of</strong> Finance introduces high school<br />

students to career opportunities in the financial services industry.<br />

The academy’s mission is to open the door to new options<br />

and equip students to make sound choices for the future. One<br />

<strong>of</strong> three member programs <strong>of</strong> the <strong>National</strong> Academy<br />

Foundation, the Academy <strong>of</strong> Finance operates as a small learning<br />

community and is located in more than 275 high schools<br />

nationwide.<br />

■ The <strong>National</strong> Endowment for Financial Education (NEFE) is<br />

a nonpr<strong>of</strong>it foundation dedicated to helping all Americans<br />

acquire the information and gain the skills necessary to take control<br />

<strong>of</strong> their personal finances. NEFE provides the necessary funding,<br />

logistical support and financial planning expertise to create<br />

personal finance programs and materials for the public. The<br />

NEFE High School Financial Planning Program (HSFPP), which

provides materials to teach the basics <strong>of</strong> personal finance to young<br />

people, is available at no cost to all high schools throughout the<br />

country. This program has reached more than 1 million high<br />

school students across the country. NEFE also sponsors the Teen<br />

Resource Bureau Website, 10 which is managed and maintained by<br />

young adults in the NEFE Fellows Program. The Web site <strong>of</strong>fers<br />

information about such topics as establishing written and meaningful<br />

goals, understanding credit, budgeting, spending wisely<br />

and much more. The Web site is updated quarterly, with content<br />

available in Spanish and text only versions, and uses the HSFPP<br />

curriculum to outline key personal finance concepts.<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

1. <strong>National</strong> Public Radio, “NPR Special Report: A Nation in Debt,” All Things<br />

Considered, Jan. 31, 2003.<br />

2. Consumer Federation <strong>of</strong> America, “CFA Research Reveals Most Americans Have<br />

Built Little Wealth,” Press Release, Feb. 20, 2001.<br />

3. Junior Achievement Inkline, A Case for Economic Education,<br />

http://www.ja.org/about/about_res_inkline_case_11.shtml.<br />

4. Administrative Office <strong>of</strong> the U.S. Courts, “Bankruptcy Filings Fell in March<br />

2005 12-Month Period,” Press Release, June 10, 2005.<br />

5. R.D. Manning, Credit Cards on Campus: Costs and Consequences <strong>of</strong> Student Debt<br />

(Washington, D.C.: Consumer Federation <strong>of</strong> America, 1999).<br />

6. Teenage Research Unlimited, Jan. 9, 2004.<br />

7. The U.S. Kids Market, Packaged Facts 2002,<br />

http://www.marketresearch.com/product/display.asp?ProductID=928713&g=1.<br />

8. Nellie Mae, Undergraduate Students and Credit Cards: An Analysis <strong>of</strong> Usage Rates<br />

and Trends (Washington, D.C.: Nellie Mae, 2002).<br />

9. Ibid.

Imagine being 30 years old and still making payments for<br />

your college freshman text books. And imagine being 60<br />

years old, in poor health and not able to retire because<br />

you began contributing to your 401(k) plan only a couple<br />

<strong>of</strong> years ago. Unfortunately, these scenarios are all too<br />

common in today’s world <strong>of</strong> high credit card debt and low rates<br />

<strong>of</strong> savings. <strong>State</strong> legislators, alarmed by this trend, are stepping<br />

in to create policies and programs to educate today’s college<br />

students and adults about personal finance. In fact, at least 10<br />

states—Florida, Idaho, Illinois, Maine, Minnesota, Montana,<br />

New Jersey, New York, Pennsylvania and Texas—introduced<br />

legislation to address financial literacy for adults and college<br />

students during the 2005 legislative session.<br />

Higher Education Policy<br />

A significant concern for college students is their rising debt<br />

resulting from multiple credit cards and a lack <strong>of</strong> sufficient<br />

financial planning. According to Nellie Mae, a leading provider<br />

<strong>of</strong> higher education loans, a study <strong>of</strong> recent student loan applicants<br />

revealed that students held an average <strong>of</strong> three separate<br />

credit cards: 78 percent <strong>of</strong> students had at least one credit card,<br />

32 percent <strong>of</strong> students had four or more credit cards, and 95<br />

percent <strong>of</strong> graduate students carried credit cards. As a result,<br />

state lawmakers are enacting legislation to specifically address<br />

personal finance education for college students. The following<br />

are examples <strong>of</strong> such legislation.<br />

In 2004, Kentucky introduced legislation prohibiting <strong>of</strong>fers <strong>of</strong><br />

a gift in exchange for a student credit card application. The legislation<br />

also directs public institutions <strong>of</strong> higher education to<br />

promulgate administrative regulations for credit card marketing<br />

and encourages postsecondary institutions to include credit card<br />

and debt education sessions as part <strong>of</strong> a new student orientation.<br />

New York introduced legislation in 2004 that requires institutions<br />

<strong>of</strong> higher education to interview students who withdraw<br />

to determine whether such withdrawal is a result <strong>of</strong> credit card<br />

debt incurred by the student.<br />

Minnesota introduced legislation in 2005 that requires student<br />

financial management pr<strong>of</strong>iciency at public postsecondary<br />

institutions.<br />

Personal Finance Education for<br />

College Students and Adults:<br />

A <strong>State</strong> Policy Analysis<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

