View CV - European University Institute

View CV - European University Institute

View CV - European University Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

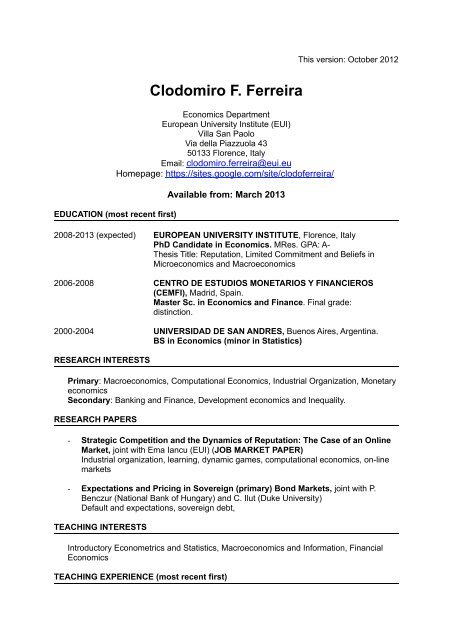

Clodomiro F. Ferreira<br />

Economics Department<br />

<strong>European</strong> <strong>University</strong> <strong>Institute</strong> (EUI)<br />

Villa San Paolo<br />

Via della Piazzuola 43<br />

50133 Florence, Italy<br />

Email: clodomiro.ferreira@eui.eu<br />

Homepage: https://sites.google.com/site/clodoferreira/<br />

EDUCATION (most recent first)<br />

Available from: March 2013<br />

This version: October 2012<br />

2008-2013 (expected) EUROPEAN UNIVERSITY INSTITUTE, Florence, Italy<br />

PhD Candidate in Economics. MRes. GPA: A-<br />

Thesis Title: Reputation, Limited Commitment and Beliefs in<br />

Microeconomics and Macroeconomics<br />

2006-2008 CENTRO DE ESTUDIOS MONETARIOS Y FINANCIEROS<br />

(CEMFI), Madrid, Spain.<br />

Master Sc. in Economics and Finance. Final grade:<br />

distinction.<br />

2000-2004 UNIVERSIDAD DE SAN ANDRES, Buenos Aires, Argentina.<br />

BS in Economics (minor in Statistics)<br />

RESEARCH INTERESTS<br />

Primary: Macroeconomics, Computational Economics, Industrial Organization, Monetary<br />

economics<br />

Secondary: Banking and Finance, Development economics and Inequality.<br />

RESEARCH PAPERS<br />

- Strategic Competition and the Dynamics of Reputation: The Case of an Online<br />

Market, joint with Ema Iancu (EUI) (JOB MARKET PAPER)<br />

Industrial organization, learning, dynamic games, computational economics, on-line<br />

markets<br />

- Expectations and Pricing in Sovereign (primary) Bond Markets, joint with P.<br />

Benczur (National Bank of Hungary) and C. Ilut (Duke <strong>University</strong>)<br />

Default and expectations, sovereign debt,<br />

TEACHING INTERESTS<br />

Introductory Econometrics and Statistics, Macroeconomics and Information, Financial<br />

Economics<br />

TEACHING EXPERIENCE (most recent first)

May 2012 Invited Lecturer.<br />

Topics In Dynamic Programming: Dynamic Games Solution<br />

and Data (PhD level). Prof. Russell Cooper and Jerome Adda.<br />

EUI.<br />

February-May 2012 Teaching Assistant.<br />

Money and Banking (undergraduate). New York <strong>University</strong>.<br />

Florence Campus. Prof. for Giampiero Gallo.<br />

2011 and 2012<br />

August-September 2009<br />

WORK EXPERIENCE (most recent first)<br />

Tutor Programming for MATLAB.<br />

PhD program at EUI.<br />

Lecturer. Probability Theory (PhD level). EUI.<br />

2010-2011 Visiting Researcher. Central Bank of Hungary (MNB).<br />

Project: Expectations and Pricing in Sovereign Bond markets.<br />

Joint with Peter Benczur (Head of Research, MNB) and<br />

Cosmin Ilut (Duke <strong>University</strong>)<br />

Summer 2007 Research Assistant. CEMFI and Bank of Spain.<br />

Prof. Claudio Michelacci.<br />

2004-2006 Junior Analyst. Advanced Logistics Group – Indra.<br />

Transport Engineering and Logistics consulting. Projects:<br />

- Shadow Prices for a Toll System Implementation in<br />

Bangkok, Thailand<br />

- Investment Valuation for the New Terminal at Port of<br />

Callao. Lima, Peru<br />

AWARDS (most recent first)<br />

2011-2012 <strong>European</strong> <strong>University</strong> <strong>Institute</strong> Ph.D. final year dissertation grant.<br />

2008-2011 Doctoral Grant, Agencia Española de Cooperación<br />

Internacional y Desarrollo, Spain,<br />

2006-2008 BBVA-Bank of Spain scholarship.<br />

2000-2002 Open contest scholarship, Universidad de San Andrés,<br />

CONFERENCE PRESENTATIONS and DISCUSSIONS (most recent first)<br />

November 2012 Workshop on Fiscal Policy and Sovereign Debt. Discussant.<br />

Florence, Italy.<br />

August 2012 Econometric Society <strong>European</strong> Meetings (ESEM). Presenter.<br />

Málaga, Spain<br />

July 2012. World Congress of Game Theory (Games 2012). Copresenter.<br />

Istambul, Turkey<br />

November 2011 Financial Fragility: Sources and Consequences. Discussant.<br />

Florence, Italy.<br />

August 2011 <strong>European</strong> Economic Association Meetings (EEA) Presenter.<br />

Oslo, Norway.<br />

September 2010 National Bank of Hungary. Research conference. Presenter.<br />

Budapest, Hungary.

