Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

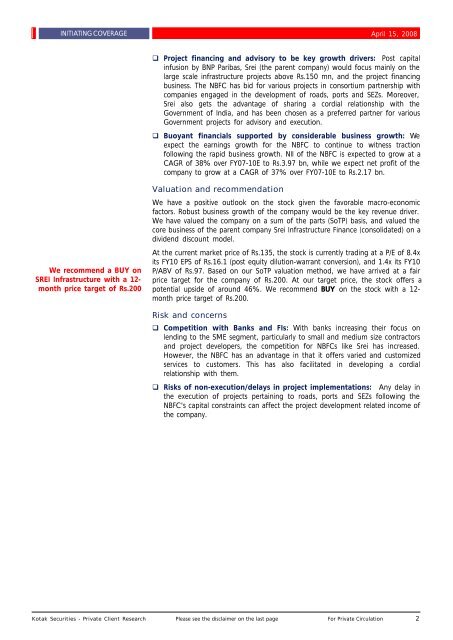

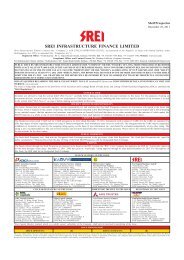

INITIATING COVERAGE April 15, 2008<br />

We recommend a BUY on<br />

SREI <strong>Infrastructure</strong> with a 12month<br />

price target of Rs.200<br />

Project financing and advisory to be key growth drivers: Post capital<br />

infusion by BNP Paribas, <strong>Srei</strong> (the parent company) would focus mainly on the<br />

large scale infrastructure projects above Rs.150 mn, and the project financing<br />

business. The NBFC has bid for various projects in consortium partnership with<br />

companies engaged in the development of roads, ports and SEZs. Moreover,<br />

<strong>Srei</strong> also gets the advantage of sharing a cordial relationship with the<br />

Government of India, and has been chosen as a preferred partner for various<br />

Government projects for advisory and execution.<br />

Buoyant financials supported by considerable business growth: We<br />

expect the earnings growth for the NBFC to continue to witness traction<br />

following the rapid business growth. NII of the NBFC is expected to grow at a<br />

CAGR of 38% over FY07-10E to Rs.3.97 bn, while we expect net profit of the<br />

company to grow at a CAGR of 37% over FY07-10E to Rs.2.17 bn.<br />

Valuation and recommendation<br />

We have a positive outlook on the stock given the favorable macro-economic<br />

factors. Robust business growth of the company would be the key revenue driver.<br />

We have valued the company on a sum of the parts (SoTP) basis, and valued the<br />

core business of the parent company <strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (consolidated) on a<br />

dividend discount model.<br />

At the current market price of Rs.135, the stock is currently trading at a P/E of 8.4x<br />

its FY10 EPS of Rs.16.1 (post equity dilution-warrant conversion), and 1.4x its FY10<br />

P/ABV of Rs.97. Based on our SoTP valuation method, we have arrived at a fair<br />

price target for the company of Rs.200. At our target price, the stock offers a<br />

potential upside of around 46%. We recommend BUY on the stock with a 12month<br />

price target of Rs.200.<br />

Risk and concerns<br />

Competition with Banks and FIs: With banks increasing their focus on<br />

lending to the SME segment, particularly to small and medium size contractors<br />

and project developers, the competition for NBFCs like <strong>Srei</strong> has increased.<br />

However, the NBFC has an advantage in that it offers varied and customized<br />

services to customers. This has also facilitated in developing a cordial<br />

relationship with them.<br />

Risks of non-execution/delays in project implementations: Any delay in<br />

the execution of projects pertaining to roads, ports and SEZs following the<br />

NBFC's capital constraints can affect the project development related income of<br />

the company.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 2