New Jersey introduced similar legislation in 2005 that requires<br />

public institutions <strong>of</strong> higher education to establish a financial<br />

management program for its students if the institution enters<br />

into an agreement for the direct solicitation <strong>of</strong> credit cards to its<br />

students. Credit card issuers are to fund the program.<br />

Several states, including Arkansas, Louisiana and West<br />

Virginia, have enacted laws to regulate marketing <strong>of</strong> credit cards<br />

to college students. Louisiana prohibits a credit card distributor<br />

from giving or <strong>of</strong>fering any gratuity as an inducement for a student<br />

to read, review or consider material relating to a credit card<br />

application unless the student has been provided a credit card<br />

debt education brochure.<br />

Six states—California, Hawaii, Louisiana, Missouri, New<br />

Mexico and Virginia—have encouraged colleges and universities<br />

to study the effects <strong>of</strong> marketing credit cards to college students.<br />

Adult Education Policy<br />

The Credit Union <strong>National</strong> Association Web site reports that<br />

60 percent <strong>of</strong> U.S. households have some amount <strong>of</strong> credit and<br />

receive an average <strong>of</strong> three credit card <strong>of</strong>fers per month, and<br />

that only 57 percent <strong>of</strong> adults get an “average” grade in bank<br />

economics. 1 According to a recent report from the Credit<br />

Union <strong>National</strong> Association, the Federal Reserve found that the<br />

typical family that filed for bankruptcy in 2007 owed more than<br />

one and one-half times its annual income in short-term debt. A<br />

family earning $24,000 had an average <strong>of</strong> $26,000 in credit<br />

card and similar debt. 2 With increasing debt and growing complexity<br />

in financial issues, there appears to be a great need for<br />

personal finance education among the adult population.<br />

<strong>State</strong> legislators are taking note and are creating programs and<br />

partnerships to address this need. New Jersey, for example, created<br />

a unique network between private organizations, credit<br />

unions and state agencies to increase personal finance awareness<br />

in the state. The network is designed to increase the distribution<br />

<strong>of</strong> financial education materials statewide, particularly in<br />

low and moderate income areas. <strong>State</strong> agencies are working<br />

with private organizations such as Columbia Bank, Garden<br />

<strong>State</strong> Mortgage, Independence Community Bank, PNC Bank,<br />

Nova Debt, Raritan Bay Federal Credit Union, <strong>State</strong> Farmers<br />

Insurance and Union Center <strong>National</strong> Bank. (over)

<strong>State</strong>s also have created state-level <strong>of</strong>fices to coordinate state<br />

financial education policies. In Pennsylvania, the Office <strong>of</strong><br />

Financial Education helps state agencies work with communitybased<br />

and private-sector partners to create and maintain a clearinghouse.<br />

The clearinghouse provides an accurate, up-to-date<br />

inventory <strong>of</strong> resources and assistance available to families in the<br />

state. The Florida Legislature considered legislation in 2005 to<br />

create the Financial Literacy Council to study the issue, and<br />

Maine considered similar legislation to establish the<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

Commission to Study the Scope and Quality <strong>of</strong> Personal and<br />

Family Financial Management Education.<br />

Legislators also have included financial education in already<br />

existing assistance programs. Illinois recognizes participation in<br />

financial literacy training as an approved work activity to meet the<br />

30-hour per week work requirement for TANF recipients. TANF<br />

funds can be used to support financial education strategies.<br />

1. http://buy.cuna.org/static/cpf_answers.html.<br />

2. Colleen Kelly, Financial Literacy in Schools: The Credit Union Commitment<br />

(Washington, D.C.: Credit Union <strong>National</strong> Association, 2002).

As with many new programs, various sources <strong>of</strong> funding<br />

are available for personal finance education, including<br />

public funding from the federal and state governments<br />

and private funding from the banking industry, foundations<br />

and nonpr<strong>of</strong>it organizations. <strong>State</strong>s vary in<br />

their approach but <strong>of</strong>ten rely on a combination <strong>of</strong> funding<br />

sources to support the programs. Colorado, for example, relied<br />

solely on state funds to assist the state Department <strong>of</strong> Education<br />

to create a personal finance resource bank. North Carolina, on<br />

the other hand, calls for the state Board <strong>of</strong> Education to provide<br />

information to local boards <strong>of</strong> education on how to secure public<br />

and private grant funds to implement the instructional portion<br />

<strong>of</strong> their personal finance law. Many states have passed resolutions<br />

that encourage state departments or boards <strong>of</strong> education<br />

to include personal finance education but do not appropriate<br />

specific funds or provide any direction or assistance for<br />

obtaining additional funding.<br />

South Carolina is using funding from the federal Jobs and<br />

Growth Tax Relief Reconciliation Act <strong>of</strong> 2003 to fund its personal<br />

finance education legislation. South Carolina requires<br />

that all high school students receive instruction in personal<br />

finance through June 2005.<br />

The federal Excellence in Economic Education Act <strong>of</strong> 2001,<br />

which later became part <strong>of</strong> the No Child Left Behind Act <strong>of</strong><br />

2001, also provides assistance for personal finance education.<br />

The act promotes economic and financial literacy among all students<br />

in grades K-12 through the award <strong>of</strong> one grant to a<br />

national nonpr<strong>of</strong>it educational organization, the <strong>National</strong><br />

Council for Economic Education (NCEE), to improve student<br />

understanding <strong>of</strong> personal finance and economics. This organization<br />

has established state councils and more than 200 university-based<br />

centers for financial literacy and funds 140 grants to<br />

organizations that are involved in teacher training, the distribution<br />

<strong>of</strong> curriculum materials to the schools, research that measures<br />

student learning, student or school-based activities and<br />

replication <strong>of</strong> best practices. Each grantee is required to subgrant<br />

