Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

Kotak Securties Limited - Srei Infrastructure Finance Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

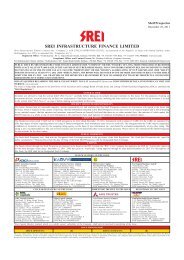

INITIATING COVERAGE<br />

Sarika Lohra<br />

sarika.lohra@kotak.com<br />

+91 22 6634 1480<br />

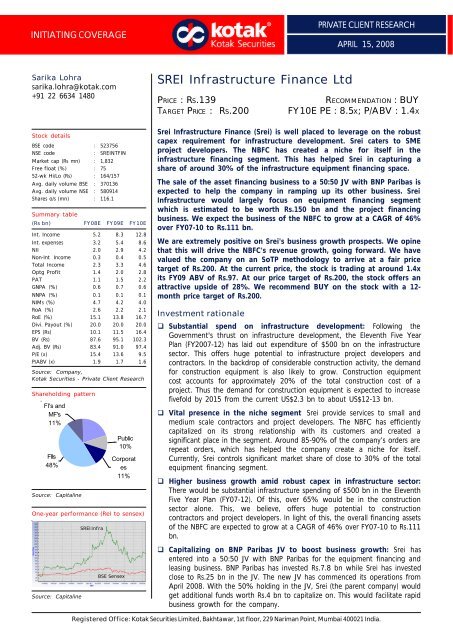

Stock details<br />

BSE code : 523756<br />

NSE code : SREINTFIN<br />

Market cap (Rs mn) : 1,832<br />

Free float (%) : 75<br />

52-wk Hi/Lo (Rs) : 164/157<br />

Avg. daily volume BSE : 370136<br />

Avg. daily volume NSE : 580914<br />

Shares o/s (mn) : 116.1<br />

Summary table<br />

(Rs bn) FY08E FY09E FY10E<br />

Int. Income 5.2 8.3 12.8<br />

Int. expenses 3.2 5.4 8.6<br />

NII 2.0 2.9 4.2<br />

Non-Int Income 0.3 0.4 0.5<br />

Total Income 2.3 3.3 4.6<br />

Optg Profit 1.4 2.0 2.8<br />

PAT 1.1 1.5 2.2<br />

GNPA (%) 0.6 0.7 0.6<br />

NNPA (%) 0.1 0.1 0.1<br />

NIMs (%) 4.7 4.2 4.0<br />

RoA (%) 2.6 2.2 2.1<br />

RoE (%) 15.1 13.8 16.7<br />

Divi. Payout (%) 20.0 20.0 20.0<br />

EPS (Rs) 10.1 11.5 16.4<br />

BV (Rs) 87.6 95.1 102.3<br />

Adj. BV (Rs) 83.4 91.0 97.4<br />

P/E (x) 15.4 13.6 9.5<br />

P/ABV (x) 1.9 1.7 1.6<br />

Source: Company,<br />

<strong>Kotak</strong> Securities - Private Client Research<br />

Shareholding pattern<br />

FI's and<br />

MF's<br />

11%<br />

FIIs<br />

48%<br />

Source: Capitaline<br />

One-year performance (Rel to sensex)<br />

Source: Capitaline<br />

SREI Infra<br />

Public<br />

10%<br />

Corporat<br />

es<br />

11%<br />

BSE Sensex<br />

SREI <strong>Infrastructure</strong> <strong>Finance</strong> Ltd<br />

PRICE : RS.139 RECOMMENDATION : BUY<br />

TARGET PRICE : RS.200 FY10E PE : 8.5X; P/ABV : 1.4X<br />

<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (<strong>Srei</strong>) is well placed to leverage on the robust<br />

capex requirement for infrastructure development. <strong>Srei</strong> caters to SME<br />

project developers. The NBFC has created a niche for itself in the<br />

infrastructure financing segment. This has helped <strong>Srei</strong> in capturing a<br />

share of around 30% of the infrastructure equipment financing space.<br />

The sale of the asset financing business to a 50:50 JV with BNP Paribas is<br />

expected to help the company in ramping up its other business. <strong>Srei</strong><br />

<strong>Infrastructure</strong> would largely focus on equipment financing segment<br />

which is estimated to be worth Rs.150 bn and the project financing<br />

business. We expect the business of the NBFC to grow at a CAGR of 46%<br />

over FY07-10 to Rs.111 bn.<br />

We are extremely positive on <strong>Srei</strong>'s business growth prospects. We opine<br />

that this will drive the NBFC's revenue growth, going forward. We have<br />

valued the company on an SoTP methodology to arrive at a fair price<br />

target of Rs.200. At the current price, the stock is trading at around 1.4x<br />

its FY09 ABV of Rs.97. At our price target of Rs.200, the stock offers an<br />

attractive upside of 28%. We recommend BUY on the stock with a 12month<br />

price target of Rs.200.<br />

Investment rationale<br />

PRIVATE CLIENT RESEARCH<br />

APRIL 15, 2008<br />

Substantial spend on infrastructure development: Following the<br />

Government's thrust on infrastructure development, the Eleventh Five Year<br />

Plan (FY2007-12) has laid out expenditure of $500 bn on the infrastructure<br />

sector. This offers huge potential to infrastructure project developers and<br />

contractors. In the backdrop of considerable construction activity, the demand<br />

for construction equipment is also likely to grow. Construction equipment<br />

cost accounts for approximately 20% of the total construction cost of a<br />

project. Thus the demand for construction equipment is expected to increase<br />

fivefold by 2015 from the current US$2.3 bn to about US$12-13 bn.<br />

Vital presence in the niche segment <strong>Srei</strong> provide services to small and<br />

medium scale contractors and project developers. The NBFC has efficiently<br />

capitalized on its strong relationship with its customers and created a<br />

significant place in the segment. Around 85-90% of the company’s orders are<br />

repeat orders, which has helped the company create a niche for itself.<br />

Currently, <strong>Srei</strong> controls significant market share of close to 30% of the total<br />

equipment financing segment.<br />

Higher business growth amid robust capex in infrastructure sector:<br />

There would be substantial infrastructure spending of $500 bn in the Eleventh<br />

Five Year Plan (FY07-12). Of this, over 65% would be in the construction<br />

sector alone. This, we believe, offers huge potential to construction<br />

contractors and project developers. In light of this, the overall financing assets<br />

of the NBFC are expected to grow at a CAGR of 46% over FY07-10 to Rs.111<br />

bn.<br />

Capitalizing on BNP Paribas JV to boost business growth: <strong>Srei</strong> has<br />

entered into a 50:50 JV with BNP Paribas for the equipment financing and<br />

leasing business. BNP Paribas has invested Rs.7.8 bn while <strong>Srei</strong> has invested<br />

close to Rs.25 bn in the JV. The new JV has commenced its operations from<br />

April 2008. With the 50% holding in the JV, <strong>Srei</strong> (the parent company) would<br />

get additional funds worth Rs.4 bn to capitalize on. This would facilitate rapid<br />

business growth for the company.<br />

Registered Office: <strong>Kotak</strong> Securities <strong>Limited</strong>, Bakhtawar, 1st floor, 229 Nariman Point, Mumbai 400021 India.

