Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

04<br />

BUSINESS CO<strong>MB</strong>INATIONS AND DISPOSALS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

<strong>Telenor</strong> Group<br />

The following acquisitions and disposals have taken place in <strong>2008</strong>, 2007 and 2006. All business combinations are accounted for by applying<br />

the acquisition method of accounting. The summary does not include capital increases or other types of fi nancing by <strong>Telenor</strong>.<br />

Acquisitions in <strong>2008</strong><br />

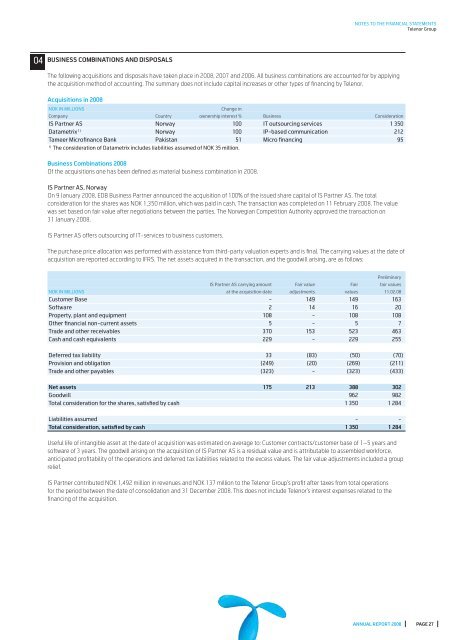

NOK IN MILLIONS Change in<br />

Company Country ownership interest % Business Consideration<br />

IS Partner AS Norway 100 IT outsourcing services 1 350<br />

Datametrix 1) Norway 100 IP-based communication 212<br />

Tameer Microfi nance Bank Pakistan 51 Micro fi nancing 95<br />

1) The consideration of Datametrix includes liabilities assumed of NOK 35 million.<br />

Business Combinations <strong>2008</strong><br />

Of the acquisitions one has been defi ned as material business combination in <strong>2008</strong>.<br />

IS Partner AS, Norway<br />

On 9 January <strong>2008</strong>, EDB Business Partner announced the acquisition of 100% of the issued share capital of IS Partner AS. The total<br />

consideration for the shares was NOK 1,350 million, which was paid in cash. The transaction was completed on 11 February <strong>2008</strong>. The value<br />

was set based on fair value after negotiations between the parties. The Norwegian Competition Authority approved the transaction on<br />

31 January <strong>2008</strong>.<br />

IS Partner AS offers outsourcing of IT-services to business customers.<br />

The purchase price allocation was performed with assistance from third-party valuation experts and is fi nal. The carrying values at the date of<br />

acquisition are <strong>report</strong>ed according to IFRS. The net assets acquired in the transaction, and the goodwill arising, are as follows:<br />

Preliminary<br />

IS Partner AS carrying amount Fair value Fair fair values<br />

NOK IN MILLIONS at the acquisition date adjustments values 11.02.08<br />

Customer Base - 149 149 163<br />

Software 2 14 16 20<br />

Property, plant and equipment 108 - 108 108<br />

Other fi nancial non-current assets 5 - 5 7<br />

Trade and other receivables 370 153 523 463<br />

Cash and cash equivalents 229 - 229 255<br />

Deferred tax liability 33 (83) (50) (70)<br />

Provision and obligation (249) (20) (269) (211)<br />

Trade and other payables (323) - (323) (433)<br />

Net assets 175 213 388 302<br />

Goodwill 962 982<br />

Total consideration for the shares, satisfi ed by cash 1 350 1 284<br />

Liabilities assumed - -<br />

Total consideration, satisfi ed by cash 1 350 1 284<br />

Useful life of intangible asset at the date of acquisition was estimated on average to: Customer contracts/customer base of 1–5 years and<br />

software of 3 years. The goodwill arising on the acquisition of IS Partner AS is a residual value and is attributable to assembled workforce,<br />

anticipated profi tability of the operations and deferred tax liabilities related to the excess values. The fair value adjustments included a group<br />

relief.<br />

IS Partner contributed NOK 1,492 million in revenues and NOK 137 million to the <strong>Telenor</strong> Group’s profi t after taxes from total operations<br />

for the period between the date of consolidation and 31 December <strong>2008</strong>. This does not include <strong>Telenor</strong>’s interest expenses related to the<br />

fi nancing of the acquisition.<br />

ANNUAL REPORT <strong>2008</strong> PAGE 27