75 percent <strong>of</strong> its grant funds to state or local education<br />

agencies and to state or local economic, personal finance or<br />

entrepreneurial education organizations. In 2004, almost $1.5<br />

million was appropriated to NCEE.<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

Finding Funds for<br />

Personal Finance Education<br />

An additional piece <strong>of</strong> federal legislation that would support<br />

financial literacy currently is pending before Congress. Senator<br />

Jon Corzine (D-NJ), Senator Daniel Akaka (D-HI) and Senator<br />

Frank Lautenberg (D-NJ) have introduced the Youth Financial<br />

Education Act, Senate Bill 1181. This legislation would provide<br />

$100 million in grants to states to help develop and implement<br />

financial education programs in elementary and secondary<br />

schools, including helping prepare teachers to provide financial<br />

education, and would create a national clearinghouse for<br />

instructional materials and information regarding model financial<br />

education programs.<br />

Private grant funds from banking institutions and foundations<br />

also are a source <strong>of</strong> funding for personal finance education.<br />

<strong>State</strong>s are working with organizations such as Jump$tart<br />

and the <strong>National</strong> Endowment for Financial Education (NEFE)<br />

to provide classroom materials and training for teachers. Louisiana,<br />

for example, capitalized on the opportunity to train 280 teachers<br />

using the NEFE High School Financial Planning Program at<br />

no charge for registration or materials, and teachers received a<br />

$110 stipend for completing the six-hour workshop. The<br />

Jump$tart Coalition raised $50,000 for the stipends.

Consumers Bankers Association<br />

www.cbanet.org<br />

Consumers Bankers Association (CBA) provides leadership,<br />

education, research and federal representation on retail banking<br />

issues such as privacy, fair lending and consumer protection legislation<br />

and regulation. CBA members include most <strong>of</strong> the<br />

nation’s largest bank holding companies as well as regional and<br />

super community banks that collectively hold two-thirds <strong>of</strong> the<br />

industry’s total assets. Since 2001, CBA has conducted an annual<br />

survey <strong>of</strong> bank-sponsored literacy programs to measure the<br />

magnitude <strong>of</strong> these programs and to examine, in detail, the<br />

range <strong>of</strong> bank efforts. With the increased legislative and regulatory<br />

focus on financial literacy, CBA has added this annual survey<br />

to its top lobbying and educational initiatives.<br />

Consumer Federation <strong>of</strong> America<br />

www.consumerfed.org<br />

The Consumer Federation <strong>of</strong> America is an advocacy, research,<br />

education and service organization. As an advocacy group, CFA<br />

advances pro-consumer policy on a variety <strong>of</strong> issues before<br />

Congress, the White House, federal and state regulatory agencies,<br />

state legislatures, and the courts. As a research organization,<br />

CFA investigates consumer issues, behavior and attitudes<br />

using surveys, polling, focus groups and literature reviews. As<br />

an education organization, CFA disseminates information on<br />

consumer issues to the public and the media, as well as to policymakers<br />

and other public interest advocates. Finally, as a service<br />

organization, CFA provides support to national, state and<br />

local organizations that are committed to the goals <strong>of</strong> consumer<br />

advocacy, research and education. Some <strong>of</strong> these organizations<br />

are consumer advocacy, education or cooperative organizations<br />

that belong to the federation.<br />

Credit Union <strong>National</strong> Association<br />

www.cuna.org<br />

Credit Union <strong>National</strong> Association (CUNA), based in<br />

Washington, D.C., and Madison, Wisconsin, is the trade association<br />

that serves America’s credit unions. The not-for-pr<strong>of</strong>it<br />

trade group is governed by volunteer directors. In partnership<br />

with state credit union leagues, CUNA provides many services<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

Personal Finance<br />

Education Resources<br />

to credit unions, including representation, information, public<br />

relations, continuing pr<strong>of</strong>essional education, and business development.<br />

CUNA also works with related organizations to provide<br />

products and services to credit unions.<br />

Excellence in Economic Education Act<br />

www.ed.gov/programs/econeducation/index.html<br />

The Excellence in Economic Education Program promotes economic<br />

and financial literacy among all K-12 students. The<br />

United <strong>State</strong>s Department <strong>of</strong> Education is authorized to make<br />

one competitive award to a national nonpr<strong>of</strong>it educational<br />

organization whose primary mission is to improve the quality <strong>of</strong><br />

student understanding <strong>of</strong> personal finance and economics. The<br />

objectives <strong>of</strong> this program are to: 1) increase students’ knowledge<br />

<strong>of</strong> and achievement in economics; 2) strengthen teachers’ understanding<br />

<strong>of</strong> economics; 3) encourage economic education<br />

research and development, disseminate effective instructional<br />

materials, and promote the replication <strong>of</strong> best practices and<br />

exemplary programs that foster economic literacy; 4) assist states<br />

to measure the effects <strong>of</strong> education in economics; and 5) leverage<br />

and expand increased private and public support for economic<br />

education partnerships at the national, state and local levels.<br />

The statute requires the grantee to subgrant 75 percent <strong>of</strong> its<br />

grant funds to state or local educational agencies and state or<br />

local economic, personal finance or entrepreneurial education<br />

organizations. The subgrantees will work in partnership with<br />

other organizations that promote personal finance and economic<br />

development.<br />

The grantee will use the remaining funds to: 1) strengthen<br />

and expand its relationships with state and local personal<br />

finance, entrepreneurial and economic education organizations;<br />

2) support K-12 teacher training programs; 3) support research<br />

on effective teaching practices and the development <strong>of</strong> assessment<br />

instruments to document student understanding <strong>of</strong> personal<br />

finance and economics; and 4) develop and disseminate<br />

appropriate materials to foster economic literacy.<br />

(over)