INITIATING COVERAGE April 15, 2008<br />

We recommend a BUY on<br />

SREI <strong>Infrastructure</strong> with a 12month<br />

price target of Rs.200<br />

Project financing and advisory to be key growth drivers: Post capital<br />

infusion by BNP Paribas, <strong>Srei</strong> (the parent company) would focus mainly on the<br />

large scale infrastructure projects above Rs.150 mn, and the project financing<br />

business. The NBFC has bid for various projects in consortium partnership with<br />

companies engaged in the development of roads, ports and SEZs. Moreover,<br />

<strong>Srei</strong> also gets the advantage of sharing a cordial relationship with the<br />

Government of India, and has been chosen as a preferred partner for various<br />

Government projects for advisory and execution.<br />

Buoyant financials supported by considerable business growth: We<br />

expect the earnings growth for the NBFC to continue to witness traction<br />

following the rapid business growth. NII of the NBFC is expected to grow at a<br />

CAGR of 38% over FY07-10E to Rs.3.97 bn, while we expect net profit of the<br />

company to grow at a CAGR of 37% over FY07-10E to Rs.2.17 bn.<br />

Valuation and recommendation<br />

We have a positive outlook on the stock given the favorable macro-economic<br />

factors. Robust business growth of the company would be the key revenue driver.<br />

We have valued the company on a sum of the parts (SoTP) basis, and valued the<br />

core business of the parent company <strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (consolidated) on a<br />

dividend discount model.<br />

At the current market price of Rs.135, the stock is currently trading at a P/E of 8.4x<br />

its FY10 EPS of Rs.16.1 (post equity dilution-warrant conversion), and 1.4x its FY10<br />

P/ABV of Rs.97. Based on our SoTP valuation method, we have arrived at a fair<br />

price target for the company of Rs.200. At our target price, the stock offers a<br />

potential upside of around 46%. We recommend BUY on the stock with a 12month<br />

price target of Rs.200.<br />

Risk and concerns<br />

Competition with Banks and FIs: With banks increasing their focus on<br />

lending to the SME segment, particularly to small and medium size contractors<br />

and project developers, the competition for NBFCs like <strong>Srei</strong> has increased.<br />

However, the NBFC has an advantage in that it offers varied and customized<br />

services to customers. This has also facilitated in developing a cordial<br />

relationship with them.<br />

Risks of non-execution/delays in project implementations: Any delay in<br />

the execution of projects pertaining to roads, ports and SEZs following the<br />

NBFC's capital constraints can affect the project development related income of<br />

the company.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 2

INITIATING COVERAGE April 15, 2008<br />

<strong>Infrastructure</strong> sector investment<br />

Sector Total 11th plan<br />

Electricity (incl. NCE) 6,165<br />

Roads 3,118<br />

Telecom 2,670<br />

Railways (incl. MRTS) 2,580<br />

Irrigation (Incl. Watershed) 2,231<br />

Water Supply and Sanitation 1,991<br />

Ports 739<br />

Airports 347<br />

Storage 224<br />

Gas 205<br />

Total Investment 20,272<br />

Total (US $ billion) 494.43<br />

Investment as % of GDP 7.53<br />

Source: Planning Commission<br />

Construction capex<br />

Particulars (Rs bn)<br />

Total investments 14500<br />

Monetary Requirements:-<br />

-For construction material 4950<br />

-For construction Equipment 1800<br />

-Manpower 1080<br />

Source: Planning Commission<br />

INFRASTRUCTURE DEVELOPMENT IN INDIA:<br />

AN OVERVIEW<br />

Robust capex requirement for infrastructure development<br />

The Eleventh Five Year Plan has outlined a massive capex requirement for infrastructure<br />

development in the country. During the Eleventh Five Year Plan the total<br />

investment in infrastructure sector is estimated to be around 7.5% of GDP. Capex<br />

for infrastructure development - which includes roads, airports, port, power oil &<br />

gas and telecom - has been pegged at around $500 bn or Rs.20,272 bn over<br />

FY07-12. The Eleventh Plan lays emphasis on attracting private investments<br />

through public private partnerships or PPP. Estimated investments under the Eleventh<br />

Five Year Plan are inclusive of both public and private investments for infrastructure<br />

development.<br />

Construction<br />

The construction sector has been the biggest beneficiary of infrastructure expansion.<br />

The structural infrastructure construction in all sectors together requires a<br />

capex of approximately Rs.14,500 bn in the 11th Five Year Plan. The major growth<br />

drivers in the construction sector are housing construction and surface transportation<br />

(roads). Considering the monetary requirement, particularly for the construction<br />

space, which has been detailed below, over 65% of investments would be directed<br />

to the construction sector.<br />

Roads<br />

Under the Eleventh Five Year Plan, the committee of members has suggested a<br />

capital investment requirement of Rs.3118 bn, by both public and private entities.<br />

The planned expansion includes development of national highways, state roads,<br />

expressways and widening of national highways.<br />

Ports<br />

The Government of India (GoI) has planned a capacity addition of 485 MMT in<br />

major ports and 345 MMT in minor ports, under the Eleventh Five Year Plan. On<br />

the back of the robust expansion, the Government has laid down a total investment<br />

of around Rs.739 bn over the Eleventh Five Year Plan.<br />

Power<br />

The power sector accounts for the largest share of the total investments required<br />

to be made in infrastructure development. Under the power for all program, the<br />

Government has targeted an addition of around 70,000 MW of power generation<br />

capacity. The Government has earmarked the upgradation and development of the<br />

transmission and distribution facility for rural electrification through the Rajiv<br />

Gandhi Grameen Vidyutikaran Yojana (RGGVY).<br />

Airports<br />

The Government has also finalized plans for the development and modernization<br />

of the four metro and 35 non-metro airports for the Eleventh Five Year Plan. The<br />

airport development also includes construction of seven greenfield airports and<br />

three airports in the North East. Based on the working committees' report, the total<br />

investment required for the development of airports in India would be close to<br />

Rs.347 bn.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 3

INITIATING COVERAGE April 15, 2008<br />

Railways<br />

For railway infrastructure development, GoI has planned the construction of dedicated<br />

freight corridors between Mumbai and Delhi and between Ludhiana and<br />

Kolkata. The railway infrastructure development plans also include construction of<br />

