Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Performance<br />

INITIATING COVERAGE April 15, 2008<br />

9MFY08 Results Highlights<br />

For the Q3FY08, SREI’s interest income doubled to Rs 1,819mn. The Net interest<br />

income of the NBFC grew by 119% to Rs802mn.<br />

Operating expenses of the NBFC increased significantly due to higher employee<br />

cost. The company also created provision against bad loans amounting to Rs<br />

82.5mn on a consolidated basis.<br />

Business volumes remained higher for the 9MFY08. Financing assets (financial<br />

and operating lease) of the NBFC clogged an excellent growth of 47% to<br />

Rs46,787mn against Rs31,767mn. Disbursements of the company for the<br />

9MFY08 surged by 18% to Rs 13,221mn.<br />

Yield on loans during the 9MFY08 stood at 14.6%, while cost of funds stood<br />

at 8.8%, the net spread of the company increased to ~5.8%. Net Profit of the<br />

company for 9MFY08 leaped by 67% to Rs 844mn. The NBFC reported an EPS<br />

of Rs 7.72 for the 9MFY08.<br />

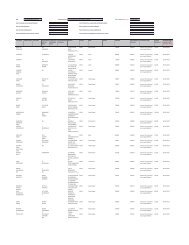

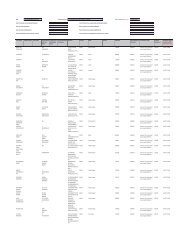

(Consolidated Rs mn) Q3FY07 Q3FY08 % chg 9MFY07 9MFY08 % chg<br />

Income 913.7 1844.1 102 2671.8 4540.4 70<br />

‘-From operating activities 907.2 1819.3 101 2661.0 4497.4 69<br />

‘-Other Income 6.5 24.8 282 10.8 43.0 298<br />

Financial expenses 539.9 1016.7 88 1552.9 2592.6 67<br />

Net Interest Income 367.3 802.6 119 1108.1 1904.8 72<br />

Total Income 373.8 827.4 121 1118.9 1947.8 74<br />

Total Expenditure 164.6 422.9 157 459.9 840.4 83<br />

Expenditure<br />

Operating profit 209.2 404.5 93 659.0 1107.4 68<br />

Provision for Bad and doubtful debts 0.0 82.5 0.0 149.4<br />

PBT 209.2 322.0 54 659.0 958.0 45<br />

Provision for Taxes 22.5 24.2 8 164.1 88.6 -46<br />

PAT (before adjustment for minority interest<br />

& profit/ loss of associates 186.7 297.8 60 494.9 869.4 76<br />

Less: share of profit/(loss) of minority interest 1.4 7.5 436 -0.4 4.6 -1250<br />

Add: Share of profit/loss of associate 6.4 -11.2 -275 9.5 -20.7 -318<br />

PAT 191.7 279.1 46 504.0 844.1 67<br />

EPS (Rs) 1.75 2.55 4.61 7.72<br />

Cost to income ratio (%) 44.0 51.1 41.1 43.1<br />

Effective Tax rate (%) 10.8 7.5 24.9 9.2<br />

Disbursements 11197 13,221 18<br />

Financing Assets 31767 46787 47<br />

Source: Company<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 10