Federal Reserve Bank <strong>of</strong> Chicago’s Finance Education Research<br />

Center<br />

http://chicag<strong>of</strong>ed.org/cedric/financial_education_research_<br />

center.cfm<br />

The center’s mission is to encourage research and disseminate<br />

information related to consumer and economic development<br />

issues such as financial education, consumer and small business<br />

financial behavior, access to credit, affordable housing, and<br />

community development and reinvestment. In line with this<br />

mission, the Financial Education Research Center seeks to promote<br />

excellence in financial education by providing online<br />

resources for researchers, educators, program directors and others<br />

interested in supporting these types <strong>of</strong> programs and initiatives.<br />

The Web site contains a comprehensive list <strong>of</strong> personal<br />

finance education resources.<br />

Institute <strong>of</strong> Consumer Financial Education<br />

www.financial-education-icfe.org<br />

The Institute <strong>of</strong> Consumer Financial Education (ICFE) provides<br />

financial, debtor, bankruptcy and financial planning education<br />

for all age groups. Special sections are devoted to teaching<br />

children about money. Other features in financial education<br />

include budget and expense guidelines, instructions for a<br />

budget with a one-page budget form, tips for using credit cards,<br />

Credit Card Warning Labels, the ICFE’s Do-It-yourself Credit<br />

File Correction Guide and Mending Your Spending.<br />

Jump$tart Organization<br />

www.jumpstart.org<br />

The Jump$tart Coalition for Personal Financial Literacy seeks to<br />

improve the personal financial literacy <strong>of</strong> young adults.<br />

Jump$tart’s purpose is to evaluate the financial literacy <strong>of</strong> young<br />

adults; develop, disseminate and encourage the use <strong>of</strong> standards<br />

for grades K-12; and promote the teaching <strong>of</strong> personal finance.<br />

JumpStart coalitions work state-by-state with people who are<br />

familiar with the particular needs <strong>of</strong> a state in the area <strong>of</strong> personal<br />

finance education for grades K-12.<br />

Junior Achievement<br />

www.ja.org<br />

Junior Achievement uses hands-on experiences to help young<br />

people understand the economics <strong>of</strong> life. In partnership with<br />

business and educators, Junior Achievement brings the real<br />

world to students, opening their minds to their potential.<br />

Through 145 American <strong>of</strong>fices, Junior Achievement reaches<br />

approximately 4 million students per year in inner cities, suburbs<br />

and rural areas.<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

<strong>National</strong> Academy <strong>of</strong> Finance<br />

www.naf.org/cps/rde/xchg/SID-3F57E0FB-FE24C6AF/naf/<br />

hs.xsl/297_373.htm<br />

The <strong>National</strong> Academy <strong>of</strong> Finance introduces high school students<br />

to career opportunities in the financial services industry.<br />

The academy’s mission is to open the door to new options and<br />

to equip students to make sound choices for the future. One <strong>of</strong><br />

three member programs <strong>of</strong> the <strong>National</strong> Academy Foundation,<br />

the Academy <strong>of</strong> Finance operates as a small learning community<br />

and is located in more than 275 high schools nationwide.<br />

<strong>National</strong> Council on Economic Education<br />

www.ncee.net<br />

The Excellence in Economic Education Act <strong>of</strong> 2001 established<br />

the <strong>National</strong> Council for Economic Education (NCEE) to promote<br />

economic and financial literacy among all students in<br />

kindergarten through grade 12 through the award <strong>of</strong> one grant<br />

to a national nonpr<strong>of</strong>it educational organization that has as its<br />

primary purpose the improvement <strong>of</strong> the quality <strong>of</strong> student<br />

understanding <strong>of</strong> personal finance and economics. NCEE,<br />

whose mission has been to promote economic and financial literacy<br />

to students in grades K-12, established state councils and<br />

more than 200 university-based centers for financial literacy.<br />

<strong>National</strong> Endowment for Financial Education<br />

www.nefe.org<br />

The <strong>National</strong> Endowment for Financial Education (NEFE) is a<br />

nonpr<strong>of</strong>it foundation dedicated to helping all Americans acquire<br />

the information and gain the skills necessary to take control <strong>of</strong><br />

their personal finances. NEFE provides funding, logistical support<br />

and financial planning expertise needed to create personal<br />

finance programs and materials for the public. Its education<br />

programs focus on increasing financial literacy among the<br />

nation’s youth, primarily through the NEFE High School<br />

Financial Planning Program (HSFPP).<br />

Washington Mutual<br />

www.wamu.com<br />

Washington Mutual strives to support teachers, schools, parents<br />

and children through grants, teacher development programs and<br />

more. Washington Mutual sponsors several programs designed<br />

to improve student and adult personal finance education,<br />

including the Class Acts program, the WaMoola for Schools<br />

program, the School Savings program, WaMoola for L.I.F.E.<br />

Lessons, the Your Money Matters program and the High School<br />

Intern Program.