10,300 km of new railway lines, gauge conversion of over 10,000 km and modernization<br />

and redevelopment of 21 railway stations. The Government also indicated<br />

the introduction of private entities in container trains for rapid addition of<br />

rolling stock and capacity.<br />

Gas<br />

In the Eleventh Five Year Plan, an investment of around Rs.205 bn is required for<br />

setting up gas distribution infrastructure, which comprises LNG terminal, gas transmission<br />

lines and city gas distribution.<br />

Telecom<br />

Of the $500 bn of planned expenditure over FY07-12, around 13% would be<br />

spent on the telecom sector, which amounts to around Rs.2670 bn. Under the<br />

Eleventh Five Year Plan, GoI plans to achieve a telecom subscriber base of 600 mn,<br />

with 200 mn rural telephone connections.<br />

<strong>Infrastructure</strong> equipment requirement<br />

With the intense need for faster implementation of infrastructure projects resulting<br />

in increased mechanization, the demand for hi-tech construction equipment is rising.<br />

Given the substantial infrastructure spending, the requirement for<br />

infrastrastructure related equipment would be significantly higher in the Eleventh<br />

Five Year Plan.<br />

In view of the sizeable construction activity, the construction equipment industry is<br />

poised for a big leap. The domestic equipment market is all set to expand five-fold<br />

to around $13 bn by FY15 from around $2.3 bn in 2007 (Source: CII). Considering<br />

the following table, this indicates that the cost of infrastructure equipment would<br />

account for approximately 20% of the total construction cost under various<br />

projects<br />

Construction and infrastructure equipment cost (project wise)<br />

Construction Construction component (%) Infra equipment as percent<br />

of total project cost of construction cost<br />

Road 100 22<br />

Power-Thermal 20 23<br />

Power- nuclear 30 23<br />

Power-hydel 70 23<br />

Airports 42 8<br />

Ports 50 20<br />

Irrigation & dredging 60 20<br />

Urban <strong>Infrastructure</strong> 60 5<br />

Railways 42 7<br />

Source: KPMG, Company<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 4

Market share<br />

HDFC Bank<br />

9%<br />

Citicorp<br />

14%<br />

ICICI Bank<br />

23%<br />

INITIATING COVERAGE April 15, 2008<br />

ABN Amro<br />

7%<br />

Source:Company<br />

GE Capital<br />

6%<br />

Others<br />

11%<br />

<strong>Srei</strong><br />

30%<br />

COMPANY BACKGROUND<br />

<strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (<strong>Srei</strong>) is a Kolkata-based infrastructure equipment<br />

financing and infrastructure project financing company. The company<br />

is owned by the Kanoria family, headed by Hemant Kanoria. The NBFC is<br />

India's leading player in the infrastructure financing segment with a market<br />

share of around 30%. <strong>Srei</strong>'s unique business matrix includes financing<br />

infrastructure, construction and mining equipment, infrastructure projects<br />

and renewable energy systems.<br />

The NBFC has also developed strong expertise in the areas of investment<br />

banking and venture funds, besides insurance broking. <strong>Srei</strong> operates across<br />

the country with a network of 51 offices and has expanded its operations<br />

overseas in Russia. In addition, through its associate concern Quipo <strong>Infrastructure</strong><br />

Equipment Ltd (QIEL), <strong>Srei</strong> has pioneered the concept of renting<br />

of construction equipment in India under the brand name of Quipo.<br />

Leader and niche player; well poised to capitalize<br />

<strong>Srei</strong> is largely catering to the financial requirement of small and medium size construction<br />

and infrastructure developers. The NBFC provides financial assistance to<br />

these contractors to help them to scale up to project developers. <strong>Srei</strong> provides asset<br />

financing services to companies engaged in varied infrastructure development<br />

activities like construction, mining, oil & gas, power, ports, telecom, railways, aviation<br />

and renewable energy.<br />

Besides this, the NBFC also offers auxiliary services to its customers along with infrastructure<br />

equipment financing. <strong>Srei</strong> provides customized solutions across various<br />

verticals to its customers. Project advisory, investment banking, debt funding and<br />

insurance advisory services are various services that the NBFC offers. This makes<br />

<strong>Srei</strong> a one-stop shop for its customers.<br />

<strong>Srei</strong> has efficiently capitalized on its strong relationship with its customers and created<br />

a niche for itself in this segment. This has facilitated <strong>Srei</strong> in capturing close to<br />

30% market share of the total equipment financing market. Currently, around 85-<br />

90% of the company’s orders are repeat orders, which has helped the company in<br />

creating a niche for itself.<br />

Recording strong growth in key business segments<br />

<strong>Srei</strong> is operating largely in three segments, which includes asset financing (financial<br />

and operating lease), project financing, and advisory and fee-based services. The<br />

asset financing business of the company contributes to around 90% of the total<br />

revenues. However, going forward, with the revamping of its business model, the<br />

project financing and advisory business would also start contributing a significant<br />

share to the total revenues of the company. Meanwhile, the asset financing business<br />

would continue to be the revenue growth driver for the company.<br />

After transferring the financial leasing business to <strong>Srei</strong> <strong>Infrastructure</strong> Development<br />

<strong>Finance</strong>, a 50:50 JV with BNP Paribas, the parent company would focus largely on<br />

big ticket equipment financing projects above Rs.150 mn. Moreover, the parent<br />

company would also concentrate more on the project financing and project advisory<br />

business.<br />

Asset financing business remains major revenue driver<br />

<strong>Srei</strong>'s asset financing business consists of financial lease and operating lease. The<br />

major part of the NBFC's business consists of financing lease, which accounts for<br />

close to 90% of the financing assets.<br />

With the commencement of the partnership with BNP Paribas, the proportion of<br />

income from infrastructure equipment financing would be curtailed as the management<br />

would increase its focus on the project financing business and advisory<br />

and fee-based services.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 5

INITIATING COVERAGE April 15, 2008<br />

BNP Paribas JV to lead to significant business transformation<br />

<strong>Srei</strong> has sold its equipment financing business to a 50:50 JV company with the<br />

world's leading leasing finance company BNP Paribas Lease Group, which is a subsidiary<br />

of BNP Paribas Bank. The new JV is called <strong>Srei</strong> <strong>Infrastructure</strong> Development<br />

<strong>Finance</strong>. <strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (the holding company) would continue to hold<br />

50% stake in the JV.<br />

BNP Paribas would pay a total consideration of Rs.7.8 bn for the asset financing<br />

business. The subsidiary company <strong>Srei</strong> <strong>Infrastructure</strong> Development <strong>Finance</strong> would<br />

largely concentrate on infrastructure equipment financing projects valued at less<br />

than Rs.150 mn and also on the insurance broking business under its umbrella.<br />