OTHER ACTIVITIES<br />

2011 - present Project Insight Europe<br />

Founding member. Think tank that focuses current socioeconomic<br />

issues, drawing on an interdisciplinary network of<br />

economists, historians, political scientists and lawyers from<br />

different countries and continents.<br />

2009 - 2010 Researcher Representative – Economics Department<br />

Designed an algorithm in the lines of the Gale-Roth-Shapley<br />

algorithms for the allocation of researchers to available<br />

workspaces given a set of revealed preferences.<br />

SKILLS<br />

Languages: Spanish (mother tongue), English (proficiency level), French (basic) and<br />

Italian (intermediate)<br />

Programming and statistical packages: MATLAB, Fortran 90, Gauss, Stata, Eviews,<br />

LaTEX, Microsoft Office<br />

PERSONAL INFORMATION<br />

Nationality: Argentinean<br />

Date of birth: 30 April 1982<br />

JOB PREFERENCES<br />

Institutions, Private sector, Academia.<br />

REFERENCES<br />

Professor Russell Cooper<br />

Department of Economics<br />

Penn State <strong>University</strong><br />

611 Kenn Graduate Building<br />

Philadelphia<br />

Tel:+1-814-863-4775<br />

Email: russellcoop@gmail.com<br />

Homepage: R. Cooper's homepage<br />

Professor Arpad Abraham<br />

Department of Economics<br />

<strong>European</strong> <strong>University</strong> <strong>Institute</strong><br />

Via della Piazzuola 43<br />

50133 Florence, Italy<br />

Tel: +39-055-4685.909<br />

E-mail: arpad.abraham@eui.eu<br />

Homepage: A. Abraham's homepage<br />

Professor Piero Gottardi<br />

Department of Economics<br />

<strong>European</strong> <strong>University</strong> <strong>Institute</strong><br />

Via della Piazzuola 43<br />

50133 Florence, Italy<br />

Tel: +39-055-4685.919<br />

Email: piero.gottardi@eui.eu<br />

Homepage: P. Gottardi's homepage

PAPER ABSTRACTS<br />

JOB MARKET PAPER<br />

Strategic Competition and the Dynamics of Reputation: The Case of An Online Market<br />

joint with Ema Iancu (EUI)<br />

This paper analyzes how reputation building and strategic competition among sellers shape<br />

their equilibrium behavior when there are different sources of asymmetric information, and<br />

how these determine the dynamics of market outcomes. In the empirical context of on-line<br />

markets, we use this analysis to show the bias that might arise in the reduced form<br />

estimation of the impact of reputation / feedback on sales due to the unobserved nature of<br />

effort, even when panel or randomized data is used. Such bias, however, decreases with the<br />

number of buyers. We examine a market in which long-lived firms repeatedly auction off a<br />

homogeneous object to a pool of short-lived buyers, and in which their competence and<br />

effort is private information. We first investigate the incentives of a single seller (a<br />

"monopolist") to build a reputation that generates higher future profits. We show that there is<br />

a unique equilibrium in Markov strategies in which effort evolves non-monotonically with<br />

reputation. Second, we characterize the impact of strategic competition for heterogeneous<br />

buyers on sellers’ behaviour and observed outcomes: as the "intensity" of competition<br />

increases in the unique equilibrium, sellers have less incentives to exert effort. By contrasting<br />

the two scenarios, we theoretically disentangle the effects of reputation and strategic<br />

competition as incentives mechanisms.<br />

SECOND PAPER<br />

Understanding Sovereign Bond Prices: Expectations, Information, and Self Fulfilling<br />

Crises<br />

joint with P. Benczur (National Bank of Hungary) and C. Ilut (Duke <strong>University</strong>)<br />

Do market participants perceive the expected values of sovereign risks correctly? When<br />

attempting to separate various determinants of sovereign bond prices, a major obstacle is<br />

that the conditional expectations of various losses are not directly observable. We use data<br />

on the realizations of the risk events (losses), and address the following four issues related to<br />

the above question. First, whether foreign currency denominated sovereign bond price<br />

differentials can be attributed entirely to differences in expected returns, consistent with<br />

expected values (probabilities) predicted from default realizations. Second, what risks<br />

(default risk alone, or default and illiquidity risks) are involved in the calculation of expected<br />

returns, and what are their relative importance. Third, do global factors have an extra impact?<br />

Finally, we test whether there are systematic expectational errors, leading to a strong<br />

feedback from investor sentiment (manifesting in low or high refinancing costs) to future<br />

default, raising the possibility of self-fulfilling debt crises, as in Cole and Kehoe (2000). In<br />

order to do answer the questions, we estimate a structural form pricing equation for bonds,<br />

and test for a role of additional factors and systematic expectational errors.