ARIZONA<br />

S.B. 1189<br />

Prohibits the licensee from directly or indirectly charging any<br />

fee for accepting a check for deferred presentment or deposit<br />

that is more than 15 percent <strong>of</strong> the face amount <strong>of</strong> the<br />

advanced check delivered to the maker by the licensee for an<br />

initial transaction or extension. Prohibits the garnishing <strong>of</strong> military<br />

earnings by a licensee. Prohibits collection activity against a<br />

member <strong>of</strong> the U.S. military or the member’s spouse during the<br />

member’s deployment to combat or combat support posting or<br />

during <strong>National</strong> Guard active duty service or any military<br />

reserve unit. Prohibits the licensee from contacting the commanding<br />

<strong>of</strong>ficer or anyone in the chain <strong>of</strong> command <strong>of</strong> a borrower<br />

in an effort to collect on a loan. Makes the licensee<br />

bound by the repayment agreement entered with respect to the<br />

borrower, including repayment agreements negotiated through<br />

military counselors or third-party credit counselors. Requires<br />

the licensee to devote some existing financial literacy effort<br />

toward addressing the educational needs <strong>of</strong> military borrowers.<br />

Requires the licensee to develop a brochure specifically for military<br />

borrowers, including the following information: 1) the<br />

requirements <strong>of</strong> this legislation; 2) military policies relating to<br />

credit; 3) where military members may find financial assistance<br />

through established military programs, Web sites and a military<br />

hotline; and 4) where military members may find information<br />

about local credit counseling alternatives.<br />

Status—Sent to Senate for concurrence, 4/28/2005<br />

CALIFORNIA<br />

A.B. 1492<br />

Allows a school district, in providing instruction in economics,<br />

to include instruction related to the understanding <strong>of</strong> personal<br />

finances.<br />

Status—Re-referred to the Committee on Appropriations,<br />

6/15/2005<br />

Financial Literacy Legislation<br />

2001-2005<br />

2005<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

A.C.R. 6<br />

Declares the month <strong>of</strong> April 2005 as Financial Literacy Month,<br />

in order to raise public awareness about the need for increased<br />

financial literacy.<br />

Status—Filed with Secretary <strong>of</strong> <strong>State</strong>, Resolution Chapter 6,<br />

3/14/2005<br />

FLORIDA<br />

H.B. 431<br />

Creates the Financial Literacy Council; provides legislative findings;<br />

provides purposes; provides for membership; provides for<br />

meetings, procedures, records and reimbursement for travel and<br />

per diem expenses; provides powers and duties <strong>of</strong> the council;<br />

provides for resources <strong>of</strong> the council; and requires annual<br />

reports to the governor and Legislature.<br />

Status—Senate, died in Messages, 5/06/2005<br />

H.B. 559<br />

Relates to prosperity campaigns; establishes the Prosperity<br />

Campaign Office to be housed in Workforce Florida Inc; provides<br />

duties <strong>of</strong> the <strong>of</strong>fice; provides for establishment <strong>of</strong> the<br />

Florida Prosperity Campaign Council; provides membership<br />

and responsibilities; requires development and <strong>of</strong>fering <strong>of</strong> a high<br />

school financial literacy course; and requires each Prosperity<br />

Campaign to connect low-wage workers to economic benefits<br />

programs and <strong>of</strong>fers additional services.<br />

Status—Died in Council, 5/06/2005<br />

S.B. 1188<br />

Establishes the Prosperity Campaign Office to be housed in<br />

Workforce Florida Inc.; provides duties <strong>of</strong> the <strong>of</strong>fice; provides<br />

for establishment <strong>of</strong> the Florida Prosperity Campaign Council;<br />

provides membership and responsibilities; requires development<br />

and <strong>of</strong>fering <strong>of</strong> a high school financial literacy course; requires<br />

each Prosperity Campaign to connect low-wage workers to economic<br />

benefits programs and to <strong>of</strong>fer additional services.<br />

Status—Died in House Commerce Council, 5/06/2005

H.R. 9057<br />

Recognizes March 23, 2005, as Junior Achievement Day in<br />

Florida, and all people <strong>of</strong> the state are called upon to foster economic<br />

education among youth and to help advance the worthwhile<br />

mission <strong>of</strong> Junior Achievement.<br />

Status—Adopted, 3/22/2005<br />

S.B. 1120<br />

Creates the Financial Literacy Council; provides legislative findings;<br />

provides purposes; provides for membership; provides for<br />

meetings, procedures, records and reimbursement for travel and<br />

per diem expenses; provides powers and duties <strong>of</strong> the council;<br />

and provides for resources <strong>of</strong> the council; requires annual<br />

reports to the governor and Legislature.<br />

Status—Died in Committee on Transportation and Economic<br />

Development Appropriations, 5/06/2005<br />

HAWAII<br />

S.B. 11<br />

Authorizes the state Board <strong>of</strong> Education to establish personal<br />

financial management education programs within the<br />

Department <strong>of</strong> Education for grades kindergarten through 12.<br />

Status—Referred to EDM, WAM, 1/27/2005<br />

S.B. 1353<br />

Directs the Board <strong>of</strong> Education to add a mandatory one-semester<br />

economic and financial management literacy course to the<br />

public high school curriculum.<br />

Status—Referred to EDM, WAM, 2/01/2005<br />

S.C.R.162<br />

S.R. 94<br />

Requests the Department <strong>of</strong> Education to add a mandatory<br />

one-semester course in economic and financial management literacy<br />

to the existing public high school curriculum.<br />

Status—Referred to EDM, WAM, 3/22/2005<br />

IDAHO<br />

H.B. 304<br />

Appropriates $10.2 million to the state Board <strong>of</strong> Education and<br />

the Board <strong>of</strong> Regents <strong>of</strong> the University <strong>of</strong> Idaho for Special<br />