Benefits from 50:50 JV with BNP Paribas<br />

The 50:50 JV with BNP Paribas would give <strong>Srei</strong> (the holding company) access to<br />

the business know-how and expertise of the BNP Paribas management on the<br />

board. This would facilitate rapid business growth for the infrastructure financing<br />

business.<br />

With the receipt of Rs.7.8 bn from the sale of 50% of the equipment financing<br />

business to BNP Paribas, this has also provided <strong>Srei</strong> (the holding company) with<br />

capital, which enables the NBFC in expanding its business.<br />

The new JV with BNP Paribas would support speedier growth in the asset financing<br />

business. This would lead to higher earnings visibility and superior returns<br />

for investors.<br />

Robust business growth following positive macroeconomic environment,<br />

additional funds from BNP Paribas<br />

The strong growth in infrastructure would continue to boost demand for infrastructure<br />

financing. The total investment requirement for the infrastructure development<br />

sector has been pegged at $500 bn during the Eleventh Five Year Plan.<br />

These investments are mainly focused on power, transportation and road development.<br />

<strong>Infrastructure</strong> equipment cost would account for around 20% of the such<br />

project cost.<br />

Over FY04-07, the NBFC's disbursements to infrastructure equipment finance has<br />

seen a sharp surge of 53% to Rs.36.23 bn, Financial leasing would comprise<br />

Rs.31.65 bn. The innovative product offering in the operating lease business would<br />

lead to multifold growth in the NBFC's operating lease assets.<br />

There would be substantial infrastructure spending of $500 bn in the Eleventh Five<br />

Year Plan (FY07-12), of which over 65% would be in the construction sector alone.<br />

This, we believe, offers a huge potential to the construction contractors and<br />

project developers. In light of this, the overall financing assets of the NBFC are expected<br />

to grow at a CAGR of 46% during FY07-10 to Rs.111 bn.<br />

Business growth (Rs mn)<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

-<br />

2007 2008E 2009E 2010E<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 6

INITIATING COVERAGE April 15, 2008<br />

Scaling up project financing biz, key driver for revenues growth<br />

The project financing business of the NBFC has recorded significant growth. <strong>Srei</strong><br />

has leveraged upon its strong relationship with small and medium enterprises and<br />

customized its disbursals. Currently, the share of revenue contribution from the<br />

project financing business is lower than the asset financing business. However,<br />

with the increase in the NBFC's focus on the project financing business the contribution<br />

will increase significantly. <strong>Srei</strong> <strong>Infrastructure</strong> as a consortium partner in various<br />

project developers has been awarded the following projects:<br />

Road development projects: SREI has recently bagged around seven NHAI/<br />

Annuity Road Projects on build-operate-transfer (BOT) basis worth more than<br />

Rs.30bn. SREI in partnership with several leading construction companies<br />

throughout India will complete these projects. These BOT road construction<br />

projects will be completed over the next 18-36 months.<br />

Road Projects<br />

Capex required Equity SREI's stale Other major<br />

(Rs mn) (Rs mn) (%) partner<br />

Trissur-Angamalli 5509 1470 49 KMC Construction<br />

Bharatpur-Mahua 2905 596 26 Madhucon Projects<br />

Madhurai-Tuticorin 8970 1404 39 Madhucon Projects<br />

Karur-Dindigul 3640 728 26 Madhucon Projects<br />

Nagpur Seoni 4723 1181 49 Saddbhav Engineering<br />

Nagpur-Kondhali 1760 330 26 Atlanta<br />

Jaora-Nayagaon 4144 1243 28 Viva <strong>Infrastructure</strong><br />

Source: Company<br />

Consortium to develop two ports. SREI has participated in 2 consortiums for<br />

development of Deep water sea ports on BOOT basis. A consortium of companies<br />

headed by Maytas <strong>Infrastructure</strong> along with SREI <strong>Infrastructure</strong>, NCC and<br />

SEC has been allotted the Machilipatnam Port and SEZ project in Andhra<br />

Pradesh. The project has already achieved financial closure and would cost<br />

close to Rs 12.5bn and is likely to be commission by Sept. 2011.<br />

The second port development project is in the state of Orissa, located in the<br />

hinterlands of Subarnarekha River. The project would cost close to Rs 17.4bn<br />

and is likely to be commissioned in three phase's over2010, 2020 and 2032 respectively.<br />

SREI holds ~70% equity in the SPV.<br />

Port Projects<br />

Capex required Equity SREI's stale Other major<br />

(Rs mn) (Rs mn) (%) partner<br />

Machilipatnam-Andhra Pradesh 12546 8856 38 Maytas, NCC & Sarat<br />

Chaterjee<br />

Subaranrekha Port - Orissa 17425 5125 70 -<br />

Source: Company<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 7

INITIATING COVERAGE April 15, 2008<br />

Propsed Ganga Expressway<br />

Source: UP State Government - PICUP<br />

Consortium partnership for development of two SEZs: Consortium of <strong>Srei</strong><br />

<strong>Infrastructure</strong> along with West Bengal Industrial Development Corporation<br />

(WBIDC) has received an in-principle approval from the West Bengal Government<br />

for setting up an SEZ for auto components. <strong>Srei</strong> holds around 89% in the<br />

SPV while the balance is held by WBIDC. The consortium would develop 500<br />

acres of land in two phases each of 250 acres at Kharagpur in West Bengal.<br />

The project would cost Rs.28-30 bn.<br />

Also, the NBFC has also received in-principle approval for setting up an engineering<br />

and capital goods SEZ at Raigad, Maharashtra - the Quipo Engineering<br />

SEZ. <strong>Srei</strong> will hold 50% in the SEZ, while the balance will be held by Quipo <strong>Infrastructure</strong><br />

Equipment (17% held by <strong>Srei</strong> <strong>Infrastructure</strong>). Therefore, effectively<br />

<strong>Srei</strong> will hold around 58.5% in the Raigad SEZ. The JV would require a total<br />

funding of around Rs.5 bn for developing a total land area of 180 hectares.<br />

The JV company has already started the land acquisition process in Raigad district<br />

for development.<br />

SEZ Projects<br />

Capex Equity SREI's Total Land other major<br />

required (Rs mn) stale (in acres) partner<br />

(Rs mn) (%)<br />

Raigadh 4428 1476 58.5 450 Engineering world SEZ<br />

Guptamani, Kharagpur 28280 810 89 500 Integrated auto<br />

industrial park<br />

Source: Company<br />

We have valued all projects individually and assigned a book value multiple based<br />

on project IRR. We are of the view that since the project is in a nascent stage, the<br />

IRR is lower. However, going forward, as the project reaches maturity, these<br />

projects would generate higher IRR. This, we believe would lead to:<br />

Thrust on advisory and fee-based services<br />

Income from fee-based services acts as a buffer, in case of interest rate fluctuation.<br />

<strong>Srei</strong> is leveraging its advisory services to its customer. Over the period, the NBFC<br />

has developed expertise in infrastructure project development. This, along with its<br />

cordial relationships with the Government has proved vital for the company’s feebased<br />

income.<br />

Of late, <strong>Srei</strong> in partnership with RITES, was the key advisor to the Pradeshiya Industrial<br />

