Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

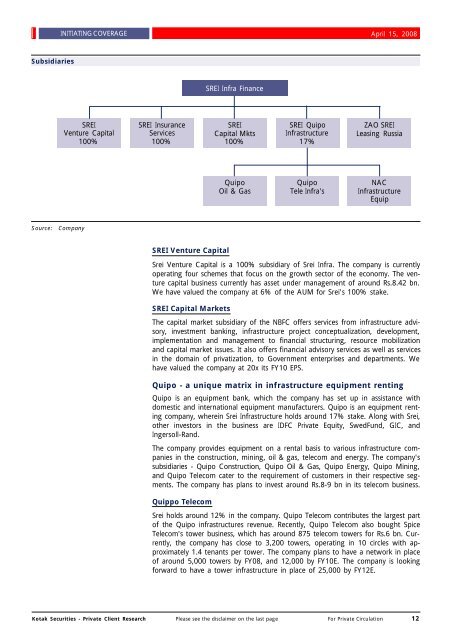

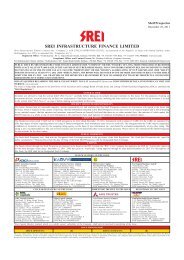

Subsidiaries<br />

Source: Company<br />

INITIATING COVERAGE April 15, 2008<br />

SREI<br />

Venture Capital<br />

100%<br />

SREI Insurance<br />

Services<br />

100%<br />

SREI Venture Capital<br />

SREI Infra <strong>Finance</strong><br />

SREI<br />

Capital Mkts<br />

100%<br />

Quipo<br />

Oil & Gas<br />

SREI Quipo<br />

<strong>Infrastructure</strong><br />

17%<br />

Quipo<br />

Tele Infra's<br />

ZAO SREI<br />

Leasing Russia<br />

NAC<br />

<strong>Infrastructure</strong><br />

Equip<br />

<strong>Srei</strong> Venture Capital is a 100% subsidiary of <strong>Srei</strong> Infra. The company is currently<br />

operating four schemes that focus on the growth sector of the economy. The venture<br />

capital business currently has asset under management of around Rs.8.42 bn.<br />

We have valued the company at 6% of the AUM for <strong>Srei</strong>'s 100% stake.<br />

SREI Capital Markets<br />

The capital market subsidiary of the NBFC offers services from infrastructure advisory,<br />

investment banking, infrastructure project conceptualization, development,<br />

implementation and management to financial structuring, resource mobilization<br />

and capital market issues. It also offers financial advisory services as well as services<br />

in the domain of privatization, to Government enterprises and departments. We<br />

have valued the company at 20x its FY10 EPS.<br />

Quipo - a unique matrix in infrastructure equipment renting<br />

Quipo is an equipment bank, which the company has set up in assistance with<br />

domestic and international equipment manufacturers. Quipo is an equipment renting<br />

company, wherein <strong>Srei</strong> <strong>Infrastructure</strong> holds around 17% stake. Along with <strong>Srei</strong>,<br />

other investors in the business are IDFC Private Equity, SwedFund, GIC, and<br />

Ingersoll-Rand.<br />

The company provides equipment on a rental basis to various infrastructure companies<br />

in the construction, mining, oil & gas, telecom and energy. The company's<br />

subsidiaries - Quipo Construction, Quipo Oil & Gas, Quipo Energy, Quipo Mining,<br />

and Quipo Telecom cater to the requirement of customers in their respective segments.<br />

The company has plans to invest around Rs.8-9 bn in its telecom business.<br />

Quippo Telecom<br />

<strong>Srei</strong> holds around 12% in the company. Quipo Telecom contributes the largest part<br />

of the Quipo infrastructures revenue. Recently, Quipo Telecom also bought Spice<br />

Telecom's tower business, which has around 875 telecom towers for Rs.6 bn. Currently,<br />

the company has close to 3,200 towers, operating in 10 circles with approximately<br />

1.4 tenants per tower. The company plans to have a network in place<br />

of around 5,000 towers by FY08, and 12,000 by FY10E. The company is looking<br />

forward to have a tower infrastructure in place of 25,000 by FY12E.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 12