Programs, including the Forest Utilization Research Program,<br />

Idaho Geological Survey Program, Scholarships and Grants<br />

Program, Idaho Museum <strong>of</strong> Natural History, Idaho Small<br />

Business Development Centers, and the Idaho Council on<br />

Economic Education for fiscal year 2006; limits the number <strong>of</strong><br />

full-time equivalent positions to 24.8; and provides legislative<br />

intent regarding money appropriated for Category B <strong>of</strong> the<br />

Idaho Robert R. Lee Promise Scholarship Program.<br />

Status—Signed by Governor, Session Law Chapter 196, 7/01/2005<br />

2<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

ILLINOIS<br />

H.B. 171<br />

Amends the Deposit <strong>of</strong> <strong>State</strong> Moneys Act. Provides that the<br />

treasurer may accept a proposal from an eligible institution that<br />

provides a reduced rate <strong>of</strong> interest if the institution agrees to<br />

expend an amount equal to the reduction for the delivery <strong>of</strong><br />

credit union products and services and financial literacy programs<br />

to low-income people or economically disadvantaged<br />

areas <strong>of</strong> the state.<br />

Status—Rule 19(a) / Re-referred to Rules Committee, 3/10/2005<br />

H.B. 468<br />

Amends the Deposit <strong>of</strong> <strong>State</strong> Moneys Act. Provides that the<br />

treasurer may accept a proposal from an eligible institution that<br />

provides a reduced rate <strong>of</strong> interest if the institution agrees to<br />

expend an amount equal to the reduction for the delivery <strong>of</strong><br />

credit union products and services and financial literacy programs<br />

to low-income members <strong>of</strong> certain credit unions.<br />

Provides that the proposal and acceptance shall be contained in<br />

an agreement between the state treasurer, the institution and a<br />

third party, if applicable, and the agreement shall restrict the use<br />

<strong>of</strong> the funds to the prospective delivery <strong>of</strong> the foregoing products,<br />

services and programs.<br />

Status—Rule 19(a) / Re-referred to Rules Committee, 4/15/2005<br />

H.B. 2001<br />

Amends the School Code and the <strong>State</strong> Finance Act. Requires<br />

the state Board <strong>of</strong> Education to develop and adopt curricula,<br />

materials and guidelines for school boards to use in implementing<br />

a program <strong>of</strong> instruction on financial literacy within courses<br />

currently <strong>of</strong>fered in public high schools in this state. Lists subject<br />

areas that the program must include. Creates the Financial<br />

Literacy Fund as a special fund in the state treasury. Provides that<br />

all money in the fund shall be used by the state board to award<br />

grants to school districts for certain financial literacy purposes.<br />

Allows a school board to establish a special fund, with money to<br />

be used for certain financial literacy purposes. Requires the state<br />

board to incorporate the elements <strong>of</strong> the program into Illinois<br />

learning standards.<br />

Status—Passed House, 4/20/2005<br />

INDIANA<br />

S.B. 632<br />

Requires schools to provide instruction in personal financial<br />

responsibility and general parenting skills to students in grades<br />

nine through 12.<br />

Status—First reading, referred to Committee on Education and<br />

Career Development, 1/24/2005

IOWA<br />

MASSACHUSETTS<br />

H.R. 29<br />

H.B. 1197<br />

Designates April 2005 as Financial Literacy for Youth Month in Includes personal financial literacy in the math curriculs for all<br />

Iowa.<br />

school grade levels.<br />

Status—Adopted, 4/28/2005<br />

S.R. 14<br />

Status—Referred to the House Committee on Education and<br />

Senate, concurred 1/26/2005<br />

Designates April 2005 as Financial Literacy for Youth Month in<br />

MICHIGAN<br />

Iowa.<br />

H.R. 43<br />

Status—Adopted, 3/22/2005<br />

Establishes April as Youth Financial Literacy Month in the state<br />

<strong>of</strong> Michigan.<br />

KENTUCKY<br />

H.B. 227<br />

Status—Adopted, 3/24/2005<br />

Creates a new section <strong>of</strong> KRS 158 to permit financial literacy S.R. 21<br />

instruction to be included in courses currently <strong>of</strong>fered in public Establishes April as Youth Financial Literacy Month in the state<br />

schools; creates a new section <strong>of</strong> KRS 158 to establish the finan- <strong>of</strong> Michigan.<br />

cial literacy trust fund in the state treasury and identifies possible<br />

fund uses; clarifies that the fund may receive state appropria-<br />

Status—Adopted, 4/13/2005<br />

tions, gifts, grants, federal funds and any other funds, both pub-<br />

MINNESOTA<br />

lic and private; identifies that the fund shall be a trust and S.F. 168<br />

agency account and made available solely for the purpose and Relates to higher education; requires student financial manage-<br />

benefits <strong>of</strong> the Kentucky financial literacy trust fund program; ment pr<strong>of</strong>iciency at public postsecondary institutions.<br />

requires the Kentucky Board <strong>of</strong> Education to promulgate<br />

administrative regulations related to disbursal <strong>of</strong> funds; and<br />

Status—Referred to Education, 1/10/2005<br />

identifies the Kentucky Department <strong>of</strong> Education as administra-<br />

MISSOURI<br />

tor <strong>of</strong> trust fund.<br />

H.C.R. 24<br />

Status—Returned to Senate Education, 3/01/2005<br />

Encourages a mandated high school course in personal finance<br />

economics.<br />

LOUISIANA<br />

S.C.R. 8<br />

Status—Adopted, 5/13/2005<br />

Designates April 28, 2005, as “Youth Personal Financial<br />

MONTANA<br />

Literacy Day at the Louisiana <strong>State</strong> Capitol.”<br />

H.B. 664<br />

Status—Filed with Secretary <strong>of</strong> <strong>State</strong>, 5/09/2005<br />