& Investment Corporation of Uttar Pradesh Ltd (PICUP) for the development of<br />

an expressway between Noida and Ballia (a 1047 km eight-lane highway) called<br />

the Ganga Expressway, which is worth Rs.300-400 bn. Usually the financial advisory<br />

fee for a particular project varies from 1-1.5%. Considering this, the company<br />

would derive significant fee income from the Ganga Expressway project spread<br />

over the life time of the project<br />

Working closely with the Government - key beneficiary of public private<br />

partnership<br />

<strong>Srei</strong> has been working on various state government projects and also is a key advisor<br />

to a number of crucial projects. Successful execution of these projects expected<br />

to help the company in getting large project to handle in future.<br />

<strong>Srei</strong> has been working closely with the Government of India on various projects.<br />

Moreover, the NBFC is a preferred partner of various state Governments for the<br />

development of various infrastructure development projects under the public private<br />

partnership ambit. This also suggests that the Government's confidence in the<br />

NBFC would be significantly remunerative to the NBFC. The Ganga Expressway is<br />

one such example of the NBFC's success in this segment.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 8

INITIATING COVERAGE April 15, 2008<br />

Strong and credible financials - higher business growth to drive<br />

earnings<br />

Substantial advancement in earning<br />

With the additional networth of Rs.4 bn (50% of Rs.8 bn from BNP Paribas JV) in<br />

the business in the wake of its 50% stake sale in the infrastructure equipment financing<br />

business to BNP Paribas, the NBFC is poised to witness strong earnings<br />

growth. Over FY04-07, the operating income of the company demonstrated a<br />

CAGR of 48%, while during FY07 the operating income of the company grew by<br />

a whopping 68% to Rs.1.5 bn.<br />

Going ahead, in view of the strong business growth (both asset financing and<br />

project financing), we expect the interest income of the NBFC to record a CAGR of<br />

50% of FY07-10 to Rs.12.75 bn. Subsequent to the attractive yields on advances,<br />

the net interest income (NII) of the NBFC is expected to surge at a CAGR of 40%<br />

over FY07-10 to Rs.4.16 bn.<br />

We expect the growth in <strong>Srei</strong>'s net profit to remain buoyant, going forward, on<br />

the back of rising business growth and attractive margins. We expect a 30%<br />

growth in net profit of the NBFC during FY08 to Rs.1.10 bn, a 39% growth in<br />

FY09 to Rs.1.54 bn and a 43% growth in FY10E to Rs.2.21 bn.<br />

NIMs remain attractive, notwithstanding abbreviation due to increased<br />

leverage and higher business growth<br />

The NIMs of the NBFC remained significantly buoyant in the past following its prudent<br />

asset liability management (ALM). Besides this, the longer duration of loans<br />

to SME project developers also supported the NBFC's margins. We opine that the<br />

NIMs of the company are likely to witness some pressure in the backdrop of strong<br />

growth in the loan book and increased leverage. During FY08, <strong>Srei</strong>'s NIMs are likely<br />

to remain firm following its efforts to contain cost of funds. We believe that with<br />

the surge in the large scale project financing business and thrust on project financing<br />

business, the net spreads of the NBFC are likely to witness marginal contraction<br />

to 2.9% & 3.0% in FY09 & FY10 respectively.<br />

Prudent credit risk mitigation efforts<br />

<strong>Srei</strong> has a sound credit appraisal mechanism, which assesses the creditworthiness<br />

of all its customers and projects across various regions. The NBFC also has strong<br />

collection and repossession capability. This has helped the NBFC in containing possible<br />

slippages. Besides this, a prudent selection of assets and customers also helps<br />

the NBFC in keeping check on its asset quality.<br />

<strong>Srei</strong>'s gross NPA for FY07 stood at Rs.380 mn or 0.82% of advances while the net<br />

NPA of the company stood at Rs.75 mn or 0.19% of advances. Given the strong<br />

credit risk mitigation system in place the NBFC is likely to maintain strong asset<br />

quality going forward.<br />

Attractive return ratio<br />

Return ratios of the NBFC are likely to remain buoyant; we expect a RoE of 17.8%<br />

and RoA of 2.4% in FY10. The strong return ratios would drive the valuations for<br />

the company.<br />

Warrant issued to Promoters<br />

The NBFC has issued and allotted 25mn warrants of Rs 100 each to Promoters<br />

group of companies each warrant convertible into equity share of Rs 10 each in<br />

one of more tranches at a price of Rs 100 per share, with in a period of 18 months<br />

from the date of allotment of warrants. We have factored in the conversion of<br />

warrant falling due in FY10. This would lead to an equity dilution around 23% for<br />

the company.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 9

Performance<br />

INITIATING COVERAGE April 15, 2008<br />

9MFY08 Results Highlights<br />

For the Q3FY08, SREI’s interest income doubled to Rs 1,819mn. The Net interest<br />

income of the NBFC grew by 119% to Rs802mn.<br />

Operating expenses of the NBFC increased significantly due to higher employee<br />

cost. The company also created provision against bad loans amounting to Rs<br />

82.5mn on a consolidated basis.<br />

Business volumes remained higher for the 9MFY08. Financing assets (financial<br />

and operating lease) of the NBFC clogged an excellent growth of 47% to<br />

Rs46,787mn against Rs31,767mn. Disbursements of the company for the<br />

9MFY08 surged by 18% to Rs 13,221mn.<br />

Yield on loans during the 9MFY08 stood at 14.6%, while cost of funds stood<br />

at 8.8%, the net spread of the company increased to ~5.8%. Net Profit of the<br />

company for 9MFY08 leaped by 67% to Rs 844mn. The NBFC reported an EPS<br />

of Rs 7.72 for the 9MFY08.<br />

(Consolidated Rs mn) Q3FY07 Q3FY08 % chg 9MFY07 9MFY08 % chg<br />

Income 913.7 1844.1 102 2671.8 4540.4 70<br />

‘-From operating activities 907.2 1819.3 101 2661.0 4497.4 69<br />

‘-Other Income 6.5 24.8 282 10.8 43.0 298<br />

Financial expenses 539.9 1016.7 88 1552.9 2592.6 67<br />

Net Interest Income 367.3 802.6 119 1108.1 1904.8 72<br />

Total Income 373.8 827.4 121 1118.9 1947.8 74<br />

Total Expenditure 164.6 422.9 157 459.9 840.4 83<br />

Expenditure<br />

Operating profit 209.2 404.5 93 659.0 1107.4 68<br />

Provision for Bad and doubtful debts 0.0 82.5 0.0 149.4<br />

PBT 209.2 322.0 54 659.0 958.0 45<br />

Provision for Taxes 22.5 24.2 8 164.1 88.6 -46<br />

PAT (before adjustment for minority interest<br />

& profit/ loss of associates 186.7 297.8 60 494.9 869.4 76<br />

Less: share of profit/(loss) of minority interest 1.4 7.5 436 -0.4 4.6 -1250<br />