Establishes an individual development account program in the<br />

Office <strong>of</strong> Economic Development. The purpose <strong>of</strong> the program<br />

MAINE<br />

is to match savings and to provide financial literacy and credit<br />

L.D. 1318<br />

counseling in order to provide eligible individuals the opportu-<br />

Establishes the Commission to Study the Scope and Quality <strong>of</strong> nity to establish special accounts that may be used: a) to pur-<br />

Personal and Family Financial Management Education.<br />

chase a first home; b) to capitalize a small business; or c) to<br />

Status—Placed in the Legislative Files (Dead), 6/17/2005<br />

fund postsecondary education or training.<br />

Status—Missed deadline for Appropriation Bill transmittal,<br />

MARYLAND<br />

H.J.R. 11<br />

3/30/2005<br />

Urges county boards <strong>of</strong> education to integrate the principles <strong>of</strong><br />

NEW JERSEY<br />

basic personal finance into the curricula and instruction estab- S.B. 1403<br />

lished for their local school systems; and urges county boards <strong>of</strong> Requires a public institution <strong>of</strong> higher education to establish a<br />

education to implement specified standards as part <strong>of</strong> a student’s financial management program for its students if the institution<br />

eligibility to graduate from a public high school and receive a enters into an agreement for the direct solicitation <strong>of</strong> credit<br />

high school diploma.<br />

cards to its students. The financial management program is to<br />

Status—First Reading House Rules and Executive Nominations, be funded by the credit card issuers and conform to the guide-<br />

2/21/2005<br />

lines for the program established by the Department <strong>of</strong> Banking<br />

3<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES

and Insurance. If a student has not successfully completed the<br />

financial management program prior to entering a credit card<br />

agreement pursuant to a direct solicitation, the student would<br />

not be liable for any interest on the debt pursuant thereto.<br />

Status—Introduced in the Senate, referred to Senate Commerce<br />

Committee, 3/29/2004<br />

NEW MEXICO<br />

H.B. 155<br />

Makes an appropriation to New Mexico <strong>State</strong> University to<br />

develop partnerships with the public schools to promote financial<br />

and economic literacy.<br />

Status—House Appropriations and Finance Committee, 2005<br />

NEW YORK<br />

A.B. 316<br />

Establishes that instruction in financial education be provided<br />

to pupils in grades nine through 12; establishes what should be<br />

included in such curricula including the basics <strong>of</strong> financial planning,<br />

budgeting, borrowing, interest rates, personal insurance<br />

policies, etc.<br />

Status—Referred to Education, 1/10/2005<br />

A.B. 1360<br />

Provides for the registration <strong>of</strong> cash-dispensing machines operated<br />

by entities other than banking organizations and establishes<br />

the “Improving Financial Literacy Fund,” consisting <strong>of</strong> money<br />

collected from civil penalties collected from civil actions pursuant<br />

to the cash-dispensing machines article <strong>of</strong> the banking<br />

law; requires disclosures <strong>of</strong> fees and other information to cashdispensing<br />

machine users.<br />

Status—Passed Assembly, delivered to Senate, referred to Rules,<br />

6/20/2005<br />

A.B. 7420<br />

Establishes the financial literacy for military families program,<br />

which is managed by the Department <strong>of</strong> Banking and provides<br />

information regarding mortgage and rental protections and obligations,<br />

credit card payments and fees, and guidance with<br />

parental and other family obligations to those who are serving<br />

in the armed forces <strong>of</strong> the United <strong>State</strong>s and members <strong>of</strong> the<br />

family <strong>of</strong> such person.<br />

Status—Passed Assembly, referred to Rules, 6/20/05<br />

A.B. 8726<br />

Establishes the financial literacy for senior citizens program,<br />

which is managed by the Department <strong>of</strong> Banking and provides<br />

information regarding mortgages, protections and obligations,<br />

preparation for retirement, establishing a budget, paying<br />

monthly bills, balancing check books, tax preparation and other<br />

4<br />

obligations to those age 50 and older.<br />

Status—Referred to Banks, 6/07/2005<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES<br />

NORTH CAROLINA<br />

H.B. 16<br />

Requires the public schools to teach personal financial literacy<br />

in high school.<br />

Status—Passed House, 5/20/05<br />

S.B. 912<br />

Directs the public schools to teach personal financial literacy to<br />

high school students.<br />

Status—Referred to Committee on Rules, Calendar, and Operations<br />

<strong>of</strong> the House, 5/31/2005<br />

OHIO<br />

H.B. 47<br />

Requires that every high school include instruction in personal<br />

economics in the requirements for graduation.<br />

Status—Assigned to Education Committee, 2/08/2005<br />

OKLAHOMA<br />

S.B. 378<br />

Requires the state Board <strong>of</strong> Education to adopt standards for<br />

personal financial economics; requires one-half unit or set <strong>of</strong><br />

competencies <strong>of</strong> personal financial economics for high school<br />

graduation.<br />

Status—Passed Senate, Referred to House Appropriations,<br />

3/16/2005<br />

OREGON<br />

H.B. 2859<br />

Requires school districts to provide instruction in financial education<br />

in secondary schools. Directs Department <strong>of</strong> Education<br />

to prepare financial education program.<br />

Status—Public Hearing held, 3/21/2005<br />

S.B. 748<br />

Directs the Department <strong>of</strong> Education to prepare financial education<br />

program. Allows school districts to implement financial<br />

education program.<br />

Status—Referred to Budget by order <strong>of</strong> the President, 5/24/2005<br />

PENNSYLVANIA<br />

H.R. 156<br />

Recognizes the month <strong>of</strong> April 2005 as “Financial Literacy<br />

Month” in Pennsylvania.<br />

Status—Adopted, 3/20/2005

H.R. 201<br />

Establishes a task force for personal financial literacy initiatives<br />

for Pennsylvanians.<br />

Status—Referred to Education, 3/29/2005<br />

S.B. 528<br />

Provides for personal financial literacy program.<br />

Status—Referred to Education, 3/29/2005<br />

RHODE ISLAND<br />

H.R. 6367<br />

Proclaims April 2005 to be “Financial Literacy Month” in the<br />

state <strong>of</strong> Rhode Island.<br />

Status—Passed House, Resolution 189, 4/20/05<br />

S.R. 994<br />

Proclaims April 2005 to be “Financial Literacy Month” in the<br />

state <strong>of</strong> Rhode Island.<br />

Status—Passed Senate, Resolution 144, 3/30/2005<br />

SOUTH CAROLINA<br />

H.B. 3020<br />

Enacts the Financial Literacy Instruction Act <strong>of</strong> 2004, to provide<br />

for the development or adoption <strong>of</strong> a curriculum for local<br />

school boards to teach financial literacy; and provides for the<br />

establishment <strong>of</strong> a fund to receive public and private contributions<br />

for financial literacy instruction.<br />

Status—Signed by Governor, Act No. 38, 4/15/2005<br />

H.C.R. 3282<br />

Applauds the newly formed South Carolina Jump$tart coalition<br />

for personal financial literacy and recognizes April 11-15, 2005,<br />

as “South Carolina Financial Literacy Week.”<br />

Status—Adopted, 1/27/2005<br />

S.B. 122<br />

Expands the educational standards and core academic areas to<br />

include certain basic skills required to function independently as<br />

an adult, including counting money and making change, understanding<br />

and applying percentages and interest rates, and balancing<br />

a checkbook.<br />

Status—Referred to Committee on Education, 1/11/2005<br />

S.B. 501<br />

Enacts the Financial Literacy Instruction Act <strong>of</strong> 2004, to provide<br />

for the development or adoption <strong>of</strong> a curriculum for local<br />

school boards to teach financial literacy; and provides for the<br />

establishment <strong>of</strong> a fund to receive public and private contributions<br />

for financial literacy instruction.<br />

Status—Referred to Committee on Education, 2/17/2005<br />

TEXAS<br />

H.B. 492<br />

Relates to personal finance education as a requirement for graduation<br />

from public high school.<br />

Status—Signed by Governor, 6/17/2005<br />

H.B. 763<br />

Relates to a financial literacy curriculum requirement in certain<br />

public high schools located in the Texas-Mexico border region.<br />

Status—Referred to Public Education, 2/09/2005<br />

H.B. 900<br />

Relates to the requirement that workforce development programs<br />

provide training in financial literacy.<br />

Status—Signed by Governor, 6/18/2005<br />

H.R. 1172<br />

Commends all those associated with Youth Financial Literacy<br />

Month and encourage parents, teachers and other leaders to<br />

help their children and students gain practical money management<br />

skills.<br />

Status—Adopted, 4/20/2005<br />

S.B. 498<br />

Relates to the development <strong>of</strong> a financial literacy program for<br />

consumers.<br />

Status—Referred to Education, 2/24/2005<br />

S.B. 851<br />

Directs the Texas Education Agency (TEA) to establish a financial<br />

literacy pilot program in no more than five school districts<br />

to provide students with the knowledge and skills necessary to<br />

make critical financial decisions. Requires TEA to report to the<br />

Legislature by January 1, 2007, on the implementation and<br />

effectiveness <strong>of</strong> the pilot program. A pilot program will allow<br />

schools to develop and test programs, and will help develop a<br />

strong and effective model for teaching financial soundness.<br />

Status—Signed by Governor, 6/17/2005<br />

VIRGINIA<br />

S.B. 950<br />

Requires instruction in economics education and financial literacy<br />

in public middle and high schools. The Board <strong>of</strong> Education is<br />

required to develop and approve objectives for economics education<br />

and financial literacy in grades six through 12. The principles<br />

<strong>of</strong> the American economic system and financial literacy also must<br />

be systematically infused in the Standards <strong>of</strong> Learning and in<br />

career and technical education programs. However, these objectives<br />

are not required to be included in the Standards <strong>of</strong> Learning<br />

assessments. To provide for experiential learning and practical<br />

5<br />

NATIONAL CONFERENCE OF STATE LEGISLATURES

application <strong>of</strong> economic and financial literacy principles, public<br />

schools also may establish on-site banking programs for students.<br />

In addition, public institutions <strong>of</strong> higher education must make<br />

provisions for the promotion <strong>of</strong> the development <strong>of</strong> student life<br />

skills through inclusion <strong>of</strong> principles <strong>of</strong> economics education and<br />

financial literacy within an existing general education course, the<br />

freshman orientation process, or other appropriate venue. The<br />

provisions <strong>of</strong> §§22.1-200.02 and 22.1-208.2:3, which provide for<br />

instruction in certain mathematics and finance objectives, and the<br />

Banking-at-School Partnership Program, respectively, have been<br />