Add: Share of profit/loss of associate 6.4 -11.2 -275 9.5 -20.7 -318<br />

PAT 191.7 279.1 46 504.0 844.1 67<br />

EPS (Rs) 1.75 2.55 4.61 7.72<br />

Cost to income ratio (%) 44.0 51.1 41.1 43.1<br />

Effective Tax rate (%) 10.8 7.5 24.9 9.2<br />

Disbursements 11197 13,221 18<br />

Financing Assets 31767 46787 47<br />

Source: Company<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 10

INITIATING COVERAGE April 15, 2008<br />

Attractive return ratio<br />

NPAs<br />

700<br />

525<br />

350<br />

175<br />

-<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Net profit growth<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Attractive Return Ratios<br />

20.0<br />

16.0<br />

12.0<br />

8.0<br />

4.0<br />

0.0<br />

GNPA (Rs mn - LHS)<br />

NNPA (Rs mn - RHS)<br />

Provision coverage (% - RHS)<br />

2007 2008E 2009E 2010E<br />

CAGR 41%<br />

2007 2008E 2009E 2010E<br />

RoE (% - LHS) RoA (% - RHS)<br />

2007 2008E 2009E 2010E<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

95<br />

85<br />

75<br />

65<br />

55<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

NII & NIM<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Operating efficiency<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Earning ratios<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 11<br />

4500<br />

3600<br />

2700<br />

1800<br />

40<br />

39<br />

38<br />

37<br />

36<br />

35<br />

34<br />

33<br />

13.4<br />

13.2<br />

13.0<br />

12.8<br />

12.6<br />

12.4<br />

12.2<br />

12.0<br />

900<br />

0<br />

NII (Rs mn - LHS) Net Spreads (% - RHS)<br />

2007 2008E 2009E 2010E<br />

C/I (% - LHS) Cost/Avg Assets (% - RHS)<br />

2007 2008E 2009E 2010E<br />

Yield on loans (%- LHS)<br />

Cost of funds (%- RHS)<br />

2007 2008E 2009E 2010E<br />

4.3<br />

3.8<br />

3.3<br />

2.8<br />

2.3<br />

9.2<br />

9.1<br />

9.1<br />

9.0<br />

9.0<br />

8.9<br />

8.9<br />

2.5<br />

2.0<br />

1.5<br />

1.0

Subsidiaries<br />

Source: Company<br />

INITIATING COVERAGE April 15, 2008<br />

SREI<br />

Venture Capital<br />

100%<br />

SREI Insurance<br />

Services<br />

100%<br />

SREI Venture Capital<br />

SREI Infra <strong>Finance</strong><br />

SREI<br />

Capital Mkts<br />

100%<br />

Quipo<br />

Oil & Gas<br />

SREI Quipo<br />

<strong>Infrastructure</strong><br />

17%<br />

Quipo<br />

Tele Infra's<br />

ZAO SREI<br />

Leasing Russia<br />

NAC<br />

<strong>Infrastructure</strong><br />

Equip<br />

<strong>Srei</strong> Venture Capital is a 100% subsidiary of <strong>Srei</strong> Infra. The company is currently<br />

operating four schemes that focus on the growth sector of the economy. The venture<br />

capital business currently has asset under management of around Rs.8.42 bn.<br />

We have valued the company at 6% of the AUM for <strong>Srei</strong>'s 100% stake.<br />

SREI Capital Markets<br />

The capital market subsidiary of the NBFC offers services from infrastructure advisory,<br />

investment banking, infrastructure project conceptualization, development,<br />

implementation and management to financial structuring, resource mobilization<br />

and capital market issues. It also offers financial advisory services as well as services<br />

in the domain of privatization, to Government enterprises and departments. We<br />

have valued the company at 20x its FY10 EPS.<br />

Quipo - a unique matrix in infrastructure equipment renting<br />

Quipo is an equipment bank, which the company has set up in assistance with<br />

domestic and international equipment manufacturers. Quipo is an equipment renting<br />

company, wherein <strong>Srei</strong> <strong>Infrastructure</strong> holds around 17% stake. Along with <strong>Srei</strong>,<br />

other investors in the business are IDFC Private Equity, SwedFund, GIC, and<br />

Ingersoll-Rand.<br />

The company provides equipment on a rental basis to various infrastructure companies<br />

in the construction, mining, oil & gas, telecom and energy. The company's<br />

subsidiaries - Quipo Construction, Quipo Oil & Gas, Quipo Energy, Quipo Mining,<br />

and Quipo Telecom cater to the requirement of customers in their respective segments.<br />

The company has plans to invest around Rs.8-9 bn in its telecom business.<br />

Quippo Telecom<br />

<strong>Srei</strong> holds around 12% in the company. Quipo Telecom contributes the largest part<br />

of the Quipo infrastructures revenue. Recently, Quipo Telecom also bought Spice<br />

Telecom's tower business, which has around 875 telecom towers for Rs.6 bn. Currently,<br />

the company has close to 3,200 towers, operating in 10 circles with approximately<br />

1.4 tenants per tower. The company plans to have a network in place<br />

of around 5,000 towers by FY08, and 12,000 by FY10E. The company is looking<br />

forward to have a tower infrastructure in place of 25,000 by FY12E.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 12

INITIATING COVERAGE April 15, 2008<br />

Project financing business<br />

Rodad project<br />

Credible Valuations<br />

We expect <strong>Srei</strong>’s EPS to record a CAGR of ~37% over FY07-10E to Rs.16.1. Meanwhile,<br />

we expect an EPS of Rs.9.7 in FY08E and Rs.11.3 in FY09. We have also factored<br />

in the potential equity dilution following the issue of 25 mn shares on conversion<br />

of 9608 warrants issue to the promoters at Rs.100 per share. This lead to<br />

an equity dilution of 23% in FY09.<br />

We have valued the company on a sum of the part (SoTP) basis, and valued the<br />

core business of the parent company <strong>Srei</strong> <strong>Infrastructure</strong> <strong>Finance</strong> (consolidated) on a<br />

dividend discount model. We have assumed cost of equity of 15% and terminal<br />

growth rate of 5%, RoE 18% for high growth period and 15% for stable growth<br />

period. We have valued the road projects with the NBFC at Rs.23.2, after assigning<br />

a book value multiple (at various IRRs) to each project.<br />

In case of the port project we have considered a discount of 20%. This is because<br />

the project is at quite a nascent stage and has not yet achieved financial closure,<br />

while valuing it at P/BV multiple. The SEZ development business is esteemed at per<br />

acre value of land. Going forward, with the maturity of these projects, the<br />

growth in revenues would be significantly higher and would also lead to a<br />

re-rating of the stock.<br />

Capex required Equity SREI's stale IRR P/BV Per share value<br />

(Rs mn) (Rs mn) (%) (%) (x) for SREI<br />

Trissur-Angamalli 5509 1470 49 17 1.3 7.0<br />

Bharatpur-Mahua 2905 596 26 18.5 1.45 1.7<br />

Madhurai-Tuticorin 8970 1404 39 16 1.2 4.9<br />

Karur-Dindigul 3640 728 26 18.5 1.45 2.0<br />

Nagpur Seoni 4723 1181 49 12 0.8 3.4<br />

Nagpur-Kondhali 1760 330 26 17 1.3 0.8<br />

Jaora-Nayagaon 4144 1243 28 17 1.3 3.4<br />

Value of SREI <strong>Infrastructure</strong> <strong>Finance</strong> (Rs) 23.2<br />

Port Projets<br />

Machilipatnam- Andhra Pradesh 12546 8856 38 17 1.04 3.2<br />

Subaranrekha Port - Orissa 17425 5125 70 17 1.04 3.4<br />

Value of SREI <strong>Infrastructure</strong> <strong>Finance</strong> (Rs) 6.6<br />

SEZ Projects<br />

Capex required Equity SREI's stale Total land Per acre Per share value<br />

(Rs mn) (Rs mn) (%) (in acres) (Rs Lakh) for SREI<br />

Raigadh 4428 1476 58.5 450 20 4.82<br />

Guptamani, Kharagpur 28280 810 89 500 20 8.14<br />

Value of SREI <strong>Infrastructure</strong> <strong>Finance</strong> (Rs) 12.96<br />

Total Value from projects for SREI <strong>Infrastructure</strong> (Rs) 42.8<br />

Assumed terminal growth rate (%) 4<br />

Source: Company; <strong>Kotak</strong> Securities - Private Client Research<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 13

Valuation<br />

INITIATING COVERAGE April 15, 2008<br />

SREI <strong>Infrastructure</strong> 133.7<br />

Project (Road, Port, SEZs) 42.8<br />

Quipo 17.3<br />

SREI Venture Capital 4.6<br />

SREI Capital 2.9<br />

Fair value of SREI <strong>Infrastructure</strong> 201.4<br />

Source:<br />

Because of the recent correction in the markets, the stock had come down by<br />

around 50% from its 52-week high of Rs.280. While the fundamentals of the<br />

company remain strong, the correction in stock price has provided an attractive opportunity<br />

to BUY the stock.<br />

At the current market price of Rs.139, the stock is trading at a P/E of 8.4x its FY10<br />

EPS of Rs.16.1 (post equity dilution-warrant conversion), and 1.4x its FY10 P/ABV<br />

of Rs.97. Based on our SoTP valuation method, we have arrived at a fair price target<br />

for the company of Rs.197. At our target price, the stock offers a potential<br />

upside of around 46%. We recommend BUY on the stock with a 12-month price<br />

target of Rs.200.<br />

Historical PBV multiple<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

Price 1x 1.5x 2x 2.5x<br />

0<br />

Mar-05 Aug-05 Jan-06 Jun-06 Nov-06 Apr-07 Sep-07 Feb-08<br />

Source: Capitaline, <strong>Kotak</strong> Securities - Private Client Research<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 14

INITIATING COVERAGE April 15, 2008<br />

ANNEXURE 1: ASSET FINANCING<br />

What is Asset financing?<br />

Asset financing is characterized as a structured line of credit secured by a specific<br />

asset or across a combination of existing assets. Usually this includes: accounts receivables,<br />

finished goods inventory, real estate, and/or equipment. With asset financing,<br />

a company uses its assets as collateral to obtain capital. The financing institution<br />

does not own the companies’ assets, but the assets can be seized if the<br />

business does not make its required payments on the loan. Besides working capital,<br />

asset financing can be used for many other purposes.<br />

Usually asset backed loans are suitable for:<br />

Financing a business expansion<br />

Business acquisitions and mergers<br />

Management buy outs<br />

Turnaround finance<br />

Refinancing of existing business loans<br />

Types of Asset <strong>Finance</strong><br />

There are three major types of leasing: finance leasing, operating leasing and contract<br />

hire. However, hire purchase is not a type of leasing but is type of asset financing.<br />

<strong>Finance</strong> Leasing: A lessee effectively acquires all financial benefits and risks<br />

without actually acquiring the legal title of the assets. The asset is owned by a<br />

lessor. The leasing rate (lease rental) is computed to collect the full value of the<br />

asset (plus finance charges or interest) during the contract period. At the end<br />

of lease period asset is returned back to the lessor. If the asset is sold to a third<br />

party, then the lessee can receive a share of the sale proceeds (if the lease is not<br />

being extended). Generally, the title of ownership of the asset is not transferred<br />

to the lessee at any time - unless a private arrangement is made with the third<br />

party. However, a lessee usually has the option to extend your lease and as he<br />

has paid for almost the full value during his initial lease period; the rental payments<br />

for subsequent periods will be minimal.<br />

Operating Lease: Operating lease is often structured for a shorter time frame<br />

than financial leasing (always significantly shorter than the working life of the<br />

asset), operating leasing is more like a regular rental. The lessor expects to be<br />

able to either sell the asset in the second-hand market or to lease it again and<br />

will therefore not need to recover the total asset value through lease payments.<br />

There may be an option to extend the leasing period at the end (this negotiation<br />

can only take place at the end of the initial rental period). As with finance<br />

leases, lessee would not be owner of the asset at any time but, contrary to financial<br />

leases, you will not share in the sale proceeds.<br />

Contract Hire: A form of operating lease (often used with cars and other vehicles)<br />

that includes a number of additional services such as maintenance, management<br />

or replacement if asset is in repair.<br />

Hire Purchase. This is an agreement for the hiring of an asset with an option<br />

to purchase. The legal title will pass to buyer when all payments have been<br />

made. The term of a hire purchase must be significantly shorter than the working<br />

life of the asset. A purchaser of the asset can claim capital allowances as if<br />

he had purchased the asset outright, gaining immediate use of it. Hire Purchase<br />

agreements are typically written for domestic users, not so much for business<br />

users.<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 15

INITIATING COVERAGE April 15, 2008<br />

FINANCIALS<br />

Income Statement (Rs mn)<br />

2007 2008E 2009E 2010E<br />

Interest income 3,667 5,228 8,340 12,751<br />

Growth % 68.2 42.6 59.5 52.9<br />

Interest expenses 2,166 3,237 5,416 8,587<br />

Net Interest Income 1,502 1,991 2,924 4,164<br />

Growth % 34.9 32.6 46.9 42.4<br />

Other Income 229 304 373 463<br />

Total Income 1,730 2,295 3,298 4,627<br />

Growth % 41.5 32.7 43.7 40.3<br />

Operating expenses 671 869 1,300 1,804<br />

Depreciation on fixed assets 23.8 28.1 35.2 43.9<br />

Operating profit 1,036 1,398 1,962 2,779<br />

Growth % 35.9 34.9 40.4 41.6<br />

Provisions & Contingencies 123 140 146 182<br />

PBT 913 1,258 1,816 2,597<br />

Provisions for Taxes 67 151 272 389<br />

PAT 846 1,107 1,544 2,207<br />

Growth % 68.0 30.9 39.4 43.0<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Key Data (Rs mn)<br />

Valuation<br />

2007 2008E 2009E 2010E<br />

EPS 7.8 10.1 11.5 16.4<br />

BV 46.4 87.6 95.1 102.3<br />

ABV 42.9 83.4 91.0 97.4<br />

P/E 17.9 13.7 12.1 8.5<br />

P/BV 3.0 1.6 1.5 1.4<br />

P/ABV 3.2 1.7 1.5 1.4<br />

Asset quality<br />

Gross NPAs 380.3 456.4 547.6 657.1<br />

Gross NPA ratio (%) 0.8 0.6 0.7 0.6<br />

Net NPA 75.8 91.0 109.1 131.0<br />

Net NPA ratios (%) 0.2 0.1 0.1 0.1<br />

Dividend<br />

DPS (Rs) 1.2 2.3 3.2 4.5<br />

Dividned Payout Ratio 15.1 20.0 20.0 20.0<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Balance Sheet (Rs mn)<br />

2007 2008E 2009E 2010E<br />

Share Capital 1,091 1,093 1,343 1,343<br />

Reserve ans Surplus 3,972 8,484 11,423 12,387<br />

Total Shareholders Fund 5,062 9,576 12,765 13,730<br />

Minority interest 40 40 40 40<br />

Deferred Tax 638 638 638 638<br />

Mezzanine capital (Tier II) 1,235 1,235 1,235 1,235<br />

Secured loans 23,697 26,066 69,075 88,071<br />

Unsecured loans 8,536 7,682 10,371 12,445<br />

Total Borrowings 32,232 33,748 79,446 100,516<br />

Total Liabilities 39,208 45,238 94,124 116,159<br />

Application of funds<br />

Financing Assets 36,152 41,992 89,742 111,512<br />

Investments 1,438 1,654 1,819 2,001<br />

Current Assets, Loans and adv 3,107 3,015 3,905 3,882<br />

Current Liabilities 1,820 1,820 1,820 1,820<br />

Net current Assets 1,287 1,195 2,085 2,063<br />

Net fixed assets 269 335 417 521<br />

Miscellaneous Assets 61 61 61 62<br />

Total Assets 39,208 45,238 94,124 116,159<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

Key Ratios (%)<br />

Return Ratios (%)<br />

2007 2008E 2009E 2010E<br />

RoA 2.8 2.6 2.2 2.1<br />

RoE 18.3 15.1 13.8 16.7<br />

PPP/Avg Assets 3.4 3.3 2.8 2.6<br />

Operating Ratio (%)<br />

Cost/Income 38 38 39 39<br />

Cost/Average Assets 2.2 2.0 1.9 1.7<br />

Debt-Equity ratio (x) 7.74 4.72 7.37 8.46<br />

Earning assets (%)<br />

Yield on Assets 12.5 13.3 12.6 12.6<br />

Cost of funds 8.9 9.1 9.1 9.1<br />

Net Interest Income 5.0 4.7 4.2 4.0<br />

Net Spreads 3.3 3.3 2.9 3.0<br />

Source: Company, <strong>Kotak</strong> Securities - Private Client Research<br />

<strong>Kotak</strong> Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 16

Research Team<br />

Dipen Shah<br />

IT, Media, Telecom<br />

dipen.shah@kotak.com<br />

+91 22 6634 1376<br />

Disclaimer<br />

INITIATING COVERAGE April 15, 2008<br />

Sanjeev Zarbade<br />

Capital Goods, Engineering<br />

sanjeev.zarbade@kotak.com<br />

+91 22 6634 1258<br />

Teena Virmani<br />

Construction, Cement, Mid Cap<br />

teena.virmani@kotak.com<br />

+91 22 6634 1237<br />

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any<br />

other person. Persons into whose possession this document may come are required to observe these restrictions.<br />

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed<br />

as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the<br />

general information of clients of <strong>Kotak</strong> Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives,<br />

financial situations, or needs of individual clients.<br />

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness<br />

cannot be guaranteed. Neither <strong>Kotak</strong> Securities <strong>Limited</strong>, nor any person connected with it, accepts any liability arising from the use of this document. The<br />

recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in<br />

this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options<br />

and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical<br />

analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may<br />

not match with a report on a company's fundamentals.<br />

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information<br />

discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are<br />

cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment<br />

businesses may make investment decisions that are inconsistent with the recommendations expressed herein.<br />

<strong>Kotak</strong> Securities <strong>Limited</strong> has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the<br />

Private Client Group . The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, target<br />

price of the Institutional Equities Research Group of <strong>Kotak</strong> Securities <strong>Limited</strong>.<br />

We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities<br />

thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation<br />

or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or<br />

have other potential conflict of interest with respect to any recommendation and related information and opinions.<br />

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or<br />

companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or<br />

views expressed in this report.<br />

No part of this material may be duplicated in any form and/or redistributed without <strong>Kotak</strong> Securities' prior written consent.<br />

Analyst holding in stock: Nil<br />

Awadhesh Garg<br />

Pharmaceuticals, Hotels<br />

awadhesh.garg@kotak.com<br />

+91 22 6634 1406<br />

Apurva Doshi<br />

Logistics, Textiles, Mid Cap<br />

doshi.apurva@kotak.com<br />

+91 22 6634 1366<br />

Saurabh Gurnurkar<br />

IT, Media, Telecom<br />

saurabh.gurnurkar@kotak.com<br />

+91 22 6634 1273<br />

Saurabh Agrawal<br />

Metals, Mining<br />

agrawal.saurabh@kotak.com<br />

+91 22 6634 1291<br />

Saday Sinha<br />

Banking, Economy<br />

saday.sinha@kotak.com<br />

+91 22 6634 1440<br />

Sarika Lohra<br />

NBFCs<br />

sarika.lohra@kotak.com<br />

+91 22 6634 1480<br />

Siddharth Shah<br />

Telecom<br />

siddharth.s@kotak.com<br />

+91 22 6634 1261<br />

Shrikant Chouhan<br />

Technical analyst<br />

shrikant.chouhan@kotak.com<br />

+91 22 6621 6360<br />

Kaustav Ray<br />

Editor<br />

kaustav.ray@kotak.com<br />

+91 22 6634 1223<br />

K. Kathirvelu<br />

Production<br />

k.kathirvelu@kotak.com<br />

+91 22 6634 1557<br />

<strong>Kotak</strong> Registered Securities Office: - Private <strong>Kotak</strong> Client Securities Research <strong>Limited</strong>, Bakhtawar, Please see 1st the floor, disclaimer 229 Nariman on the last Point, page Mumbai 400021 India. For Private Circulation 17